The Importance of Life Insurance Policy Reviews

A life insurance policy review is an important process that will help you understand your current coverage and make sure it still meets your needs. While owning a life insurance policy may seem pretty straightforward, some policies can be extremely complex.

When we talk about a life insurance policy review, we are typically referring to permanent life insurance policies. These types of policies generally include whole life insurance and universal life insurance.

Unbeknownst to many people, the ongoing performance of the policy (and premiums) are based on assumptions that may or may not come true. In some cases, the policy may outperform the initial projections, but in many cases, they are actually underperforming.

The result can be devastating to an individual who is under the impression that if they pay the premium the coverage will always be there.

What Factors Can Affect Permanent Life Insurance Policy Performance?

Permanent life insurance policies are usually designed to last a lifetime. However, there are a number of factors that can both positively and negatively affect policy performance. Here are a few of the most common:

- Dividend, Crediting, or Investment Rate Performance

- Changes in Mortality Rates and Policy Expenses

- Policy Loans

- Permanent Policies with a Term Rider

In order to help understand how these factors can affect permanent life insurance policy performance, it will help to understand the difference between guaranteed and current assumptions.

Guaranteed assumptions include the maximum mortality and plan expense charges and minimum dividend or crediting rate a carrier can apply to a life insurance policy. Both of these will vary from policy to policy.

Current assumptions assume current expenses and current dividend or crediting rates. This is what the carrier is actually charging for the coverage.

Dividend, Crediting, or Investment Rate Performance and Policy Expenses

What rate your policy receives is going to be a function of what type of policy you own. A whole life insurance policy will have a dividend rate. A current assumption and/ or index universal life insurance policy will have a crediting rate. A variable universal life policy will receive a credit based on the underlying subaccount investment performance.

Changes to any of the abovementioned rates will impact the policy’s current assumptions. The guaranteed assumptions will remain unaffected assuming premium payments are made on time.

If you own a whole life insurance policy the cash value will receive a dividend based on the carrier’s dividend rate. If the carrier has a guaranteed dividend rate of 4.00% the current dividend rate can never be less.

Whole Life Insurance Policy Review Example

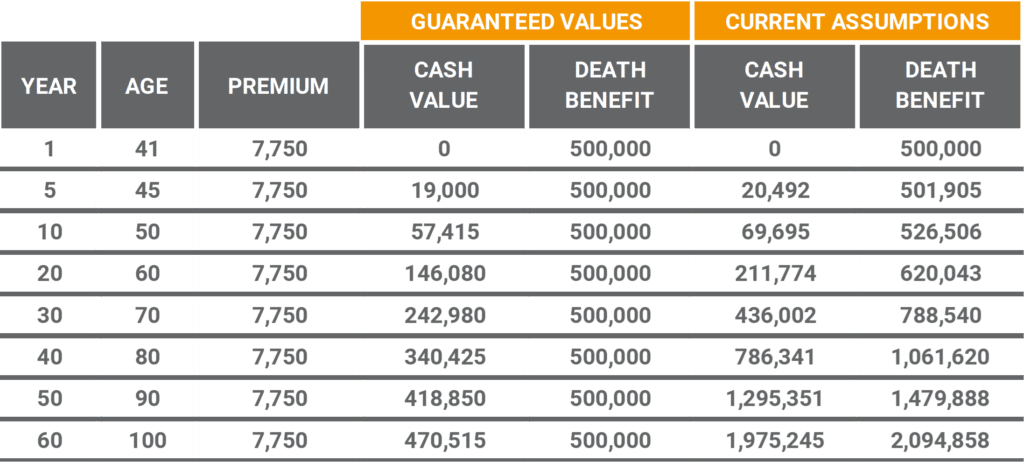

The following example illustrates a $500,000 whole life policy insuring a 40-year-old male. The policy assumes a 5.75% current dividend rate for the life of the policy. The policy has a 4.00% guaranteed dividend rate.

The columns labeled Guaranteed Values use the guaranteed dividend rate and maximum mortality and policy expense charges. The columns labeled Current Assumptions assume the current dividend rate and current mortality and expense charges.

Notice that at Age 80 the Current Assumptions Death Benefit is $561,620 greater than the Guaranteed Values Death Benefit. At the same time the Current Assumptions Cash Value is projected to be $445,916 greater than the Guaranteed Values Cash Value.

