The Benefits of a Life Insurance 1035 Exchange

A life insurance 1035 Exchange is a tax-free transfer of policy values from a life insurance or annuity policy to a new policy. This allows policy owners to avoid taxation on policy gains from the old policy to the new policy. Section 1035 of the Internal Revenue Code governs how these exchanges work.

When contemplating a 1035 Exchange there are a couple of rules that are important to understand:

- A life insurance policy owner can do a 1035 Exchange from one life insurance policy to another. You can also do a 1035 exchange with mutlitple life insurance policies to a single policy. A 1035 Exchange can also be done from a life insurance policy to a non-qualified annuity.

- A 1035 Exchange from a non-qualified annuity to a life insurance policy is not allowed. You can do a 1035 Exchange from an existing annuity to a new annuity.

For purposes of this article, we are going to focus on life insurance 1035 Exchanges.

How Does A 1035 Exchange Using Life Insurance Work?

A Life Insurance 1035 Exchange allows the policy owner to make a tax-free exchange of policy values from an existing policy to a new policy.

When doing a 1035 Exchange the original life insurance carrier transfers policy values directly to the new life insurance carrier. The policy owner is never in actual receipt of policy values. Each carrier has its own set of rules when transferring and receiving policy cash values via a 1035 Exchange. Certain carriers make it difficult to do a 1035 Exchange, while others make it very easy.

There are two main reasons for considering a 1035 Exchange:

1 – Avoid Ordinary Income Taxes on Policy Gains

This occurs when policy cash values exceed the policy owner’s cost basis. The cost basis is the amount of premium the policy owner has paid into the policy. Assuming a policy owner has made $100,000 of premium payments over the life of the policy their cost basis would be $100,000.

If during that time the policy cash values grew to $160,000 the policy owner would owe ordinary income taxes on the $60,000 gain if the policy were to be surrendered. A 1035 Exchange avoids this taxable event by allowing the policy owner to make a tax-free 1035 Exchange to a new policy. The policy owner would also carry over their $100,000 cost basis to the new policy.

2 – Preserve Life Insurance Policy Cost Basis

Preserving your cost basis can also provide great future benefits. Let us assume we have the same $100,000 cost basis from our earlier example. But instead of having a policy cash value of $160,000 it is only $60,000. While no taxes would be owed if the policy were surrendered, the policy owner would have given up $40,000 of cost basis.

Even if you have a policy with a cost basis higher than the policy cash value you should still consider a life insurance 1035 Exchange if you need coverage.

Like-For-Like Life Insurance 1035 Exchange

In order to do a 1035 Exchange the insured(s) and policy owner must be identical.

For instance, let us assume my Living Trust owns a life insurance policy individually insuring my life. When doing the Exchange the new policy must have the same policy owner and insured. The 1035 Exchange to the new policy will not be allowed if I change the owner of the new policy from my trust to me individually. You may be able to change the policy owner after the Exchange is complete, but there may be tax consequences when doing so.

If I want to change the policy from an individual policy to a survivorship policy insuring me and my wife I would not be able to do a 1035 Exchange. In order to do this, I would have to surrender my policy. From there I could make a lump-sum contribution to the survivorship policy. In this example, I would give up my cost basis in the existing policy and owe ordinary income taxes on any policy gain.

What Are the Benefits of a Life Insurance 1035 Exchange?

Depending on what the policy owner is trying to accomplish there may be a number of benefits for doing a 1035 Exchange. Policy owners considering a 1035 Exchange may do so because:

- They want to reduce ongoing premiums.

- Increase the amount of coverage without any additional costs.

- Get better product guarantees.

- Take advantage of a different type of policy.

In order to understand the benefits of a 1035 Exchange, it makes sense to provide a few different examples. For purposes of illustrating these examples let us make the following initial assumptions:

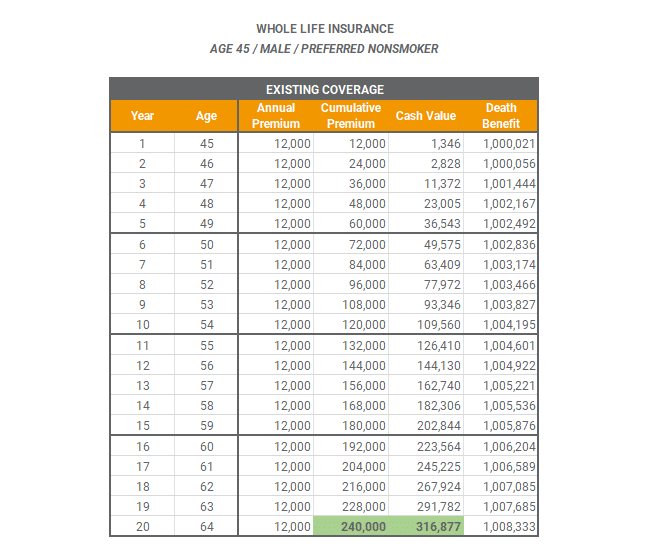

- Age 45 Male purchased a $1 Million Whole Life Insurance Policy at a Preferred Nonsmoker Health Class Rating

