A Guide to Understanding Indexed Universal Life Insurance (IUL)

Indexed Universal Life Insurance is a type of universal life insurance offering permanent protection. There are three different types of universal life insurance policies:

- Universal Life (UL)

- Indexed Universal Life (IUL), and

- Variable Universal Life (VUL)

The primary difference between these policy types is how the cash value of the policy is credited. Index universal life cash value based on the performance of the index.

An Indexed Universal Life policy gives the policy owner the option of allocating the cash value to the Fixed Account, Indexed Account(s), or a combination of both.

Indexed Universal Life Insurance Account Types

Fixed Account

All net premiums (premiums paid minus expenses) are initially placed in the fixed account. The Fixed Account earns fixed interest declared by the company subject to a contractually guaranteed minimum (typically 2-percent).

When premiums are paid, the owner of the policy can decide how to allocate the cash value among the available index options.

Indexed Accounts

Indexed Accounts offer the policy owner the potential for greater cash value growth than a traditional universal life policy. The performance of Index Accounts is based on the performance of underlying indices. The most common index available is the S&P 500 Index.

The actual amount credited to a policy will be based on the chosen index AND other factors that may include Cap Rate, Participation Rate, Spread, Floor, and Multipliers. All of which we will do our best to explain further.

It is important to note that indexed universal life insurance policies do not directly invest in the selected index.

Indexed Universal Life Insurance Terms and Definitions

Segment

The amount of net premiums allocated to a specific index account creates a Segment.

Let’s assume a policy owner makes the decision to allocate net premiums to the S&P 500, 1-Year Point-To-Point index strategy.

The premium allocated to this segment is based on the value of the S&P 500 today and the value at the end of the Segment to determine the Segment Growth Rate.

Segment Growth Rate

The Segment Growth Rate is the percentage change of the chosen index based on its value at the beginning of the segment compared to the segment value at maturity.

If the value of the S&P 500 at the beginning of the Segment is 1,000 and 1-year from now (when the Segment matures) it is 1,050 the Segment Growth Rate would be 5-percent.

The actual amount credited to the policy will be subject to other policy factors. These factors may include the Floor, Spread, Cap Rate, and/or Participation Rate.

Floor

The Floor is the minimum annual Segment Growth Rate for an indexed account. Most policies have a guaranteed Floor of zero percent. When Segment Growth Rate is negative the Floor is credited to the policy.

Even in years where Segment Growth Rate is negative, policies will still incur expenses that will impact policy cash values.