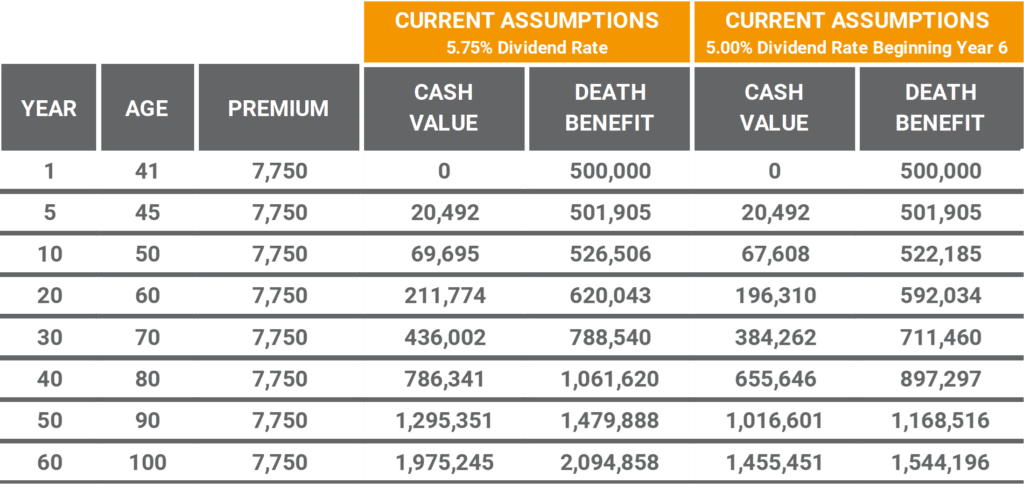

But what happens to the Current Assumptions if the Dividend Rate drops from 5.75% to 5.00% in Policy Year 6?

Here you will see that values in Years 1 and 5 are the same. This is because we are using the same assumptions. But, when the dividend rate changes in Year 6 from 5.75% to 5.00% you will see the values in future years change.

At Age 80, instead of having $768,341 of Cash Value and a $1,061,620 Death Benefit it has gone down to a Cash Value of $655,646 and $897,297 Death Benefit.

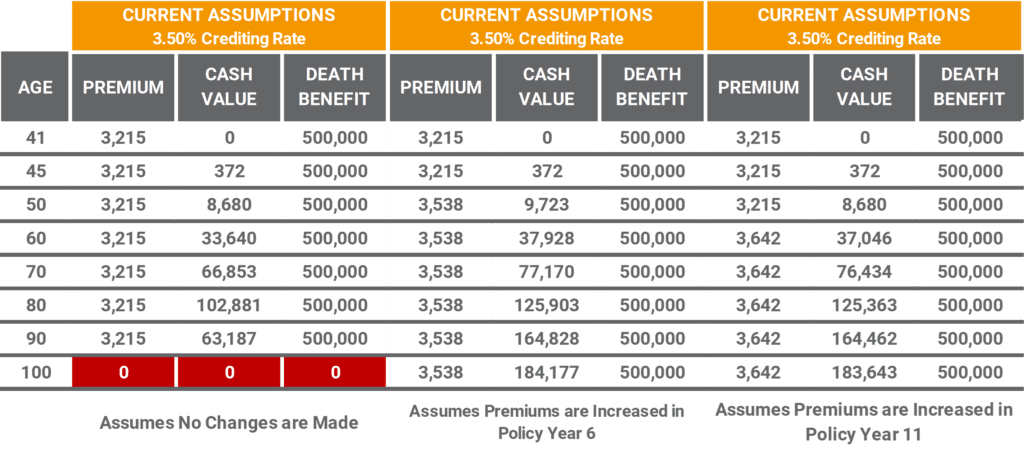

Universal Life Insurance Policy Review Example

Current Assumption Universal Life Insurance is generally the least expensive type of permanent life insurance available in the marketplace. This type of policy does offer certain guarantees, but the policy owner is mostly interested in how the policy performs assuming the current assumptions.

