How Your Permanent Life Insurance Policy Could Terminate Before You Die and What You Can Do to Stop It From Happening

Purchasing life insurance coverage is important for many people. It helps protect against the financial loss of a loved one, provides liquidity for estate protection, or can be used to provide supplemental retirement income in later years.

But, many people who own life insurance rarely take the time to review their coverage. Performing a life insurance policy review every few years (if not more frequently) is important for anyone who owns a permanent life insurance policy. This includes universal or whole life insurance protection.

Many people who own permanent life insurance don’t realize how many moving parts a policy can have. In many cases, people (and even advisors) have very little understanding of how these moving parts can impact a policy.

A Different Perspective

The easiest way to understand (most) permanent life insurance policies is by comparing it to your retirement plan.

Think of it this way…

Let’s say you’re currently 45-years old and your plan is to retire at Age 65. To retire, you know you’ll need to have $1 million in your retirement account when you turn 65. You are also confident you can earn 5-percent growth on your money.

Based on this set of assumptions, we can determine you would need to contribute $26,663 per year reach to have $1 million in your retirement account at Age 65.

If you earned 6-percent you would be able to discontinue contributions at Age 61, and would still end up with a little over $1 million at Age 65.

Conversely, if you earned 4-percent you would need to either increase the amount you contribute to meet your goal or delay your retirement beyond Age 65. If you chose to delay your retirement, you would have $1 million at Age 67.

Make Sense?

Most permanent life insurance policies work in a similar fashion. Permanent life insurance policies include cash value. The cash value of a policy is used as a reserve to offset the increased charges of the policy as you get older. Essentially, you are overpaying for coverage early on, and underpaying for coverage as you get older.

Check out The Flexibility and Benefits of Universal Life Insurance to get a better understanding.

The cash value is often linked to a crediting rate or dividend issued by the insurance company. Any changes to the underlying crediting mechanism will affect the policy (similar to your retirement account). This is especially true when the policy cash value is linked to an index or invested in subaccounts (mutual funds).

Life Insurance Policy Review Case Study

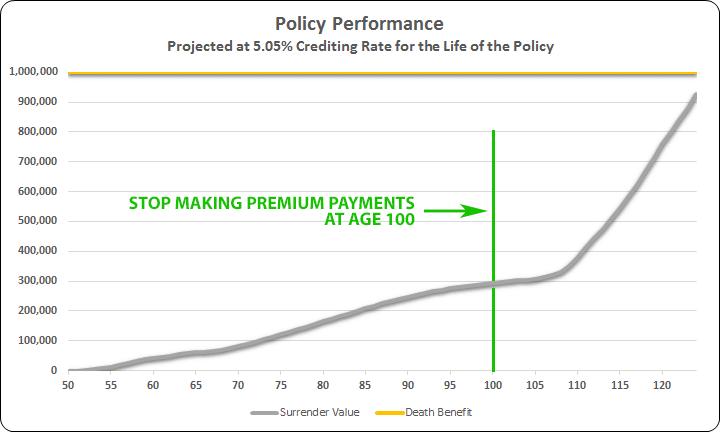

Take for instance a 50-year old male interested in $1 million of permanent life insurance protection. Utilizing a universal life insurance policy with a 5.05% crediting rate (we are assuming the policy owner will make premium payments annually every year until the insured is age 100).

Based on these assumptions the policy owner will pay an $8,337 premium per year. At Age 100 it is projected the policy will have $291,315 of cash value, and the coverage will last until the insureds Age 125.

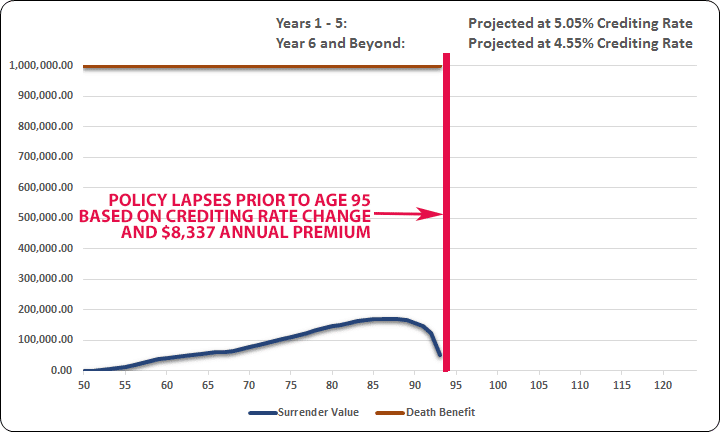

Now, let’s assume the insurance company reduces its crediting rate from 5.05% to 4.55% beginning in Policy Year 6.

Assuming the policy owner continues to make the $8,337 annual premium, the coverage will lapse or terminate when the insured is 95. Now, this is fine if the insured passes away prior to 95, but what happens if they live beyond Age 95?

However, if the insured lives beyond age 95 it is projected the policy owner will have to pay $111,910 each year for the coverage to stay in force.

