The Problem With Some Life Insurance Carriers…

Advising individuals, families, and business owners on their existing permanent life insurance coverage continues to be challenging.

In fact, I just hung up the phone after waiting for over an hour to speak with a customer service representative. Between hold times and not always receiving accurate information working with carriers to service clients can be frustrating.

One of the more recent challenges is some carriers (not all) are only illustrating guarantee assumptions – even though policies were originally issued using current assumptions. This may not mean much to you, but it will if you have a current assumption universal life policy and want to receive illustrations assuming current assumptions.

What Does This Mean and Why Should I Care?

Current assumption universal life insurance is a very common policy type. In most cases, premiums are calculated using current assumptions.

With current assumption universal life insurance, you have four elements that control the performance of the policy. They include the following:

- Guaranteed Crediting Rate

- Guaranteed Mortality and Expenses

- Current Crediting Rate

- Current Mortality and Expenses

Guaranteed Crediting Rate

The guaranteed crediting rate is the minimum contractually guaranteed rate the carrier can credit the policy. Many older policies (10+ Years) have a minimum guarantee rate of 4.00%. We are seeing newer policies with minimum guarantee rates of 2.00% and in some cases lower.

Guaranteed Mortality and Expenses

The guaranteed mortality and expenses are the maximum expenses a carrier can charge for coverage. The cost of coverage will increase over time, but carriers are not allowed to increase the cost of coverage beyond the guaranteed mortality and expenses.

Current Crediting Rate

The current crediting rate is what the carrier is currently crediting the policy. The current crediting rate is going to be equal to or greater than the guaranteed crediting rate. If the guaranteed crediting rate is 4-percent and the current crediting rate is 5-percent then the premium is typically calculated using the current crediting rate of 5-percent.

If the current crediting rate goes below the initially projected 5-percent then additional premiums will be required. Failure to increase ongoing premiums will result in the coverage lapsing prior than expected.

Current Mortality and Expenses

The current mortality and expenses are what the carrier is currently charging for coverage. As an example, the guaranteed mortality and expense maybe $1.00 per $1,000 of death benefit. The current mortality and expense maybe $0.70 per $1,000 of death benefit.

In today’s environment, we are seeing more policies with current crediting rates equal to the guaranteed crediting rate. We are also seeing most carriers maintaining their current mortality and expenses at a level below the guaranteed mortality expense rate.