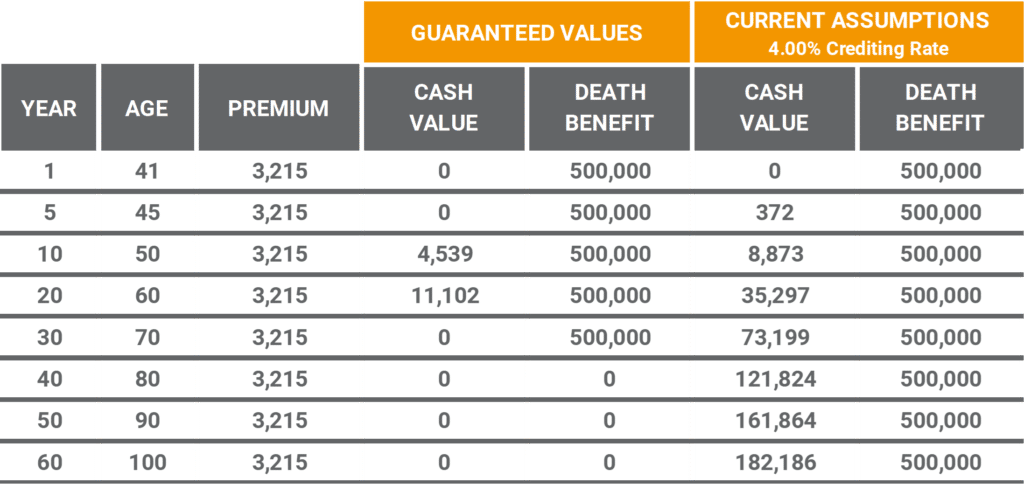

For this example, we will continue to use the same inputs as we did above for our 40-year-old male. The main difference with this policy is it has a guaranteed crediting rate of 1.00% and we are assuming a 4.00% current crediting rate.

The first thing you will notice is the premium is significantly lower on this policy when compared to the whole life policy. Conversely, the death benefit under the Current Assumptions is not increasing over time.

In addition, the policy guarantees for this policy are much worse in comparison to the whole life policy. In fact, the policy guarantees go away just before the insured reaches age 80. If you were to increase the premiums policy guarantees would last longer.

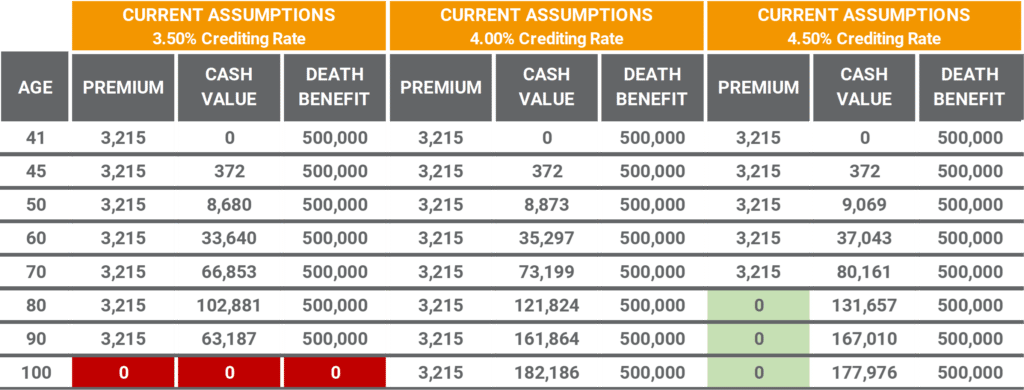

Now let’s take a look at what happens to the policy if the Crediting Rate increases and decreases by 0.50% in Policy Year 6.

There’s great news if the Current Crediting Rate increases to 4.50% beginning in Policy Year 6 and continues for the life of the policy. Assuming the $3,215 annual premium the policy owner would be able to stop making premium payments after they turn Age 75.

Unfortunately, if the Current Crediting Rate goes down in Policy Year 6 from 4.00% to 3.50% the policy is projected to lapse after the insured’s 91st birthday. The good news is if we catch this early enough during a life insurance policy review the costs are negligible.

In this example, we can increase the premium in Policy Year 6 to $3,538. Alternatively, if we wait until Year 11 the premium increases to $3,642. By doing this the policy is able to continue to the insured’s Age 125. If Current Crediting Rates increase in the future we can reduce the premium or continue to make the same premium payment over a shorter period of time.

Life Insurance Policy Loans

Life insurance policy loans can have a great impact on policy performance. Typically there are two scenarios where a policy owner will borrow money from their life insurance policy:

- They need access to cash and borrow money from the policy, or

- Are using their policy to provide a stream of income over time.

