The Flexibility and Benefits of Universal Life Insurance

Universal Life Insurance is the least expensive and most flexible form of permanent life insurance.

Like most permanent life insurance policies, universal life insurance consists of three components:

- Premium

- Cash Value

- Death Benefit

Universal life insurance allows policy owners to pay minimum premiums to cover the cost of insurance. Policy owners can also make additional premium payments towards cash value accumulation. The cash value accumulation can then be used to offset premiums in future years.

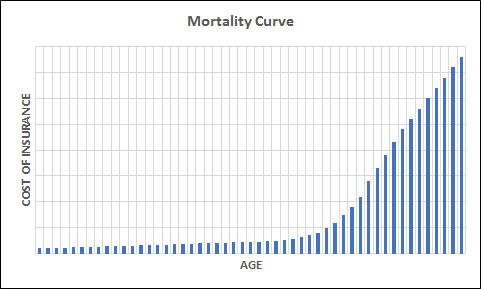

Understanding Cost of Insurance

The cost of insurance for a universal life insurance policy is based on the insureds age, health class, and death benefit. The cost of insurance increases incrementally each year based on your age.

For instance, assuming the same health class and death benefit, the cost of insurance for an 85-year old is going to be much greater than it is on a 50-year old.

This can be easily demonstrated with the following hypothetical Mortality Curve.

The above mortality curve is only an example. It should not be relied upon for current or future premiums into an existing policy. This was created for demonstration purposes only.

The mortality curve illustrates what the cost of insurance is at different ages. This represents the minimum amount of premium the policy owner would need to pay to maintain the coverage.

Now, you may look at this and think it gets really expensive the older you get. This would be accurate if you were ONLY making minimum premiums each year.

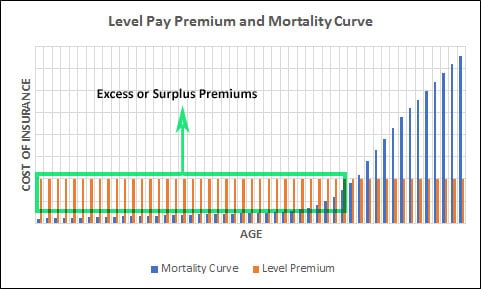

Most people choose to not make minimum premium payments into their universal life insurance policies – at least not in the early years. By doing this, a reserve or surplus is created in the policy in the form of cash surrender value.

The cash surrender value is then used to offset the increased cost of insurance as you get older.

To demonstrate, let’s assume the policy owner is interested in making premium payments every year for the rest of their life.

As you can see, the above chart illustrates the mortality curve and yearly premium payment. In the early years, the policy owner is paying more than the minimum cost of insurance. The premium paid in excess of the cost of insurance becomes a part of the policy cash value.

At any time, the policy owner can access the cash surrender value of the policy. This can be in the form of a withdrawal or policy loan. If the policy owner decides to surrender or get rid of the coverage they would receive the cash surrender value.

Based on ongoing premium payments and policy assumptions, the cash value should continue to grow until the minimum cost of insurance exceeds the annual premium.

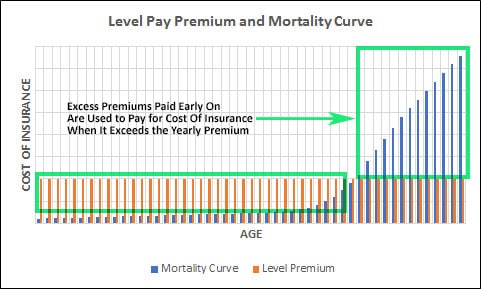

In later years, when the cost of insurance exceeds the yearly premium payment, the insurance company will access the policy cash values to cover the shortfall.

By taking this approach policy owners can keep the cost of having permanent universal life insurance coverage affordable.

The Flexibility of Universal Life Insurace

Because universal life insurance is so flexible it makes it easy to make changes.

