The Benefits of A Spousal Lifetime Access Trust (SLAT)

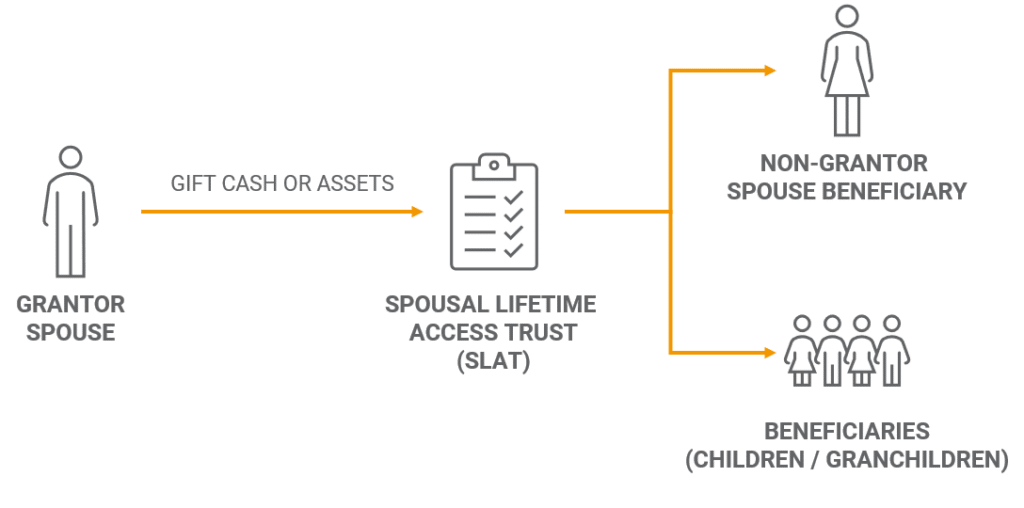

A Spousal Lifetime Access Trust (SLAT) allows a client to make irrevocable transfers of assets to fund trust-owned life insurance. A Spousal Lifetime Access Trust can provide families with the flexibility to benefit from the trust in several different circumstances.

Spousal Lifetime Access Trust(s) are ideal for married couples with a potential estate tax liability who want flexibility in their estate planning. A Spousal Lifetime Access Trust allows one spouse to be a beneficiary of the trust, while the other spouse is the grantor of the trust.

How Does a Spousal Lifetime Access Trust Work?

Families with interest in transferring assets to heirs will need to take steps to reduce estate taxes. A common way to do this is to make lifetime transfers of assets to an irrevocable trust.

Assets transferred to an irrevocable trust will continue to appreciate the same as if they were individually owned. The difference is the growth of the assets in the irrevocable trust occurs in the trust and outside the taxable estate.

When the client dies the total accumulated value is available in the trust for the benefit of the beneficiaries and no additional transfer taxes are due and payable at the client’s death.

The challenge with making irrevocable transfers of assets is oftentimes the client no longer has control of those assets. Most clients would make the transfer to receive the tax result but often have worries about what the future will bring.

For instance, what if they need those assets resulting from some unforeseen event?

This is where a Spousal Lifetime Access Trust can be useful. A Spousal Lifetime Access Trust allows families to remove assets from their estate while providing indirect access to those assets.

What is a Spousal Lifetime Access Trust?

A Spousal Lifetime Access Trust is an irrevocable life insurance trust with some additional features. Like a traditional irrevocable life insurance trust, transfers will be outside the taxable estate and held for the benefit of heirs. In this scenario, securing individual or survivorship life insurance coverage using trust assets can make sense.

What makes a Spousal Lifetime Access Trust different from a traditional Irrevocable Life Insurance Trust (ILIT) is:

- The inclusion of the client’s spouse as a beneficiary of the trust, and

- The authority given to the trustee to make distributions to the client’s spouse even if the client is still living.

The spousal distributions may be defined according to an ascertainable standard or the trust document may give the trustee absolute discretion to make distributions as they see fit. With the inclusion of the Spousal Lifetime Access Trust provisions the trust now contains a fail-safe.

If circumstance call for it, the trustee can make distributions to the client’s spouse. Even if the intent of the trust was for the grantor’s heirs.

If an unforeseen event were to occur requiring the use of the transferred assets, the trustee can make periodic distributions to the client’s spouse as a beneficiary.

This may occur from an unexpected and unplanned catastrophic illness or long-term care event that depletes the couple’s assets. The trustee can make distributions to the client’s spouse to help cover ongoing expenses.