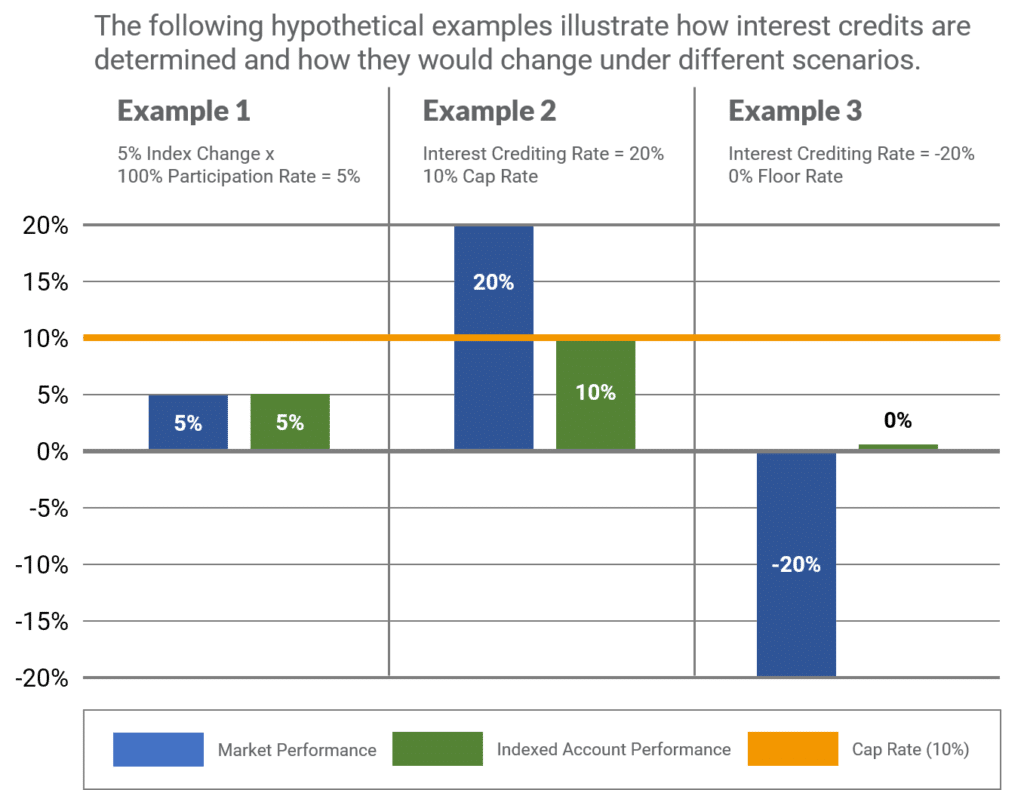

Cap Rate

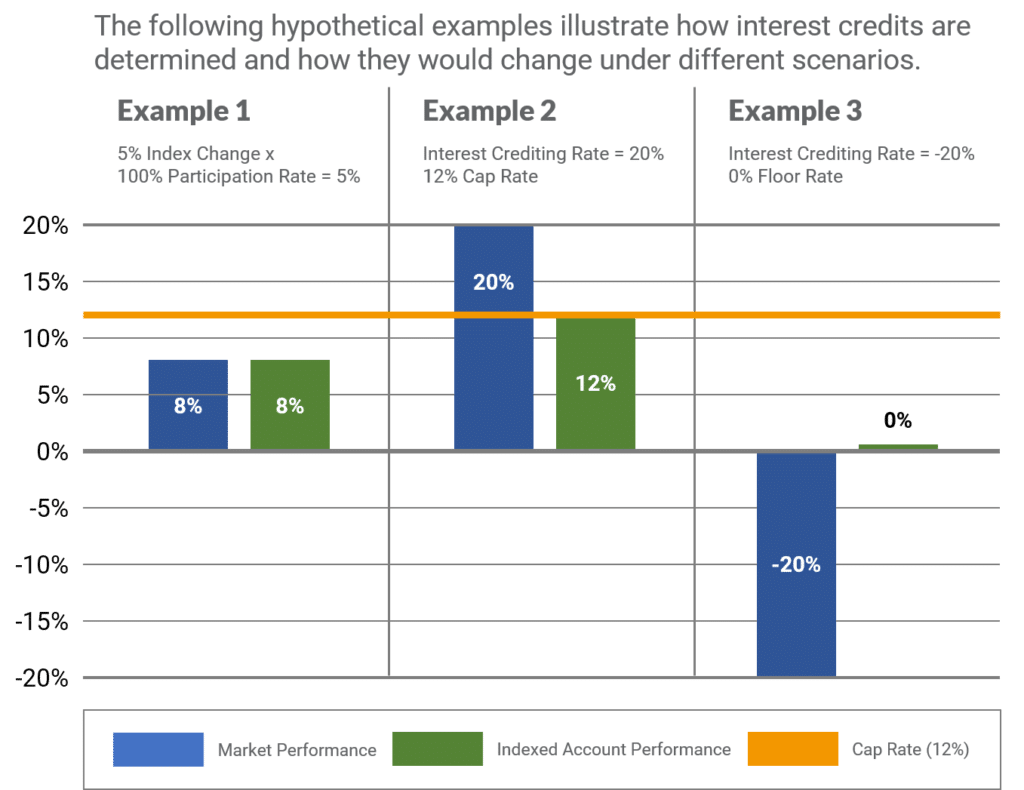

Cap Rate is the maximum amount of segment growth that is credited to the policy cash value for an indexed account.

For instance, if a policy has a Cap Rate of 10-percent and the underlying Segment Growth Rate is 15-percent, the policy will receive a credit based on the Cap Rate of 10-percent.

NOTE: Carriers can adjust the Cap Rate up or down. Most carriers will generally have a minimum guaranteed Cap Rate of 3 or 4-percent.

