[Case Study] Planning for a Tax-Efficient Legacy Using an Irrevocable Life Insurance Trust

Mike (Age 59) and Carol (Age 57) have an $18 million estate. They both recognize that under current laws their estate would not be taxable today.

They also recognize the current laws are scheduled to sunset on January 1, 2026. If this were to happen it would essentially cut the lifetime exemption in half and expose a portion of their estate to estate taxes. The good news is Mike and Carol have enough time to develop a plan while the life exemption remains high.

Estate Assumptions

In addition to Mike and Carol’s $18 million estate, they have three children and neither of them have ever been divorced. They have not used any portion of their lifetime exemption and are not making any annual gifts.

Approximately $13 million of their estate is comprised of privately held stock and real estate, while the remaining $5 million consists of their residence, qualified plan assets, bank accounts, and non-qualified investments.

Neither of them is ready to start gifting their privately held stock or real estate. Because of this, it made sense to evaluate whether an Irrevocable Life Insurance Trust combined with an annual gifting strategy would be beneficial for them.

Assuming Mike and Carol’s estate grows at a 3-percent after-tax rate their estate would grow to $53.7 million at life expectancy in 37-Years.

Based on the lifetime exemption growing at 2-inflation, this would result in projected estate taxes of approximately $10.2 million or 19-percent of their gross estate.

Protecting from Future Tax Loss Using an Irrevocable Life Insurance Trust

One of the key features of a properly structured Irrevocable Life Insurance Trust (ILIT) is the death benefit is both income and estate tax-free, which creates incredible leverage for the grantor’s estate.

An Irrevocable Life Insurance Trust offers an established solution for families looking for a tax-efficient way to transfer significant assets without incurring estate taxes.

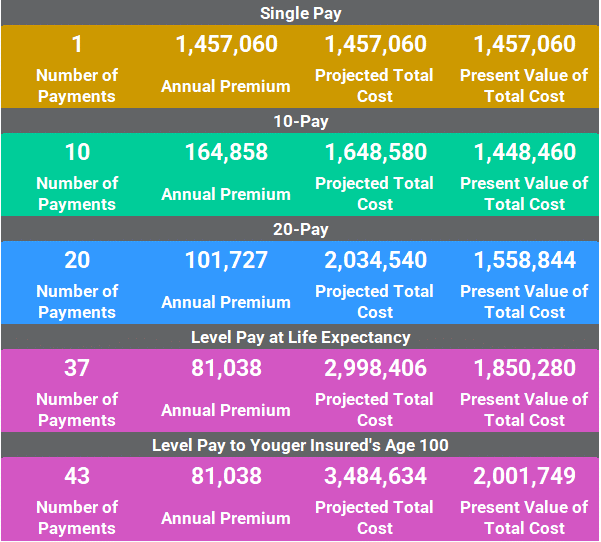

To determine if an ILIT makes sense for Mike & Carol we analyzed a $10 million survivorship life insurance policy assuming the following payment modes:

- Single Pay

- 10-Pay

- 20-Pay

- Level Pay to the second insured’s Age 100

Each scenario assumes a preferred nontobacco health class for both.

After completing a comprehensive life insurance market analysis, we were able to determine the best pricing available given the four payment modes as follows:

These numbers are hypothetical and specific to this unique fact pattern. The present value of total cost is calculated assuming a 3 percent discount rate. To discuss your family’s needs you can click this link to schedule a complimentary 30-minute Zoom call.

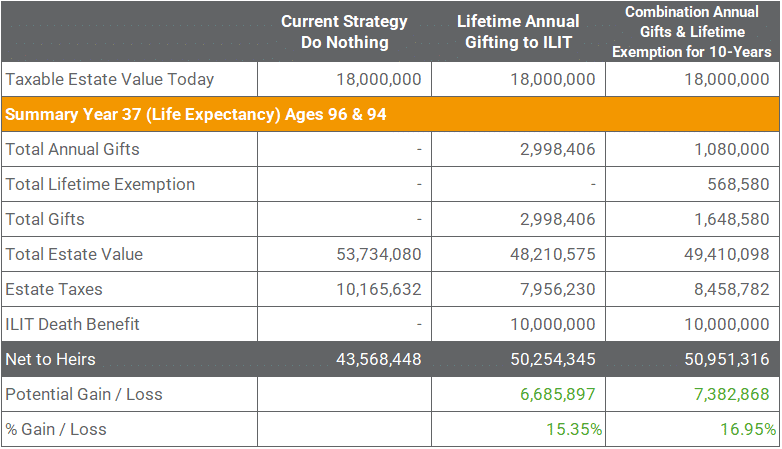

Once we have this information, we can evaluate which payment mode makes the most sense from two perspectives:

- The overall impact on their available annual gift and lifetime exemption, and

- Which gifting strategy maximizes what they can transfer to their heirs.

Based on the parameters, we can determine the 10-pay creates the greatest transfer of wealth for heirs.

However, to take advantage of this Mike and Carol will initially make an annual gift of $108,000 per year (3 beneficiaries times $18,000 annual gift per beneficiary times 2 people making the gift).

