[CASE STUDY] How A Restricted Property Trust Reduced Our Client’s Tax Rate From XX.X% to YY.Y%

A Restricted Property Trust provides business owners and/or key executives with tax-favored, long-term cash accumulation and income distribution.

A Restricted Property Trust can provide 8% plus returns when compared to alternate investments.

To understand the concept better let’s take a look at a sample case study.

Restricted Property Trust Case Study – Meet Bob

Bob is a 50-year old physician interested in reducing his taxable income. He is one of 12 physicians in his medical group.

Because the physician group consists of 12 people, it has been impossible to agree on any type of plan (other than a 401(k)) that would allow for significant tax-deductible contributions and retirement accumulation.

Bob’s CPA suggested a Restricted Property Trust. The RPT will allow Bob to make a deductible corporate contribution without requiring the participation of other physicians or employees.

Funding the Restricted Property Trust

Bob wants to make a $100,000 annual contribution to his Restricted Property Trust.

In order to do so, he reduces his income by $100,000. The medical practice then contributes $100,000 (he would have otherwise received as income) to his Restricted Property Trust.

Bob commits to making this contribution annually for a period of 10-years (5-Year Commitment at a Time).

If the Participant is unable to make the annual contribution it will result in the assets of the trust being given to a charity chosen by Bob when the plan is initially established.

Bob will recognize thirty percent or $30,000 of the contribution as income by making an 83(b) election. He will also recognize a minimal Economic Benefit cost on the death benefit.

When the contribution is made the RPT will own a whole life insurance policy. Because of this, assets are able to grow tax-deferred.

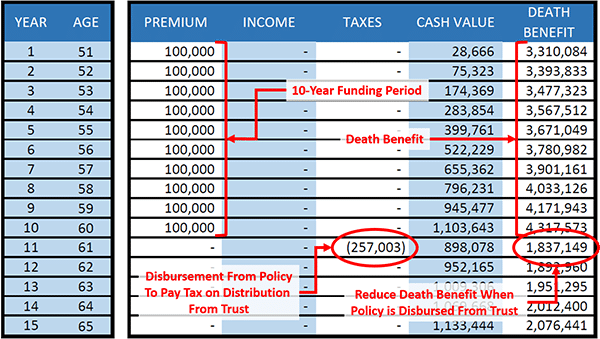

The initial policy death benefit is $3,230,273 and is projected to increase to $4,317,573 by end of year 10. If Bob passes away during the funding period, his wife Jan would receive the death benefit.

Disbursement from the Restricted Property Trust

At the end of Year 10 the policy is distributed from the Restricted Property Trust. Bob will recognize income on the excess policy cash values created by the 83(b) election and Economic Benefit costs. Any tax due is usually paid for from the policy cash values.

In order to maximize cash flow from the policy in future years the death benefit is reduced to $1,837,149 at distribution. The policy will not require any additional payments for it to stay in effect.

In addition, a non-taxable disbursement is made from the policy for $257,003 to fund the estimated tax cost of the trust distribution.

Supplemental Retirement Income

When Bob retires at Age 66 he will receive NON-TAXED DISBURSEMENTS from the policy for $86,925 per year for 20-years.

This is equal to $1,738,500 of income tax free supplemental income from the life insurance policy.

If Bob lives to Age 100 there will still be a $365,931 death benefit with $234,556 policy cash value.

Restricted Property Trust Cash Flow Comparison

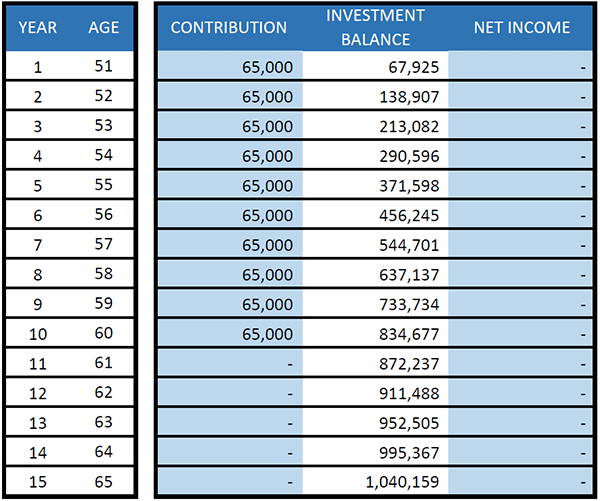

Like most people, Bob wanted to know the economic impact of adopting a Restricted Property Trust versus continuing to pay taxes and reinvest the difference.

