On March 23, 2021, Constellation announced they had entered into an agreement with Ohio National Mutual Holdings, Inc. and Ohio National Financial Services, Inc. (“Ohio National”) for $1 billion.

Read the Constellation Insurance Holdings, Inc. March 23, 2021, Announcement

When this announcement was made it meant the members or policy owners of Ohio National had to vote to approve or disapprove of the transaction. If the demutualization was approved it meant the ownership and legal structure of the company would change to a stock insurance company.

Constellation is backed by a Quebec based institutional investor and Ontario Teacher’s Pension Plan Board.

On March 31, 2022, Ohio National Mutual Holdings, Inc. announced the successful demutualization of the company with Constellation Insurance Holdings, Inc. (“Constellation”).

Read the Ohio National March 31, 2022, Announcement

To better understand what this means it is important to understand the differences between a mutual insurance company and a stock insurance company.

What is a Mutual Insurance Company?

Mutual insurance companies are owned by its members or policy owners. The net profits of the mutual insurance company are then distributed to its members in the form of a policy dividend or reduction of premiums.

Mutual insurance companies are not traded on a stock exchange or owned by outside shareholders other than its policy owners. Because of this mutual insurance companies tend to be more conservative than there stock insurance company counterparts.

What is a Stock Insurance Company?

Shareholders own stock insurance companies not policy owners. With a stock insurance company, it is the shareholders who participate in the profitability (and losses) of the insurance company.

Unlike a mutual insurance company, the members or policy owners do not participate in the net profits of the insurance company.

In many cases stock insurance companies will be publicly traded on a stock exchange. Some of the more well-known stock insurance companies include Prudential, MetLife, and Principal. At one point all of these insurance companies were mutual insurance companies.

What Happens When a Mutual Insurance Company Becomes a Stock Company?

When a mutual insurance company becomes a stock company the members or policy owners receive a buyout based on their interest in the mutual insurance company. The buyout is paid in the form of cash, additional policy benefits, or stock of the newly formed entity.

The policy owner buyout of Ohio National was $500 million.

Members were given the option to receive their buyout in the form of (1) additional policy benefits, or (2) cash. If a member did not make an election, they automatically received additional policy benefits.

What’s specifically interesting about this demutualization is the new stock insurance company will not be publicly traded on a stock exchange. This is the path that most companies have historically taken when demutualizing.

Instead, it is owned by a private equity company backed by a Canadian institutional investor and teacher’s pension fund. The financial success of the new stock company will specifically benefit these two entities.

On March 11, 2022, the Ohio National members voted to approve the demutualization of Ohio National Mutual Holdings, Inc. It was converted to a stock company named Ohio National Holdings, Inc. and became a subsidiary of Constellation Insurance Holdings, Inc.

In addition to the $1 billion purchase price (including the $500 million member buyout), Constellation agreed to make an additional $500 million capital contribution over a four-year period to Ohio National Life Insurance Company.

The BIG QUESTION is – how will this impact policy owners and their policies moving forward?

