Life Insurance and Mortality: What Life Insurance Carriers Don’t Want You To Know!

There are certain inevitabilities in life. Like it or not, one of them is death. When our own mortality comes into question there are always challenges and questions we must confront.

For people who own life insurance, many times they’ll want to make sure the coverage is active or inforce. After all, you’ve likely spent years making premium payments. The proceeds from a life insurance policy can have a significant financial impact on family members.

But, what happens when you have a permanent life insurance policy and your facing mortality?

Unbeknownst to many people, permanent life insurance may allow insureds facing mortality to reduce or even stop making premium payments.

Why Is This?

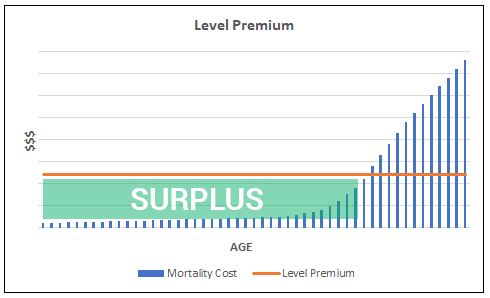

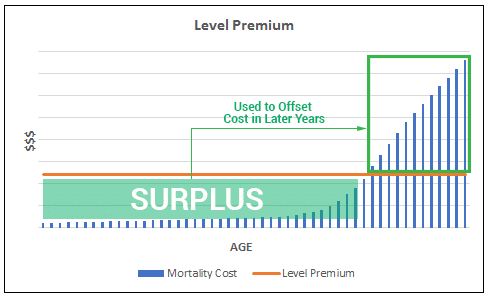

When you purchase a permanent life insurance policy you are overpaying for coverage. The reason for this is to create a surplus in the policy. The surplus is then used to offset future costs – when the expenses of the policy exceed the premiums being paid.

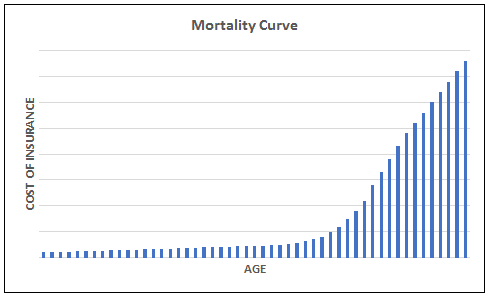

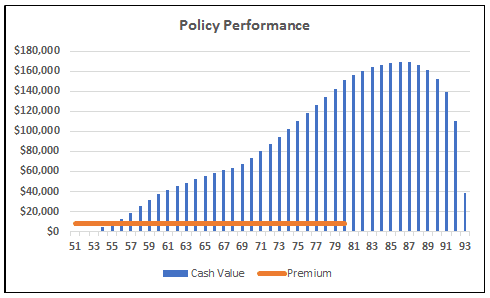

The following chart shows the “cost” or “expense” of a life insurance policy on a yearly basis. You’ll see in the early years the cost is relatively low. As you get into your 80’s and 90’s the cost of the coverage becomes prohibitively expensive.

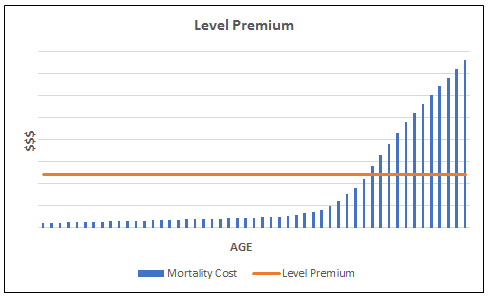

This makes sense because the older we get the closer we are to dying. To avoid costly charges later in life, insurance companies and agents will often “levelize” premiums.

This approach creates a policy surplus in the early years that is then used in the later years to offset policy expenses.

When the cost of the policy exceeds the premium being paid, the surplus is used to offset the policy cost(s). This is why, at a certain age, you will see the cash value of a policy begin to decline.

