What The Northwestern Mutual Dividend Rate Reduction Means For Policyowners

On October 26, 2016, the CEO of Northwestern Mutual announced a 45-basis point dividend scale interest rate reduction to its policy owners. This reduction will significantly impact any Northwestern Mutual dividend-producing policy.

Based on the press release, it is clear Northwestern Mutual would like policy owners to focus their attention on the dollar amount of the dividend being paid, and not the fact they are reducing the dividend scale interest rate from 5.45% to 5.00%.

You can read the press release from Northwestern Mutual here. Pay special attention to the last sentence of paragraph 3.

Full disclosure, while I am an independent life insurance consultant, I am not able to sell products or policies issued by Northwestern Mutual. Their distribution channels are such that they disallow independent advisors from illustrating and selling their products.

To the credit of Northwestern Mutual, the estimated $5.2 billion dividend payment is likely to be the largest dividend payout by any insurance company this year. However, size is relative.

It’s not about the dollar amount the Northwestern Mutual dividend pays out to its policy owners. It’s about the dividend scale interest rate.

There are three primary factors contributing to the Northwestern Mutual dividend scale interest rate: mortality experience, investment performance, and expenses.

Let’s briefly break down each of these factors.

Mortality experience simply projects the dollar amount of claims to be paid out over a period of time. If claim experience is lower than anticipated the dividend scale interest rate increases.

Like mortality experience, if the expenses of issuing and administering dividend-producing insurance products cost less than the projected dividend scale interest rate will be higher.

When it comes to investment performance, insurance companies are not chasing the “hot stock”. In fact, a large percentage of any insurance companies invested assets consists primarily of different types of bonds.

Check out the April 2013 Chicago Fed Letter titled What do U.S. life insurers invest in to learn more.

Obviously, higher investment returns mean a higher dividend scale interest rate. But, current economic conditions are making it difficult for many insurance companies to achieve any meaningful returns.

It’s great if you’re applying for a home loan. It’s bad when you’re trying to operate an insurance company.

I understand why Northwestern Mutual would focus on the size of the dividend payout. However, the fact is the Northwestern Mutual dividend rate has steadily declined since 2008.

At a time when people are living longer lives, mortality experience should improve dividend rates.

Policy administration and expenses should be less than what they were ten years ago based solely on advances in technology. Again, this should have a positive impact on the declared divided.

This would naturally bring into question investment returns and how assets are managed. It is understandable investment returns aren’t as easy as they once were. But, many of their competitors seem to be less impacted.

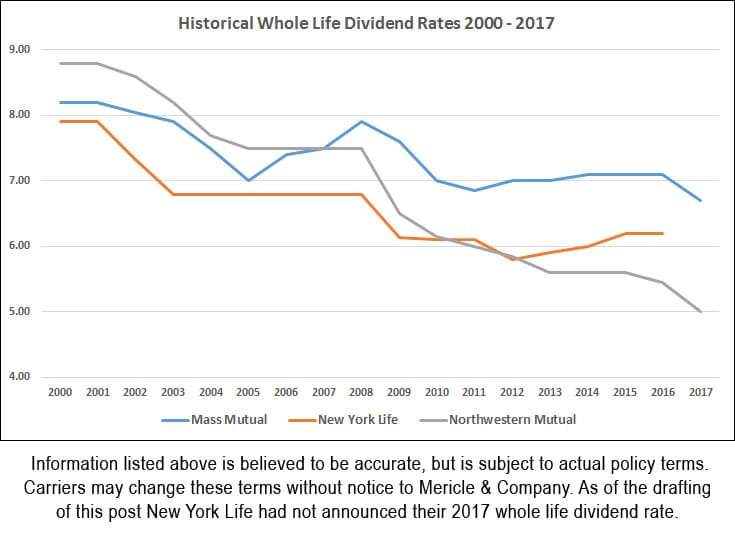

A Historical Perspective on Whole Life Dividend Rates

2000 – 2017

Back to the original point, the size of the Northwestern Mutual dividend is not what matters. What matters is the dividend rate. This will have a major impact on policyholders over the life of their policies.

In 2008, the Northwestern Mutual dividend scale interest rate was 7.50%. It has declined by 2.50% over this period.

Comparatively, Mass Mutual announced its 2017 declared interest dividend rate on November 6, 2017. They announced a reduction in their declared dividend interest rate from 7.10% to 6.70%.

While this reduction is similar in size to Northwestern Mutual, MassMutual’s policy owners will still receive 1.70% more in dividend payouts over the next year.

In addition, Mass Mutual declared dividend interest rate in 2008 was 7.90%. For 2017, the declared dividend interest rate is 6.70%. A reduction of 1.20% compared to Northwestern Mutual’s 2.50% reduction over the same period.

Both carriers will be quick to point out the declared dividend interest rate is not guaranteed. I am not disputing this. In fact, I agree with this statement completely.

However, if in 2008, I presented a whole life insurance policy to you (from either company) there would have been at least two sets of numbers.

The first set would show the guaranteed minimum declared dividend rate and maximum mortality (guaranteed assumptions). The second would show the current declared dividend rate and current mortality (current assumptions).

Most companies use the current assumptions to solve for premium, cash values, dividends, paid-up-additions, etc.

So, in 2008 Northwestern Mutual would have assumed your policy was going to receive a dividend scale interest rate of 7.50% every year for as long as you owned the policy.

Nine years later, instead of getting 7.50%, you are only getting 5.00%.

Frankly, the dividend scale interest rate has declined so much it will impact any Northwestern Mutual policy purchased before TODAY! I wish I was trying to be dramatic or emphasize a point here…but I’m not.

Based on our research, this drop is the largest decline for any “major” dividend-paying insurance company this year. From 2008 to 2009 alone, the Northwestern Mutual dividend scale interest rate dropped from 7.50% to 6.50%.

What Does This Mean for Northwestern Mutual Policyowners?

Truthfully, it doesn’t matter when you purchased your policy.

If the performance is based on a dividend payout – the policy is underperforming. This will impact any number of components including premiums, cash value, and death benefit – something in your policy is not performing the way it was initially sold to you.

You need to have your policy reviewed to make sure you understand how the reduction in the Northwestern Mutual dividend scale interest rate is going to impact the ongoing performance of your policy.

You should meet with your Northwestern Mutual advisor and a life insurance advisor who is unaffiliated with Northwestern Mutual to explain what is going on with your policy.

Check out our post on “How Your Permanent Life Insurance Policy Could Terminate Before You Die and What You Can Do To Stop It From Happening“.

This post takes an in-depth look at how a reduction in a permanent life insurance policy crediting or dividend rate can affect a policy’s performance.

On the flip side, if you are a proponent of buying low, there has never been a better time to consider a whole life insurance policy issued by Northwestern Mutual. However, I would probably advise you to hold off until we see an uptick in the declared dividend interest rate.

For questions or inquiries please email us at hello[at]mericleco.com.

Jason Mericle

Founder

Jason Mericle created Mericle & Company to provide families, business owners, and high net worth families access to unbiased life insurance information.

With more than two decades of experience, he has been involved with helping clients with everything from the placement of term life insurance to highly sophisticated and complex income and estate planning strategies utilizing life insurance.

Stay In The Know

Get exclusive tips and practical information to help you create, grow, sustain, and protect your wealth.

Ask Us Anything

We Are Here To Answer Your Questions