The Definitive Guide To Split Dollar Life Insurance Arrangements

A Split-Dollar Life Insurance plan is a sophisticated strategy that can help with the payment of life insurance premiums. A life insurance policy’s premium, cash value, and death benefit are split between two parties under a split-dollar arrangement. A Split Dollar arrangement is useful in helping to:

- Minimize income and gift taxes when funding large premium payments,

- Reduce cash flow to fund life insurance coverage,

- Provide an executive benefit by a company to encourage employee(s) to stay with the company, and

- Fund the replacement of a key employee or executive due to an unforeseen loss.

Today, there are two primary uses when considering a Split-Dollar life insurance arrangement:

1. Private Split-Dollar

Private split dollar plans can provide estate liquidity to help minimize income, estate, and gift taxes. This type of arrangement works well for affluent families who want to acquire life insurance outside of their estate to create liquidity for estate planning purposes.

2. Corporate Split-Dollar

Companies use corporate split-dollar plans as an executive benefit to help retain key employees or to replace the loss of a valued employee or owner. Business owners may also use them to help fund buy-sell agreements.

Split-Dollar Life Insurance Arrangement History

Split-Dollar life insurance arrangements have existed since 1964.

Under these arrangements, Party A (think employer) would typically fund a majority of the premium payments. Party B (think employee) can access the cash value and name their own beneficiary. Party B will then receive the net proceeds after Party A receives the advanced premiums.

Cash value in a life insurance policy has the potential to grow and accumulate over time. Any cash value growth above the contributed premiums is a gain (or equity) to Party B. Party B’s equity in the policy is non-taxable. The IRS viewed the gain as escaping taxation and potentially abusive.

Since Party B was receiving value in the form of a death benefit and/or equity in the policy, the IRS introduced a series of Revenue Rulings. The Revenue Rulings would require Party B to pay a tax on the value of the death benefit. The Revenue Rulings stated the value of the policy to Party B was equal to the one-year term premium of the face amount or use an IRS published table (PS 58) indicating the value of the policy each year. Even with the Revenue Rulings, Split-Dollar life insurance arrangements were economical and attractive for estate planning and executive compensation.

The IRS and Treasury Department still felt the untaxed equity in a split-dollar life insurance policy was abusive. In 2001, the IRS published Notice 2001-10 and 2002-8 to address the taxable amounts of split-dollar life insurance policies. In September 2003, the Treasury implemented regulations similar to the IRS notices.

The Final Split Dollar Regulations

The final split-dollar regulations apply to arrangements entered into after September 17, 2003. Split-dollar arrangements entered into prior to this date do not fall under the guidelines of the final regulations provided they are not materially modified after this date. These arrangements are still governed by the original economic benefit rules under Revenue Ruling 64-328 and Revenue Ruling 66-110.

New Split-Dollar Life Insurance Arrangements Subject to Final Regulations

The final split-dollar regulations created two tax regimes for arrangements moving forward – economic benefit and loan regime. How you structure your specific split-dollar arrangement will be specific to certain factors and result in different taxation.

Split-Dollar Life Insurance – Economic Benefit Regime

Under an economic benefit split-dollar arrangement, an employer or individual will advance premiums and endorse or assign certain rights to an employee or Irrevocable Life Insurance Trust (ILIT). If an ILIT is the policy owner, the trust should receive gifts for the economic benefit each year.

If a corporate entity advances you, an employee, or your trust the premium, you need to recognize the economic benefit cost annually as income. Subsequently, an employee can make a premium payment equal to the annual term cost, and avoid paying income tax.

The value of the economic benefit is based on IRS issued Table 2001 rates or the insurer’s annual renewable term rates, whichever is lower. Economic benefit rates do increase with age. The economic benefit rates for survivorship coverage can be significantly lower than rates for a single life policy.

Split-Dollar Life Insurance – Loan Regime

Loan Regime split-dollar allows an individual or company to loan the annual premium to an individual or trust. The individual or trust agrees to repay the loan at a future date using policy cash values, other funds, or at death using life insurance proceeds.

The balance of the loan is equal to the premiums paid. The individual or trust can then pay the loan interest or accrue it over time. Accrued interest is added to the outstanding loan balance. Loan interest is calculated using a fair market rate or the Applicable Federal Rate under IRC §7872.