Ohio National Post Constellation Transaction

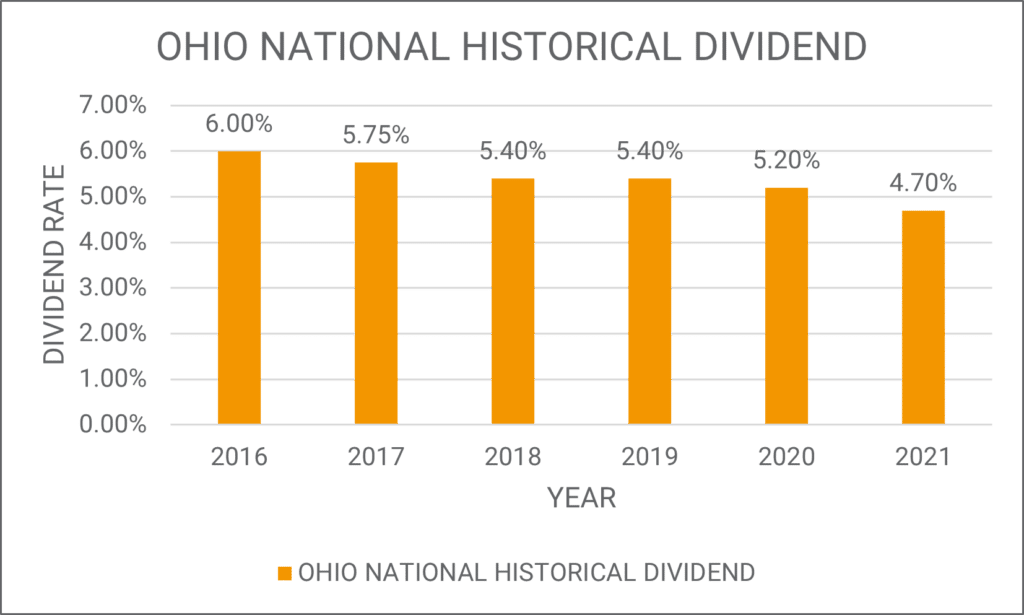

Historically, Ohio National has been known as a good whole life insurance company. However, from 2016 – 2021 their whole life dividend rate declined (like many other carriers) from 6-percent to 4.7-percent.

This was the most significant decline amongst mutual insurance carriers during this timeframe.

When you look at an Ohio National illustration shows two groups of numbers (1) guaranteed and (2) non-guaranteed.

As the name suggests, the Guaranteed group is the group of guaranteed premiums, cash value, and death benefit based on the Guaranteed Dividend Rate and maximum allowable Guaranteed Charges and Expenses.

Contractually, at a minimum, the Guaranteed Group is what the insurance carrier is legally and contractually obligated to provide.

The Non-Guaranteed Group includes the non-guaranteed or current dividend rate, current charges and expenses, along with the non-guaranteed cash value and death benefit. The insurance carrier is not contractually obligated to maintain either of these.

Guaranteed vs. Non-Guaranteed Example

The following hypothetical example will help to understand how guarantees and non-guarantees work.

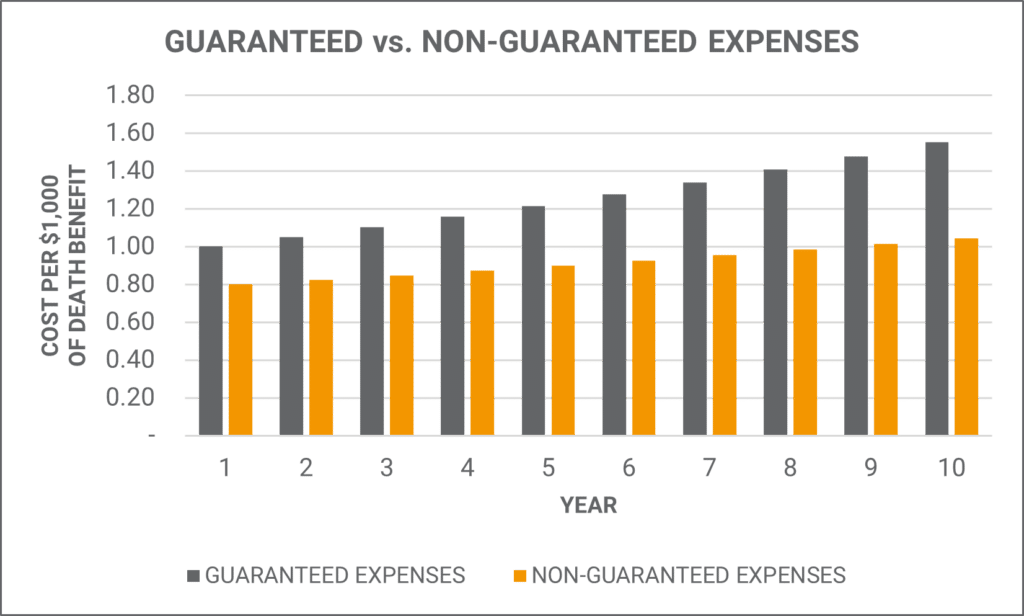

Here we are showing guaranteed verse non-guaranteed expenses. The guaranteed expenses assume the maximum charges a carrier can take based on the policy. Most policies will include a table showing what these are.

The current expenses are what the carrier is currently charging the policy owner. These charges will typically increase every year as the charges are based on the age of the insured in that policy year.

The following example assumes the cost per $1,000 of the net death benefit.

It is possible for the non-guaranteed charges to be equal to the guaranteed charges. However, contractually, the carrier cannot charge more than the guaranteed charges in any given year.