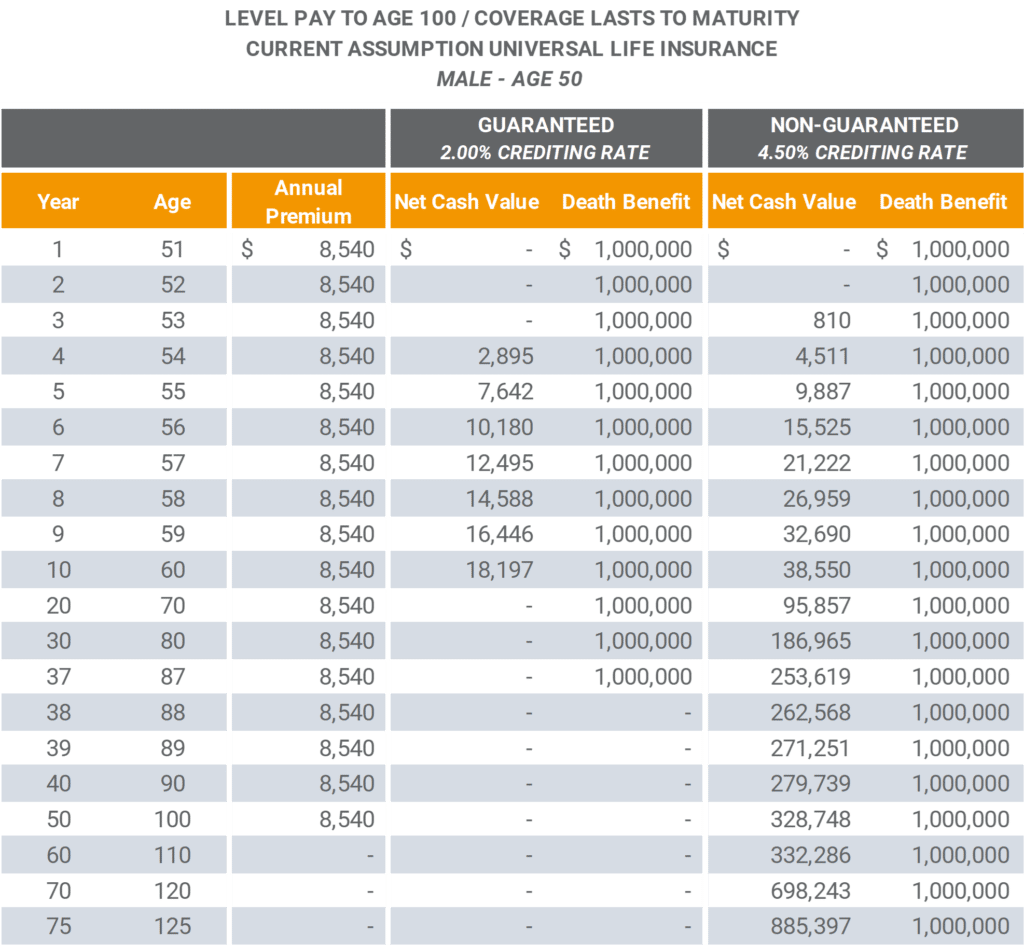

Current Assumption Universal Life Guarantees vs. Non-Guarantees Example

In the following example, you will see two columns labeled Guaranteed 2.00% Crediting Rate and Non-Guaranteed 4.50% Crediting Rate.

The Guaranteed columns assume a minimum guaranteed crediting rate of 2.00% with maximum allowable mortality and expense charges. Conversely, the Non-Guaranteed column assumes the current policy crediting rate of 4.50% and current mortality and expense charges.

The $8,540 annual premium is calculated assuming the current crediting rate and mortality and expense charges. Based on this premium coverage is GUARANTEED to the insured’s Age 88. This means that as long as the $8,540 premium is paid the death benefit is guaranteed to the insured’s Age 88 no matter what.

Under the Non-Guaranteed assumptions, the policy owner is able to stop premium payments at Age 100. From there the coverage lasts to maturity or Age 125 with this policy. Under the current assumptions, there is $253,619 of cash in the policy at the time the guarantees are scheduled to expire.

If current crediting rates and/or mortality and expense charges go down less premium will be required. You can accomplish this by reducing the annual premium or stop making premium payments to Age 100.

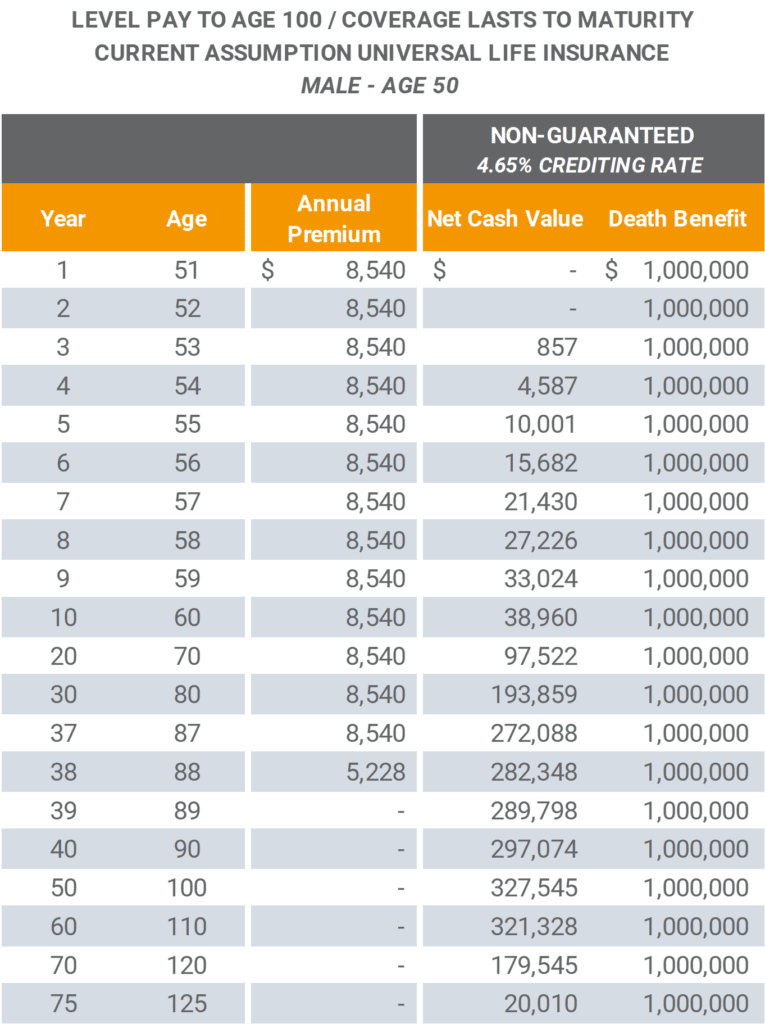

What Happens When Current Crediting Rates Increase?