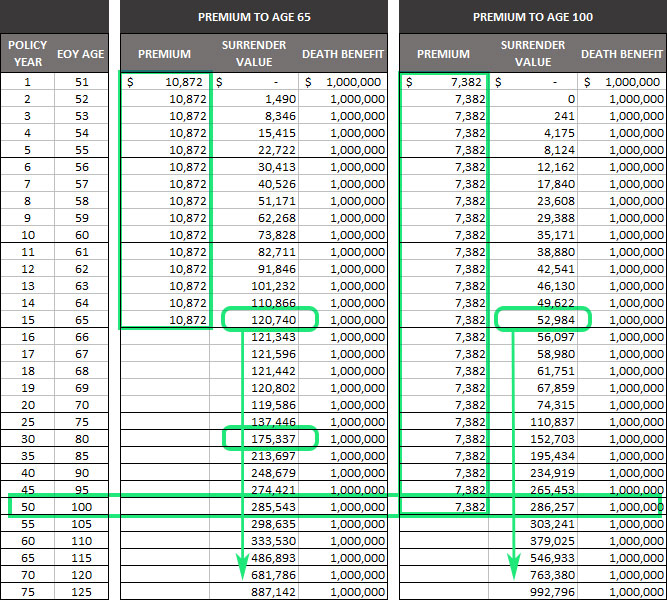

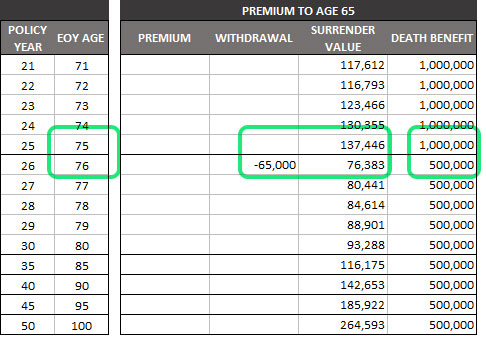

Take the case of a 50-year old male who wants $1 million of coverage. Based on this information we can analyze different ways to make premium payments. For this example, we’ll look at two approaches:

- Paying premiums until he turns Age 100, and

- Paying premiums until he turns Age 65

In addition, we’re going to use what we refer to as a current assumption universal life insurance policy (we’ll discuss the different types of universal life insurance later).

Please note these are hypothetical examples. Individual results will be different. The following is for informational purposes only.

By making premium payments to Age 65 (or overpaying for coverage early on) the policy has a projected cash surrender value of $120,740. This is enough cash value for the policy to last until the insured turns 125.

Alternatively, paying premiums every year to Age 100 results in a cash value of $52,984 at Age 65. This makes sense since we’ve paid less into the policy, and a larger percentage of the premium is being used to pay the cost of insurance. The result is less surplus premium going to the policy cash value.

If the policy owner decides to surrender or get rid of the coverage, they would receive the cash surrender value. In the Pay to Age 65 example, the policy owners would have paid $163,080 in total premium. If the policy is surrendered at Age 80 the policy owner would receive $175,337. They would have also had $1 million of coverage for 30-years.

At Age 100 the policy cash surrender values in both scenarios is almost the same at $285,543 versus $286,257.

Now, to further demonstrate the flexibility of universal life insurance, let’s assume the policy owner who made Premium Payments to Age 65 decides at age 75 they don’t need $1 million of coverage. Instead, they’d like to reduce the coverage to $500,000.

It wouldn’t make sense for the policy owner to do this since they’ve already paid for $1 million of protection.

But, by working with the insurance company, we can calculate a withdrawal of $65,000 to the policy owner. The withdrawal is tax-free as a return of basis and happens when the death benefit is reduced to $500,000.

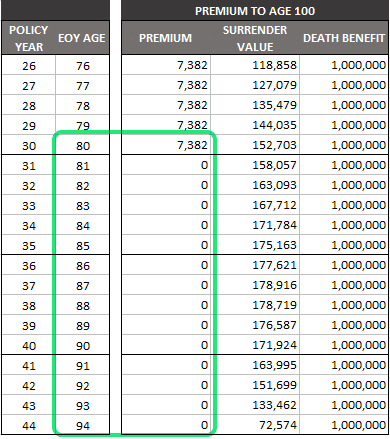

To further illustrate the flexibility of universal life insurance let’s look at one more example.

This time let’s assume the policy owner who is expected to make premium payments to Age 100 goes to the doctor and learns he only has a short time to live. At the time of the diagnosis he is age 80.

Based on this new information we know he won’t need the coverage to last to his Age 100. Instead, he may only need it to last a few more years.

Any premium payments made to the insurance company for this coverage is only to the benefit of the insurance company.

By doing a quick analysis we can calculate that if he stops making premium payments at Age 80 the coverage will still last until he turns Age 94.

This is extremely advantageous. There is nothing the insurance company can do about it.

These are just a couple of examples of how flexible universal life insurance can be. There are many, many more scenarios that can exist.

- You can make changes to the premium payment frequency

- Size of premium payments

- Not make premium payments

If the policy has cash value you have options.

Types of Universal Life Insurance

So far, we’ve discussed the cost of insurance and flexibility. But, there are also different types of universal life insurance policies. The main difference between the different policy types is how the cash value of the policy is credited.

