Northwestern Mutual Struggles Continue – Should Policy Owners be Worried?

Northwestern Mutual announced on January 26, 2017, they will be laying off hundreds of employees by March 31st.

The company’s chief investment officer told the Milwaukee Business Journal the layoffs were necessary due to low-interest rates that jeopardize the company’s position as a low-cost producer of life insurance.

This announcement comes as Northwestern Mutual finalizes construction on its $450 million, 32-story, 1.1 million square foot office tower scheduled to open in fall 2017.

Northwestern Mutual is also on target to complete construction on their $100 million, 33-story parking and residential tower in spring 2018.

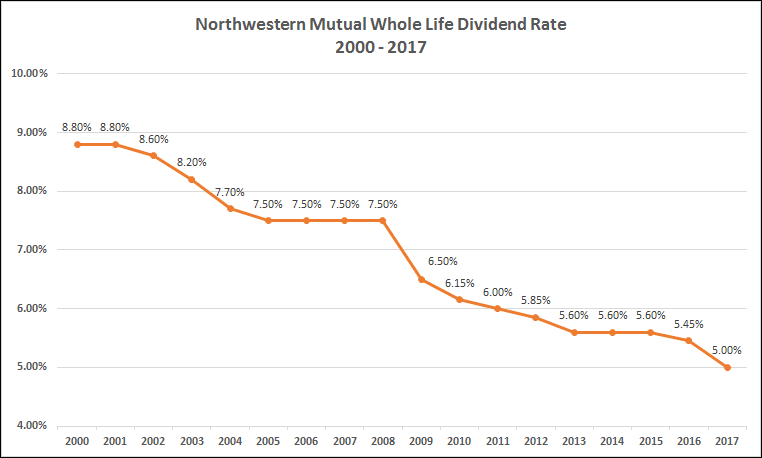

All of this is on the heels of their October 2016 announcement to reduce their already declining whole life insurance dividend rate from 5.45% to 5.00%. Since 2008, Northwestern Mutual has reduced its dividend rate by 2.50%.

All this while their industry peers have seen dividend reductions of less than 1-percent over the same time period.

The low-interest rate environment is a challenge all carriers are having to work through. However, most carriers do not seem to be as impacted as Northwestern Mutual.

What’s most curious to me, is the rating agencies continue to maintain the companies financial strength at the highest possible level.

It would appear to me there is more going on within Northwestern Mutual than “low-interest rates”.

The layoffs shouldn’t have any immediate financial impact on policy owners.

However, the announced dividend rate reduction in October 2016 will have a substantial impact on policy owners.

If you own a Northwestern Mutual whole life insurance policy it is highly likely (if not an absolute certainty) your policy is not performing as proposed when the coverage was purchased.

It is important for policy owners to understand how the dividend reduction will impact their policy. By doing so they will have a better understanding of their options, ongoing cost, and policy performance.

Disclaimer: Northwestern Mutual does not allow outside or independent agents/advisors to sell their line of insurance products. Because we are not affiliated with Northwestern Mutual we are able to evaluate your existing coverage and make recommendations based on the entire life insurance marketplace – not just what Northwestern Mutual offers.

Jason Mericle

Founder

Jason Mericle created Mericle & Company to provide families, business owners, and high net worth families access to unbiased life insurance information.

With more than two decades of experience, he has been involved with helping clients with everything from the placement of term life insurance to highly sophisticated and complex income and estate planning strategies utilizing life insurance.

Stay In The Know

Get exclusive tips and practical information to help you create, grow, sustain, and protect your wealth.

Ask Us Anything

We Are Here To Answer Your Questions