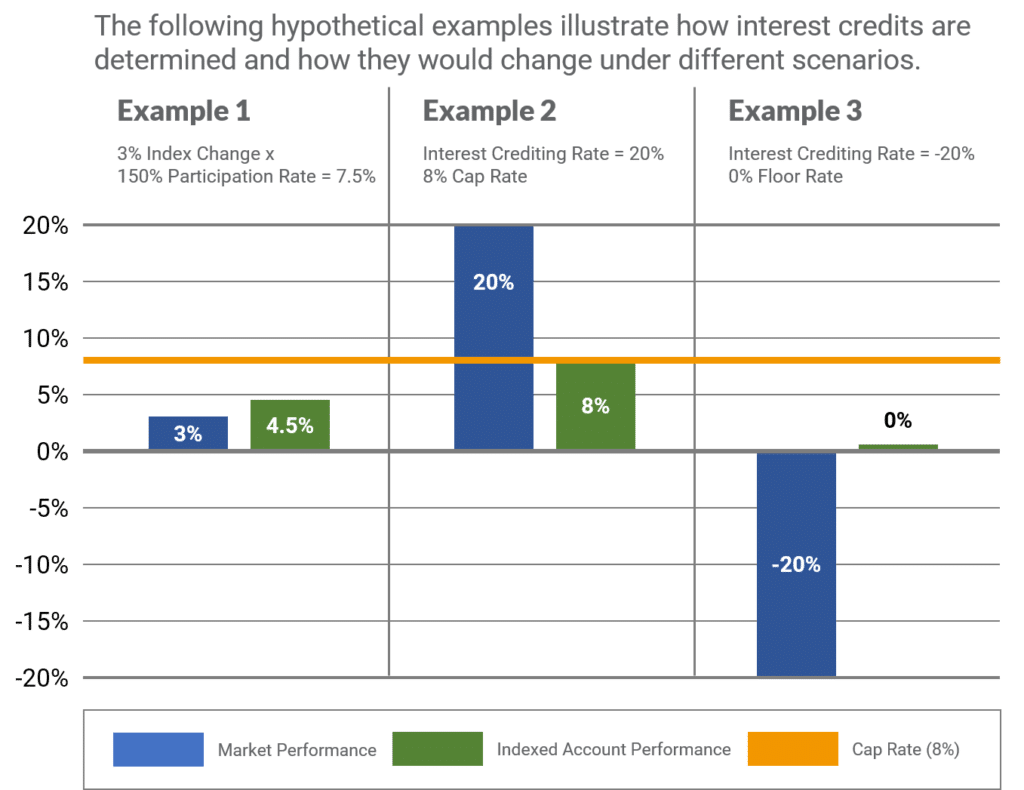

Participation Rate

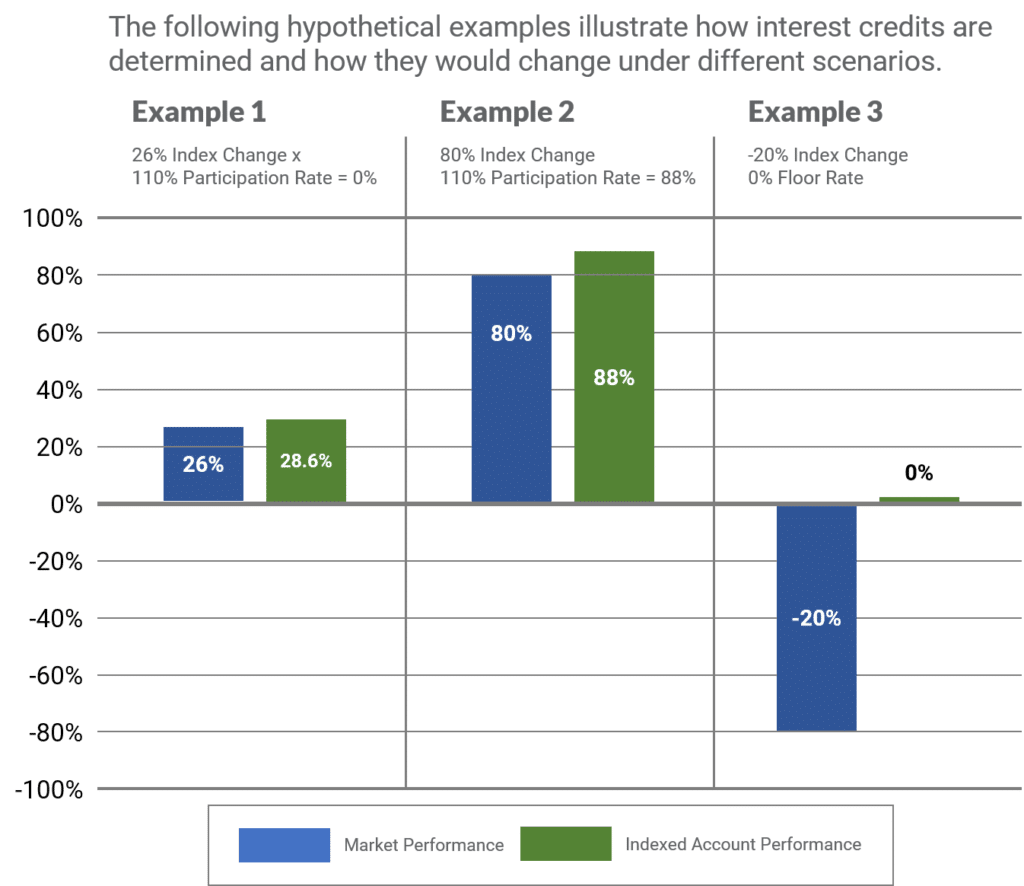

To determine what a policy is credited, the Participation Rate is applied to the Segment Growth Rate. A Participation Rate can be less or more than 100-percent.

To better understand this, we are going to use the following assumptions and example:

- Cap Rate – 10%

- Segment Growth Rate – 5%

- Participation Rate – 150%

An Index with a 150-percent Participation Rate and Segment Growth Rate of 5-percent will receive a credit of 7.5-percent (5.00% Segment Growth Rate times 150% Participation Rate is Equal to 7.50%) to the Segment.