The different types of universal life insurance policies include:

- Current Assumption or Flexible Premium Universal Life

- Fixed Premium or No Lapse Guaranteed Life Insurance

- Indexed Universal Life

- Variable Universal Life

Current Assumption or Flexible Premium Universal Life Insurance

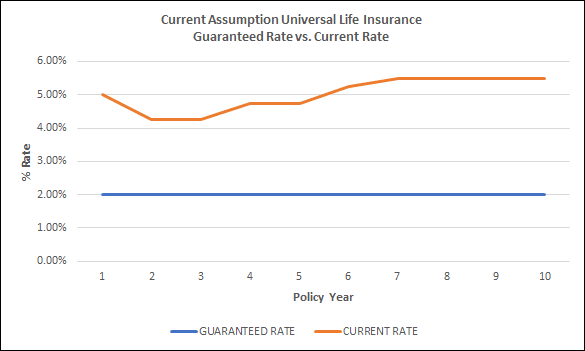

Current assumption universal life insurance is the type of policy we used in our previous examples. In addition to the uniqueness of the flexibility of the product, is how the cash value is credited.

A current assumption universal life insurance policy has a guaranteed and current crediting rate. The guaranteed rate is the minimum amount an insurance company will credit a policy on a year-to-year basis.

The guaranteed rate is usually somewhere between 2% and 4%. Most newer policies tend to be closer to 2%. This rate is the minimum crediting rate an insurance company is legally required to credit a universal life insurance policy regardless of economic conditions.

The current rate is the rate the insurance company is currently crediting the policy. This rate is usually higher than the guaranteed rate. For instance, you may have a universal life policy with a 2-percent guaranteed rate with a current crediting rate of 5-percent.

Current assumption universal life insurance is the most conservative and flexible type of permanent life insurance available.

Fixed Premium or No Lapse Guaranteed Universal Life Insurance

No lapse guaranteed universal life insurance is different than current assumption universal life insurance. This type of policy offers very little, if any, cash value. What it does do is guarantee the coverage.

This means that if you make premium payments on time the coverage is guaranteed. It works a lot like a term insurance policy that lasts to age 100. The benefit of this type of policy is the premiums can be slightly less expensive than a current assumption universal life insurance policy. But, you tend to lose most of the flexibility available through other types of universal life insurance policies.

Indexed Universal Life Insurance

Indexed universal life insurance offers many of the same benefits as current assumption universal life. The main difference is how the policy cash value is credited.

The cash value of an indexed universal life insurance policy is credited based on the performance of the chosen index. Different policies offer different indexes. The most common is the S&P 500.

If the chosen index performs positively the policy is credited appropriately. What makes this type of policy unique is it still offers a guaranteed rate of at least 0-percent. In years where the chosen index performs negatively, the policy owner is still guaranteed a crediting rate of at least zero.

Because the insurance company is guaranteeing a crediting rate they will often place cap rates or participation rates on what the policy is credited when the performance of the chosen index is positive.

A cap rate simply places a maximum limit on what the cash value is credited when the chosen index performs positively. For instance, if a policy has an 8-percent cap rate and the index grows by 10-percent, the policy will be credited 8-percent. If the index grows by 6-percent, the policy will be credited 6-percent.

A participation rate is the percentage of the chosen indices growth the policy cash value will be credited. For instance, if a policy has an 80-percent participation rate and the index grows by 10-percent, the policy will be credited 8-percent (10% growth times 80% participation rate). If the index grows by 6-percent, the policy will be credited 4.8-percent.

Each indexed universal life insurance policy has a number of unique features and benefits. If you’re interested in this type of policy, we would recommend scheduling a complimentary consultation.

You can also learn more by visiting our Guide to Indexed Universal Life Insurance.

Variable Universal Life Insurance

Variable universal life insurance policies allow the policy owner to participate in the market through subaccounts. Variable simply means the performance of the policy cash value is tied to market returns.

Subaccounts are comprised of different mutual funds. A policy owner can choose what subaccounts they would like to invest in. The cash value will change daily based on the chosen subaccounts.

In addition to the subaccounts, policy owners still have the option to place the cash value in the fixed account. By placing all the cash value in the fixed account, the policy will perform like a current assumption UL policy.

Variable life insurance is the riskiest of all permanent life insurance policies.

Final Thoughts on Universal Life Insurance

Universal life insurance is an affordable and flexible way to secure needed permanent life insurance coverage. When evaluating your life insurance planning needs it is important to understand how and why a specific universal life insurance policy is applicable to your specific needs.

It is important to work with someone who has the knowledge and experience to understand what those needs are and identify what type of policy is best suited for your specific situation.

Jason Mericle

Founder

Jason Mericle created Mericle & Company to provide families, business owners, and high net worth families access to unbiased life insurance information.

With more than two decades of experience, he has been involved with helping clients with everything from the placement of term life insurance to highly sophisticated and complex income and estate planning strategies utilizing life insurance.

Stay In The Know

Get exclusive tips and practical information to help you create, grow, sustain, and protect your wealth.

Ask Us Anything

We Are Here To Answer Your Questions

Start A Conversation

Schedule a complimentary 30 minute Zoom meeting to learn more about your options.