The Ultimate Guide to Indexed Universal Life Insurance

Indexed Universal Life Insurance (IUL) offers a unique alternative to more traditional permanent life insurance policies.

While Indexed Universal Life Insurance may not be right for everyone – it does help fill a gap in the permanent life insurance marketplace.

Index universal life insurance is a type of permanent life insurance allowing for flexible premium payments. Each indexed universal life insurance policy consists of a premium, cash value, and death benefit.

The cash value of the policy is determined by the performance of the chosen market index.

How Does Indexed Univeral Life Insurance Work?

What makes indexed universal life insurance unique is how the policy cash value is credited.

Index refers to the underlying indices being used to determine how the policy cash value is credited.

The most common and well-known index used in indexed universal life is the S&P 500. Depending on the carrier and product you will likely have access to several indices.

While the performance of the chosen index determines how the policy’s cash value is credited, the policy is not actually “invested” in the index. Because of this, the amount credited to the policy is contractually guaranteed to be at least zero.

Even if the chosen index performs negatively, the policy crediting rate is guaranteed to never be less than zero.

Insurance companies do this by purchasing options on the chosen index. Because of this, they can eliminate any negative returns in years where the chosen index is less than zero.

To guarantee a return of zero percent (even in years when the index returns -37%), insurance companies had to develop crediting methods. Crediting methods determine how much of the positive returns the cash value of the policy will be credited.

The best analogy is to think of a floor and ceiling. The floor is the guaranteed rate. This is the worst you can do. The return on the index can never be lower than the guaranteed rate or floor.

The ceiling represents the maximum amount the cash value can be credited based on the performance of the chosen indices. This represents the ceiling. The ceiling will be determined by the chosen index and crediting method.

The ability to avoid negative returns is the most important feature of indexed universal life insurance.

Although these policies include a contractual guarantee of zero or higher it is possible for the cash value to go down in any given year. The reason for this is policy fees, administration, and mortality expenses are still taken from the policy to support the death benefit.

Some policies do guarantee a certain cash value over a specified period. When evaluating indexed universal life insurance, it is important to understand how the policy you are evaluating works.

Indexed Universal Life Insurance Cap Rates, Participation Rates, Spreads, and More

There are three primary crediting methods used for indexed universal life insurance policies (1) cap rate, (2) participation rate, and (3) spread.

In some cases, a life insurance company will use a combination of crediting methods to determine how the cash value is credited in any given year.

Based on the return of the chosen index we can determine how the policy cash value will be credited.

IUL Cap Rates

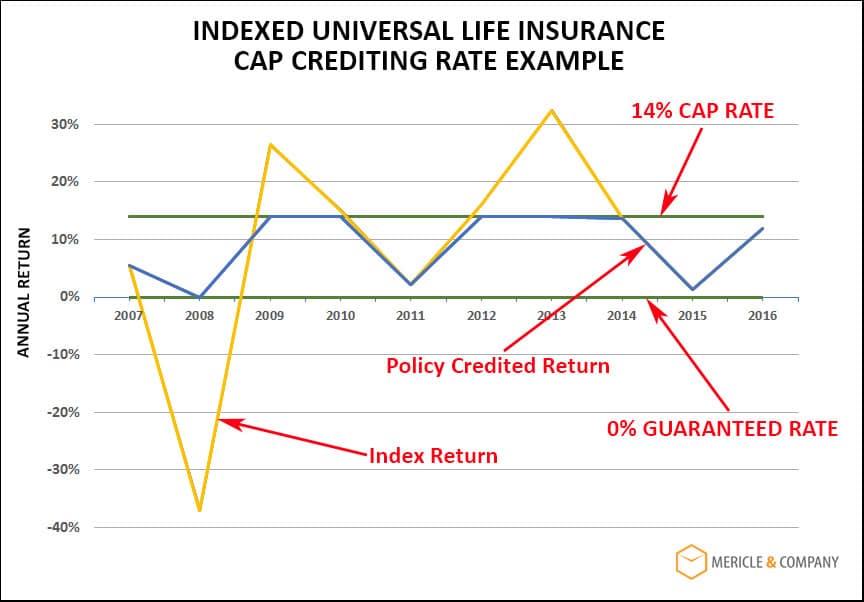

An IUL Cap Rate places a limit on how much the cash value of the policy can be credited.