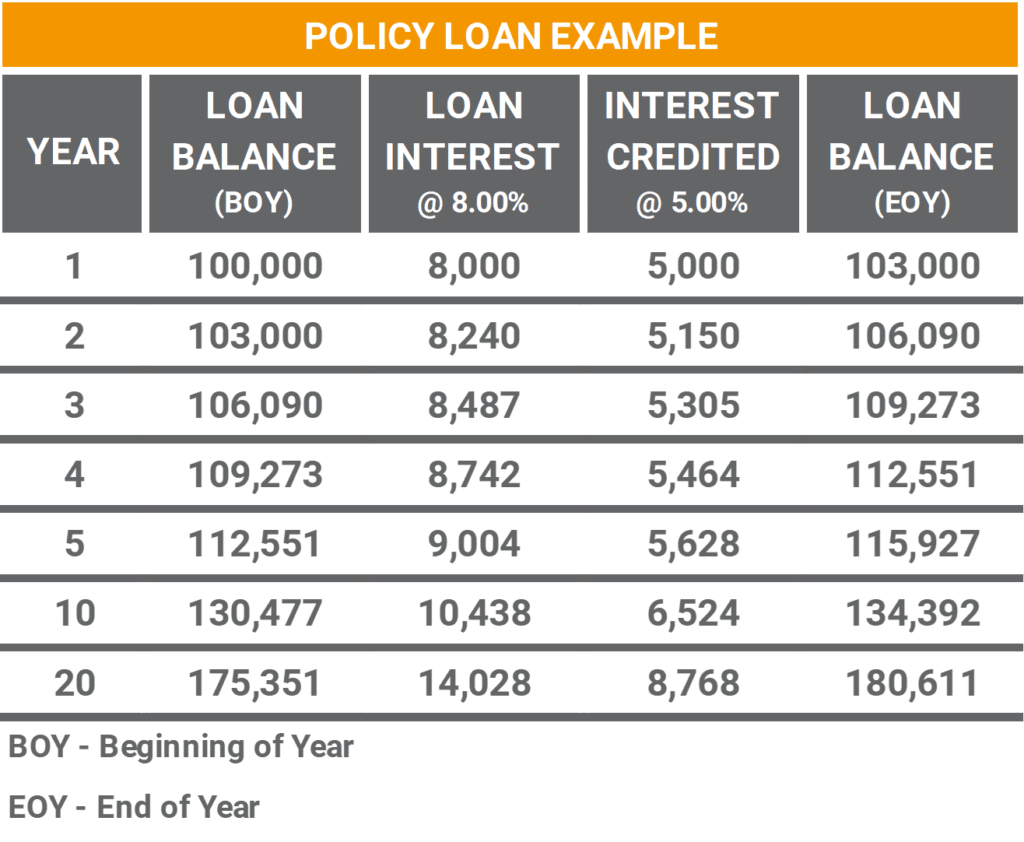

The way policy loans work is the policy owner borrows money from their policy. The loan is not a taxable distribution because it is treated as a loan. The insurance carrier will charge interest on the loan but will continue to pay a dividend or credit on the borrowed funds.

Each policy will include what the interest is on the loan and how the borrowed funds are credited. Many older (and some current) whole life policies charge 8% loan interest and pay a dividend at their current dividend rate or something slightly lower.

As an example, if you borrow $100,000 from your policy at 8.00% the loan interest is $8,000 per year. If we also assume a 5.00% dividend rate then the $100,000 loan will receive a credit of $5,000.

The net effect of the loan is -$3,000 of total interest or a 3.00% net loan interest rate. Beginning in Year 2, the outstanding loan balance will increase to $103,000 and will continue to increase over time.

As policy loans increase the death benefit will also go down by an amount equal to the gross policy death benefit less the outstanding loan balance.

Policy loans vary from policy to policy. Some products include a net-zero loan after the policy has been in force for a certain number of years.

In these situations, you may borrow money at a 5-percent interest rate, but the outstanding loan balance will also receive a credit of 5-percent. Like in our example above, if your policy has a $100,000 loan with 5-percent interest your loan interest will be $5,000, but you will receive a credit of $5,000 to offset the interest. The net result being the loan stays at $100,000 instead of increasing over time.

Permanent Policies with a Term Rider

We see this a lot with older whole life policies where the insured is in their 80s or 90s. When these policies were originally issued they include a term blend rider. The intent of the term blend rider was to reduce the overall cost of the policy and premiums.

However, the cost of the rider increases every year. As insureds get older the cost for this rider can become exorbitant causing the policy to lapse or require additional premiums. The reason for this is policies issued in the 1990s assumed much higher dividend rates than what was actually achieved.