Using the same scenario, but assuming a Segment Growth Rate of 8-percent would result in a total Segment Growth Rate of 12-percent. Since the Segment includes a Cap Rate of 10-percent the Segment would receive a credit of 10-percent and not 12-percent.

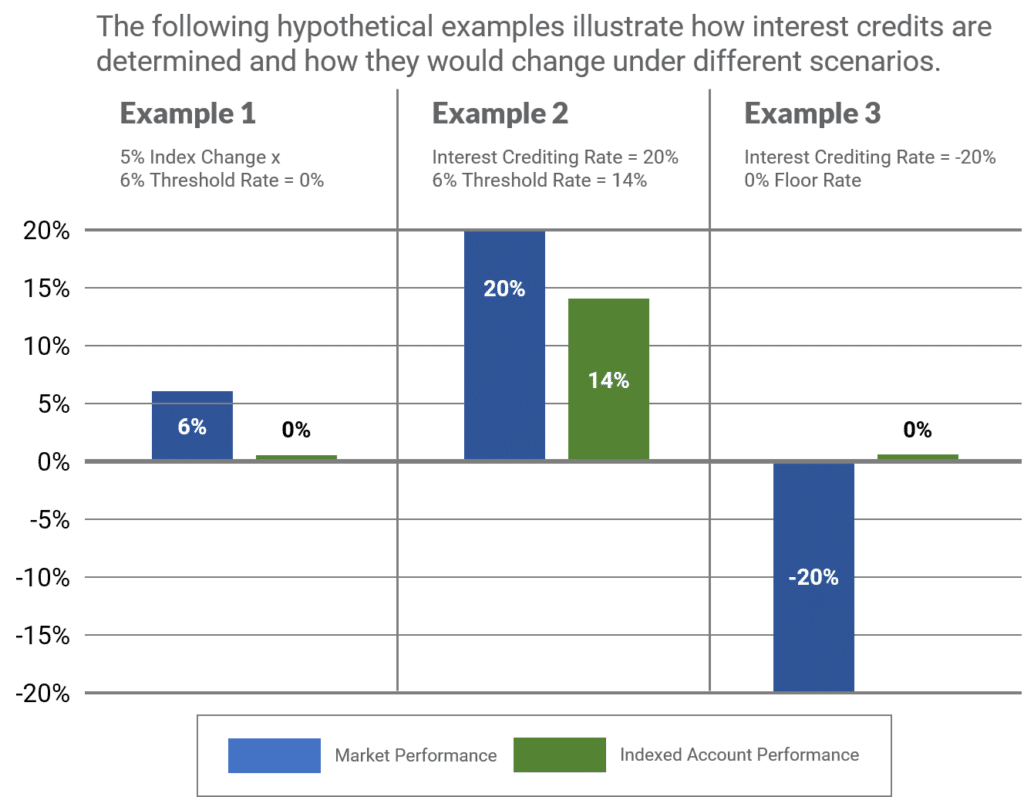

Threshold Rate

Some index accounts include a Threshold Rate. This is the rate that must be exceeded on an uncapped account before credit is given. In order to determine the Segment Growth Rate, the carrier reviews the performance of the underlying index and reduces it by the Threshold Rate to determine the credit to the policy.