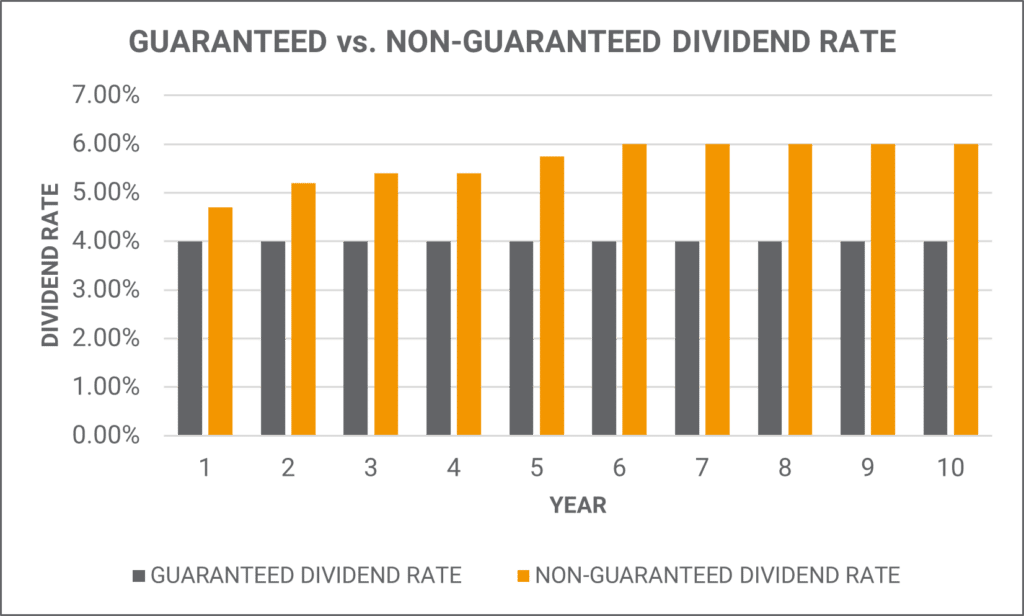

The next hypothetical example shows the guaranteed verse non-guaranteed dividend rate. While the guaranteed expenses are the maximum a carrier can charge per $1,000 of death benefit the guaranteed dividend rate is the minimum dividend rate the carrier can credit the policy cash value.

This example assumes a 4-percent guaranteed minimum dividend rate. You will notice the current dividend rate is higher each year. However, like the guaranteed and non-guaranteed expenses, the non-guaranteed dividend rate can be reduced as low as the guaranteed dividend rate.

At this time, we have not been able to confirm Ohio National’s guaranteed dividend rate. And, the guaranteed dividend rate can be different based on the policy and when it was issued. We have seen products from other carriers with a guaranteed dividend rate equal to 0-percent. However, we typically see whole life policies (issued more than 5-years ago) with a guaranteed dividend rate around 4-percent.

Ohio National Whole Life Insurance – To Be?

Now that we have a better understanding of the guaranteed and non-guaranteed components of a whole life policy let’s take a look at an actual case study.

In 2017, I was asked to review a friend’s Ohio National whole life insurance policy.

The policy was issued in February 2015. He is paying $28,385 per year for $1.6 million of coverage. The initial illustration assumed he would pay premiums for the life of the policy.

Fast forward to 2022 post Constellation transaction. He reached back out to me to see if I would take another look at the policy. This was a great opportunity for us to see what was actually happening with the policy post-transaction.

While I would like to say I was surprised, I sadly wasn’t.