In order for Bob to net $100,000 into the Restricted Property Trust his pre-tax equivalent would be $130,000.

Assuming Bob’s income tax bracket is fifty percent, he would net $65,000 on income of $130,000.

If we compare $100,000 going into the Restricted Property Trust (that will own a whole life insurance policy) and $65,000 going into a taxable investment – we can determine what rate of return needs to be achieved on the taxable investment to equal the performance of the Restricted Property Trust.

Assuming a whole life dividend rate of 6.34%, Bob can decide if the Restricted Property Trust makes sense.

Restricted Property Trust Funding and Policy Distribution

Policy Assumes A 6.34% Current Dividend Rate

The whole life insurance policy owned by the Restricted Property Trust is very conservative. The earnings in the policy are based on an annual dividend issued by the insurance company.

For comparison purposes it is important to give consideration to the additional asset class risk you would have to take for a comparable investment.

A certificate of deposit (CD), money market, or municipal bond are comparable assets within a similar risk class as a whole life insurance policy.

After-Tax Funding Analysis

Assuming $135,000 pre-tax equivalent and a 50% individual income tax bracket, the net contribution is $65,000.

A 9.00% assumed rate of return is used for comparison to a taxable alternate. It is also assumed taxes are paid in the year of the gain – similar to interest earned in a savings account.

Taxable Investment Assumption of 9.00% Annual Rate of Return

Restricted Property Trust vs. Taxable Investment Cash Flow AnalysisAssuming distributions begin in Year 16 (or at Bob’s Age 66) it easy to decide which strategy makes the most economic sense.

Restricted Property Trust

The whole life insurance policy provides annual non-taxable cash flow of $86,925. Bob is able to receive this money on an annual basis each year for a 20-year period.

If Bob were to pass away during the distribution phase his beneficiary would receive the policy death benefit.

Taxable Investment

When analyzing the taxable investment, a 9.00% gross rate of return was used.

This would give Bob access to the same $86,925 (net of taxes) per year. But, instead of receiving this over 20-years it would run out in Year 16.

If Bob passed away during the distribution phase his beneficiary would only receive the Investment Balance.

Thoughts on Bob

The recommendation for Bob was to move forward with implementing the Restricted Property Trust as it enabled him to achieve the following:

- The Restricted Property Trust provides a $100,000 deduction for the medical practice.

- It does not require other doctors or staff to participate.

- For the amount contributed to the Restricted Property Trust, Bob is able to reduce his tax rate during plan participation from 50.0% to 17.1%.

- Bob will receive $329,165 net tax savings during plan participation.

- The death benefit will provide an immediate source of liquidity for Bob’s beneficiaries if he passes away at any time.

- The economics of using a Restricted Property Trust will help Bob meet his goals. Provided Bob is able to commit to the funding period and amount it makes sense to move forward.

Because of the conservative nature of the whole life insurance policy and the ability for participation to be limited to Bob, the Restricted Property Trust makes a lot of sense.

It doesn’t matter if Bob is a physician, key employee, attorney, or owner of a manufacturing company. Provided the interested party can commit to the funding period and amount, then the Restricted Property Trust can be a valuable tool.

DISCLOSURE

TAX ADVICE

Any tax advice contained in this communication is not intended or written to be used, for the purpose of (i) avoiding penalties under the Internal Revenue Code or (ii) promoting, marketing, or recommending to another party any transaction or matter addressed herein.

These materials are not intended to be opinions or advice on legal, tax, accounting, or investment matters. Private counsel should be consulted prior to application of this general information to specific situations.

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

The information contained in this article is hypothetical. Results and performance will vary based on a number of factors. If you are interested in a Restricted Property Trust you should consult with a licensed advisor to help you understand and evaluate your options.

Jason Mericle

Founder

Jason Mericle created Mericle & Company to provide families, business owners, and high net worth families access to unbiased life insurance information.

With more than two decades of experience, he has been involved with helping clients with everything from the placement of term life insurance to highly sophisticated and complex income and estate planning strategies utilizing life insurance.

Stay In The Know

Get exclusive tips and practical information to help you create, grow, sustain, and protect your wealth.

Ask Us Anything

We Are Here To Answer Your Questions