Spread

To calculate the Spread you multiply the Segment Growth Rate times the Participation Rate less the Spread. Most index crediting strategies utilizing a Spread do not have a Cap Rate.

Assuming a Segment Growth Rate of 20-percent, 100-percent Participation Rate, and a 4-percent Spread would result in a Segment credit of 16-percent.

Comparing Different Indexes

Most indexed universal life insurance policies include different index crediting options in addition to the Fixed Account. We have done our best to highlight a few of the more common index options available. Also, policy owners can choose more than a single index allowing for a more diversified approach.

1-Year Indexed Account

The 1-Year Indexed Account credit a 100-percent Participation Rate of the S&P 500 index performance (to exclude dividends) over a 1-year Segment period, not to exceed the current Cap Rate of 9.00% with a guaranteed Floor of 0-percent.

1-Year High Par Indexed Account

The 1-Year High Par (Participation) Account credits a 150-percent Participation Rate of the S&P 500 Index performance (to exclude dividends) over a 1-year Segment period, not to exceed the current Cap Rate of 8-percent with a guaranteed Floor of 0-percent.

1-Year High Cap Indexed Account

The 1-Year High Cap Indexed Account credits a 100-percent Participation Rate of the S&P 500 Index performance (to exclude dividends) over a 1-year Segment period, not to exceed the current Cap Rate of 12-percent with a guaranteed Floor of 0-percent.

1-Year No Cap Indexed Account

The 1-Year High Cap Indexed Account credits a 100-percent Participation Rate of the S&P 500 Index performance (to exclude dividends) over a 1-year Segment period, less the 6-percent Threshold Rate with a guaranteed Floor of 0-percent.

The index will credit 0-percent if the S&P 500 performance is equal to or less than the Threshold Rate.

High Par 5-Year Indexed Account

The High Par 5-Year Indexed Account credits a 110-percent Participation Rate of the S&P 500 Index performance (to exclude dividends) over a 5-year Segment period, no current Cap Rate guaranteed Floor of 0-percent.

How Are Indexed Universal Life Insurance Cap Rates and Participation Rates determined?

The combination of a Carriers Portfolio Yield of their General Account and Cost of Options determine the Cap Rate. The higher the Portfolio Yield the greater the budget available to purchase options to support the index credits.

The options market determines the cost of providing an index credit to the policy owner. The cost of options impacts the Cap Rate and Participation Rate. For example, options that have a 12-percent Cap Rate cost more than an option with a 10-percent Cap Rate.

Market volatility can also impact the cost of options. The more volatility, the higher the cost of options. When volatility decreases, so too does the cost of the options.

Understanding Indexed Universal Life Insurance Policy Loans

One of the unique features of most permanent life insurance policies is how they are treated from a tax perspective. Cash value growth and accumulation inside a policy are generally never taxable. Distributions from a policy are generally tax-free in the form of withdrawals and policy loans. This also assumes the policy is not a Modified Endowment Contract (MEC).

Most distributions from a life insurance policy are typically structured as a withdrawal of basis first. Once the policy basis is withdrawn then future distributions are made in the form of policy loans. Like most loans, the carrier charges interest. However, the insurance carrier will continue to credit the borrowed amount in the form of a Loan Interest Rate Credit.

Indexed universal life policies have two common loan options (1) Traditional (or Standard) Loan and (2) Index (or Variable) Loan. The option you choose can significantly impact the performance of the policy once loans start. Let us explore the differences.

Traditional (Standard) Loans

Policy owners can take loans against their policy’s cash surrender value up to a Maximum Loan Amount.

Traditional Loans charge interest at an adjustable loan rate set by the carrier generally at the beginning of each year. Loan rates generally range from 2% to 4% depending on the policy.

The net cost of a traditional policy loan equals the loan interest rate less the loan interest rate credited. Most policies will have a loan interest rate that is slightly higher than the loan interest credit in policy Year 1 – 10. Beginning in Year 11, the net cost of the loan relative to the loan interest rate credited will typically be between 0% to 0.5%.