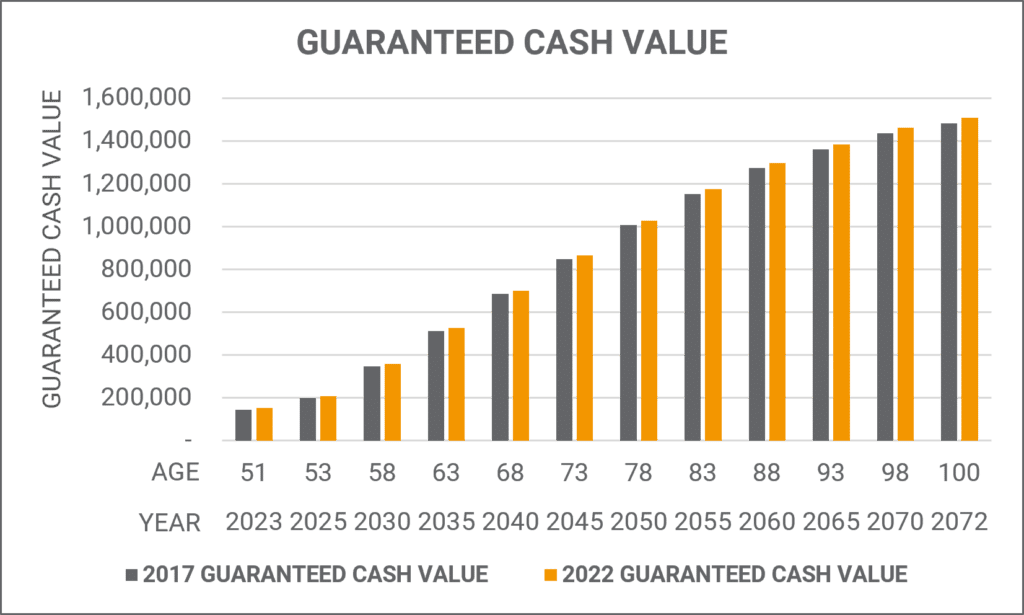

The following shows the guaranteed cash value in 2017 to the guaranteed cash value in 2022 following the demutualization. You will notice the guaranteed cash values in 2022 are greater than they were in 2017.

The reason for this is the result of him electing to receive his portion of the buyout as additional policy benefits.

These values assume he continues to make the ongoing $28,384 annual premium for the rest of his life.

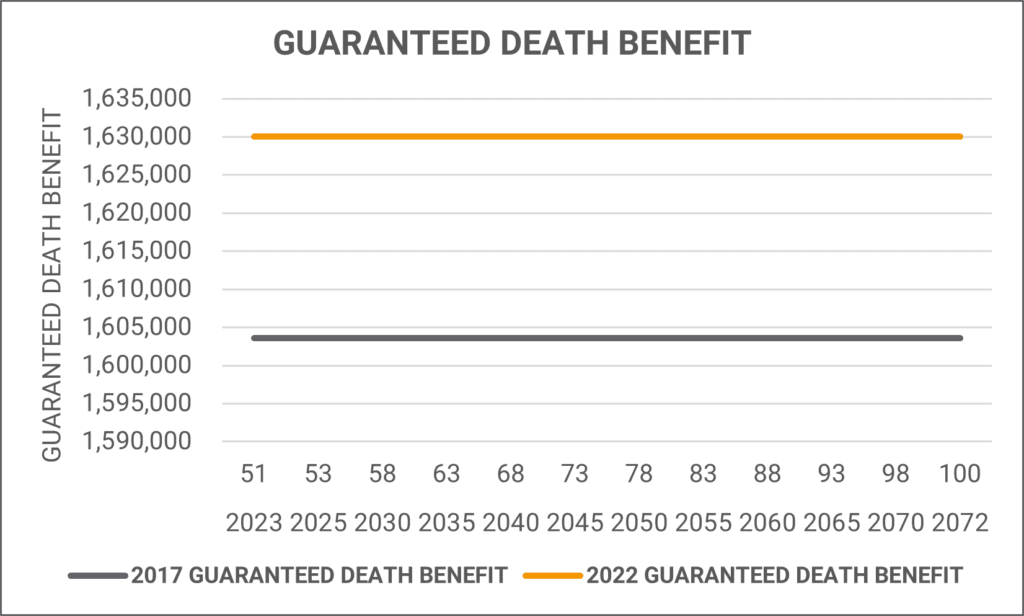

We then compared the guaranteed death benefit from 2017 to 2022. Because of his election to receive the buyout as additional policy benefits the guaranteed death benefit actually increased by $26,390.

If you are only concerned about the guarantees of the policy, there is no reason for you to continue reading. Because of the buyout, the guaranteed death benefit and cash value are likely in a better position today than they were in 2017.

This is fantastic! Go demutualization…. Right?

Ohio National Whole Life Insurance – Or?

Now that we have had a chance to look at the Ohio National Whole Life Policy Guarantees let’s look at the non-guaranteed assumptions.

