What is a Term Life Insurance Conversion?

A term life insurance conversion allows a policy owner to convert their existing term insurance to a permanent life insurance policy.

Term life insurance is the most common form of life insurance individuals own. It is useful for providing family protection, buy-sell agreements, or key man insurance.

Term life insurance offers protection for a predetermined period of time (or term). Term life insurance is most commonly available for 10, 15, 20, 25, or 30-year terms. The longer the term, the higher the premium.

Prior to purchasing a term life insurance policy, the policy owner makes the decision as to how they want the coverage to last. If a 10-year term life insurance policy is chosen the premium and death benefit will be guaranteed for the entire 10-year period. If there is a need for coverage beyond year 10 the insured will need to apply for new coverage or convert the existing policy prior to the end of Year 10.

Term Life Insurance Example

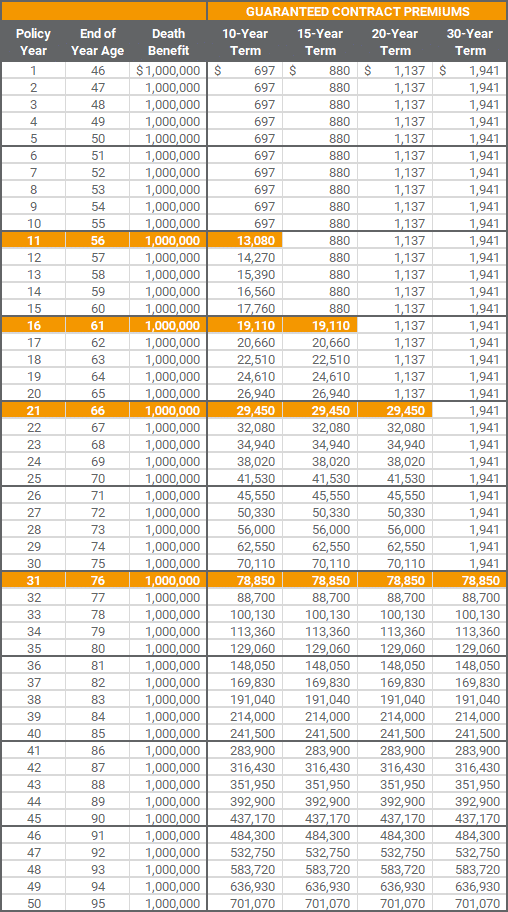

The following assumes a 45-year old female with a preferred nonsmoker health class rating. She is considering term life insurance to replace her income if something were to happen to her.

In this example, we are evaluating 10, 15, 20, and 30-year term life insurance options. In the year the term period expires premiums start to increase on an annual basis. Term life insurance only guarantees the premium for the term of the policy.

If you want to keep the policy beyond the term, you will need to pay the increased premium. Premiums will continue to increase each year on the policy anniversary once the term has expired.

The option to continue a term life insurance policy beyond the guaranteed term period typically does not make sense. However, if there has been a change with the insured’s health, continuing the coverage beyond the term period can make a lot of sense.

In most cases, if a need for coverage exists beyond the term period it makes the most sense to apply for new coverage. The new coverage can be a new term and/or permanent life insurance policy.

Term Life Insurance Conversion

Most term life insurance policies will allow the policy owner to do a term life insurance conversion. A term life insurance conversion allows the policy owner to convert their existing term coverage to a new permanent life insurance policy.

The conversion can only be done using the same carrier who initially issued the term life insurance policy. For example, if the term insurance is through Carrier A, you can only convert it to a permanent policy from Carrier A.

The biggest benefit of a term life insurance conversion is there is no medical underwriting. The permanent life insurance policy is issued based on the underwriting health class obtained when the policy was issued. This can be a great benefit.

Think about it for a minute. Assuming the original coverage was issued when you were 45-years old and you were in great health. Now, you’re 62-years old and you have a 17-year old 20-year term policy. Since acquiring the coverage there have been changes to your health.