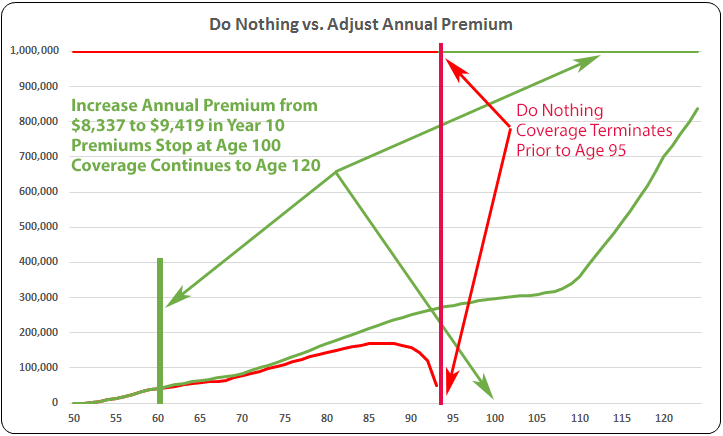

Had a policy review been conducted in Year 10 of the policy, the policy owner would have been made aware of how the policy is projected to perform.

From there a recommendation could be made to avoid the policy terminating prior to age 95. And, what options are available to keep the coverage in force while avoiding having to pay $111,910 per year at Age 94.

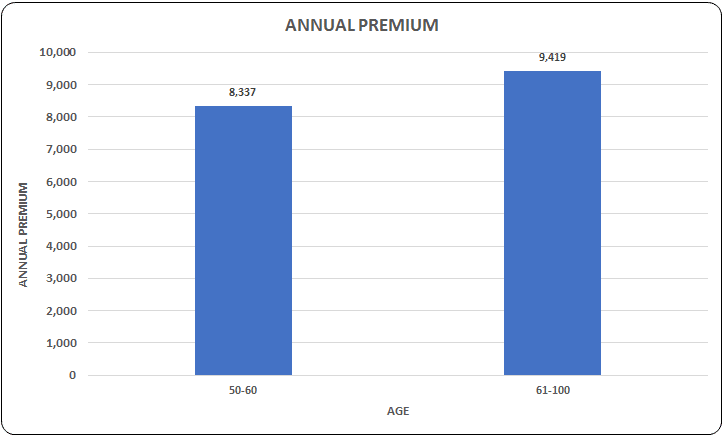

The first recommendation would be to increase the premium payment in Year 11. By doing this the policy will avoid termination at age 95, and ensure the coverage remains in force for the life of the insured.

By doing a simple calculation we can determine that by increasing the premium from $8,337 to $9,419 in Year 11, the policy will continue to perform as originally intended.

Since the policy crediting rate was reduced to 4.55%, the additional premium will help to offset this reduction.

It doesn’t make a difference if the policy is universal or whole life insurance. Any decline in the crediting or dividend rate since the coverage was initially purchased will have an impact on how the policy performs over its lifetime.

In most cases, permanent policies purchased 10 or more years ago will have likely experience a crediting or dividend rate reduction. Some policies issued between 5 and 10 years ago may have experienced a decline. Most policies purchased in the last 5-years probably will not have seen a decline. But, there are some policies that will.

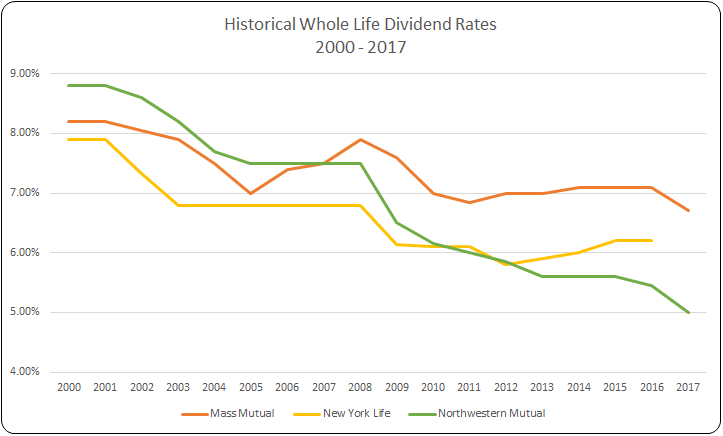

The following chart outlines Mass Mutual, New York Life, and Northwestern Mutual’s historical dividend rates since 2000.

With the exception of Mass Mutual, the declared dividend rate for each company has either stayed the same or gone down each year since 2000. These declines will have a significant impact on the overall performance of the policy.

The good news is over the past 5 to 7-years rates have begun to settle. Part of this is because they can’t go much lower. In some cases they can, but there isn’t that much further they can go down.

If you purchased a policy in the last 5-years it is likely your policy will end up performing very close to the level it was initially purchased.

You essentially bought low. Congratulations!

As interest rates rise we should see dividend and crediting rates increase – something we haven’t seen in quite some time. If this happens there may be a time where you can reduce your premium, not make as many premium payments, or improve the cash value.

Revisiting our earlier scenario, if the policy was purchased when the crediting rate was 4.55% (instead of 5.05%) the projected annual premium would have been $8,903 (instead of $8,337).

