[Case Study] How Crediting Rates Can Adversely Impact Life Insurance Policy Performance

In 2008, Michael sold his successful manufacturing company at the age of 52. As a result of the sale, Michael was able to retire and enjoy the finer things in life.

At the same time, Michael’s estate planning attorney recommended he acquire a $1.5M life insurance policy. The coverage is to help provide liquidity for purposes of transferring his estate to his 3 children.

He applied for a current assumption universal life insurance policy. He was able to obtain a Preferred Plus health class with a $19,161 annual premium.

Michael accepted the policy. He named his irrevocable life insurance trust as the owner and beneficiary of the policy.

When we met Michael in 2021 the $1.5M policy assumptions had changed and needed a review.

Michael engaged us to complete a policy review, analysis, and make recommendations.

We initially requested two things from the insurance carrier:

- A copy of the original illustration issued with the policy, and

- A current illustration based on using the original policy premium

Based on this information we were able to make specific recommendations to Michael to ensure his goals and objectives are met.

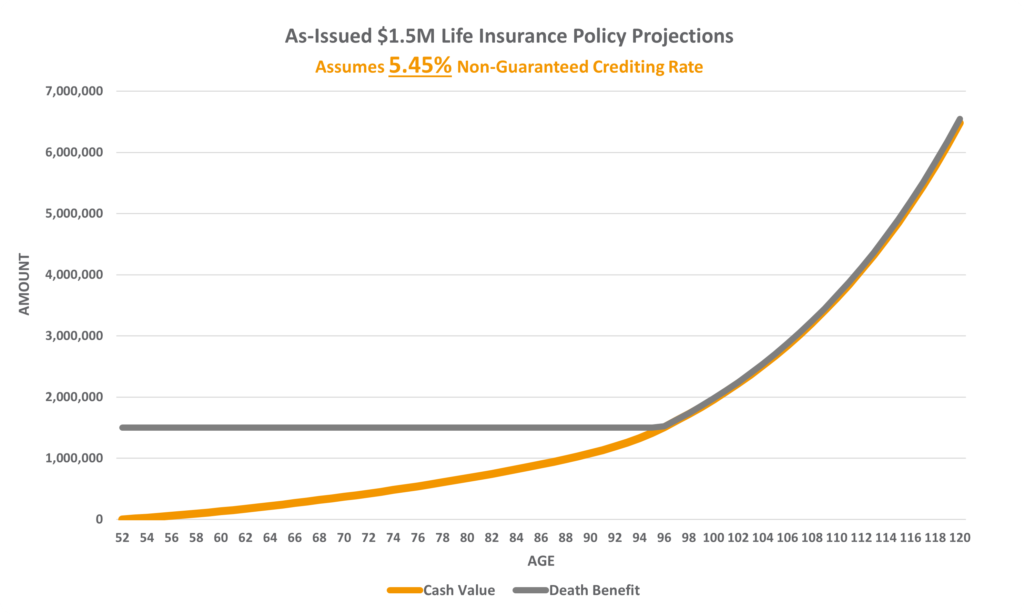

Original Policy Projections

- Assumed a credit to the policy cash value of 5.45% for the life of the policy.

- At age 96 the death benefit would start to increase based on the projected cash value exceeding the $1.5M death benefit.

- The projected cash value was almost $2M at the insured’s Age 100.