Unlike an economic benefit split-dollar plan, interest on the loan arrangement is based on cumulative premiums paid instead of the economic benefit cost of the death benefit.

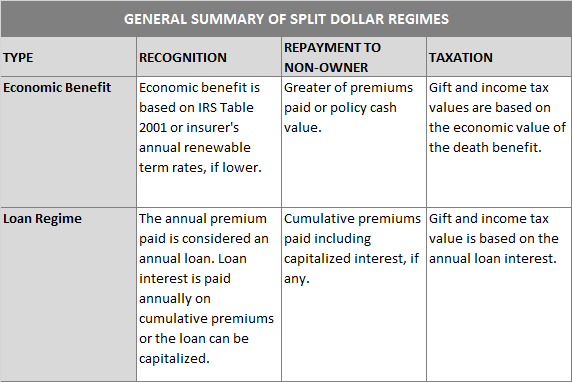

SUMMARY OF SPLIT-DOLLAR REGIMES

Types of Split-Dollar Life Insurance Arrangement – Endorsement and Collateral Assignment

Endorsement Split Dollar

One of the most common uses of endorsement split-dollar is when a company owns a policy on you and endorses some or all of the death benefit to you or your trust. The most common use of endorsement split-dollar is for business planning.

It is a cost-effective way for an employer to provide protection for themselves or a key executive. Endorsement split-dollar arrangements can also be set up to provide supplemental retirement income.

Consequently, endorsement split-dollar is used as a non-qualified deferred compensation program to create golden handcuffs. Life insurance is a tax-efficient vehicle that can be used to fund deferred compensation payments for an employee at retirement.

Under this arrangement, the participant contributes the term cost of the death benefit for their beneficiaries as a survivor benefit. Alternatively, the company can bonus the annual term cost as additional taxable compensation to the participant.

Benefits of Endorsement Split Dollar

Endorsement Split Dollar is most beneficial as an executive benefit. Since the cost is limited to the economic benefit it offers low-cost death benefit protection and/or supplemental retirement income. A company can use endorsement split-dollar to provide key-person protection on an employee or owner. And, can be an attractive option when establishing and funding a buy-sell agreement.

As a result, Endorsement Split-Dollar allows for cost recovery from the death benefit proceeds.

Collateral Assignment Split Dollar

Collateral assignment split-dollar is generally for use by individuals or companies when a trust owns the life insurance policy. The life insurance policy is either an individual policy or a survivorship policy. The owner of the policy (trust) pledges the cash value and death benefit to repay premiums advanced by the non-owner.

A collateral assignment split-dollar arrangement is usually set up between an individual and their trust. However, an individual’s company can advance premiums using corporate dollars. The policy is then collaterally assigned to the individual or company advancing the premiums as security for repayment of premiums.

The Benefit of Collateral Assignment Split Dollar

The use of Collateral Assignment Split Dollar is oftentimes for estate planning. It can provide estate liquidity while minimizing gift taxes and the use of an individual’s lifetime exemption. Since economic benefit rates can be low, you can minimize gift taxes while leveraging gifts of premiums with life insurance. Collateral Split-Dollar can also be beneficial for business buy-sell planning.

Types of Split-Dollar Plans Using the Economic Benefit Regime

While Split-Dollar Final Regulations changed plan structures, they created new ways to achieve specific planning objectives. Under the economic benefit regime, there are four primary designs you can utilize.

- Private Non-Equity Collateral Assignment between a Family Member(s) and Trust;

- Corporate Non-Equity Collateral Assignment between a Company and Employee or Trust;

- Endorsement Split Dollar where the Company Owns the Policy and Provides Benefits to the Employee; or

