A life insurance retirement plan or LIRP is a tax-efficient way for individuals to save for retirement by providing benefits you can enjoy during your lifetime.

It also pays an income tax-free death benefit to help replace your lost earnings potential.

Life insurance retirement plans allow you to protect your loved ones while saving for retirement. LIRP is a perfect supplemental retirement strategy for high-income earners who are maximizing qualified plan contributions.

LIRP is not for everyone. Those with an interest in using LIRP must have a long-term outlook. It is similar to marriage. If you know after five years of marriage it will end in divorce, there is no reason to do it. Life insurance for retirement planning is no different.

Using The Right Mix

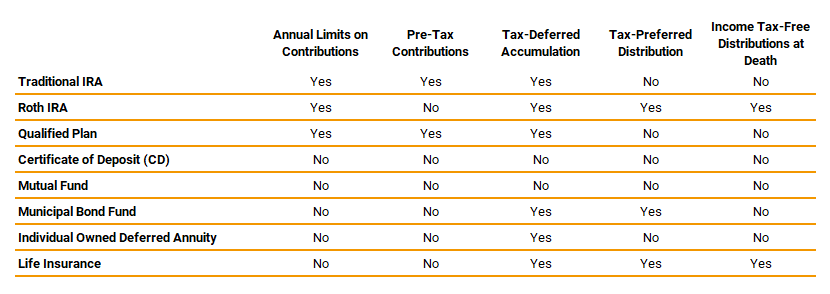

When we think about retirement, most people visualize a 401(k) or Traditional IRA. We call these qualified assets. Qualified plans/assets are great tools for saving for retirement. They offer tax-deductible contributions and tax-deferred growth – a win-win.

The problem with qualified assets is they are taxed at ordinary income tax rates when you take distributions from them. And, in most cases, you are unable to access them until Age 59 1/2 without penalty.

This is why it is important to diversify the tax structure of your retirement assets. Instead of investment diversification, we’re talking about tax diversification. Doing this will provide greater flexibility during retirement.

To begin, start by looking at how your retirement assets are going to be taxed. The following represents the different asset classes and assets that make up those classes. Think of each class as a bucket – retirement buckets.

Assets Held in Retirement Plans (Qualified Assets)

Distributions are generally taxed at ordinary income tax rates. They include:

- 401(k)

- Pension Plans

- Profit Sharing

- Traditional IRA

Assets Held Outside Retirement Plans (Nonqualified Assets)

Generally taxed at capital gains or ordinary income tax rates. They include:

- Stocks

- Mutual Funds

- Real Estate

Overlooked Assets (Tax-Free)

- Life Insurance Retirement Plan (LIRP)

- Roth IRA

- Municipal Bond Interest

Having assets in each class allows you to pick and choose what assets class to draw from during retirement. Being less reliant on accessing taxable distributions from an IRA gives you control over maximizing your retirement income.

How Does a Life Insurance Retirement Plan (LIRP) Work?

A life insurance retirement plan can provide tax-free distributions through policy withdrawals and loans and an income tax-free death benefit.

Contributions to a life insurance retirement plan are done so on an after-tax basis, similar to a Roth IRA.

An individual begins by purchasing a personally owned cash value life insurance policy. The types of cash value life insurance policies most commonly used are whole life, variable life, and index universal life insurance.

The net premium is then allocated to the policy cash value and grows tax-deferred, similar to a 401(k) or Traditional IRA.

At retirement, you can take tax-free withdrawals and loans from the policy’s cash value to supplement your retirement income.

At your death, your beneficiary will receive the policy’s net death benefit income tax-free.

Choosing the Right Product for Life Insurance Retirement Planning (LIRP)

When taking advantage of LIRP there are endless policies to choose from. As mentioned previously, the most common policies are whole life and indexed universal life insurance.

Most life insurance companies held as stock companies offer indexed universal life insurance. A stock insurance company is a publicly-traded company listed on an exchange. These companies include Prudential, Lincoln Financial Group, John Hancock, and many others.

Insurance companies held as mutual companies tend to offer whole life. A mutual insurance company is owned by its policyholders. They include companies like MassMutual, New York Life, and Northwestern Mutual.

When choosing a life insurance policy for a life insurance retirement plan it is important to choose one that corresponds with your goals, objectives, and risk profile. Whole life tends to be a more conservative product from a performance perspective when comparing it to indexed universal life insurance.