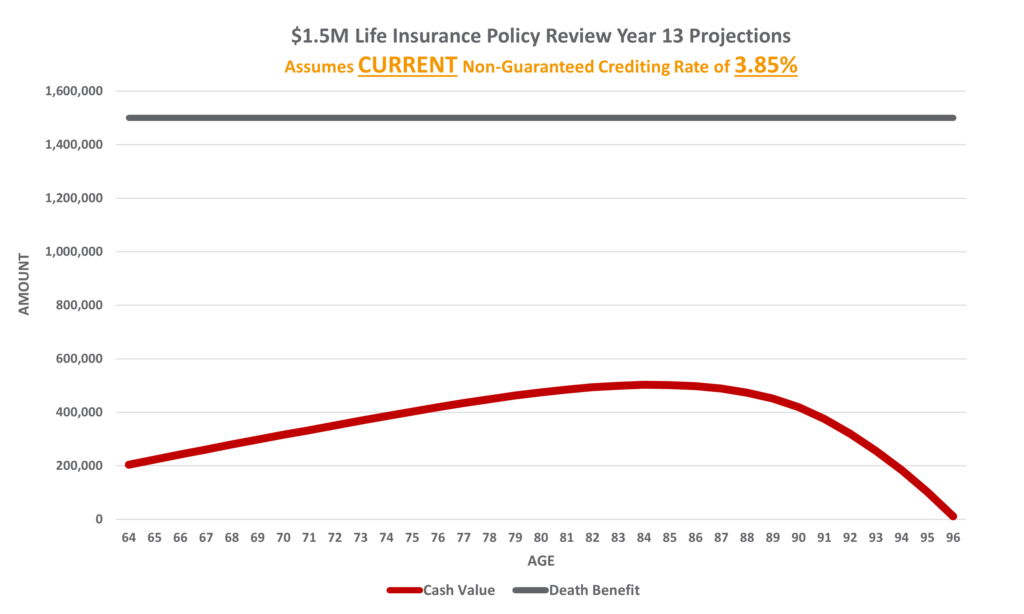

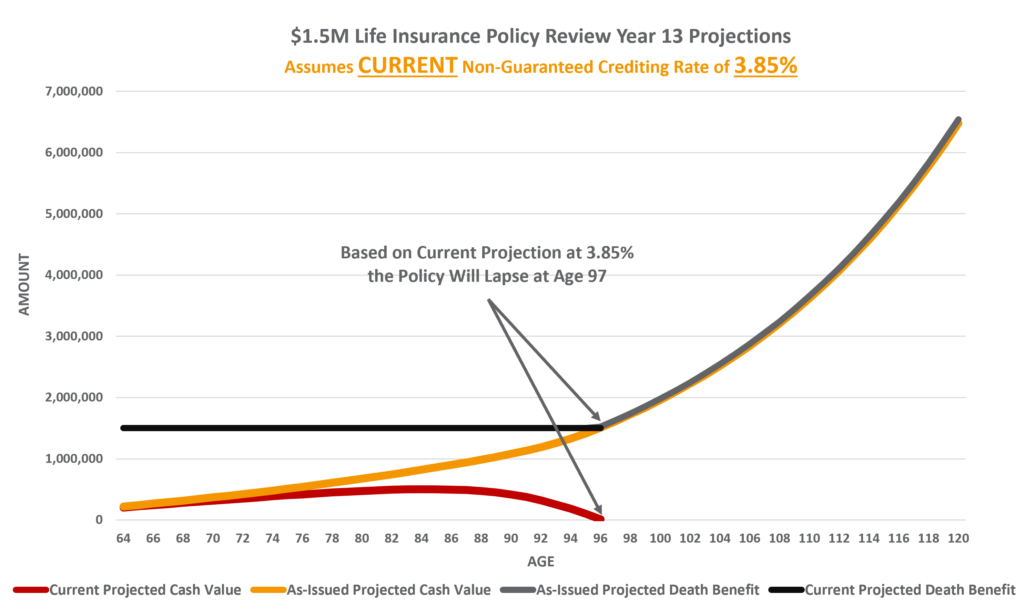

Current Projections – Universal Life Insurance Policy Review

- The current crediting rate declined from 5.45% to 3.85% adversely affecting the projected policy cash values.

- Instead of an increasing death benefit at age 96 – the policy will lapse at the insured’s age 97 based on current projections.

The Reality

- The current $19,191 annual premium in combination with the 3.85% current crediting rate result in the policy lapsing at the insured’s age 97.

- For the policy to last to the insured’s age 100 based on current projections the policy owner would need to (a) increase the annual premium, or (b) reduce the death benefit.

Life Insurance Policy Recommendations

1 – Wait And See

While the policy is not performing as it was originally projected, it is still in decent shape. Since we were able to identify the shortfall early on it gave Michael the time to make decisions about the policy without any major financial impact today.

2 – Increase the Annual Premium Payment

Increasing the annual premium from $19,161 per year to $20,672 would allow the coverage to last to Michael’s age 100 based on the current assumptions today.

If the policy owner was to wait another 10-years to increase the premium it is likely the annual premium at that time would range from $30,000 or $40,000.

3 – 1035 Exchange to a Less Costly Policy

Policy Option #1

We recommended a policy like the one he has, but from a different carrier. This resulted in a reduction in premiums to maintain the coverage to Age 100 from the proposed $20,672 to $15,527 per year based on current assumptions ($5,000+ annual savings).

The new policy also provides a guaranteed death benefit through Michael’s Age 91. His current policy offers guarantees through Age 70. The new coverage would also continue to last to Michael’s Age 125 based on current assumptions.

Policy Option #2

A No Lapse Guarantee Universal Life policy is a policy that has contractual guarantees. The carrier must pay the death benefit regardless of the policy crediting rate provided the insurance carrier receives the required premiums on time.

By doing this the annual premium would increase from the projected $20,672 to $21,172 per year ($500 annual increase). This option guarantees the premium and the death benefit for the rest of Michael’s life and removes any risk of future declines to the carrier’s current crediting rate.

Lastly, in Policy Year 25 Michael can exercise an option to receive back all the premiums he paid into the policy. He would no longer have life insurance coverage but would recoup the entire cost of the policy.

Conclusion

Life insurance carriers across the board continue to reduce current crediting and dividend rates. The impact of this on many individual policies has the potential to be catastrophic for the policy owners and beneficiaries.

If you own a permanent life insurance policy that has not been reviewed in the past 5-year you should consider a universal life insurance policy review.

The above information above is for informational purposes. It should not be relied upon for individual planning purposes. It was written to support the marketing transactions or topics discussed.

Jason Mericle

Founder

Jason Mericle created Mericle & Company to provide families, business owners, and high net worth families access to unbiased life insurance information.

With more than two decades of experience, he has been involved with helping clients with everything from the placement of term life insurance to highly sophisticated and complex income and estate planning strategies utilizing life insurance.

Stay In The Know

Get exclusive tips and practical information to help you create, grow, sustain, and protect your wealth.

Ask Us Anything

We Are Here To Answer Your Questions