- Private Switch Dollar

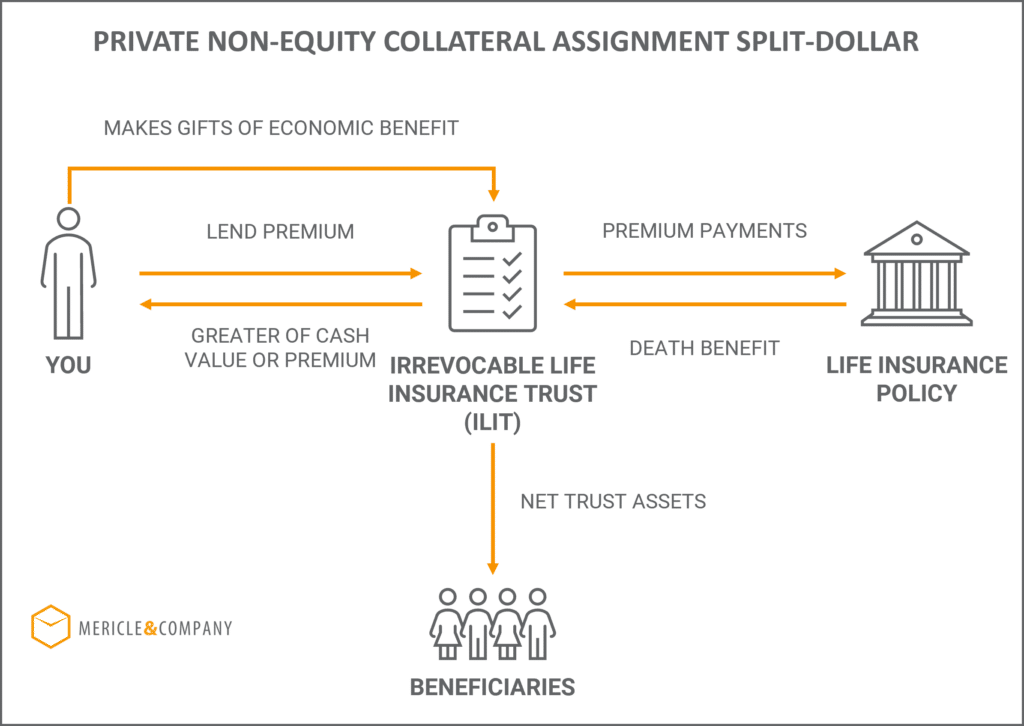

Private Non-Equity Collateral Assignment Split-Dollar

A Private Non-Equity Collateral Assignment Split Dollar plan is most appropriate for individuals funding a significant life insurance need who want to minimize gift tax and the use of their lifetime exemption to purchase coverage in their ILIT.

Under this arrangement the individual advances premiums to their Irrevocable Life Insurance Trust (ILIT). The ILIT makes premium payments to the insurance company. The individual makes gifts of economic benefit to the ILIT based on the net death benefit. At death, the ILIT receives the proceeds from the life insurance policy. As a result, the individual’s estate receives the greater of the policy’s cash values or premiums paid.

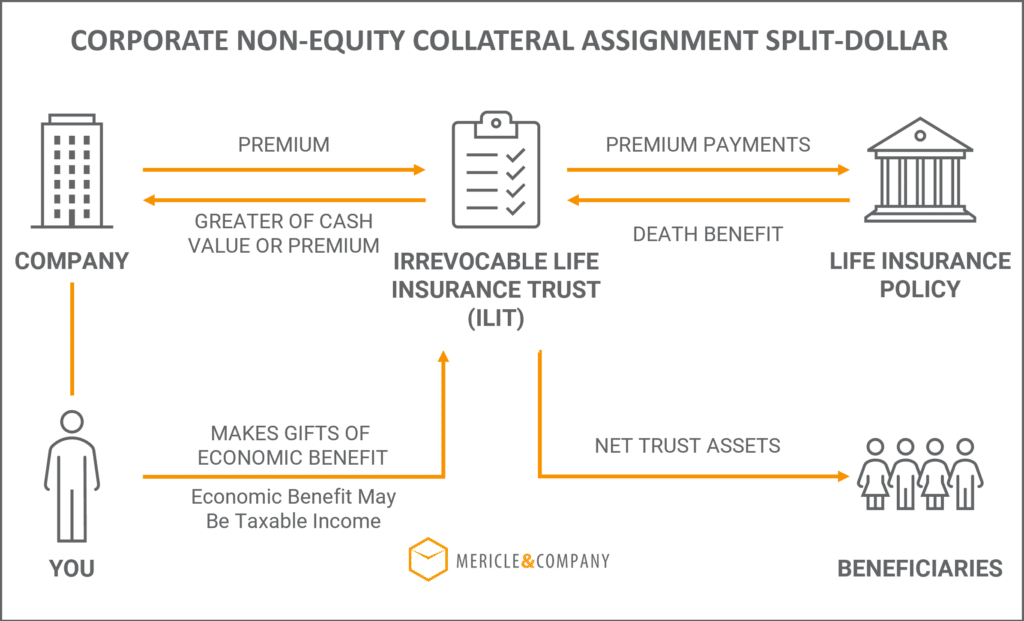

Corporate Non-Equity Collateral Assignment Split Dollar

A Corporate Non-Equity Collateral Assignment Split Dollar plan works best for individuals who want to minimize gift tax and the use of their lifetime exemption to pay premiums from their company.