If your policy initially assumed an 8-percent dividend rate over the life of the policy and the actual dividend rate was closer to 6-percent, then there is not going to be sufficient enough cash value to continue to maintain the cost of the policy as the insured gets older.

Doing a life insurance policy review will help you understand how your policy is performing and what to anticipate in the future.

How To Do a Life Insurance Policy Review?

A life insurance policy review helps to make sure your existing coverage is performing as originally intended and is still the best option given your current situation. There are a few things to keep in mind when doing a life insurance policy review.

First, review your existing coverage to make sure the death benefit is still enough to achieve your goals and objectives. If you have had a major life event, such as getting married, having a child, a divorce, or change in financial situation it may make sense to adjust your coverage.

Second, make sure the owner and beneficiaries of your policy still align with your priorities. It is easier to make beneficiary changes versus ownership changes.

Third, you can do this yourself or work with a life insurance professional to request policy illustrations from the carrier. We refer to one of the most common illustration requests to be an “As Is” illustration.

An “As-Is” illustration will simply illustrate your policy assuming your current premium payment and current dividend (or crediting) rate and mortality and expenses.

Additional illustration requests may assume a “zero pay” or “level pay solve to age 100.”

A “zero pay” solve assumes you make no additional premiums. This illustration will show you how long your policy will last without any additional premium payments.

A “level pay” solve will solve for the premium needed to keep the coverage in force to Age 100 based on current policy assumptions.

This may show that you can reduce your premiums if the policy’s current assumptions are performing better than originally projected.

Conversely, if the policy’s current assumptions are performing worse than originally projected it will illustrate a higher premium to maintain the coverage to Age 100.

Life Insurance Policy Review Process

Over the years we have done hundreds of life insurance policy reviews with dozens of different carriers. Knowing what questions to ask and what types of illustrations to request can save the policy owner a lot of time and frustration.

Here are some options when considering a life insurance policy review:

Do It Yourself

By doing it yourself you can simply contact the carrier’s customer service number. You will need to verify you are the owner of the policy by providing them with your policy number, along with the name and tax id of the policy owner.

Once you are verified as the policy owner you can request any policy information you want including beneficiaries, policy values, and illustrations.

Work With A Professional

You can work with a life insurance professional generally in one of two ways.

- Like the Do It Yourself example above, you can call the carrier with the insurance professional on the line. From there you can verify the policy owner information and authorize the customer service representative to discuss the policy with the insurance professional. From there the insurance professional can ask any questions they deem to be necessary in order to advise you on the policy.

- The second way is to complete a Third Party Authorization signed by the policy owner to the carrier granting the insurance professional permission to obtain policy information on the owner’s behalf.

Once the policy information is received the life insurance professional should be able to aggregate the information and provide you with a summary of the policy and how it is performing. After receiving the initial information it may be necessary to request additional information.

It is important to note this process takes time as insurance carriers can take 10 business days or more to provide information.

How Often Should I Review My Life Insurance Policy?

This is a tricky one and will vary from policy to policy. The policy type will likely determine how frequently the policy should be reviewed.

For current assumption policies like a variable, index, or current universal life insurance it makes sense to review them on an annual basis. This will help you understand how your policy is performing. It will also allow you to make necessary changes to the premium or death benefit. The same can be true for whole life policies assuming you are more interested in the performance of the current assumptions.

If you have a no-lapse guaranteed universal life insurance policy and you make premium payments on time there is not much reason to review the policy. However, if you miss a premium or don’t pay the premium on time you should complete a policy review.

Lastly, if there are any major life events it may make sense to revisit your policy.

Life Insurance Policy Review Checklist

Prior to doing a policy review, you should prepare the following information:

- It may seem obvious, but you will need to know the name of the carrier.

- Get the policy number

- Identify the name of the owner. This could be an individual, trust, or business.

- Obtain the owner’s Tax ID.

- Although it may not be necessary you should have the insured’s date of birth.

Once you have this information you will be ready to start the life insurance policy review process. The next steps are as follows:

- Locate the phone number for the life insurance carrier’s customer service.

- The policy owner needs to be the one who contacts the carrier and provide them with the information captured above.

When contacting the carrier you should request the following information:

- Current beneficiary information

- Mailing address confirmation

- As-Is illustration

Once you receive this information you may need to make a follow-up call to request additional illustrations. If you need to update the beneficiary information or the mailing address you will need to request the proper paperwork from the carrier.

Life Insurance Market Analysis

When working with a life insurance professional they should be able to provide you with a life insurance market analysis.