In the following example, we are using the same $8,540 annual premium, but the crediting rate increases from 4.50-percent to 4.65-percent.

The slight crediting rate increase reduces the number of years premiums are required by approximately 11 ½ years. Conversely, if crediting rates decrease below what was initially projected more premium will be required.

For individuals who own a current assumption universal life insurance policy, it is important to understand how they work. Most permanent universal life insurance policies are based on current assumptions, whether the policy owner is aware of this or not.

Since carriers have the ability to adjust the current crediting rate it is important to do a life insurance policy review on an annual or bi-annual basis. This will allow the policy owner to make any necessary changes without any surprises.

What’s the Problem with Life Insurance Carriers Only Illustrating Guaranteed Assumptions?

Now that you have a better understanding of how current assumption universal life insurance works, we can have a conversation about the changes a few carriers have made with their in-force illustrations.

Specifically, carriers are illustrating current assumption policies using only guaranteed assumptions.

Think about this for a minute. You purchased a policy 20-years ago. You’ve paid thousands or millions of dollars to the carrier in order to have the death benefit.

Now you or your advisor requests an in-force illustration from the carrier. When you receive the illustration, it only shows the guaranteed assumptions even though the policy was issued based on current assumptions.

Since the illustration is using guaranteed assumptions, it is likely going to show the policy lapsing well before Age 100. If you are old enough it will probably show the policy lapsing within the next year.

A Real-Life Example

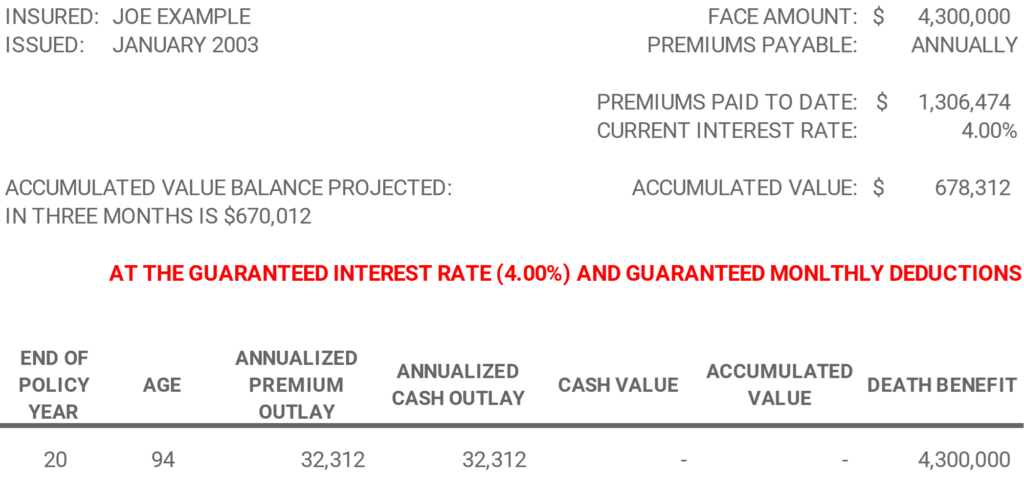

The following is a real-life example. We have removed any carrier or client-specific information, but the following is based on actual data received from one of these carriers.

For background purposes, this policy was acquired 20-years ago when the insured was 74-years old. It was purchased for estate planning purposes by his irrevocable life insurance trust.

When issued the $32,312 annual premium was sufficient to carry the policy to Age 113 based on current assumptions. In fairness, a lot has happened since the policy was issued. The crediting rate was initially projected at 6.25-percent. It has now been reduced to the guaranteed crediting rate of 4.00-percent.

So, additional premiums would have been required for the coverage to last to Age 100. Unfortunately, now we don’t know what the actual number is because the carrier will only give us the amount for the guaranteed premium.

According to this illustration, the policy will lapse at the end of policy year 20 if the owner makes the $32,312 annual premium. Again, these are based on guaranteed assumptions. However, you will notice the accumulation value is $676,878.

The current mortality and expense charges are approximately $14,000 per month and are increasing by approximately 11-percent each year as Joe gets older.

If the policy charges are $14,000 per month, then that would be $168,000 of charges in year 20. Assuming no additional premiums are paid and the cash value does not receive a credit, Joe would have $510,878 of cash value in the policy at the end of the year.

Under current assumptions, the policy would remain in force for a few more years without any additional premiums.

So why are carriers not illustrating current assumptions?

Good question.

They should not be allowed to do this. It puts the policy owner and advisor in a very difficult situation. Not being able to project how the policy will perform under the current assumptions makes it impossible to predict future policy performance.