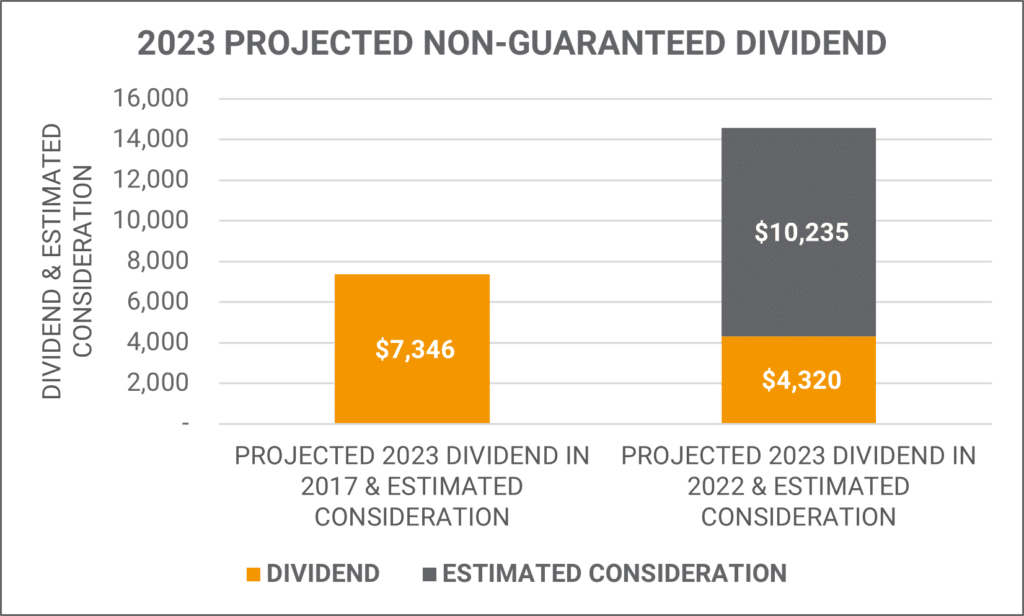

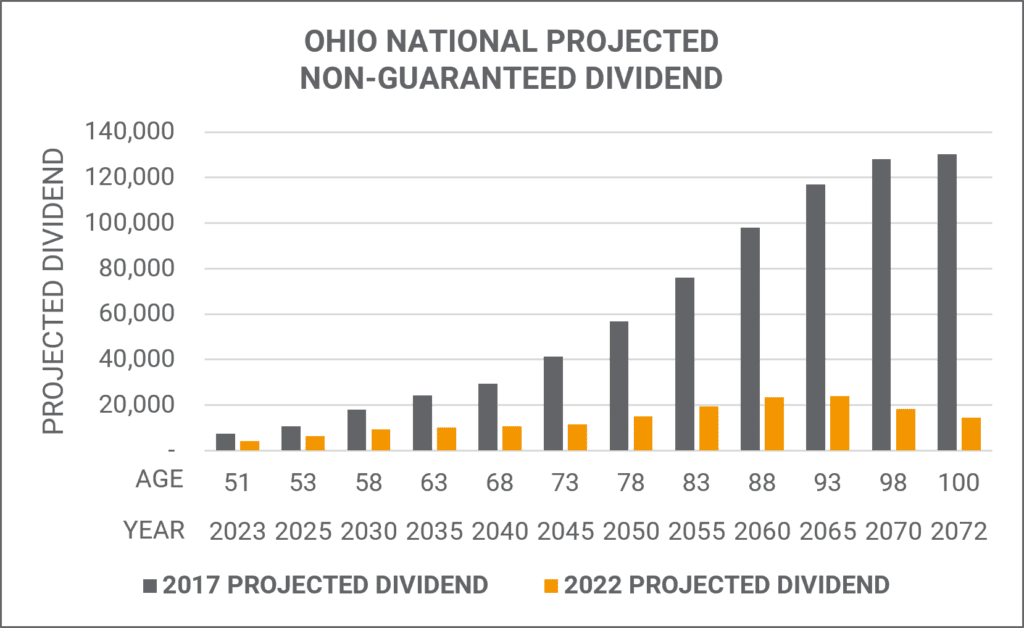

Let’s start by looking at the projected non-guaranteed dividend for the policy anniversary year end in 2023.

The left represents what the projected non-guaranteed dividend would be in 2023 based on Ohio National’s dividend rate in 2017. We mentioned earlier that in 2017 Ohio National’s 2017 dividend was at 5.75-percent.

The right represents the projected non-guaranteed dividend in 2023 based on the 2022 dividend rate. We don’t know exactly what the dividend rate is for 2022 as it has not been announced publicly. In addition, it is not referenced in the policy illustration.

What we do know is the dividend rate in 2021 was 4.70-percent. We also know the projected non-guaranteed dividend has gone down by more than 41-percent over this period of time.

This one is not entirely a result of Ohio National demutualizing. In fact, it may illustrate how much financial trouble Ohio National was actually in prior to the transaction.

You will also notice the Estimated Consideration. This represents the policy owner’s buyout. Had he elected to take the buyout in cash this would have likely been how much he would have received.