The other primary factor is the expenses of the policy. When choosing a product for LIRP it is important to choose a policy that is going to have low policy expenses.

The average expense ratio of a mutual fund is between 1 and 1.5-percent per year depending on the fund category. When evaluating different policies for life insurance retirement planning it is important to choose a policy with fees that are less than 1.5-percent over the life of the policy.

Why are Low Policy Fees Important for LIRP?

When your life insurance retirement plan has low fees, a majority of your premiums will remain in the policy cash value. This allows for policy cash values to grow at a quicker pace.

The more money available for growth, the better compounding of cash values and less life insurance you have to pay for.

Admittedly, most of the fees and expenses of a life insurance policy are going to be in the first few years of the policy. This is why it is so important to view this as a long-term vehicle for accumulating assets. More on this later…

Life Insurance Retirement Plan (LIRP) Considerations

When considering a life insurance retirement plan there are a few key considerations:

- The design of the policy is for accumulation, not death benefit (we’ll cover this more below).

- You may need to purchase additional coverage separate from LIRP to satisfy your overall individual need for life insurance.

- Understand how the cash value growth works and how distributions inf the form of withdrawals and loans will impact the policy.

- Make sure you include an Overloan Protection Rider to prevent the policy from lapsing.

Life Insurance Retirement Plan (LIRP) Case Study – Accumulation Phase

When evaluating a life insurance retirement plan policy, it is important to design the policy for maximum accumulation.

To maximize cash for retirement the policy should have as little death benefit as possible. When doing this the death benefit will vary from year-to-year. This amount will also vary from carrier to carrier.

By minimizing the death benefit, we are also minimizing the cost of insurance and expenses in order to maximize the policy cash values.

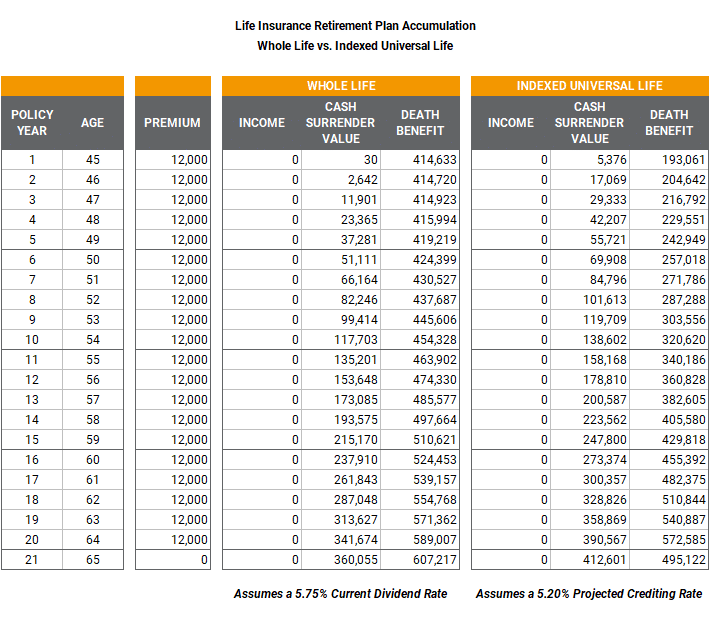

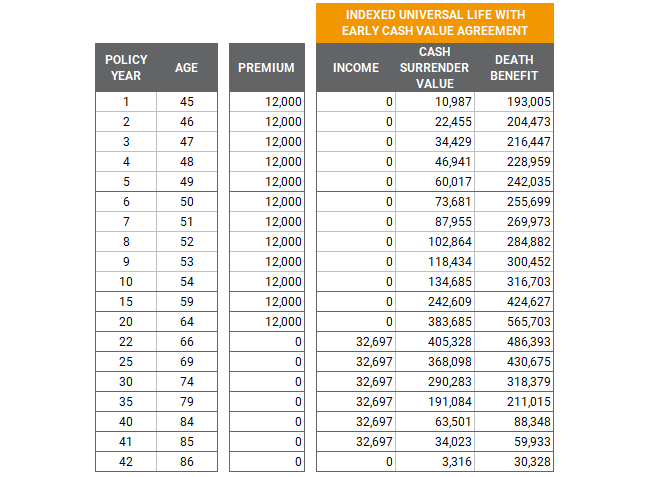

For purposes of this example, we are going to use the following assumptions:

- Age 45 Male in Good Health

- Wants to fund the policy for 20-years

- Distributions from the policy will begin at age 66 and continue for 20-years

- Desire to contribute $12,000 per year for 20-years

In our comparison, we are going to evaluate both whole life and indexed universal life insurance policies.