A policy with a Cap Rate cannot be credited more than the declared Cap Rate by the insurance company.

For instance, if the Cap Rate is 14% the policy cannot be credited more than this. If the index has a return of 25%, the policy will be credited 14%. If the index return is -15% the policy will be credited 0%.

All the Cap Rate does is place a maximum return on how much the policy can be credited.

In this example, the average index return was 8.75%. The credited return to the index universal life insurance policy cash value was 9.06%. The primary reason the policy crediting rate outperformed the index return was because of the 0% guarantee return.

Insurance companies do reserve the right to adjust the Cap Right.

IUL Participation Rates

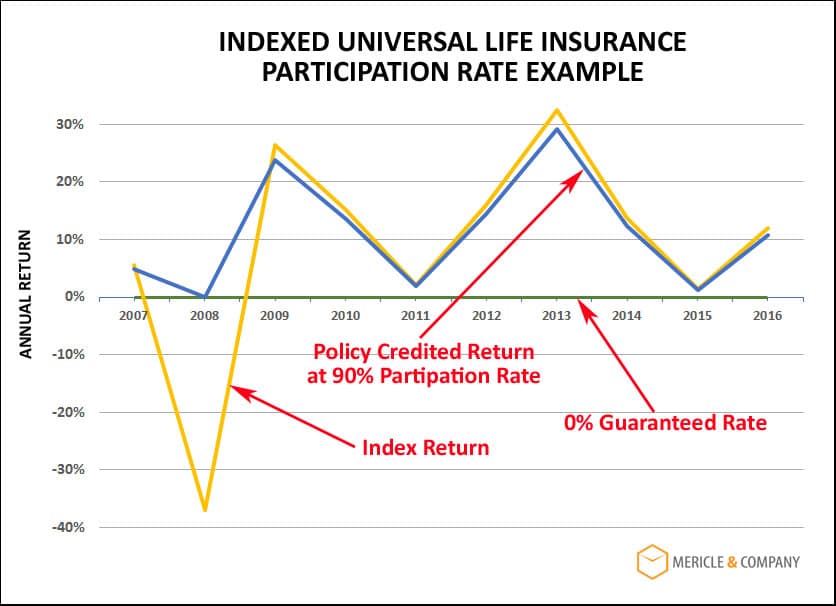

IUL Participation Rates are very different from Cap Rates. A Participation Rate can best be described as the percentage of the total index period return the policy would be credited.

Stated differently, if the crediting method has a 90% participation rate and the index return is 10%, the policy crediting rate is 9% (10% Index Return times 90% Participation Rate).

Using the same index assumption in this example as we did for the Cap Rate, the average index return is still 8.75%. However, using the Participation Rate crediting method assuming a 90-percent participation rate, the average over the same period of time would have been 11.21%.

Again, assuming the underlying index performs negatively the policy would be credited no less than 0% in this example.

