Life insurance owned by an irrevocable life insurance trust (ILIT) can be the easiest and most efficient way to pay estate taxes.

If you want to reduce estate taxes and preserve your wealth, then an irrevocable life insurance trust deserves your consideration.

Irrevocable Life Insurance Trust (ILIT)

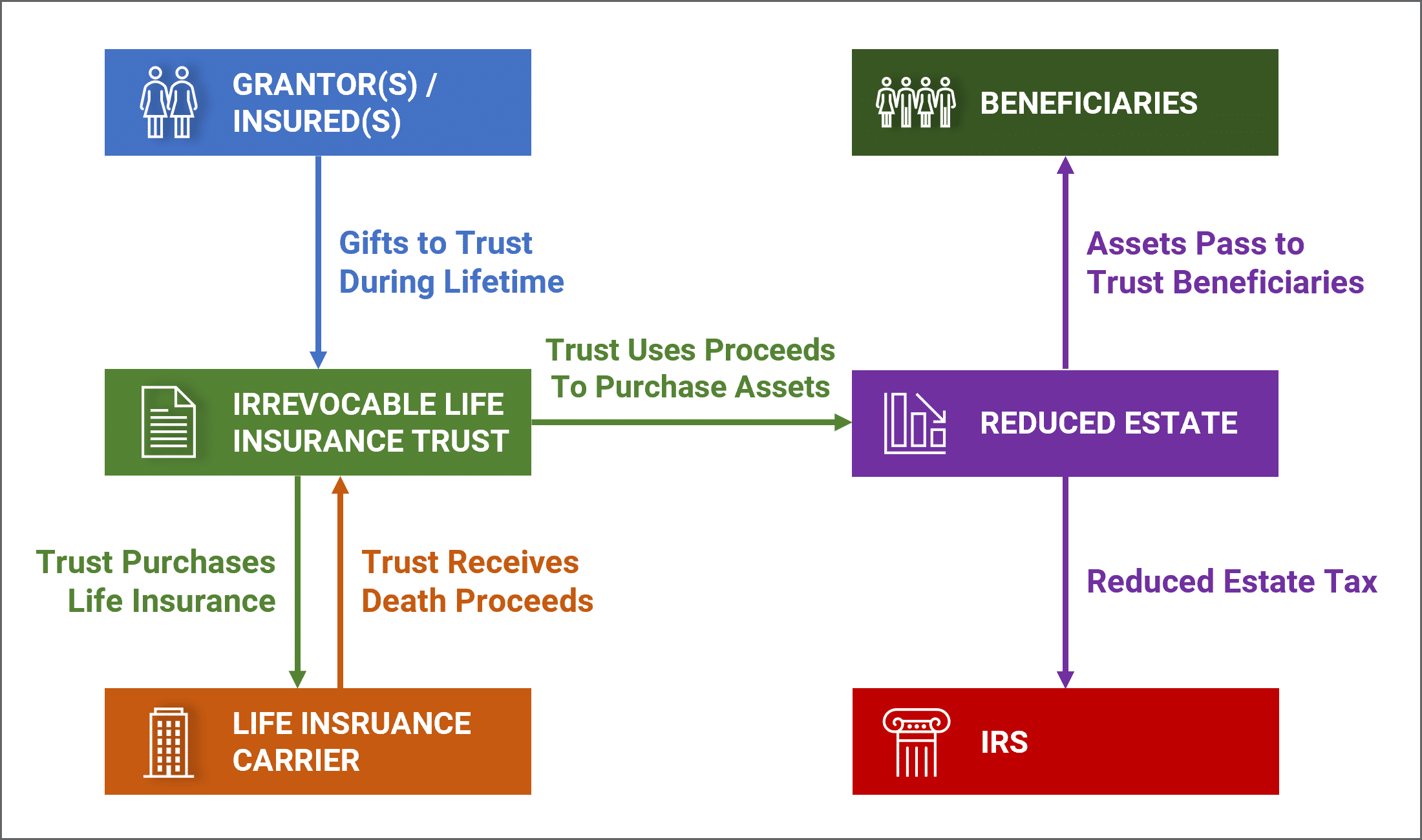

The purpose of an irrevocable life insurance trust or ILIT is to prevent life insurance death benefits from being subject to estate taxes.

An irrevocable life insurance trust involves three parties:

- The grantor or the person funding the trust.

- Trustee or person managing the trust according to the trust language.

- Beneficiary or person who will have access to or receive the trust property

Because an ILIT is irrevocable, any transfer of property to the trust cannot be transferred back without the consent of the trustee and beneficiaries.

Most irrevocable life insurance trusts will only own a life insurance policy. The grantor of the ILIT will make gifts equal to the life insurance policy premiums. In order to accomplish this, the grantor will use annual gifts or a portion of their lifetime exemption.

The grantor writes a check payable to the irrevocable life insurance trust equal to the premium due.

The trustee deposits the check into the ILIT’s checking account. The trustee then writes a check payable to the insurance company for the premium due.