- The annual premium is $12,000 each year for his lifetime

- He is the owner of the policy

- The policy was purchased 20-years ago and his Current Cost Basis is $240,000

- The Current Policy Cash Value is $316,877 representing a $76,877 ordinary income taxable gain if coverage is surrendered

- The insured and policy owner is now Age 65 and is still a Preferred Nonsmoker Health Class Rating

The following is a historical look at his existing whole life insurance coverage cash values, death benefit, and premiums.

Example #1 – Using a Life Insurance 1035 Exchange to Reduce Ongoing Premiums

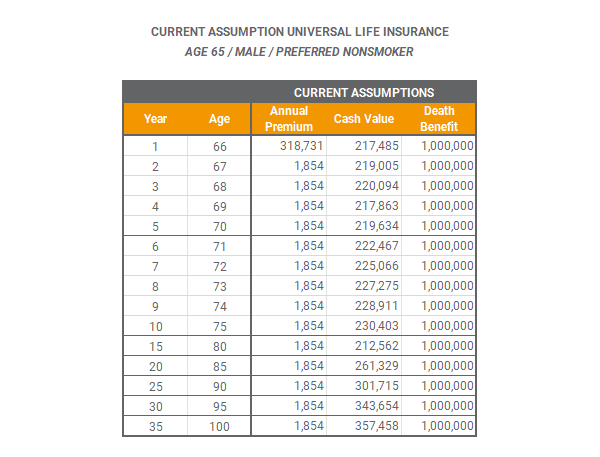

The policy owner has an interest in evaluating whether he can get the same $1 Million of coverage for less than $12,000 per year. After evaluating several options, we were able to identify the following product that will help him accomplish this goal.

Assuming a tax-free 1035 Exchange of $316,877 we are able to reduce the ongoing annual premium from $12,000 per year to $1,854 per year. Assuming current assumptions the coverage will last to his Age 120.

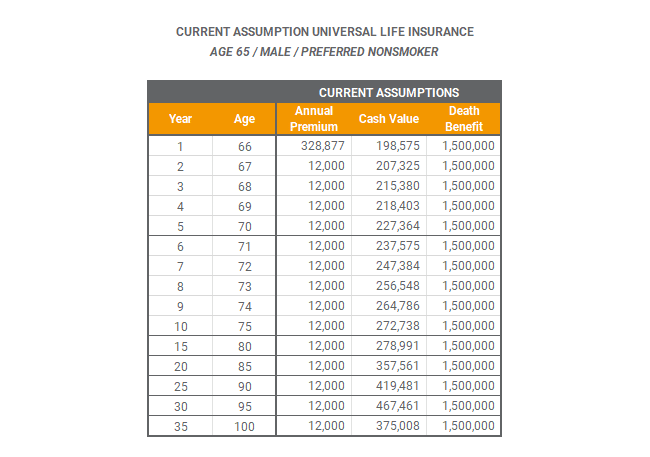

Example #2 – Using a Life Insurance 1035 Exchange to Increase Coverage

In this example, he wants to know if he were to keep paying $12,000 per year how much additional life insurance coverage could he get. Using the same policy as above we are able to secure $1.5M of death benefit. The net result is an increase in coverage of $500,000.

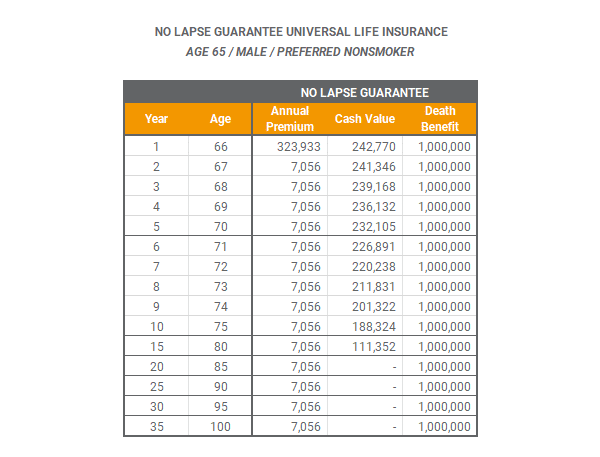

Example #3 – Using a Life Insurance 1035 Exchange for Guaranteed Coverage

The Whole Life Insurance Policy is a guaranteed permanent life insurance policy. The policy owner does not need access to policy values and prefers a policy with fewer moving parts. We evaluated a number of No Lapse Guarantee Universal Life Insurance policies to see if any would make sense.

