Life insurance premium financing allows ultra-affluent families to secure life insurance coverage by borrowing ongoing premium payments.

Most people owning life insurance make premium payments directly to an insurance company.

When taking advantage of premium financed life insurance – the bank makes premium payments to the insurance company. The owner of the policy makes interest payments to the bank or lending institution.

There are endless scenarios for structuring a life insurance premium financing policy.

Each design is highly-personalized and tailored to the individual considering its use.

Life Insurance Premium Financing Case Study

John is a 75-year old successful entrepreneur. John has taken advantage of several estate planning techniques including the use of his lifetime exemption, discounting of assets, sales to defective trusts, and grantor retained annuity trusts (GRATs).

He is significantly limited in what he can do without having to pay gift taxes. His estate taxable net worth (after all of the gifting and discounting) is approximately $80 million. This $80 million is comprised of privately held stock ($30 million), real estate ($35 million), and liquid assets ($15 million).

Schedule a Complimentary 20-Minute Phone Consultation to learn more about life insurance premium financing.

John has been married to his second wife for a number of years. Upon his passing, she will receive approximately $10 million under the unlimited marital deduction. The $70 million balance will be includable and subject to estate tax at John’s death.

Assuming a 40% estate tax rate and no growth on existing assets, John’s estate would owe approximately $28 million in taxes.

Because John’s estate is comprised of highly illiquid assets, life insurance is an attractive option to provide liquidity.

Life Insurance Premium Financing Analysis

After John and his team advisors agree $30 million of life insurance coverage is necessary – we identify the insurance company with the best underwriting and pricing.

When this process is complete we are able to evaluate which funding option and plan design makes the most sense for securing the coverage.

Premium Financing Case Design

When considering premium financing for John two things were important:

- Secure a loan at a low rate, and

- Reduce or eliminate the required collateral

Many life insurance premium financing designs fail because the guarantor is required to pledge collateral equal to the amount of the premium borrowed because the policy has little or no cash value.

Step 1

Identify carriers with products that include a high percentage of cash value relative to the premium paid.

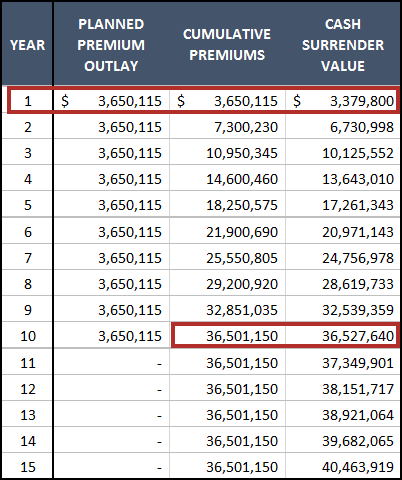

In Year 1 the cash value is 92.6% of the premium paid. By Year 10, the cash surrender value exceeds the total premiums paid.

Since premiums are being borrowed, any difference between the borrowed amount and cash value will require collateral to be pledged.

For instance, in Year 1 the policy owner borrows the annual premium of $3,650,115. The difference between this amount and the cash value is $270,315 ($3,650,115 premium less $3,379,800 cash surrender value).

The guarantor of the loan will pledge $270,315 as collateral to secure the loan.

Step 2

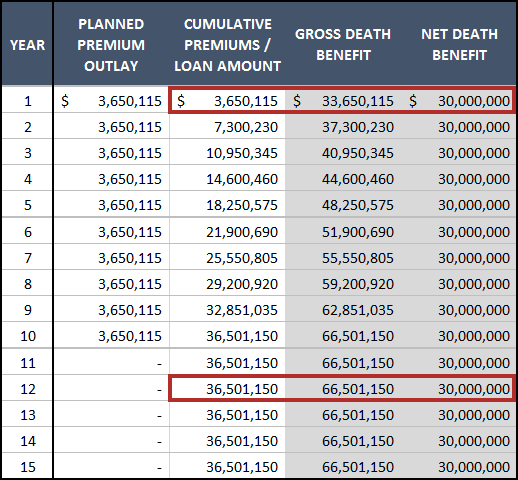

Use a policy with a “Return of Premium” death benefit. A Return of Premium death benefit adds an amount equal to any premium payment to the death benefit of the policy. This allows for the bank loan to be repaid at death and the beneficiaries to receive the net amount (or base) death benefit.