Both policies assume a minimum non-MEC death benefit solve in order to maximize income from each policy in the future. Premium payments are made over a 20-year period.

The whole life policy has a significantly higher initial death benefit during the accumulation period of the LIRP. Conversely, the indexed universal life insurance policy has a greater cash value.

You will also notice the death benefit increases over time. This is done intentionally to minimize policy fees and expenses.

Life Insurance Retirement Plan (LIRP) Case Study – Max Income Phase

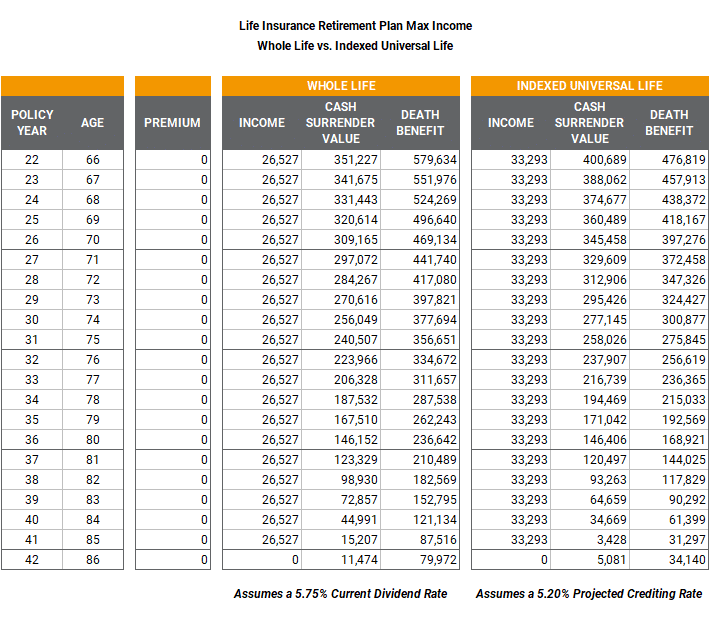

Now that the accumulation phase is complete it is time to see what the maximum income from the policy looks like. We are assuming income begins at Age 66 and continues to Age 85.

There is nothing that says this has to happen. Income from the policy can vary and distributions can occur at different times. For instance, we might want to wait until we are Age 70 to begin receiving income. You can do this. Each policy offers a lot of flexibility when it comes to receiving policy income.

In this example, the whole life insurance policy will provide $26,527 of tax-free income per year for 20-years totaling $530,540. The index universal life insurance policy distributes $33,293 of income per year totaling $665,860.

It is important to note these amounts are not guaranteed, nor is the actual policy performance. These illustrations are based on current policy assumptions, which include the current dividend rate on the whole life policy and assumed crediting rate on the index universal life insurance policy.

Life Insurance Retirement Plan (LIRP) Case Study – Policy Maintenance

The performance of the dividend or index rate will determine policy cash values, death benefits, and income from each policy. If the actual performance is greater than our assumptions then these three items will be higher, including the income. If actual performance is less than the current assumptions income – income, cash values, and death benefits will be lower.

This is why it is important to review the policies on the anniversary to make any changes necessary to allow for the continued success and performance of the LIRP.

It is also important to keep the coverage in force, even after all income has been received from the policy. If the coverage is surrendered with a policy gain, the gain will be taxable at ordinary income tax rates.

This is why we include the Overloan Protection Rider on the policy. This rider will prevent the policy from lapsing once all income had been paid.

