Advanced Planning: Leveraging Sales to a Defective Trust Using Life Insurance

A high-net-worth family was working with their estate planning attorney to reduce estate taxes and minimize gift taxes. The couple’s $160 million net worth is comprised primarily of high-growth, high-income producing real estate.

The husband (Age 58) runs the daily operations of the company and wants to make sure his wife (Age 56) has sufficient funds to maintain her lifestyle if he predeceases her. They also have a strong desire to leave a legacy for their heirs, while making substantial philanthropic contributions.

At life expectancy, the couple’s approximate estate tax liability is projected to be $50 million after charitable bequests and estate planning.

Should the husband predecease his wife, he wants her to have access to $10 million of liquidity for her to use for living expenses along with creating another source of funds to assist with paying estate taxes.

The couple would also like to retain control of a majority of their real estate holdings but are comfortable using $10 million of assets for planning purposes. The holdings are growing by 5% and providing 6% of income annually.

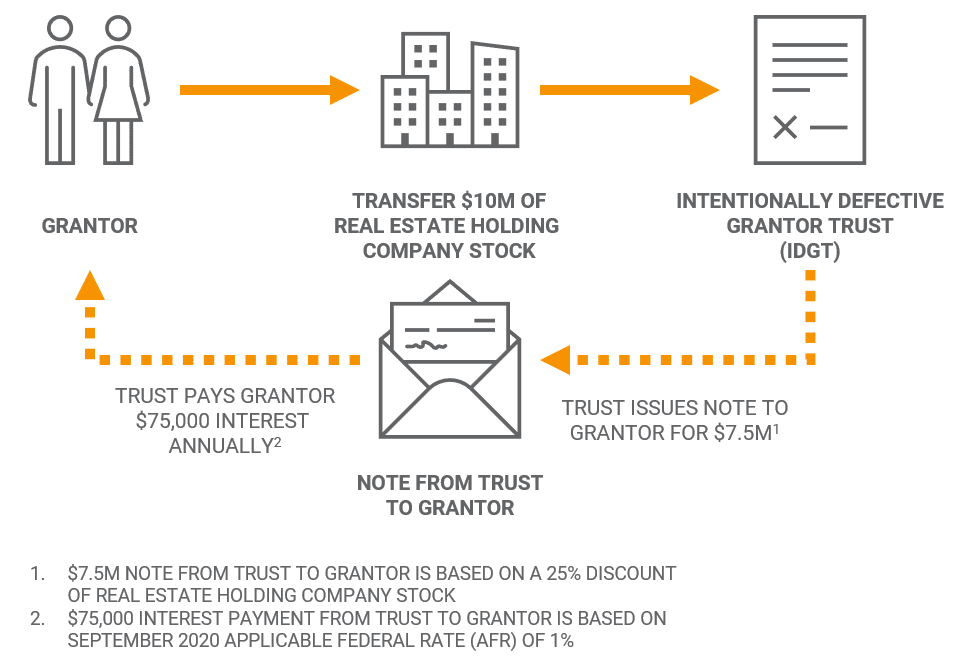

To accomplish this, the couple had a third-party valuation completed on their real estate holding company. Based on the valuation, they received a 25-percent discount on $10 million of company stock. The couple then sold the stock to an Intentionally Defective Grantor Trust (IDGT) in return for a note.

The shares of the real estate holding company were sold to the trust using a 30-year note. The note is based on the current long-term applicable federal rate (AFR) of 1.00%.

A “seed” gift of $1 million was made to the trust using a combination of cash and real estate holdings. This will help to ensure the transaction is treated as a legitimate sale, while providing the trust with first-year liquidity needs.