A life insurance market analysis is the process of reviewing what policies currently exist in the marketplace that may be a more suitable option.

In some cases, there may be similar coverage at a lower price or a policy that offers better guarantees.

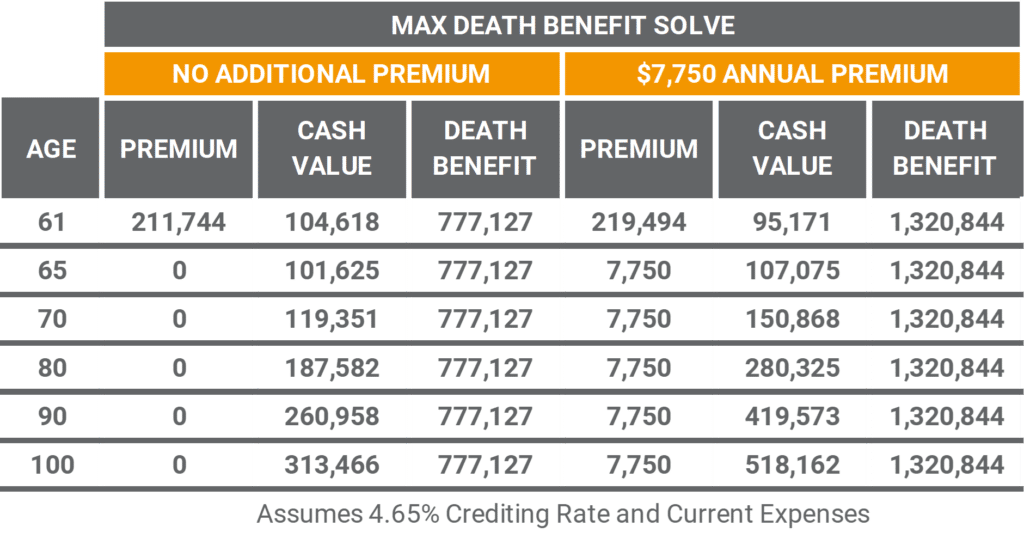

Using our example from above, let’s assume our 40-year old is now 60. Their whole life insurance policy now has $211,774 of cash value with a $620,000 death benefit and an annual premium of $7,750.

He is interested in learning more about what other options are available. He is interested in two scenarios:

- What is the maximum amount of coverage he could have without any additional premium payments, and

- How much coverage could he get if he continues making the same premium?

Since he has $211,774 of cash value and has paid total premiums of $155,000 he would have a $56,774 gain if he were to surrender the policy. For this reason, we will do a life insurance 1035 exchange in order to transfer the entire cash value to the new policy without triggering a taxable gain.

You will notice the first-year premiums are equal to $211,744 and $219,494. The $211,744 represents the cash value that was received via the 1035 exchange from the original carrier. The $219,494 is the 1035 exchange plus the $7,750 annual premium.

No Additional Premium

By paying no additional premium he would be able to secure a death benefit of $777,127. His current policy has a death benefit of $624,000 and requires $7,750 of ongoing premiums. By age 70 the death benefit on his current policy grows to $788,000. But, it also requires $77,500 of additional premiums.

Pay $7,750 Ongoing Premium

By continuing to pay $7,750 per year he is able to secure a death benefit of $1,320,844. This is more than double the existing coverage. However, by age 90 the existing coverage has more death benefit and cash value. As a result, it is important to take this into consideration prior to make any changes to the existing coverage.

Life Insurance Policy Review Conclusion

If you own a permanent life insurance policy it makes sense to complete a life insurance policy review.

At a minimum, it will give you an idea of where your policy is at and how it is performing. It will also allow you the opportunity to make any changes to the coverage.

Completing a market analysis will also confirm if you’re existing coverage is still the best option available.

Click here to schedule a complimentary introductory life insurance review call.

The information contained in this article is hypothetical. Results and performance will vary based on a number of factors. Consult with a licensed professional to learn more.

Updated July 6, 2022

Jason Mericle

Founder

Jason Mericle created Mericle & Company to provide families, business owners, and high net worth families access to unbiased life insurance information.

With more than two decades of experience, he has been involved with helping clients with everything from the placement of term life insurance to highly sophisticated and complex income and estate planning strategies utilizing life insurance.

Stay In The Know

Get exclusive tips and practical information to help you create, grow, sustain, and protect your wealth.

Ask Us Anything

We Are Here To Answer Your Questions