Using Life Insurance in a Spousal Lifetime Access Trust

There are generally three ways to use a Spousal Lifetime Access Trust (SLTA) with life insurance:

- Survivorship Life Policy

- Single Life Policy

- Two SLATs Using Single Life Policies

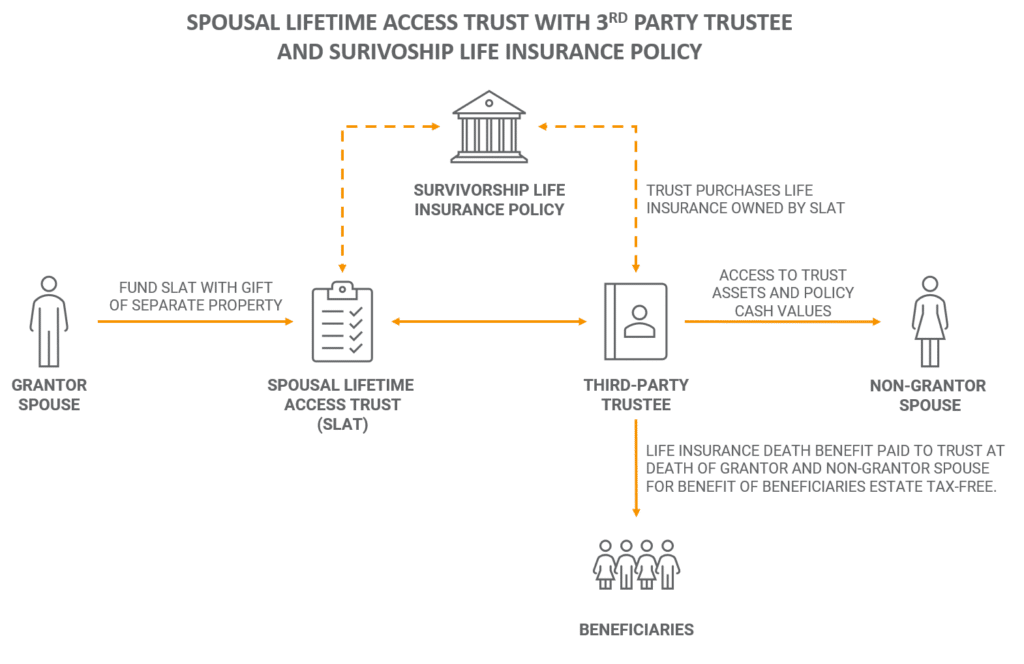

Survivorship Life Insurance Policy

When using a SLAT to fund a survivorship life insurance policy one of the insureds is the grantor of the SLAT and the other non-grantor spouse is the beneficiary of the trust. Under the terms of the trust, the trustee is able to make distributions of both income and principal to the non-grantor spouse beneficiary or other beneficiaries (e.g. children).

At the second death, the SLAT will receive the death benefit income and estate tax-free. The death benefit from the life insurance policy is available for distribution to the SLAT beneficiaries.

Survivorship Life Insurance Considerations

When using a survivorship life insurance policy neither the husband nor wife can be the trustee of the SLAT. The non-spouse beneficiary should not have any rights or powers under terms of the SLAT to avoid any inclusion of the policy death benefit in their estate.

When using a survivorship life insurance policy, the non-grantor spouse CANNOT:

- Be the Grantor

- Be the Trustee

- Make Direct or Indirect Contributions to the SLAT

If the non-grantor spouse dies first the contingent beneficiaries (e.g. typically the children) will have access to trust assets. Effectively disinheriting the grantor spouse.

If the grantor spouse dies first the non-grantor spouse will be unable to make any gifts or transfers to the trust without the death benefit being includable in the estate.

One way to cover the contingency of the grantor spouse dying first would be for the SLAT to own a term life insurance policy insuring the grantor spouse. Or the grantor spouse can make a testamentary bequest to the SLAT for a sum of money to fund future premium payments upon their death.

