Common Life Insurance Policy Riders

Life insurance policy riders are add-ons to a life insurance policy at issue. The best way to think of a rider is they are like an option for your car.

For instance, you have a base model car. Then, for an additional cost, you can add options. Options may include an upgraded stereo, navigation system, leather interior, etc.

Life insurance policy riders can be added to any type of life insurance policy – term or permanent life insurance. The riders that are available will vary by carrier, product, and the state of issue.

It is important to note policy owners are not able to add riders once the policy has been issued. Life insurance policy riders must be added prior to coverage being placed in force.

In addition, each policy rider will have a different cost. The cost will be reflected in the policy premium.

Some of the more common policy riders include:

- Disability Waiver of Premium

- Accelerated Death Benefit Rider

- Long-Term Care Rider

- Overloan Protection Rider

- No-Lapse Guarantee Rider

Depending on the carrier and the product the name of the rider may vary from the riders referenced above. In addition to understanding what each rider does you should also take the time to educate yourself on how each carrier/product defines the rider.

Disability Waiver of Premium

The disability waiver of the premium rider waives your premium when a non-preexisting injury or sickness prevents you from working. Most carriers require the insured to be totally disabled in order to receive benefits.

With most carriers, the waiver of premium rider will expire at a certain age, typically age 60 or 65. There may be limits on how much monthly or annual premium the insurance carrier will waive. In most cases, the insurance carrier will waive premiums until the insured recovers, or the policy terminates.

In order to be eligible to receive benefits under the disability waiver of premium rider you will need to confirm a physical impairment or disability. This can be done by providing a physician statement and/or a notice from the Social Security Administration.

In some cases, there may also be a waiting period of 6-months before eligible benefits go into effect.

There is a cost for this rider. The cost will vary from product to product.

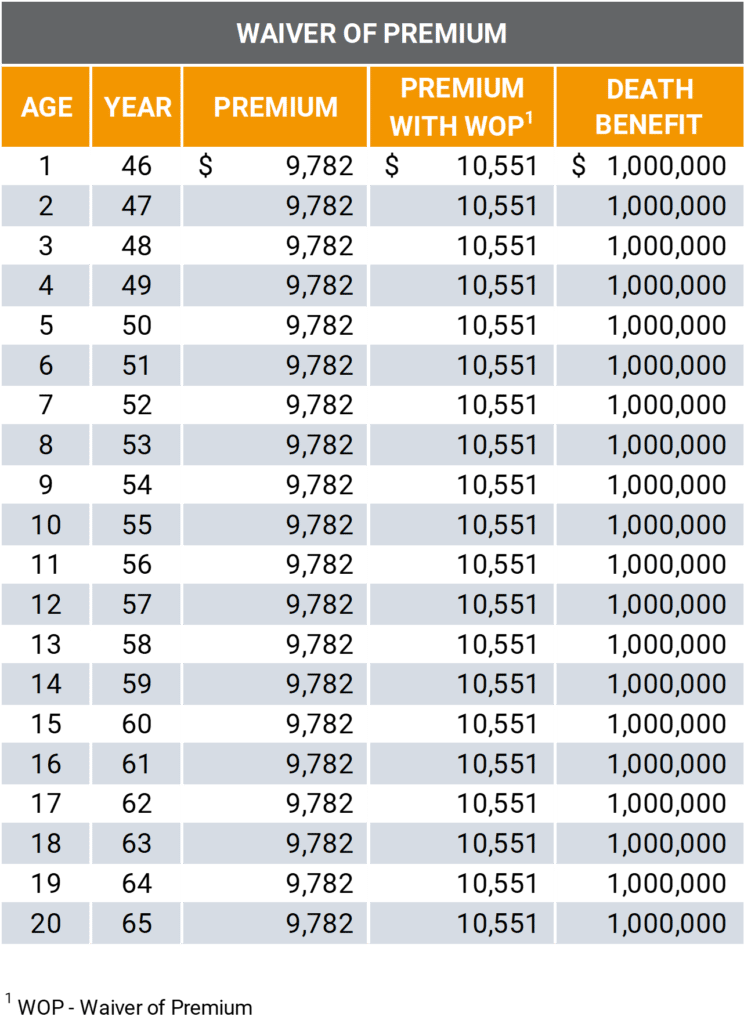

As an example, we have included the following comparison on a policy insuring a 45-year-old for $1 million of permanent life insurance coverage. It is a current assumption universal life insurance policy. We are assuming he pays premiums until Age 65 and the coverage remains in force to maturity based on current assumptions.