What Does This Have To Do With Life Insurance and Mortality?

Depending on your age when faced with mortality and the financial health of your permanent life insurance policy, you may have options.

While life insurance carriers may cringe at the following statement, it is absolutely true:

The goal of every insured with a permanent life insurance policy should be to die with as little money in the policy as possible.

Think about it.

What is the benefit of having a pile of cash in your policy?

It’s great for the insurance company, but not so great for your beneficiaries.

Let’s say you have a $1 million policy with $100,000 of cash value. Assuming you pass away, the insurance company would pay out the full $1 million benefit. Since you have $100,000 in cash value the net financial impact to the insurance company is only $900,000.

Are You Starting To See The Picture?

When the time comes where your mortality becomes foreseeable you (or a family member) need to evaluate your life insurance options. Whether you deal directly with the insurance company or an agent you should ask the following questions:

- How long will the coverage last without any additional premium payments?

- What is the “cost of insurance” for the coverage to last another month, year, etc.?

When we talk about death being foreseeable, it could be days or years. If it’s days, you simply need to make sure the coverage is there. If it’s going to be longer you need to know your options. You also need to know what the cost would be if the insured lives longer than expected.

For illustrative purposes, let’s say the insured in question purchased a $1 million policy at age 50. The level premium payment was projected to be $8,240 per year for the rest of their life. At age 80 the individual in question experiences health complications. Uncertain as to how much longer they will live, they make the decision to review the existing life insurance coverage.

The first question is how long will the coverage last without any additional premium payments?

After careful review and analysis, we can determine the coverage will last THIRTEEN more years without any additional premium payments.

This is significant. If our insured feels they will not live an additional 13-years, why should they continue to make premium payments?

The answer is they wouldn’t (unless they have a soft spot in their heart for the insurance company).

Permanent life insurance is confusing. Understanding your options shouldn’t be. Like many other assets, permanent life insurance allows you to build equity. This equity can be used to sustain coverage.

If your policy is financially healthy, there is no reason to continue making premiums if you know your mortality risk.

Alternatively, if your policy is financially unhealthy you will have to pay additional premiums to keep the coverage inforce. If this is the case it is important to ask the insurance company for the “pure” cost of insurance to keep the coverage inforce for another year. This could result in paying less than the projected level premium.

This approach is riskier. By doing this you’ll be paying the “true” cost of the coverage. As referenced earlier, you are now paying on the mortality curve. The risk of this is living longer than expected. Since you’ve chosen to pay the actual cost of the policy, expenses will increase every year. If you live too long, the coverage may become cost-prohibitive.

Final Thoughts on Life Insurance and Mortality

By working with an advisor who understands how a policy works can have a significant financial impact. Knowing what options you have, and how each option could affect the policy will allow you and your family to make the most informed decision possible based on the given circumstances.

If you have a question, comment, or policy you’d like reviewed you can email us at info@mericleco.com.

DISCLOSURE

TAX ADVICE

Any tax advice contained in this communication is not intended or written to be used, for the purpose of (i) avoiding penalties under the Internal Revenue Code or (ii) promoting, marketing, or recommending to another party any transaction or matter addressed herein.

These materials are not intended to be opinions or advice on legal, tax, accounting, or investment matters. Private counsel should be consulted prior to application of this general information to specific situations.

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable. We cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Jason Mericle

Founder

Jason Mericle created Mericle & Company to provide families, business owners, and high net worth families access to unbiased life insurance information.

With more than two decades of experience, he has been involved with helping clients with everything from the placement of term life insurance to highly sophisticated and complex income and estate planning strategies utilizing life insurance.

Stay In The Know

Get exclusive tips and practical information to help you create, grow, sustain, and protect your wealth.

Ask Us Anything

We Are Here To Answer Your Questions

Start A Conversation

Schedule a complimentary 30 minute Zoom meeting to learn more about your options.