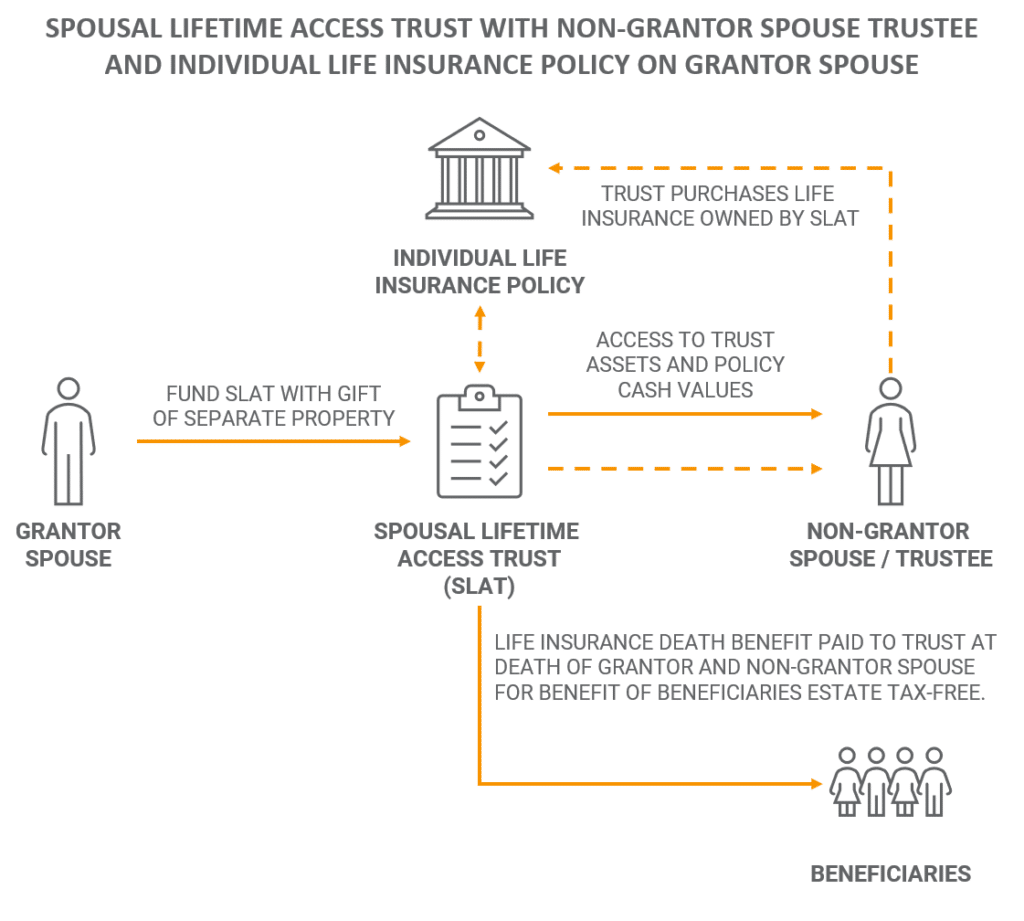

Single Life Insurance Policy

A single-life insurance policy Spousal Lifetime Access Trust is like a survivorship SLAT. The exception is it owns a life insurance policy on one spouse. When using a single life insurance policy only the insured grantor spouse can make contributions to the trust.

The death benefit can provide the uninsured spouse (non-grantor beneficiary) with income protection. They also have indirect access through the trustee to policy cash values via withdrawals and loans.

If the trustee is a third party, the uninsured spouse’s access to the cash value (and other assets) will be subject to the third-party trustee’s discretion as directed by the terms of the trust. If the uninsured spouse is the trustee, their access to policy values will be subject to an ascertainable standard like health, education, maintenance, and support.

When properly structured, at the death of the insured spouse the trust will receive the death benefit income and estate tax-free. This provides the surviving spouse with income protection to maintain their standard of living over their lifetime.

The uninsured non-grantor spouse cannot make contributions to the trust. If they do, they would be considered a grantor with a retained interest for estate tax purposes. Resulting in the value of the trust assets being includable in their estate.

A SLAT funded with a single life policy can be beneficial because the uninsured spouse can be the trustee. However, the uninsured spouse’s access to trust assets must be limited to an ascertainable standard (e.g. health, maintenance, education, or support) for any assets or policy death benefits to be excluded from the estate.