Without the Disability Waiver of Premium, the annual premium is $9,782. When we include the Waiver of Premium Rider the annual premium is $10,551. This represents a 7.9-percent increase in annual premium to include the Waiver of Premium rider.

Again, prior to adding this life insurance policy rider it is important to understand how the policy defines it. It may make sense to also evaluate an individual disability insurance policy in lieu of the waiver of premium rider.

Accelerated Death Benefit Rider

The Accelerated Death Benefit Rider (ADBR) allows the policy owner to accelerate a percentage of the policy death benefit if the insured has a life expectancy of 12 months or less.

If the insured has a life expectancy of 12 months or less, they will be able to access up to a specified percentage of the policy death benefit up to a maximum amount on a tax-favored basis.

To better understand this, we have included the following two examples. Each example assumes the policy owner can access up to 50 percent of the death benefit up to $1 million.

Example #1

The policy owner has a $1 million death benefit and is able to access up to 50 percent of the death benefit as an accelerated benefit. In this case it is pretty simple. They would be able to access $500,000 as an accelerated death benefit. The remaining $500,000 (less any interest or fees) would be paid to the beneficiaries upon the insured’s death.

Example #2

In this case, the policy owner has a $5 million death benefit. Since the maximum death benefit, they are able to access is $1 million (representing 20 percent of the death benefit) this is the amount they would receive. The beneficiaries would then receive the remaining $4 million (less any interest or fees) at the insured’s death.

Accelerated benefits received by the policy owner will not be subject to federal taxes. Benefits can be used to help pay medical bills, hospice care, nursing home, etc.

The death benefit will then be reduced by the amount of the accelerated death benefit received. Leaving whatever death benefit remains for the policy beneficiaries.

Currently, there is no cost for including the accelerated death benefit rider on your life insurance policy. However, if utilized there may be a minimal, one-time administrative fee.

Long-Term Care Rider

Life insurance with long-term care riders has become increasingly popular over the past several years. The reason for this is traditional long-term care policies are able to increase premiums. A long-term care rider provides more cost stability.

A long-term care rider is another form of an accelerated death benefit rider in that it provides a benefit prior to death. The difference between the long-term care rider and accelerated death benefit rider is not required to have a life expectancy of 12 months or less in order to be eligible to receive benefits.

In order to qualify for benefits the insured must require assistance with two of six activities of daily living (ADLs) or have a severe cognitive impairment.

Activities of Daily Living (ADLs) include the following:

- Eating

- Bathing

- Dressing

- Continence

- Mobility

- Toileting

In addition, prior to receiving access to benefits, the insured must satisfy a waiting period or elimination period. The waiting period is typically 90 days, but some policies allow you to choose. The shorter the waiting period the more expensive the rider will be.

When the policy is applied for the policy owner will generally have the option to choose what percentage of the death benefit, they want to have access to on a monthly basis. Generally, the percentage will be 1 percent, 2 percent, or 4 percent of the initial face amount.

The length of monthly benefits will be based on the percentage of the death benefit you are accessing and the total initial death benefit.