IUL Spreads

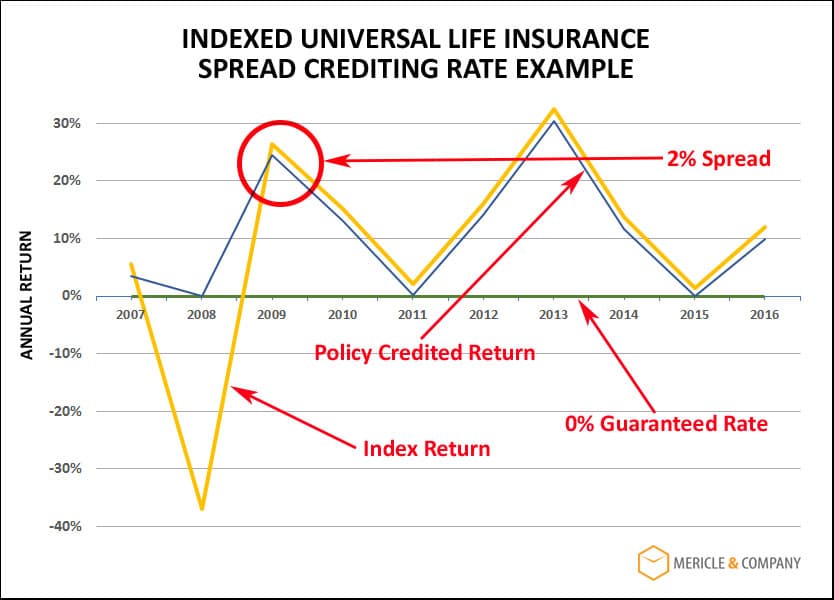

Indexed universal life insurance spreads are like management fees. Spreads are expressed as a percentage. If an indexed universal life insurance policy has a 2.00% spread, the cash value will be credited the gross index return less the spread.

Using the IUL Spread crediting method the average return would have been 10.72%.

Combining IUL Crediting Methods

To make it more confusing, it is possible to have a crediting methodology that includes both a Participation Rate and Cap Rate.

For instance, assuming a 14% Cap Rate, 90% Participation Rate, and a 10% Index Return we can determine the crediting rate.

Step 1 – Participation Rate

Based on a 10-percent index return and 90-percent participation rate the crediting rate is 9-percent.

Step 2 – Cap Rate

Since the crediting rate of 9-percent exceeds the 8-percent Cap Rate we know the policy crediting rate is 8-percent.

Now that you’ve mastered indexed universal life insurance crediting methods, it’s time to understand index periods or segments.

Understanding Indexed Universal Life Insurance Index Periods and Segments

In addition to the crediting method, the index period and segments play a significant role in determining how the cash value is credited.

The index period is the starting and ending point of a segment. A segment begins any time you start a new index period.

For instance, if the owner of a policy makes monthly premium payments the policy will have 12 segments. One segment for each payment. Each segment will then have its own index period.

The most common index period is annual point-to-point. An annual point-to-point index period means the insurance company is going to look at the value of the chosen index on the day the segment began and the value of the index one year later.

If the value at end of the period is greater than it was at the beginning the cash value of the policy will be credited in accordance with the crediting method. Conversely, if the value is less the policy will be credited the guaranteed rate.

When the index period has matured, the owner can choose to continue with the same indexing strategy, move to another index strategy, or move to the fixed account.

Other point-to-point indexing periods may include two or five-year periods or something completely different.

Alternate indexing periods may include averages, such as daily or monthly. With a monthly average, an insurance company may look at the index return at the beginning and end of a 30-day period. At the end of a year, they may take the average of all twelve 30-day periods to determine the policy crediting rate for that segment.

Final Thoughts on Indexed Universal Life Insurance

Index universal life insurance can be a very confusing product. But, it has a lot of advantages. What makes indexed universal life insurance unique is the ability to receive positive returns based on the performance of the chosen index without being subject to losses.

In today’s financial environment index universal life insurance provides policy owners with the opportunity to participate in market returns without participating in negative returns.

It is important to remember these are still life insurance policies. And, there is still a cost to having life insurance protection. So while you may have a guaranteed return of zero percent it is possible for the policy cash value to go down based on policy expenses.

When considering index universal life insurance it is important to work with somebody who understands how the policy works.

The information contained in this article is hypothetical. Results and performance will vary based on a number of factors. If you are interested in indexed universal life insurance you should consult with a licensed advisor to help you understand and evaluate your options.

Jason Mericle

Founder

Jason Mericle created Mericle & Company to provide families, business owners, and high net worth families access to unbiased life insurance information.

With more than two decades of experience, he has been involved with helping clients with everything from the placement of term life insurance to highly sophisticated and complex income and estate planning strategies utilizing life insurance.

Stay In The Know

Get exclusive tips and practical information to help you create, grow, sustain, and protect your wealth.

Ask Us Anything

We Are Here To Answer Your Questions

Start A Conversation

Schedule a complimentary 30 minute Zoom meeting to learn more about your options.