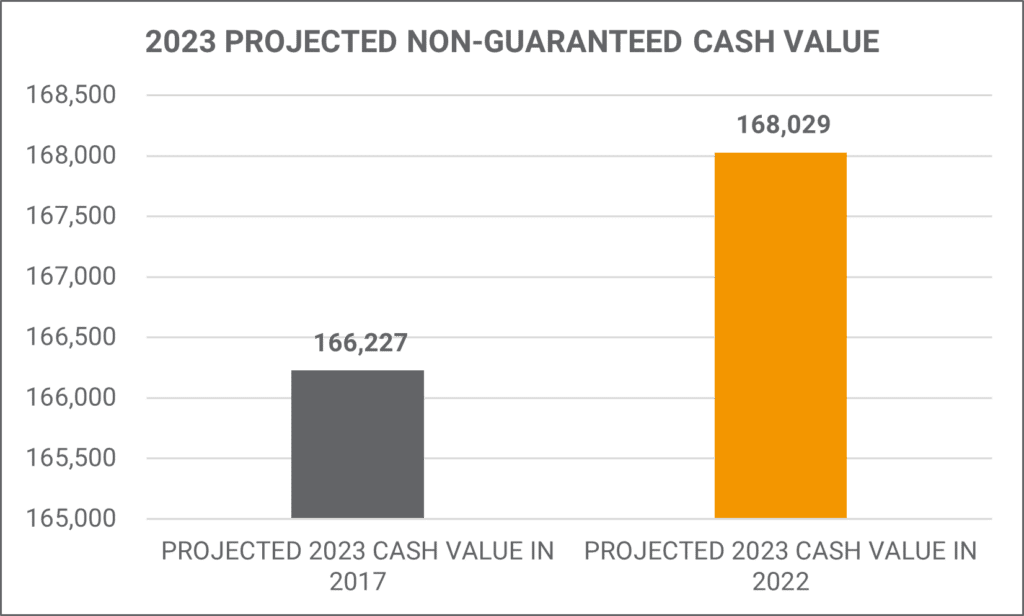

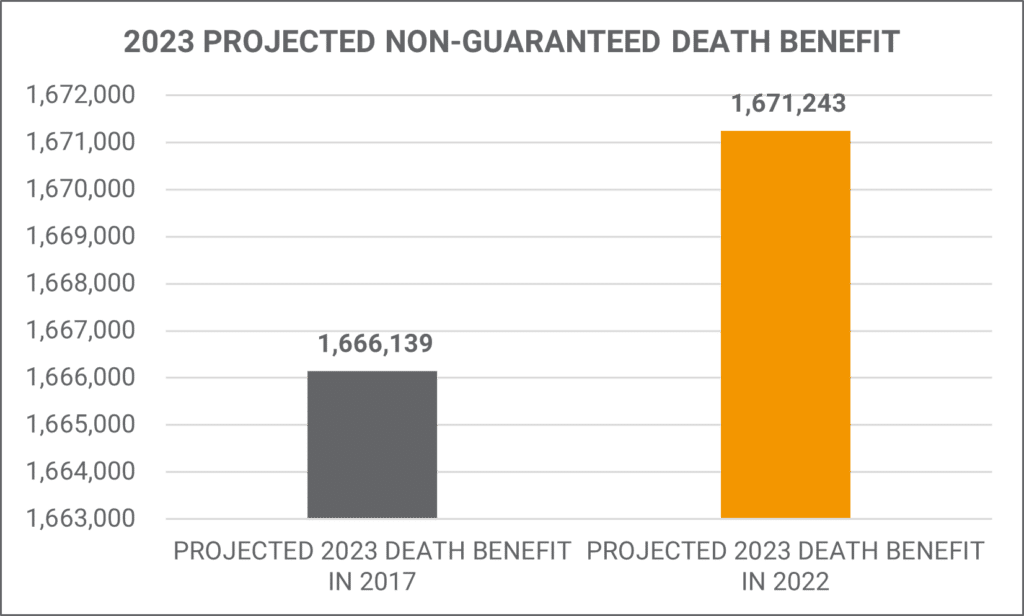

Between the dividend and estimated consideration, the policy cash value is actually performing better from a non-guaranteed cash value and death benefit perspective than what was illustrated in 2017.

The projected non-guaranteed cash value is actually $1,802 higher than what it was in 2017. This is primarily due to the influx of cash resulting from the estimated consideration.

The projected non-guaranteed death benefit is also $5,104 higher than what it was in 2017.

It looks like demutualization is still good… Right?