Unlike Private Non-Equity Collateral Assignment Split Dollar, the company pays the premiums, not the individual. Under this arrangement, the company funds the premium to the ILIT, and the ILIT makes premium payments to the life insurance company. The individual makes a gift of the economic benefit to the ILIT. At death, the ILIT receives the death benefit and reimburses the company for premiums paid. Heirs receive the balance of the trust assets.

Learn more about using an Irrevocable Life Insurance Trust to help accomplish your estate planning goals.

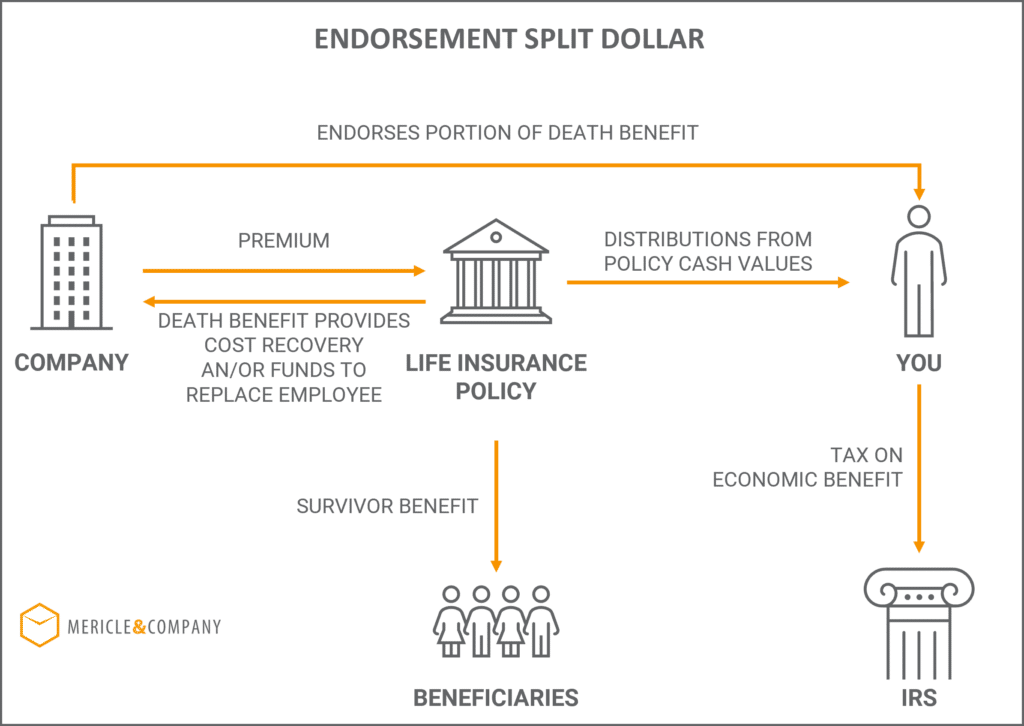

Endorsement Split Dollar

In an Endorsement Split-Dollar arrangement the company owns a policy on an employee. This provides additional benefits for the employee’s family or funds the cost to replace an employee.

With Endorsement Split-Dollar the company owns the policy and makes premium payments on a policy insuring the employee. The employer endorses a portion or all the death benefit to the employee. As a result, the employee pays a tax on the economic benefit received from the assigned death benefit.

In certain situations, the employer will retain a portion of the death benefit as a “key man” policy. At death, the employer receives reimbursement for the advanced premiums. At this time, the employee’s named beneficiaries will receive the assigned death benefit.

Endorsement split-dollar can also be used as a buy-sell agreement life insurance funding tool.