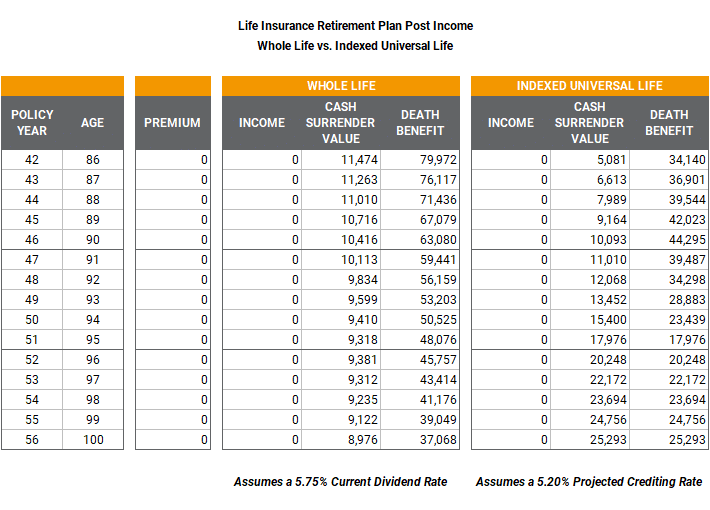

The following illustrates the policy after all income has been received.

The death benefit represents the net death benefit of the policy. This is the amount your beneficiaries will receive in any given year.

While the income from the policy is tax-free, it will be fully taxable if a policy surrender occurs.

For instance, if the index universal life insurance policy were to be surrendered at Age 90, the policy owner would recognize an ordinary income taxable gain of $435,953. Thereby, defeating the entire purpose of establishing the LIRP.

Calculating The Taxable Gain

Total premiums paid over 20-years are equal to $240,000 ($12,000 annual premium times 20-years). Income received from the policy from Age 66 to Age 85 is equal to $665,860 ($33,293 policy distribution for 20-years).

The surrender value of the policy at Age 90 is $10,093. Add the sum of the income received ($665,860) plus the surrender value at Age 90 ($10,093) totaling $675,953.

Subtract the total income received plus surrender value at Age 90 ($675,953) less the sum of total premiums paid ($240,000) equals a total gain of $435,953.

Life Insurance Retirement Plan Policy Expenses

In order for LIRP to make sense, we need to make sure the expenses align with the fees if we were to use a mutual fund. The policy fess for a life insurance policy is going to be the most expensive in the early years of the policy.

This is why LIRP only works for individuals who have a long-term outlook on what the policy can do for them for purposes of tax diversification in the future.

We want to ensure the policy fees over the life of the policy are similar to what they would be if you chose to invest in a mutual fund with an average 1.50% annual fee on the value of the assets.

For comparison purposes, we are going to evaluate two index universal life insurance policies. We are going to extract the expenses of each policy and compare them to the policy’s accumulated value. The accumulated value is the policy cash value without any surrender charges.

Carrier A represents the carrier producing the Maximum Income in the example above. Carrier B is a different carrier using the same assumptions.

Using the current assumptions, Carrier A produces an annual income of $33,293 beginning at Age 66 thru Age 85. The average expense of the policy from inception thru Age 85 is 1.18-percent.

Using the same assumptions, Carrier B provides an annual income of $29,750 during the same period of time. Carrier B’s average expenses from inception thru Age 85 is 2.07-percent.

Life Insurance Retirement Plan (LIRP) – Withdrawals

The other important factor of a LIRP life insurance policy is loan interest. When distributions from a policy being, they are usually in the form of a withdrawal. Withdrawals are nothing more than a return of basis (or the premiums you have paid into the policy).

for instance, let’s assume we have made $240,000 of total premiums into the policy during the accumulation phase ($12,000 per year times 20-years). When we begin to receive distributions from the policy they will initially be in the form of a repayment of the original premiums.

If the policy owner is receiving distributions of $33,293 per year, the first 7+ years will be in the form of a policy withdrawal.

Once the policy owner has received the sum of their premium payments in the form of policy withdrawals, future distributions are treated as policy loans. The benefit of a policy loan is it is not taxable to the policy owner.

Life Insurance Retirement Plan (LIRP) – Loans

When distributions are in the form of a loan, the policy (or carrier) will charge loan interestest on the outstanding loan balance. The carrier will also credit the loan balance with some type of interest or dividend rate.

For this reason, it is important to understand how loan interest on a life insurance retirement plan works. At the most basic level, you will typically want a LIRP policy that offers a net-zero loan.

A net-zero loan is when the outstanding loan balance borrowing rate is equal to the loan interest crediting rate. The greater the spread between these two rates, the more expensive it is to borrow money from the policy.

For example, a 4-percent loan interest rate and 4-percent loan crediting rate would result in a net-zero loan. On a $100,000 loan balance, the carrier charges $4,000 of loan interest but also credits the loan $4,000.