As an example, if you borrow $100,000 from your policy in Year 8 with a loan interest charge of 2.5-percent and loan interest rate credit of 1-percent, the gross cost of the loan in that year is $2,500. But, you will still receive a loan interest rate credit of $1,000 ($100,000 loan amount times 1% loan interest rate credit). The net cost of the loan in Year 8 will be $1,500 ($2,500 loan interest charge less $1,000 loan interest rate credit).

Alternatively, if the $100,000 policy loan begins in Year 18 you would have the same loan interest charge of 2.5-percent, but the loan interest rate credit could be equal to 2.5-percent. Effectively zeroing out the policy loan moving forward.

Index Loans

Index Loan interest rates are variable and can change. Each product’s loan interest rate will vary. We are seeing index loan interest rates of around 6-percent.

Under an Index Loan Option loan proceeds go into an Index Appreciation Account. The Index Appreciation Account goes into an Index Appreciation Account Segment. The Appreciation Account Segment earns a Segment Interest Credit at Segment Maturity.

The cost of an Index Loan can vary substantially compared to a Traditional Loan. The net cost of an Index Loan equals the Loan Interest Charge less the sum of any Index Segment Interest Credits earned by the Index Appreciation Account.

Index Loans can have a major financial impact on an indexed universal life insurance policy – positively and negatively. The risk of a policy lapsing with an Index Loan is much greater than it is with a Traditional Loan.

Index Loans Example

Borrowing $100,000 from your policy with a Loan Interest Charge of 6-percent results in the gross interest of the loan to be $6,000. An Index Appreciation Account Segment’s performance is then used to calculate the Loan Interest Rate Credit.

If the Index Appreciation Account Segment earns 0-percent, then the net cost of the loan is $6,000. If the Index Appreciation Account Segment earns 8-percent there would be a Loan Interest Rate Credit of $8,000 resulting in a net loan cost of +$2,000.

In a scenario where an Index Segment has a Cap Rate of 8.5% and Loan Interest Charge of 6-percent, I am not sure I understand why anyone would risk 6-percent to earn a net gain of 2.5-percent. Before you decide to borrow money from your indexed universal life insurance policy it is extremely important to understand your loan options and how it works. It can be a very costly mistake if chosen incorrectly.

Policy Withdrawals and Loans will result in a reduction of the policy’s death benefit.

In addition to Index Loans potentially having a negative impact on an indexed universal life insurance policy, carriers have begun to add a feature called a Multiplier. Multipliers give policy owners the opportunity to improve the Index Segment Growth Rate beyond what it would earn using a Traditional Index Segment with a Cap and Participation Rate.

What are Multipliers and How Do They Work in an Indexed Universal Life Insurance policy?