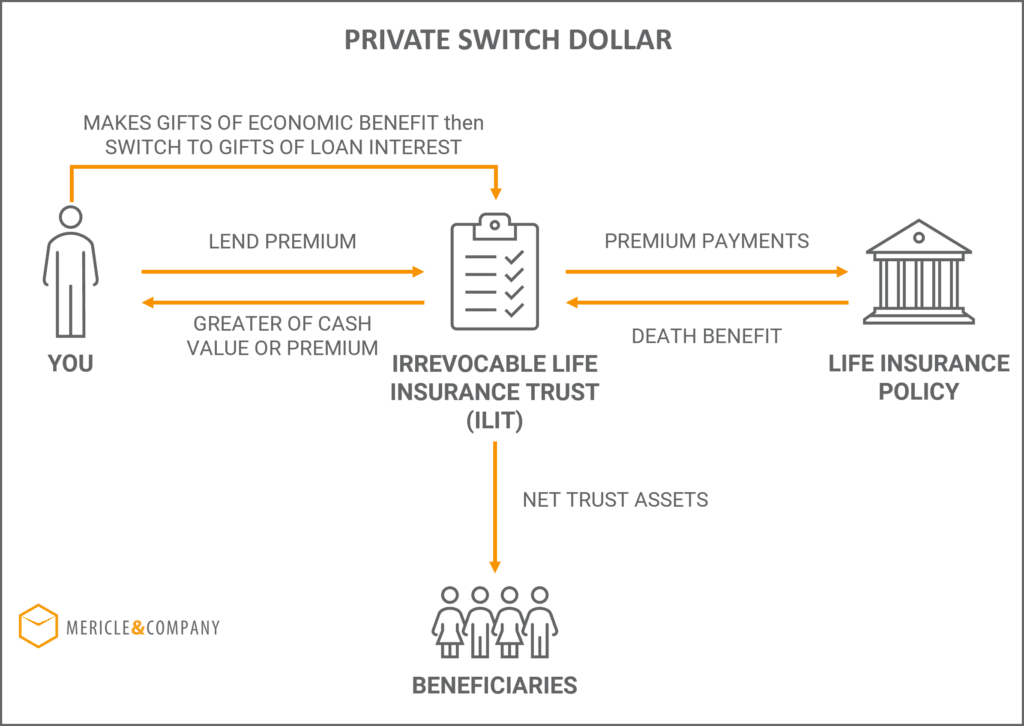

Private Switch Dollar

Private Switch Dollar combines the economic benefit and loan regime into a single arrangement. At older ages, the economic benefit regime can exceed the cost of using a loan regime split dollar. When this occurs you can elect to “switch” from the economic benefit regime to loan regime. With this in mind, you will need to terminate the collateral assignment from the policy and establish a promissory note. The initial loan balance will be equal to prior premiums paid (or the cash value, if greater).

You can also use Private Switch Dollar prior to the cash value of the policy moving into a gain position. This occurs when the cash value of the policy exceeds the total premiums paid.

Under a Private Switch Dollar arrangement an individual advances premium payments to their ILIT. The ILIT then makes premium payments to the insurance company. The insured initially makes gifts of the economic benefit to the ILIT. When the economic benefit costs exceed the loan interest cost a switch occurs to loan regime split dollar. At this point, the individual makes gifts of loan interest to the ILIT, instead of gifts of economic benefit.

At death, the ILIT receives the entire death benefit. The ILIT reimburses the individual’s estate based on premiums paid or cash value, whichever is greater. Once this is complete the ILIT retains the balance of the death benefit for the beneficiaries.