The results could be financially devastating to the policy owner and their family. Especially when they are in their 90s and unable to obtain new coverage.

Eliminating current assumption projections is a way for the carrier to scare the policy owner. Forcing them to decide to surrender the coverage they have paid a lot of money into or increase premiums according to the policy guarantees.

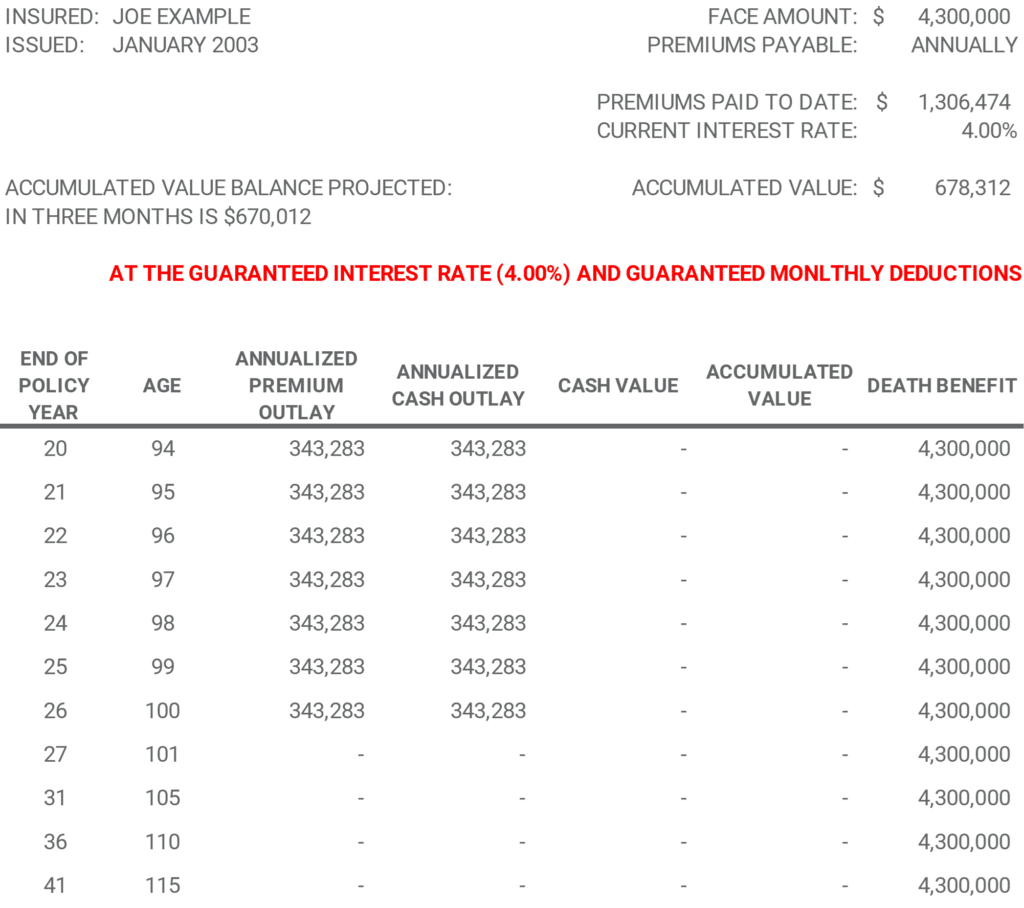

In this case, the carrier is asking for the policy owner to increase the $32,312 annual premium to $343,283 per year. They are doing this knowing there will be more than $500,000 of cash value in the policy at the end of the year.

If you or someone you know is facing this situation the first step is to speak with an advisor who understands what is going on. They can help advise you on the appropriate steps for your coverage.

In some cases, there may not be as much cash value. This may create a problem where the policy owner is actually forced to increase premiums.

The course of action recommended for Joe is to continue to make the annual premium and monitor the coverage and his health on an annual basis.

The goal of any permanent life insurance policy is to pass away by paying the least amount for coverage with as little cash value in the policy as possible.

The information contained in this article is hypothetical. Results and performance will vary based on a number of factors. Consult with a licensed professional to learn more.

Jason Mericle

Founder

Jason Mericle created Mericle & Company to provide families, business owners, and high net worth families access to unbiased life insurance information.

With more than two decades of experience, he has been involved with helping clients with everything from the placement of term life insurance to highly sophisticated and complex income and estate planning strategies utilizing life insurance.

Stay In The Know

Get exclusive tips and practical information to help you create, grow, sustain, and protect your wealth.

Ask Us Anything

We Are Here To Answer Your Questions

Start A Conversation

Schedule a complimentary 30 minute Zoom meeting to learn more about your options.