If the policy insures a single individual the death benefit is payable to the irrevocable life insurance trust (ILIT) upon their passing.

When using a survivorship life insurance policy, meaning one policy insures two lives (spouses), the death benefit is payable to the irrevocable life insurance trust after the second insured’s passing.

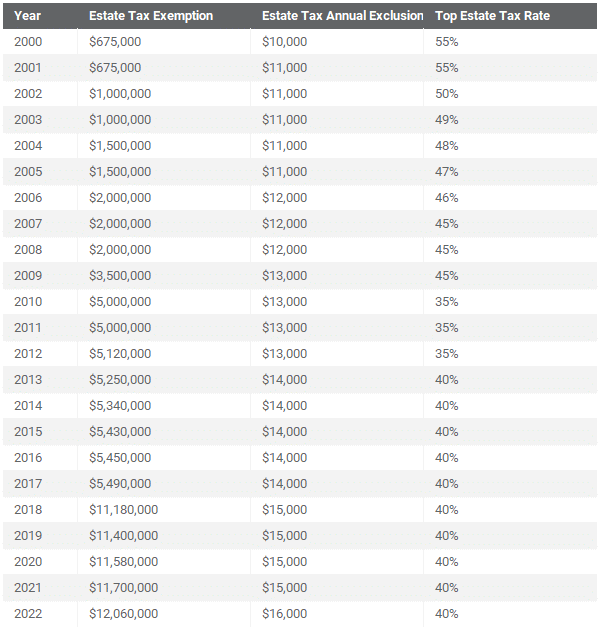

2022 Estate Tax Exemptions, Annual Exclusion, and Tax Rates

In 2022, individuals can transfer up to $12.06 million (or $24.12 million for married couples) to heirs. The $12.06 is an increase from $11.7 million in 2021.

In addition to the lifetime exemption, individuals can take advantage of the $16,000 annual gift-tax exemption. This allows individuals to gift $16,000 every year to any person they choose without tax.

For example, if you have two children and five grandchildren, you can give each of them $16,000 per year, totaling $112,000. For married couples, you could make an annual gift totaling $224,000.

Annual gifts do not reduce your lifetime exemption.

Gifts are not deductible, nor are they taxable to the recipient.

Any estate with assets exceeding the lifetime exemption amount will be subject to a forty-percent federal estate tax.

Let’s say when you and your spouse die, you leave an estate valued at $40 million to your heirs. Since we can exclude $12.06 million per individual, approximately $16 million will be subject to federal estate taxes. With a forty-percent federal estate tax rate, the estate will have a $6.4 million tax liability.

If the estate has $6.4 million of liquid assets then it is pretty easy to satisfy the estate tax obligation.

But what if your estate doesn’t have enough cash to pay the tax?

Simply stated, this is where life insurance plays a critical role in estate planning with irrevocable life insurance trusts.

Lifetime Exemptions, Annual Exclusions, and Tax Rates 2000 – 2022

The current estate tax exemption and annual gift tax exclusion are due to sunset at the end of 2025. The exemption amount is set to reduce to pre-2018 estate tax exemption amounts with an adjustment for inflation.

While the current estate tax exemption and annual gift tax exclusion are set to expire, the IRS will not have any ability to claw back any gifts made through 2025.

How To Properly Structure Life Insurance With An Irrevocable Life Insurance Trust

Life insurance provides liquidity to help pay estate taxes.

Not only does life insurance provide the cash to pay the estate tax, but it can also keep the estate from having to sell assets to pay the tax.

This makes life insurance one of the most highly-efficient and simple ways for families to transfer their estates to heirs.

When properly structured, proceeds from a life insurance policy are income and estate tax-free.

The key is structuring the ownership and beneficiary of the life insurance policy properly.

We want to make sure the death benefit is not includable in the estate and is not subject to estate taxes. Especially when it is easily avoidable.

When considering life insurance for estate planning the first steps are to determine:

- How much coverage do you need?

- Are the needs of the estate for individual or survivorship life insurance?

- What carriers and products offer the best pricing and underwriting?

Individual life insurance coverage pays a death benefit when the individual dies. Survivorship life insurance coverage pays the death benefit after the second insured dies. Other names for survivorship life insurance include joint-survivor or second-to-die life insurance. It is usually less expensive than individual life insurance coverage.

Once these steps are complete and the decision is to move forward, the next step is to complete underwriting and draft the trust.

Irrevocable Life Insurance Trust (ILIT) Benefits

Irrevocable life insurance trusts offer a number of benefits. These include:

- Providing immediate liquidity to help minimize estate taxes or expenses of an estate.

- Maximize control over the distribution of death benefit proceeds to beneficiaries.

- Proceeds received by an ILIT are generally protected from creditors of the irrevocable life insurance trusts beneficiaries until they receive actual trust proceeds.

- Equalize inheritance when the grantor would like to pass down a single asset (e.g. business or real estate) to one child while providing equal value for other children.

- Avoid gift tax issues.