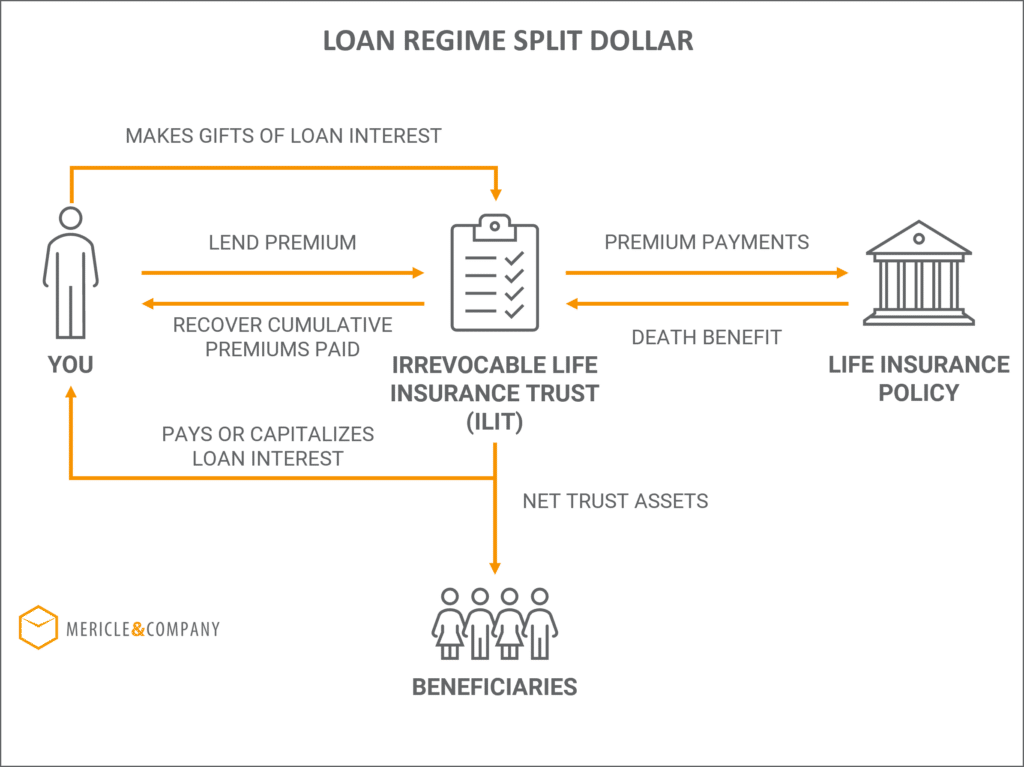

Split-Dollar Plans Using Loan Regime

Establishing a Loan Arrangement Split Dollar plan makes the most sense when it is economical to do so. Determining if loan arrangement split-dollar makes more sense than the economic benefit regime is a function of your age and interest environment.

Under a split-dollar loan arrangement plan, an individual lends premiums to their irrevocable life insurance trust. The ILIT pays premiums to the insurance company. The individual makes gifts of loan interest to their ILIT typically based on an Applicable Federal Rate (AFR).

The individual also has the option of capitalizing loan interest. Capitalized loan interest is added to the loan balance of cumulative premiums paid. As a result, the loan will continue to grow each year by any premium payments and capitalized loan interest.

At death, the ILIT receives the death benefit from the life insurance company. The ILIT then “pays off” the outstanding loan balance (including any capitalized loan interest) to the insured’s estate. Net proceeds remain in the ILIT. The beneficiaries then receive distributions from the trust according to the trust provisions.

Final Thoughts on Split-Dollar Life Insurance

Split-Dollar Life Insurance arrangements are ideal for companies looking to provide additional benefits to key employees. In addition, it can be beneficial for families who have a desire to minimize gift taxes and the use of their lifetime exemption for estate tax purposes to acquire life insurance protection.

There are a number of benefits to using a Split Dollar arrangement. Your need for life insurance, age, interest rate environment, and premium sources will dictate which arrangement may be best for you. When considering split-dollar life insurance, it is important to work with an attorney and life insurance advisor who understands the intricacies of this arrangement.

To learn more about how you may benefit from split-dollar life insurance please email us at hello@mericleco.com.

DISCLOSURE

TAX ADVICE

Any tax advice contained in this communication is not intended or written to be used, for the purpose of (i) avoiding penalties under the Internal Revenue Code or (ii) promoting, marketing, or recommending to another party any transaction or matter addressed herein.

These materials are not intended to be opinions or advice on legal, tax, accounting, or investment matters. You should consult private counsel prior to application of this general information to specific situations.

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable. We cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

The information in this post is hypothetical. Values shown are not guaranteed and will vary from product to product. Assumptions are subject to change by the carrier. Actual results may be more or less favorable.

Jason Mericle

Founder

Jason Mericle created Mericle & Company to provide families, business owners, and high net worth families access to unbiased life insurance information.

With more than two decades of experience, he has been involved with helping clients with everything from the placement of term life insurance to highly sophisticated and complex income and estate planning strategies utilizing life insurance.

Stay In The Know

Get exclusive tips and practical information to help you create, grow, sustain, and protect your wealth.

Ask Us Anything

We Are Here To Answer Your Questions

Start A Conversation

Schedule a complimentary 30 minute Zoom meeting to learn more about your options.