Ohio National Whole Life Insurance – Not To Be?

In its current state, the policy seems to be performing at or near where it was projected to be in 2017 for both the guaranteed and non-guaranteed values.

Now, let’s take a look at how the policy projected non-guaranteed values perform in the future.

Ohio National Whole Life Insurance – Non-Guaranteed Dividend

Let’s start with the non-guaranteed dividend.

The projected 2023 dividend in 2017 was $7,346. The projected 2023 dividend in 2022 dropped to $4,320. Representing a 41.2-percent reduction in less than 6-years.

In 2017, the 2040 non-guaranteed dividend was projected at $29,490. In 2022, the 2040 projection has gone down by 63.5-percent to $10,758.

In 2017, the total projected dividends to be received from 2023 thru 2052 was $908,761. In 2022, those projected dividends over the same period of time had fallen to $315,219. The net result is a $593,542 deficit representing a total percentage loss of 65.3%.

Ohio National Whole Life Insurance – Non-Guaranteed Cash Value

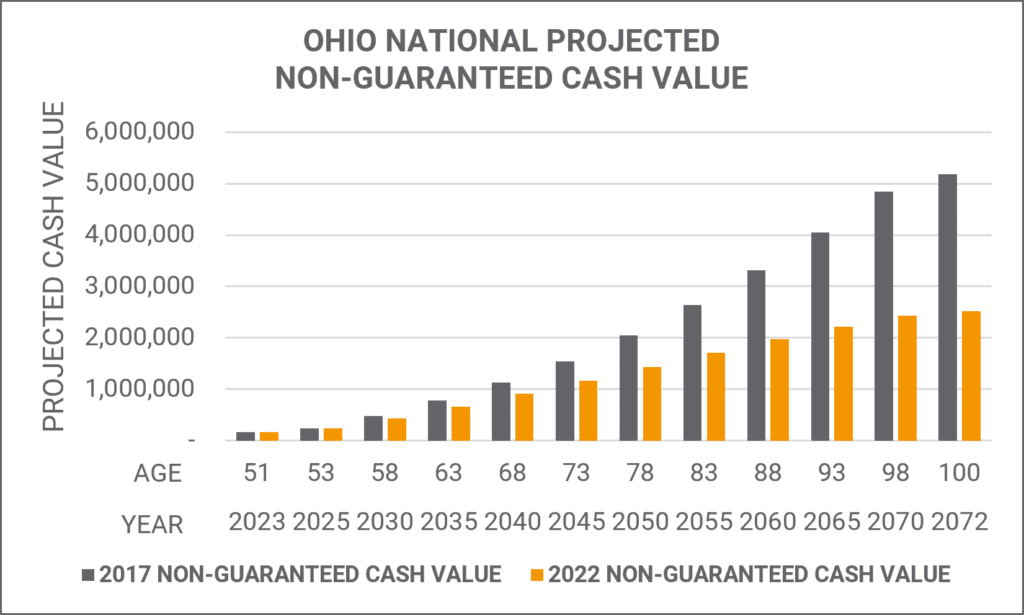

Since we know the non-guaranteed dividend has been significantly reduced, we can assume the non-guaranteed cash value will be lower.

Now, you may not necessarily care about the cash value. If the policy was acquired solely for the death benefit than the cash value may not be that important to you.

However, it is important to note, the non-guaranteed cash value is going to be what drives the non-guaranteed death benefit.

We can see in the following chart the non-guaranteed cash value deficit is not that bad in the early years. But, as the insured gets into his 70s, 80s, and 90s we can see a much larger spread between the cash value projected in 2017 versus 2022.

By age 80 there is $729,199 less cash value in the policy than what was projected in 2017. If the insured is lucky enough to live to age 100 there is $2,664,818 less cash value when compared to the 2017 projections.