Life Insurance Underwriting

When a life insurance company underwrites an individual for coverage the insurance company will review medical history and records, financial information, and other items necessary to determine your underwriting class and to make sure the requested death benefit is suitable.

The insured will complete some form of a medical exam by a third-party examiner paid for by the insurance company prior to the policy issue. Life insurance exam requirements vary based on the face amount of the policy and the carrier. At a minimum, this will include height, weight, blood, and urine analysis.

The insurance carrier will make an underwriting or health class offer once they receive and review all the information. This is what will determine the pricing of the life insurance policy.

Informal Underwriting

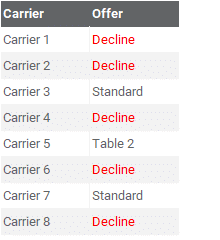

If you or your spouse have any medical history or if there are any questions about what underwriting health class you might be, we recommend applying for coverage on an informal basis.

This allows us to obtain your medical records and submit them to multiple insurance companies for “informal offers”.After reviewing the medical records, each insurance company will make tentative underwriting or health class offers subject to a list of requirements to secure the actual policy.

In this example, medical records were submitted to eight different life insurance companies. Of the eight companies, only three of them were able to make offers.

Upon receipt of the informal offers, we evaluate the impact of these offers on the pricing of each policy. This allows us to recommend the life insurance policy most suitable for the given fact pattern.

Formal Underwriting

Formal underwriting begins when a carrier receives the life insurance application. Each life insurance company has its own application.

When applying for life insurance for estate planning it is critical to set up the ownership and beneficiary properly. Failure to do so could result in the death benefit being subject to estate taxes.

By naming your irrevocable life insurance trust (ILIT) as the owner and beneficiary of the policy death benefit proceeds should avoid income and estate taxes.

To accomplish this, the trustee of the ILIT will sign as the owner of the policy.

In addition, most life insurance companies will require the completion of a “Trust Certification” form as a part of the application.

Since formal underwriting can take a few weeks, many people choose to have their ILIT drafted to coincide with underwriting.

There are situations where a formal application is submitted before an ILIT has been drafted or executed. When taking this approach, it is important to list the owner on the application as “to be determined” or “pending”.

This allows the life insurance company to continue underwriting the policy, while the creation of the ILIT is occurring. Upon execution of the ILIT, the insurance company will require additional paperwork to reflect the ILIT as the owner and beneficiary of the policy.

The date of life insurance application should ALWAYS be after the execution date of the irrevocable life insurance trust (ILIT).

Once the requirements are complete, the insurance company will issue the policy.

Crummey Letters

When using annual gifts to fund an ILIT the trustee should send out “Crummey letters” to trust beneficiaries. This should take place in any year a gift is made to the irrevocable life insurance trust.

“Crummey letter” serves to inform the trust beneficiaries of their ability to withdraw the gifted amount during a specified window. Usually 30-days.

The IRS will only consider it a tax-free gift if the person has the ability to take it in the short term. By doing this, the trustee can make sure the life insurance death benefit remains outside of the estate.

What If I Already Have a Life Insurance Policy, But It Isn’t Owned by an Irrevocable Trust?

If you already have a life insurance policy, you can transfer it to an irrevocable life insurance trust.

To do this you need to submit the proper ownership and beneficiary change forms to the life insurance company. You can get this paperwork by contacting the carrier directly or your life insurance advisor.

Prior to doing so, it is important to determine if there will be any transfer for value issues. Completing a valuation on the policy prior to transferring it to the irrevocable trust will avoid any valuation issues in the future.

Prior to making any changes make sure you have an irrevocable life insurance trust set up and executed. In addition, the trustee will need to sign as the new owner of the policy.

If you pass away within three years of changing the ownership the death benefit will likely be subject to estate taxes.

Also, we encourage you to speak with your agent, accountant, or tax attorney to make sure you do not incur any income taxes because of the transfer.

Final Thoughts on Irrevocable Life Insurance Trusts

Life insurance owned by an irrevocable life insurance trust provides liquidity and estate tax protection. It provides immediate cash to pay estate taxes and other expenses while protecting assets for your heirs.

Life insurance prevents estates from having to sell assets to pay taxes. This includes real estate, privately held stock, hedge funds, art, jewelry, and other illiquid assets.

If your estate will be subject to estate taxes, it is important to understand the role life insurance can play in transferring it to heirs. It doesn’t matter if you’re worth $15 million or a gazillion dollars.

A well-designed properly structured life insurance policy with an irrevocable trust (ILIT) can literally save your estate millions of dollars.

Last updated April 6, 2022

DISCLOSURE

TAX ADVICE

Any tax advice contained in this communication is not intended or written to be used, for the purpose of (i) avoiding penalties under the Internal Revenue Code or (ii) promoting, marketing, or recommending to another party any transaction or matter addressed herein.

These materials are not intended to be opinions or advice on legal, tax, accounting, or investment matters. Private counsel should be consulted prior to the application of this general information to specific situations.

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.