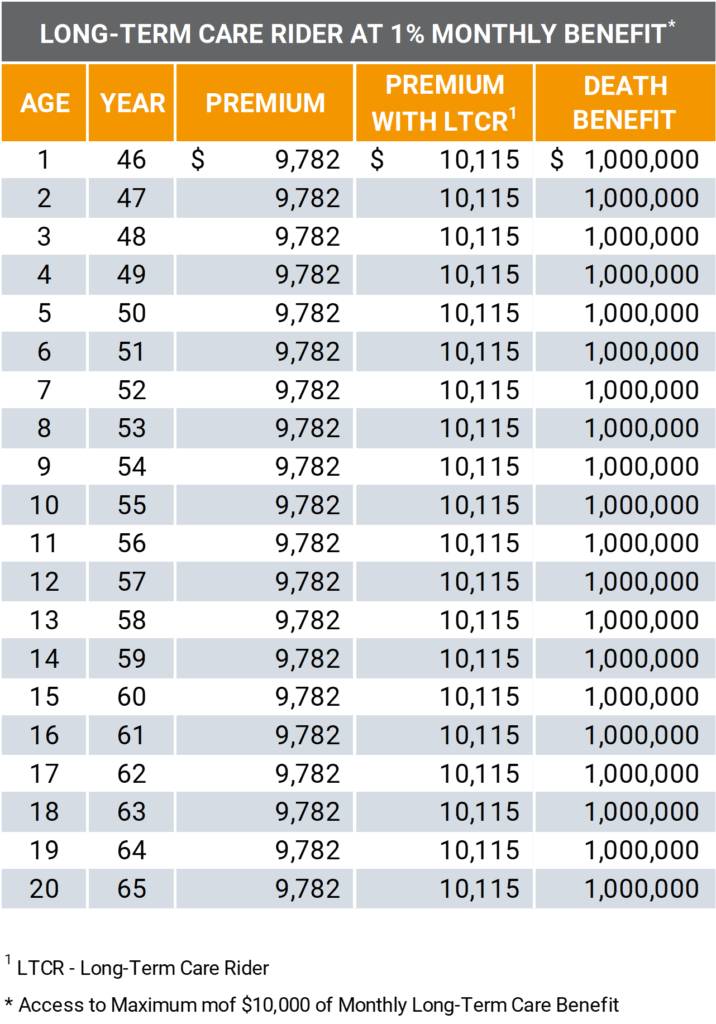

For instance, let’s assume you chose a 1-percent monthly benefit on a $1 million policy. You would be able to access $10,000 per month of long-term care benefits ($1 million times .01). Based on this, you would be able to access $10,000 per month for 100 months or just over 8 years.

Using the same example and policy referenced above the annual premium to add the 1-percent long-term care to the base policy would increase the annual premium from $9,782 to $10,115.

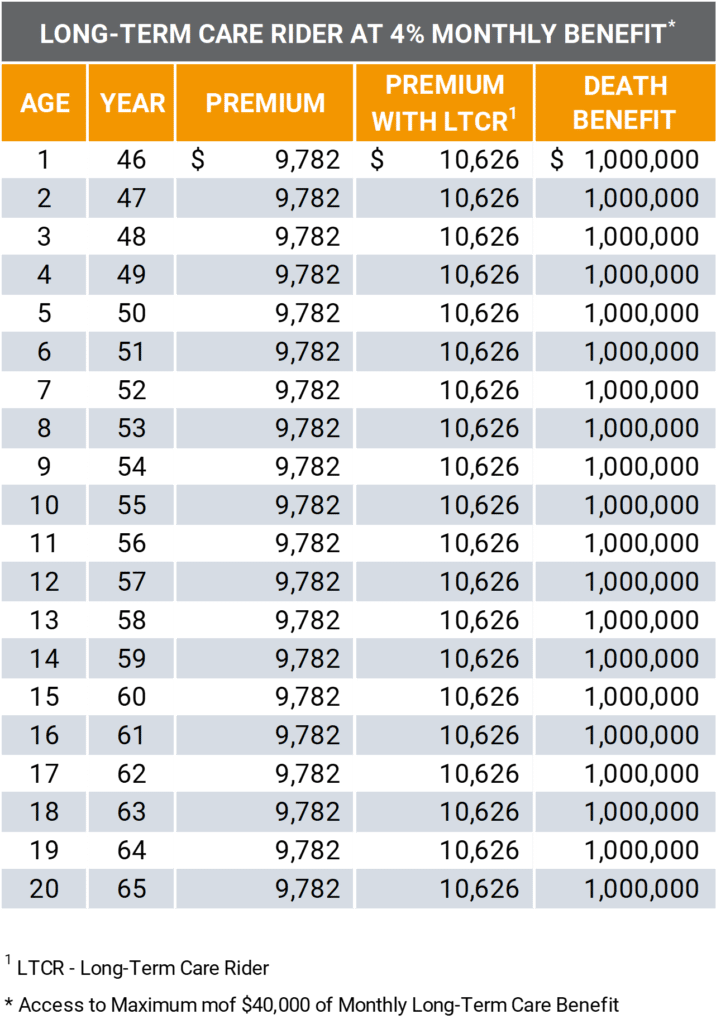

Instead of choosing a 1-percent monthly benefit, let’s assume you chose the 4-percent monthly benefit. You would now be able to access up to $40,000 per month, but for only 25 months.