Those changes may lower your health class or prevent you from being able to obtain new coverage. When you do a term life insurance conversion the new permanent policy is based on your health class when you were 45-years old.

When the term life insurance conversion occurs the premium for the permanent policy are based on the original health class and current age. The longer you wait to do the conversion, the higher the premium will be.

Term Life Insurance Conversion Period

The option to do a term life conversion is generally available during the guaranteed term period or prior to a certain age, whichever occurs first. As an example, if you purchase a 20-year term policy at Age 50 and it is convertible to Age 65, you will only be able to convert the coverage in the first 15-years of the policy.

Conversely, you may have a 20-year policy that only allows you to convert it in the first 10-years. It is important to review your term insurance coverage in order to identify the expiration date of the conversion.

Each policy will specify the age you can convert up to. The age will vary by carrier and even product. The most common maximum conversion ages are 65,70, or 75. We prefer term policies with an Age 75 maximum conversion age for obvious reasons.

How Much Coverage Can I Convert?

The policy owner can convert all or a portion of the existing term life insurance coverage. For instance, if you have a $1 million term life insurance policy, you can convert up to a maximum of $1 million.

There is not a requirement to convert all of the coverage. You can convert any amount less than the policy face amount. If you have a $3 million policy and only want to convert $1 million, you can.