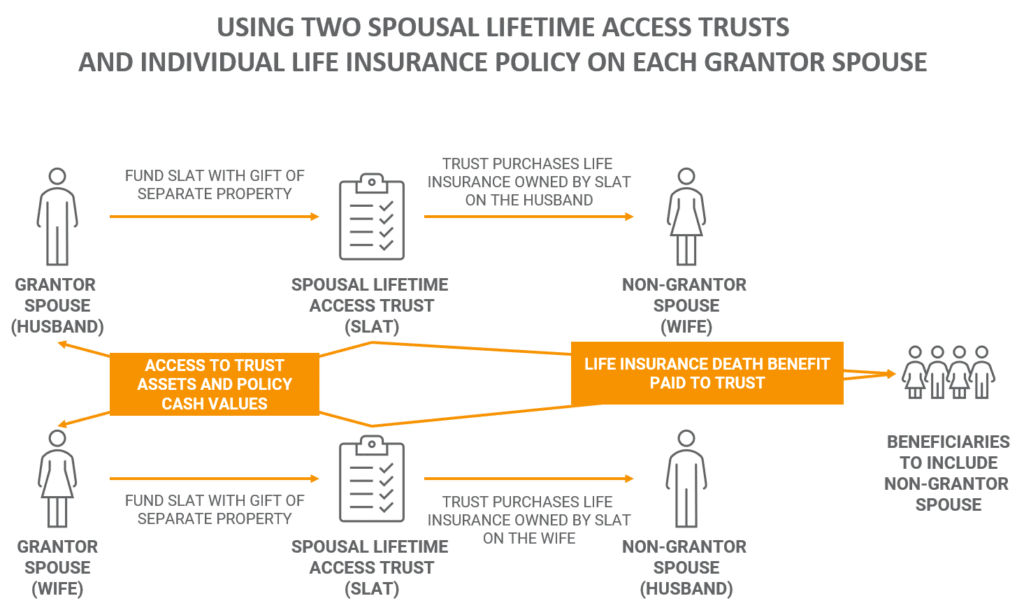

Two Spousal Lifetime Access Trusts Using Single Life Insurance Policies

When creating two Spousal Lifetime Access Trusts each spouse would be the grantor of the non-grantor beneficiaries’ trust. For instance, under the husband’s trust, he would be the grantor and insured. Under the wife’s trust, she would be the grantor and insured. Her husband (non-grantor beneficiary) and children would be the beneficiaries of her trust.

The trusts could be established where the beneficiary spouse is the trustee provided they are comfortable having distributions subject to an ascertainable standard (e.g. health, maintenance, education, or support. Otherwise, they could have an independent, third-party trustee.

When establishing two SLATs it is important for the client’s attorney to understand the Reciprocal Trust Doctrine. The rule comes into play when donors create a reciprocal trust that avoids estate taxes but does not change the economic position of each donor with respect to the property. Failure could result in trust assets being includable in their estate.

Separate Property

For purposes of making gifts to the SLAT, the grantor should contribute separate property rather than joint or community property. Using separate property is necessary in order to exclude trust assets from the non-grantor spouse’s estate for estate tax purposes.

In community property states there should be clear documentation that the grantor is using separate property to fund the trust. A non-grantor spouse cannot make direct or indirect gifts to the SLAT.

What are the Benefits of a Spousal Lifetime Access Trust?

There are several benefits to using a Spousal Lifetime Access Trust. The client (grantor spouse) has made an irrevocable transfer of assets to the trust for the benefit of the beneficiaries. Thereby removing the asset and all appreciation of the asset from their taxable estate.

Despite having made the irrevocable transfer, trust assets remain available for the benefit of the client’s non-grantor spouse, if necessary.

The death benefit of the life insurance policy owned and benefitting in the Spousal Lifetime Access Trust will remain available for the benefit of the trust and its beneficiaries at the death of the insured(s). Death benefits paid to the trust will not be subject to income and estate taxes at the death of the insured(s).

Any withdrawals from the policy by the trustee to make distributions from the SLAT prior to death can reduce the death benefit and could cause the policy to lapse.

As with any trust, the Spousal Lifetime Access Trust should only be used after consulting competent tax and legal counsel. Furthermore, Spousal Lifetime Access Trust must be drafted by a competent attorney who understands the ins and outs of drafting such a trust to meet the goals and objectives of the client.

Key Points to Remember

A Spousal Lifetime Access Trust is for married couples that allows them to:

- Create an Irrevocable Life Insurance Trust (ILIT).

- Provide the non-grantor spouse indirect access to trust assets while maintaining flexibility in planning.

- Keep life insurance death benefit proceeds outside of the estate free from income and estate taxes for beneficiaries.

Conclusion

A Spousal Lifetime Access Trust can be a great solution for married couples who have an estate that will likely be subject to estate tax. A SLAT can provide flexibility for transferring wealth to future generations without worrying about losing access to trust assets.

A Spousal Lifetime Access Trust with permanent life insurance can provide liquidity via the policy death benefit. A properly drafted SLAT will receive the death benefit proceeds income and estate tax-free per IRC 101(a).

DISCLOSURE

TAX ADVICE

Any tax advice contained in this communication is not intended or written to be used, for the purpose of (i) avoiding penalties under the Internal Revenue Code or (ii) promoting, marketing, or recommending to another party any transaction or matter addressed herein.

These materials are not intended to be opinions or advice on legal, tax, accounting, or investment matters. Private counsel should be consulted prior to application of this general information to specific situations.

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Jason Mericle

Founder

Jason Mericle created Mericle & Company to provide families, business owners, and high net worth families access to unbiased life insurance information.

With more than two decades of experience, he has been involved with helping clients with everything from the placement of term life insurance to highly sophisticated and complex income and estate planning strategies utilizing life insurance.

Stay In The Know

Get exclusive tips and practical information to help you create, grow, sustain, and protect your wealth.

Ask Us Anything

We Are Here To Answer Your Questions

Start A Conversation

Schedule a complimentary 30 minute Zoom meeting to learn more about your options.