Ohio National Whole Life Insurance – Non-Guaranteed Death Benefit

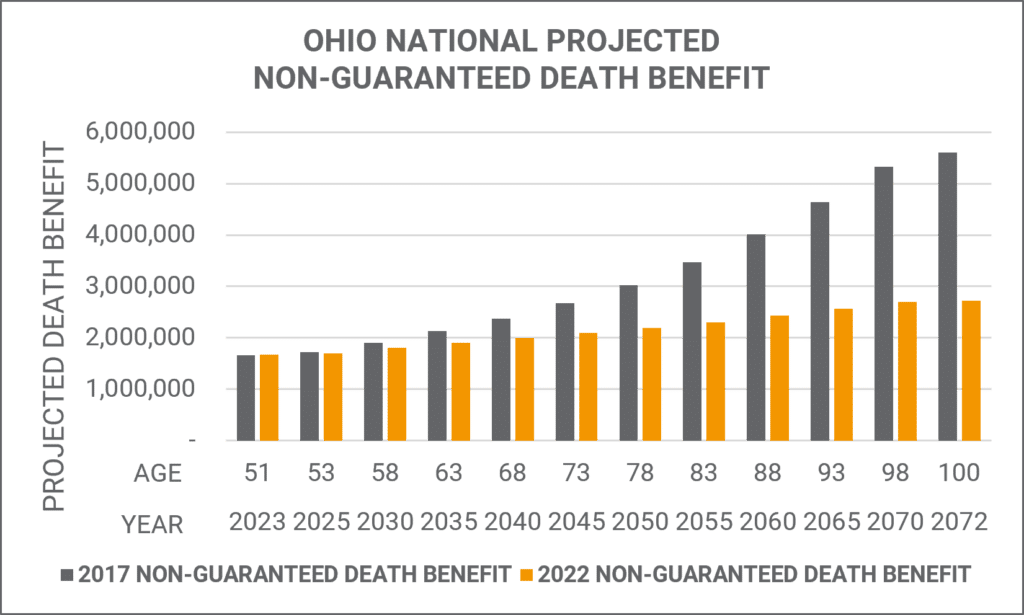

When purchasing whole life insurance many people are looking at the non-guaranteed death benefit when making their decision. They have the piece of mind knowing they have policy guarantees but are hopeful they are able to achieve the non-guaranteed assumptions.

Otherwise, why would you pay so much premium? In most cases, you can get a policy with a guaranteed death benefit for much lower premiums.

In 2023, we actually have about $5,000 more non-guaranteed death benefit than what was projected in 2017. This is largely due to the Estimated Consideration or buyout of Ohio National.

By 2025, the non-guaranteed death benefit is actually $16,758 less than what was projected in 2017. And, continues to decline for the remainder of the life of the policy.

By age 88, the non-guaranteed death benefit is more than $1.5 million less than was projected in 2017. Instead of having more than $4 million of coverage, there is just under $2.5 million of death benefit.

Go Demutualization… Wrong!

What Are My Options?

If you own an Ohio National whole life insurance policy, you have a few options. The first (and most obvious) is to continue paying premiums. You still have the policy guarantees and any non-guaranteed projections are only a bonus.

Second, you can put the policy on Reduced Paid Up. When you do this Ohio National will calculate how much death benefit you would receive without requiring any additional premiums. It will likely be significantly lower than the current death benefit, but you would not need to make any future premium payments and would still have some death benefit in force.

Third, you could surrender the policy. By surrendering the policy, you would receive the policy cash values and would no longer have the death benefit protection. When doing this you should see if you have any policy gains as these would be considered taxable at ordinary income tax rates.

Fourth, you could look at replacing the policy with one from another carrier via a life insurance 1035 exchange. A 1035 exchange occurs when the cash value of your existing policy is transferred to another policy. When the transfer occurs, there are no taxes on any policy gains to the policy owner.

This could be a good way to keep your coverage while potentially reducing your ongoing premium.

Ohio National Whole Life Insurance 1035 Exchange

In this particular instance, we looked at replacing his Ohio National whole life insurance policy with a guaranteed universal life insurance policy.

By doing a 1035 Exchange of his existing $168,029 cash value he is able to secure $785,000 of death benefit without any additional premiums. The coverage is fully guaranteed to his Age 110. Had he elected the reduced paid-up option with Ohio National he would have received just under $500,000 of death benefit.

If he wants to continue making his annual $28,384 premium, he would be able to secure more than $3.3 million of guaranteed life insurance coverage. This is twice the amount of coverage he has today.

Each policy and insured situations are different. A 1035 exchange does not always make sense, but in a lot of cases, it does. If you are interested in exploring a 1035 exchange of your Ohio National whole life insurance policy, please email us at info@mericleco.com.

Final Thoughts – Ohio National

Ohio National was likely in a difficult financial position to demutualize and sell the company for $1 billion plus a $500 million capital contribution. However, it was ultimately the policy owners who voted to allow the transaction to happen.

If you are an Ohio National policy owner, it is more important than ever to keep an eye on your policy. It would appear the policy owners are actually the ones funding the buyout, not Constellation Insurance Holdings, Inc. Understand that you may have other options depending on why you originally obtained the coverage.