In this example, the premium is added to the base death benefit of $30 million.

In Year 12, the total premiums paid (and the outstanding loan balance) is $36,501,150. By taking the outstanding loan balance and adding it to the based death benefit of $30 million – the policy has a $66,501,150 gross death benefit.

If the insured passes away in Year 12, a death benefit of $66,501,150 will be paid to the borrower/owner/beneficiary of the policy. The borrower will then be obligated to pay the $36,501,150 outstanding loan balance – leaving the beneficiary with a net $30 million.

Step 3

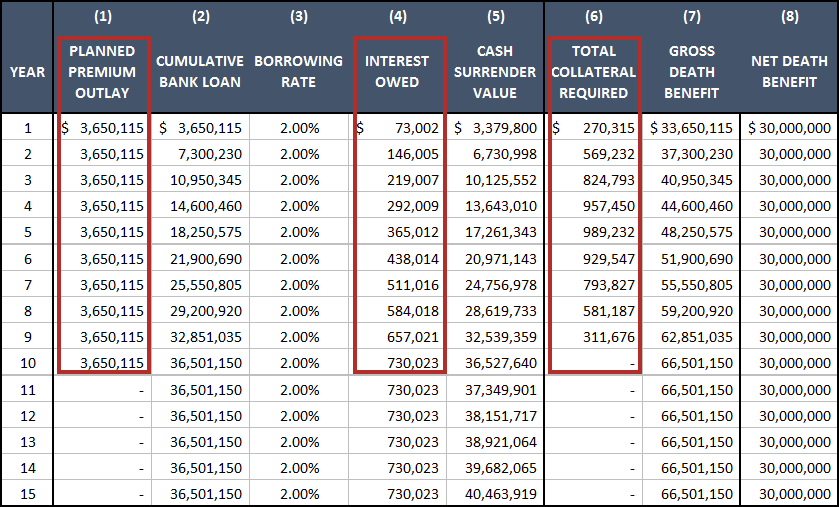

Secure a loan with favorable borrowing rates and collateral requirements. Depending on the lender, rates can range from 2.00% to as high as 6.00%.

The more of a relationship the borrower is willing to establish with the bank, the more favorable the rates. Rates are usually based on 30-Day LIBOR, 1-Year LIBOR, or the Prime Rate.

The borrower can choose to make interest payments in advance or in arrears. When paid in arrears, the borrower is required to pledge collateral for the projected interest owed.

Step 4

Finalize plan design and implement the strategy.

Design #1 – Less Collateral / More Interest

Design #1 requires premium payments annually for the next 10-years. This allows the policy cash value to exceed the cumulative bank loan in Year 10 moving forward. The result is the elimination of the need to pledge outside collateral for purposes of securing the loan.

Design #2 – More Collateral / Less Interest

Design #2 requires premium payments annually for the next 7-years. This results in the need to pledge additional collateral outside of the policy in all years. By doing this the borrower is able to reduce the cumulative loan amount, which reduces the ongoing interest owed.

By borrowing premium payments to obtain life insurance coverage the policy owner is able to trade premium payments for interest payments. This allows the insured to continue to grow their assets, maintain their cash flow, and infuse their estate with needed liquidity at death.

Schedule a Complimentary 20-Minute Phone Consultation to learn more about life insurance premium financing.

While there are risks (variables) to doing premium financing they are often offset by the benefits. Working with a group that understands and anticipates these variables can alleviate many of the concerns.

To learn more about life insurance premium financing or discuss your personal situation send an email to hello@mericleco.com.