If in Year 6 the crediting rate increased to 5.05% the policy owner could:

Life Insurance Policy Review – Scenario 1

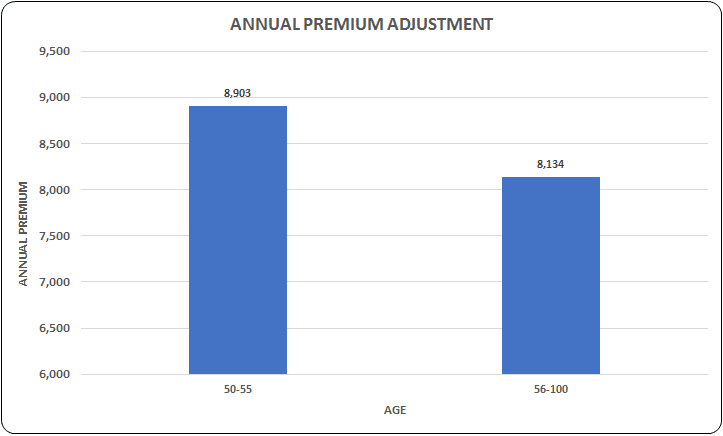

Reduce Ongoing Premium Payments From $8,903 To $8,134 (Beginning Year 6)

By reducing the premium payment in Year 6 to $8,134 the policy owner would continue to pay this amount for the life of the insured. Remember, this also assumes the crediting rate stays at 5.05% from Year 6 for the life of the policy (which is not likely). However, if the crediting rate goes up the premium could be adjusted down.

Life Insurance Policy Review – Scenario 2

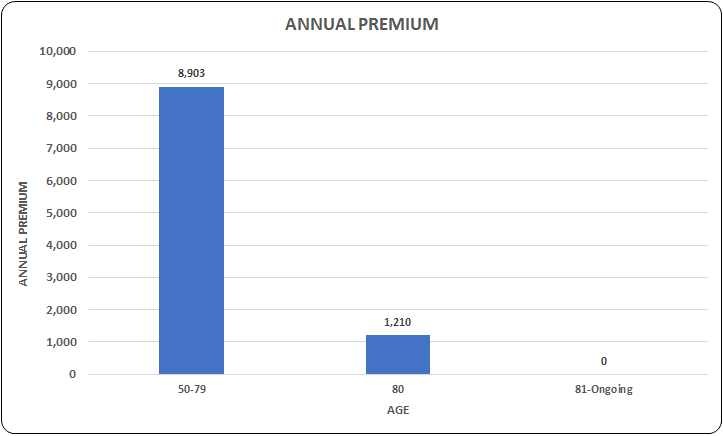

Continue Paying the $8,903 Annual Premium

If the policy owner decides to continue paying the annual premium of $8,903, despite the crediting rate increase, they would create a surplus of cash value.

Because of this, the policy owner would be able to stop making premium payments after the insureds 80th birthday. The policy would have enough cash surrender value to support the ongoing costs of the policy until the insured passes away.

Life Insurance Policy Review Final Thoughts

Hopefully, we’ve demonstrated the value of completing a life insurance policy review every few years. If you’re considering a life insurance policy review or are looking for a second opinion on your existing coverage, it is important to work with an advisor who is independent and NOT affiliated with a single insurance company (e.g. New York Life, Mass Mutual, Northwestern Mutual, etc.)

It is important to work with an advisor who understands what your trying to accomplish, understands the marketplace, and can make independent recommendations based on your specific situation.

A proper policy review will include a detailed analysis of existing coverage and options moving forward. It should consider any changes that have occurred since the policy was originally purchased:

- Has there been a change in lifestyle (e.g. new job, kids, divorce, etc.)?

- Has the need for coverage changed?

- Is the amount of existing coverage still appropriate (do you need more, less, or the same amount of coverage)?

- Has the reason for having the coverage changed?

Once these items have been addressed, an independent insurance advisor should be able to perform a market analysis. This process involves reviewing pricing, crediting options, and expenses of other life insurance products to determine if a different policy may be more suitable.

Think of your permanent life insurance policy like you would any other investment or retirement account. It should be monitored and reviewed on a regular basis to determine if it is performing as planned. If it isn’t, taking the time to make proper adjustments early on will be to your benefit.

Please note the charts used are for informational purposes. Many factors can influence the performance of a policy. It is important you work with someone who understands permanent life insurance and is not affiliated with a specific life insurance company.

Jason Mericle

Founder

Jason Mericle created Mericle & Company to provide families, business owners, and high net worth families access to unbiased life insurance information.

With more than two decades of experience, he has been involved with helping clients with everything from the placement of term life insurance to highly sophisticated and complex income and estate planning strategies utilizing life insurance.

Stay In The Know

Get exclusive tips and practical information to help you create, grow, sustain, and protect your wealth.

Ask Us Anything

We Are Here To Answer Your Questions

Start A Conversation

Schedule a complimentary 30 minute Zoom meeting to learn more about your options.