If the loan interest is 5-percent and the loan interest credit is 4-percent, the loan balance would grow to $101,000 at the end of the year.

The policy owner does not have to make loan interest payments out-of-pocket. They can. But, if the LIRP policy is properly designed there will be no need to do so.

Index universal life insurance policies generally have 2 or 3 options when it comes to determining the loan interest rate. The policy owner does not need to choose a loan type until a loan is made from the policy.

LIRP Overloan Protection Rider

When considering a LIRP it is critically important to consider policies offering the Overloan Protection Rider (OLP). This rider prevents the policy from lapsing. When the policy’s outstanding loan balance exceeds a percentage of the policy’s account value, the OLP is exercised.

This allows the policy to stay in force until the death benefit is paid. Once invoked there can be no further policy transactions including premium payments, loans, or withdrawals.

There are generally no fees to include this rider on the policy. However, some carriers will charge a fee for exercising the Overloan Protection Rider. When this occurs, it covers all future policy charges including the cost of insurance and policy expenses.

By including the OLP rider the policy owner is able to avoid taxation on the loan and provide beneficiaries with a minimal death benefit net of the outstanding loan balance.

Each carrier treats the OLP differently. It is important to understand how it works from policy to policy. However, when considering a life insurance for a retirement plan policy it is important to include the OLP rider.

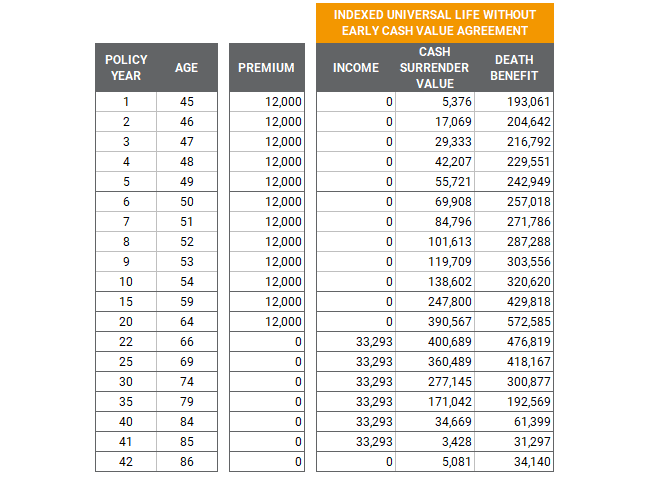

Cash Value Enhancement Rider or Early Cash Value Agreement

Some policies make available a Cash Value Enhancement Rider or Early Cash Value Agreement. The purpose of these types of riders is to remove the surrender charges found in most policies in the first 10 to 15-years.

On the surface, these types of riders make a lot of sense. It increases the policy values in the early years, but there is a cost for the rider that will impact future policy cash flows.

Remember, the reason for a life insurance retirement plan is based on our long-term outlook and desire to have tax diversification during retirement.

Here is a summary of our initial policy:

You will notice in the first 10-years there is a difference between the Accumulation Value and Surrender Value. This is because the policy includes a surrender charge to encourage policy owners to keep the coverage. This is not uncommon.

After Year 10, the surrender charge goes away. The Accumulation Value is equal to the Surrender Value from Year 10 on. You will also notice the policy is making distributions of $33,293 per year for 20-years beginning at Age 66.

Here is a summary of when we add the Early Value Agreement to the same policy:

With the Early Value Agreement, the surrender charges no longer exist in any year. Because there is a charge for this rider it reduces policy distributions from $33,293 per year to $32,697.

The Case for Life insurance Retirement Plan (LIRP)

LIRP is not for everyone. It is for high-income earners who are looking for additional tax-efficient ways to improve their retirement income. The tax benefits available through life insurance provide a unique way to accumulate supplemental retirement income with an ordinary income tax-free death benefit.

Each individual situation is different. When considering a life insurance retirement plan it is important to see how it compares to other asset classes. Depending on the carrier and product type outcomes will vary significantly.

Last Updated March 2, 2022

The information contained in this article is hypothetical. Results and performance will vary based on a number of factors. If Life Insurance Retirement Planning is of interest to you you should consult with a licensed advisor to help you understand and evaluate your options. Schedule a complimentary life insurance retirement plan phone call.