We were able to recommend a policy that was fully guaranteed to the insured’s Age 121 and reduce the annual premium from $12,000 per year to $7,056 per year.

Example #4 – Access Tax-Free Policy Distributions

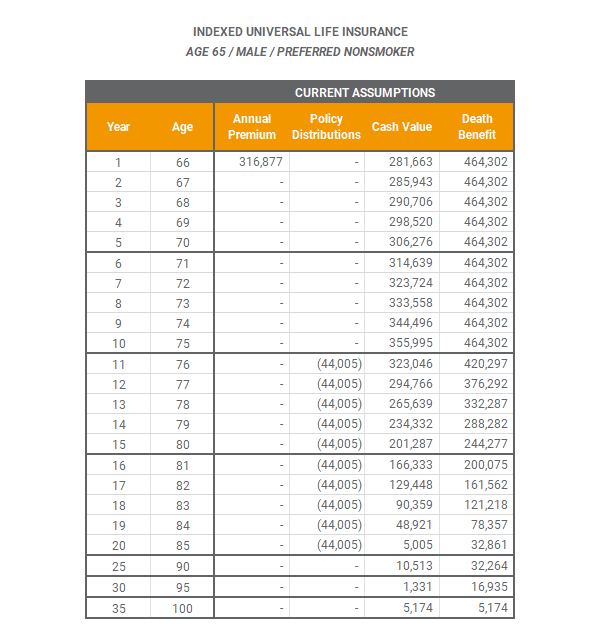

The policy owner no longer has a need for life insurance coverage. At the same time, he does not have any interest in paying ordinary income taxes on the policy gains. For this scenario, we were looking for a policy that would minimize the death benefit while maximizing policy cash value performance. The following indexed universal life insurance policy could help him accomplish his goals.

By reducing the death benefit to $464,302 we are able to minimize the cost of insurance of the policy. This allows the policy cash value to grow at a more rapid pace. At Age 76 the policy owner is able to take $44,005 of tax-free distributions each year for 10-years. And his beneficiaries will also receive an income-tax-free death benefit when he passes away.

What Should You Consider Before Doing a Life Insurance 1035 Exchange?

Prior to completing a 1035 Exchange the policy owner should start by considering what their objectives are. In many cases, the motivation to do a 1035 Exchange is based on reducing ongoing policy costs or increasing coverage.

Before moving forward you should review your existing coverage in comparison with the new policy. Depending on the policy types you may want to look at the guarantees of each policy. Older policies will tend to have better guarantees than newer policies.

You should also understand how the new policy works in comparison with the existing policy. Is the policy you are considering more risky or aggressive than the policy you already have?

In many cases, there will be new fees and commissions when doing a 1035 Exchange to a new policy. These fees will impact policy cash values. It is important to understand how this may impact your decision.

Life Insurance 1035 Exchange Final Thoughts

A 1035 Exchange can be very beneficial in the right situation. It can allow policy owners to exchange their existing coverage for a new policy without triggering ordinary income taxes on policy gains. Whether it makes sense from a financial perspective may depend on your overall estate plan or retirement strategy. Knowing the option exists can be important if your need for life insurance coverage has changed.

The above information is not intended to be opinions or advice for tax, legal, accounting, or investment advice. Your attorney and/or tax advisor should be consulted prior to the application of this general information for specific situations.

IRC CIRCULAR 230 NOTICE: To the extent this message or any information concerns tax matters, it is not intended to be used by a taxpayer to avoid penalties that may be imposed by law.

Jason Mericle

Founder

Jason Mericle created Mericle & Company to provide families, business owners, and high net worth families access to unbiased life insurance information.

With more than two decades of experience, he has been involved with helping clients with everything from the placement of term life insurance to highly sophisticated and complex income and estate planning strategies utilizing life insurance.

Stay In The Know

Get exclusive tips and practical information to help you create, grow, sustain, and protect your wealth.

Ask Us Anything

We Are Here To Answer Your Questions

Start A Conversation

Schedule a complimentary 30 minute Zoom meeting to learn more about your options.