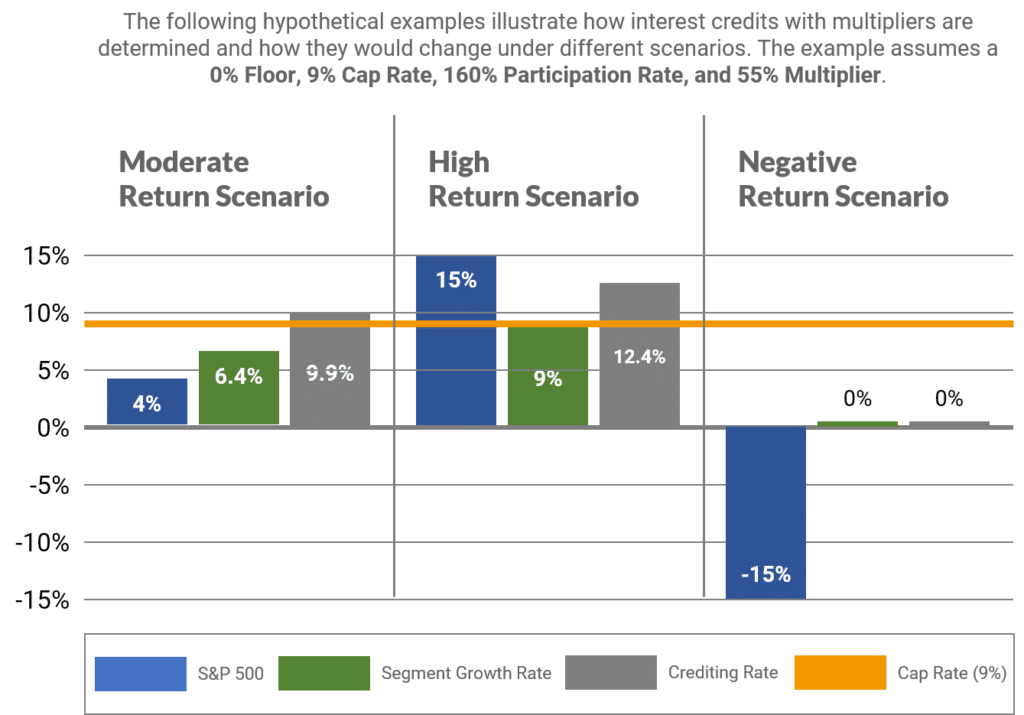

Multipliers are interest credits that are provided in addition to the Segment Growth Rate. The multiplier provides a percentage increase used to increase the index interest earned when the underlying index performs positively.

Multipliers can take on many different forms and vary widely across carriers and products. Some multipliers are guaranteed, while others are non-guaranteed.

For example, assuming a Segment Growth Rate of 4-percent, Participation Rate of 160-percent, and a Cap Rate of 9-percent the Segment would receive a credit of 6.4-percent (4% Segment Growth Rate times 160% Participation Rate).

If the underlying Segment included a Multiplier of 55-percent, you would multiply the 6.4-percent time 1 plus the Multiplier (1.55-percent) for a total interest credit of 9.92-percent.

What makes it more interesting the Segment Growth Rate is subject to the Cap Rate, but the Multiplier is not.

For example, if the Segment Growth Rate is 8-percent and the Participation Rate is 160-percent the Segment Growth Rate is 12.4-percent, but it would be subject to the Cap Rate of 9-percent. The result would be a Segment credit of 9-percent. You would then add the 55-percent Multiplier for a total interest credit of 13.95-percent.

Understanding Multipliers

Multipliers can enhance illustration performance and the potential to increase total interest credited. It is important to understand all the components of how multipliers work. Most carriers and products include an additional policy charge when an index includes a multiplier. Charges generally range from 2-percent to 7-percent.

Multiplier charges can create adverse policy value outcomes. Not all products disclose these charges. By using an index that includes a multiplier a multiplier charge can be applied to the insurance policy’s accumulation value. An index universal life insurance policy that includes a 0-percent Floor and a Multiplier charge can create negative interest earned. This will leave the policy owner with a negative balance at the end of the year.

Most indexed universal life insurance products are including Multipliers, but carriers don’t easily identify which indexes contain a multiplier.

Indexed Universal Life Insurance Thoughts, Comments, and Observations

Indexed Universal Life Insurance is one of the most complicated life insurance products available to consumers. The product itself may not be for everybody. For individuals considering indexed universal life, you should work with an advisor who understands its nuances and subtleties.

After evaluating different indexed universal life insurance products from different carriers each product can vary drastically. Even comparing products can sometimes be difficult. The product and policy design should be based on what you are trying to accomplish.

Indexed Universal Life is not a product you purchase and put in the drawer for the rest of your life. It is a financial product with moving parts. The only thing that is 100-percent accurate about indexed universal life is that the numbers illustrated will always change.

It is, for this reason, important to review policy performance on an annual or semi-annual basis with your advisor.

If you have an existing indexed universal life insurance policy we recommend scheduling a policy review with your advisor. If you prefer, we would be happy to assist you in the policy review process for free. Simply email us at info@mericleco.com.

DISCLOSURE

TAX ADVICE

Any tax advice contained in this communication is not intended or written to be used, for the purpose of (i) avoiding penalties under the Internal Revenue Code or (ii) promoting, marketing, or recommending to another party any transaction or matter addressed herein.

These materials are not intended to be opinions or advice on legal, tax, accounting, or investment matters. Private counsel should be consulted prior to application of this general information to specific situations.

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable. We cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

The information in this post is hypothetical. Values shown are not guaranteed and will vary from product to product. Assumptions are subject to change by the carrier. Actual results may be more or less favorable.

Jason Mericle

Founder

Jason Mericle created Mericle & Company to provide families, business owners, and high net worth families access to unbiased life insurance information.

With more than two decades of experience, he has been involved with helping clients with everything from the placement of term life insurance to highly sophisticated and complex income and estate planning strategies utilizing life insurance.

Stay In The Know

Get exclusive tips and practical information to help you create, grow, sustain, and protect your wealth.

Ask Us Anything

We Are Here To Answer Your Questions