Here is how it would look if you added the 4-percent monthly long-term care rider:

This would give the policy owner access to a maximum of $40,000 of monthly long-term care benefits.

When it comes to long-term care riders there are generally two ways benefits can be received – reimbursement or indemnity. Reimbursement simply reimburses you for any long-term care expenses up to the maximum monthly amount. Indemnity benefits will pay out the entire monthly amount regardless of what long-term care expenses were incurred. Indemnity policies will typically be more expensive than reimbursement policies.

Under the reimbursement option, if you do not exceed the maximum monthly allowance the benefits will be added to the backend of the policy.

Like the accelerated death benefit rider, any remaining death benefit will go to the policy beneficiaries.

Overloan Protection Rider

The overloan protection rider can be valuable for policy owners who are anticipating using policy loans to fund future needs. This is most common in policies that are being overfunded to provide supplemental retirement income at some point in the future.

When overfunding a life insurance policy, the policy owner is typically going to take distributions from the policy in the future. These distributions are generally treated as a combination of withdrawals and policy loans.

Policy loans are non-taxable to the policy owner as long as the coverage continues to remain in force. Eventually, the loans are repaid at death using the life insurance policy gross death benefit. The beneficiaries will receive the death benefit net of any policy loans.

There are situations where policy loans are so significant they may cause the coverage to lapse. When this occurs the policy owner will be responsible for paying ordinary income taxes on any distributions that were received above their policy basis.

In these situations, the overloan protection rider prevents the policy from lapsing when the loan exceeds a certain percentage of the policy cash value. When the overloan protection rider is exercised there is typically a one-time rider charge that is applied to the policy that covers all future charges. This allows the policy to remain in force until the insured passes away. Thereby avoiding any taxation resulting from an over-leveraged policy lapsing.

It is important to note there are certain requirements that must be met in order to be eligible to execute the overloan protection rider.

Typically, the policy will need to have been in force for more than 10 or 15 years. The loan balance will need to exceed a certain percentage of the policy’s account value (e.g. more than 90 percent).

No-Lapse Guaranteed Rider

The no-lapse guarantee rider is designed to keep a life insurance policy from lapsing if the policy cash values were to reach zero on a universal life policy.

Historically, many carriers have offered no-lapse guarantee universal life insurance coverage to policy owners. Over time, we have seen some carriers add this as a rider to an existing current assumption universal life policy.

The benefit of this rider is it keeps the policy from lapsing regardless of policy performance. However, in order for the rider to work the policy owner must make premium payments on time. Missing a single premium can result in the forfeiture of this rider.

There is an additional cost for this benefit. But it can also provide peace of mind that no matter how the policy current assumptions perform your premium and death benefit will always be there.

Final Thought on Life Insurance Policy Riders

Life insurance policy riders are additional options for your life insurance coverage. Depending on your goals it may make sense to consider some or all of them prior to securing coverage.

There are a number of products that offer additional riders that were not covered in this blog post. Prior to determining if a rider is good for you make sure you understand how the rider is defined and what requirements must be met prior to being able to access benefits.

DISCLOSURE

TAX ADVICE

Any tax advice contained in this communication is not intended or written to be used, for the purpose of (i) avoiding penalties under the Internal Revenue Code or (ii) promoting, marketing, or recommending to another party any transaction or matter addressed herein.

These materials are not intended to be opinions or advice on legal, tax, accounting, or investment matters. You should consult private counsel prior to application of this general information to specific situations.

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable. We cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

The information in this post is hypothetical. Values shown are not guaranteed and will vary from product to product. Assumptions are subject to change by the carrier. Actual results may be more or less favorable.

Jason Mericle

Founder

Jason Mericle created Mericle & Company to provide families, business owners, and high net worth families access to unbiased life insurance information.

With more than two decades of experience, he has been involved with helping clients with everything from the placement of term life insurance to highly sophisticated and complex income and estate planning strategies utilizing life insurance.

Stay In The Know

Get exclusive tips and practical information to help you create, grow, sustain, and protect your wealth.

Ask Us Anything

We Are Here To Answer Your Questions