In addition to the annual gift, they will also use approximately $56,900 of their lifetime exemption on an annual basis for 10 years or approximately $570,000 of their total lifetime exemption (representing 1.8 percent of their projected lifetime exemption at life expectancy).

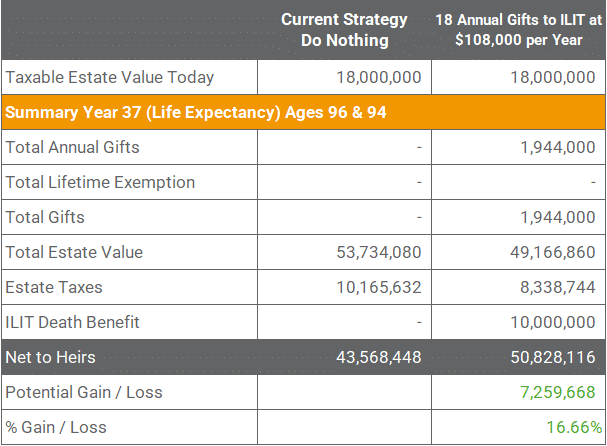

Mike and Carol’s estate planning attorney asked us to complete an analysis assuming we use only the $108,000 annual exclusion gift to avoid using any portion of their lifetime exemption.

By doing this we can solve for the number of years required to make premiums into the policy for the $10 million of coverage last to maturity at Carol’s age 125.

The net result is to make 18 annual gifts of $108,000 per year to the ILIT to secure the $10 million of coverage.

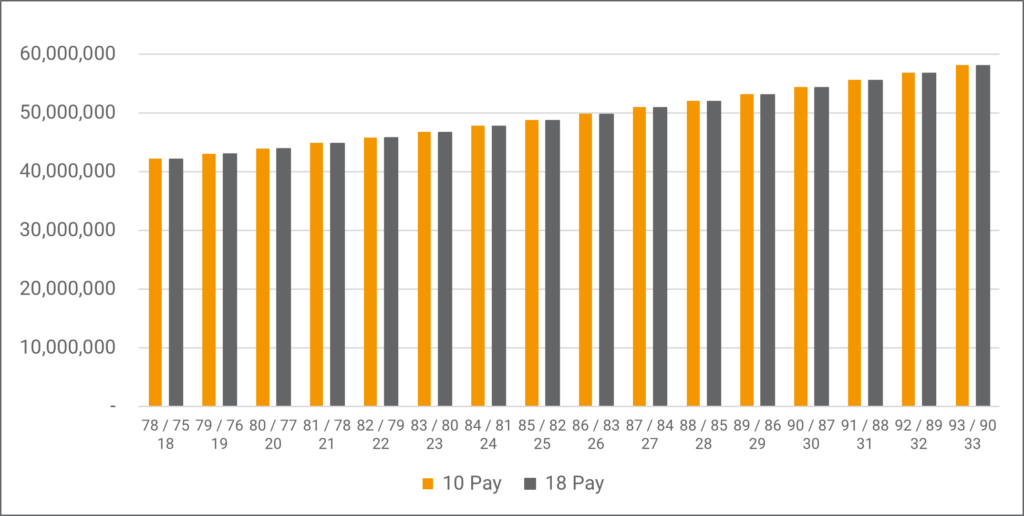

While the 10-Pay transfers a greater amount to Mike and Carol’s children, the net results are insignificant.

Irrevocable Life Insurance Trust (ILIT) Net to Heirs Comparison

10-Year Gifting Strategy Using Annual Gifts and Some Lifetime Exemption vs. 18-Year Gifting Strategy Using Only Annual Gifts

The Solution

Mike and Carol choose to make a $108,000 annual gift to their Irrevocable Life Insurance Trust for the next 18-years. The ILIT will then own and be the beneficiary of the $10 million second-to-die life insurance policy to increase the value of their net estate as much as possible.

In addition, Mike and Carol don’t have to gift any other assets. They have protected their estate from estate tax erosion.

The proceeds from the life insurance policy will provide liquidity to help minimize estate taxes, expenses of the estate, and other transfer costs to prevent the estate from selling other assets.

The ILIIT also provides Mike and Carol with control over the distribution of death benefit proceeds to beneficiaries.

DISCLOSURE

TAX ADVICE

Any tax advice contained in this communication is not intended or written to be used, for the purpose of (i) avoiding penalties under the Internal Revenue Code or (ii) promoting, marketing, or recommending to another party any transaction or matter addressed herein.

These materials are not intended to be opinions or advice on legal, tax, accounting, or investment matters. Private counsel should be consulted prior to the application of this general information to specific situations.

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Jason Mericle

Founder

Jason Mericle created Mericle & Company to provide families, business owners, and high net worth families access to unbiased life insurance information.

With more than two decades of experience, he has been involved with helping clients with everything from the placement of term life insurance to highly sophisticated and complex income and estate planning strategies utilizing life insurance.

Stay In The Know

Get exclusive tips and practical information to help you create, grow, sustain, and protect your wealth.

Ask Us Anything

We Are Here To Answer Your Questions

Start A Conversation

Schedule a complimentary 30 minute Zoom meeting to learn more about your options.