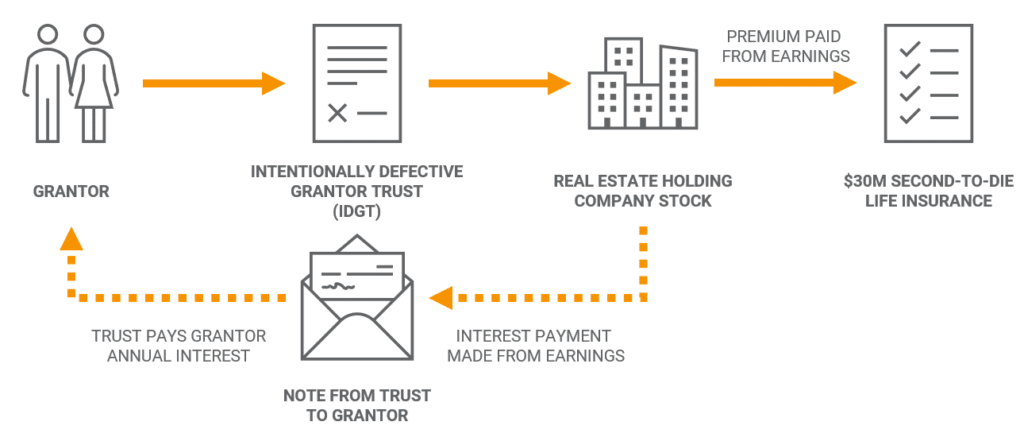

The real estate holdings inside the trust will generate income. The income is used to purchase a $30 million second-to-die life insurance policy and pay interest back to the grantor. The trust owns and is the beneficiary of the life insurance policy and pays the annual premium of $222,421. The trust also makes interest payments of $75,000 to the grantor(s).

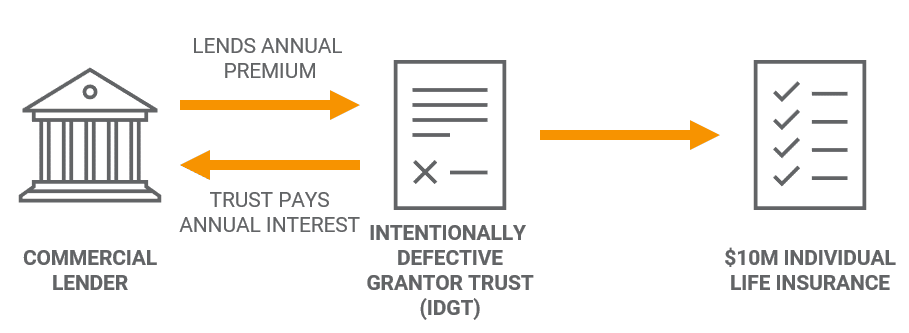

The second step is to secure $10 million of individual coverage on the husband. Using commercial premium financing, the trust will borrow the annual premium of $219,699 from a commercial lender for 10-years. The trust will use the excess income from IDGT to pay the loan interest each year. This also gives the trust enough excess earnings to pay off the premium finance loan in Year 11.

This design provides the client with a great deal of flexibility. The $10 million death benefit proceeds can be used to repay some or all the IDGT note. This could then be paid to the wife to pay for living expenses or help the estate.

Why this Makes Sense?

Using these techniques, the clients were able to:

- Secure needed life insurance coverage outside of their estates.

- Use cash flow from real estate holdings in the Intentionally Defective Grantor Trust (IDGT) to make premium payments and service loan interest.

- Transfer the growth on $10 million of high-income producing real estate out of their estate, while taking advantage of a low September 2020 AFR rate of 1.00%.

- The premium financed life insurance policy on the husband was able to benefit from a low-interest-rate environment.

- The death benefit proceeds can be used to help cover living expenses for the wife, and/or repay the note from the IDGT or are used to assist with estate taxes.

Conclusion

Current low-interest rates available via the Applicable Federal Rate and 12-month LIBOR provide clients with several estate planning opportunities. In this case, low rates helped the clients:

- Move the appreciation of the real estate holdings outside of the estate, creating an “estate freeze” on those shares.

- Acquire life insurance policies in their trusts and minimize gift tax costs.

- Provide liquidity for estate taxes at the second death, and

- Provide liquidity for the wife to help cover living expenses or additional estate tax obligations.

By using the combination of these techniques, the couple has the assurance the wife will have liquidity when needed, and there will liquidity to help pay estate taxes.

DISCLOSURE

TAX ADVICE

Any tax advice contained in this communication is not intended or written to be used, for the purpose of (i) avoiding penalties under the Internal Revenue Code or (ii) promoting, marketing, or recommending to another party any transaction or matter addressed herein.

These materials are not intended to be opinions or advice on legal, tax, accounting, or investment matters. Private counsel should be consulted prior to application of this general information to specific situations.

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Jason Mericle

Founder

Jason Mericle created Mericle & Company to provide families, business owners, and high net worth families access to unbiased life insurance information.

With more than two decades of experience, he has been involved with helping clients with everything from the placement of term life insurance to highly sophisticated and complex income and estate planning strategies utilizing life insurance.

Stay In The Know

Get exclusive tips and practical information to help you create, grow, sustain, and protect your wealth.

Ask Us Anything

We Are Here To Answer Your Questions

Start A Conversation

Schedule a complimentary 30 minute Zoom meeting to learn more about your options.