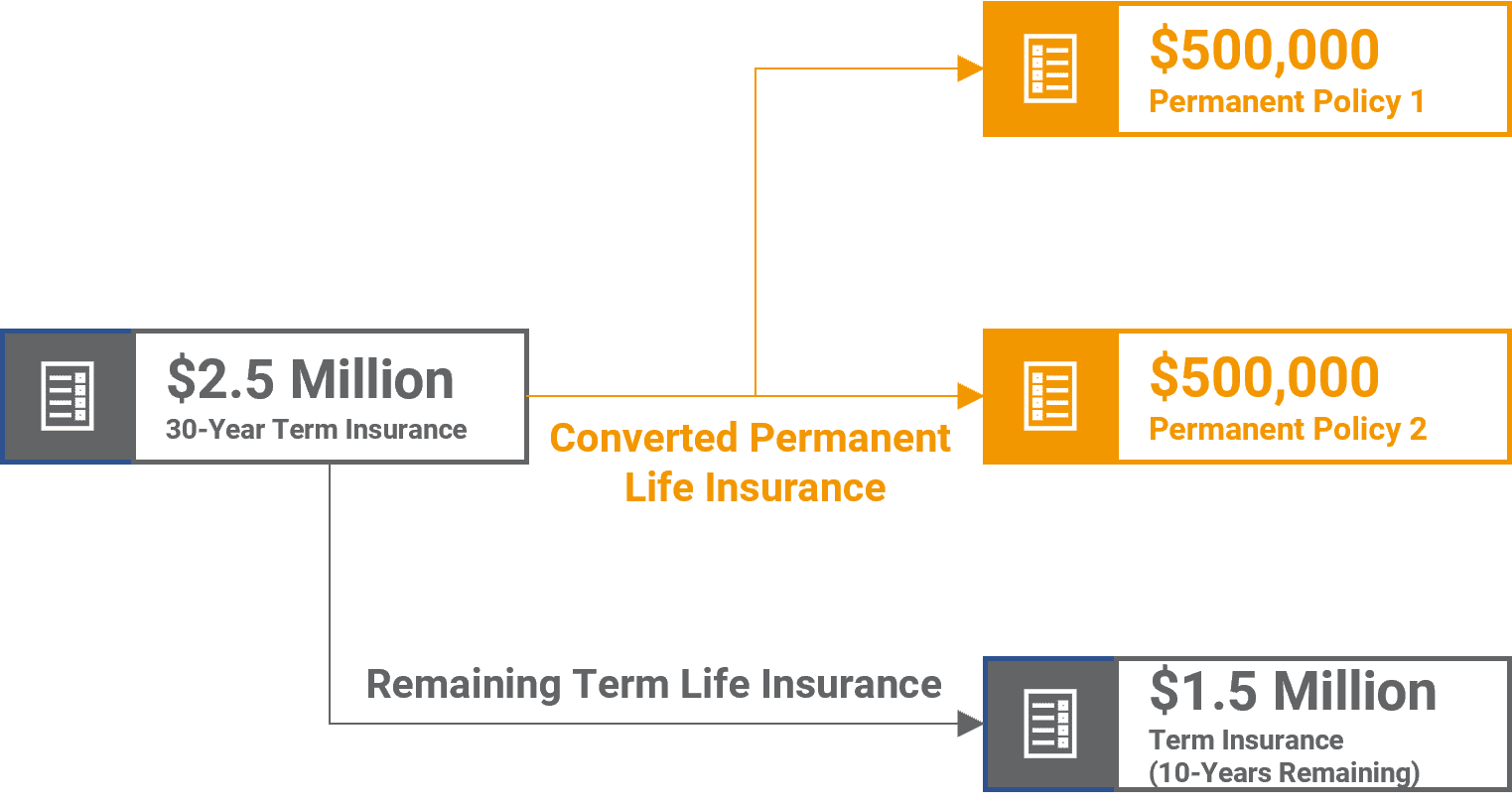

For instance, using our prior example, we have a 45-year old female who purchased a 30-year term life policy with a $2.5 million death benefit. Let’s call her Janine.

Janine is now 64-years old and loses her term life insurance conversion option when she turns 65.

Janine has 2 children and wants to provide them each with $500,000 when she passes away. There is still a temporary need for $1.5 million of coverage.

The temporary need will help make sure her spouse is able to maintain their standard of living if she passes away prior to retirement.

Janine evaluates her term life insurance conversion options. She makes the decision to convert a total of $1 million of coverage to permanent life insurance.

However, she wants to convert the $1 million of coverage to two $500,000 policies – one for each child. She then submits two-term conversion forms to the issuing term life insurance carrier for $500,000 each.

Janine then provides the insurance carrier with instructions that she would like to keep the remaining $1.5 million of term insurance coverage until it expires 10-years from now.

The insurance carrier then adjusts the premium of the original term life insurance policy to correspond with the death benefit reduction from $2.5 million to $1.5 million.

Term Life Insurance Conversion Considerations

Term life insurance is the simplest form of life insurance. If you have or are considering term life insurance there are a few things to keep in mind.

The first is the financial strength of the carrier issuing the policy. There are several rating agencies that provide information on an insurance company’s financial strength. Rating agencies include Standard & Poor’s, Moody’s, Fitch, and A.M. Best to name a few.

It is important to assess the financial strength of the issuing carrier prior to making your final decision.

There are a number of financially strong carriers who offer inexpensive term life insurance policies.

The second consideration is the maximum age at which you can convert the term policy. This was discussed earlier. We like policies that have a maximum conversion age of 75. If a policy was available with a later conversion age it would make sense to consider it.

Whether you have an existing term life policy or are considering one, you should contact the carrier or agent to find out what is the maximum conversion age.

The last consideration is the competitiveness of the carrier’s permanent life insurance policies. Most people overlook this.

Having a term life insurance conversion is great, but what if the permanent policies you can convert to are not any good?

It defeats the point of doing a conversion. We’ll discuss this more in the next section.

Term Life Insurance Conversion Permanent Policy Options

There are certain life insurance companies that are simply interested in issuing term life insurance policies that do not offer a term life conversion option. The cost of these policies may be less expensive than some of their competitors, but it is typically not by much.

Other carriers may offer a term life insurance conversion option, but limit what permanent policies you can convert to. Life insurance carriers who do this do so deliberately.

They will limit the term life insurance conversion to a single product within their portfolio. When they do this, the permanent policy tends to be incredibly overpriced relative to the market and other products.

Carriers do this to reduce their risk. Since the conversion is based on the health class received when the original term policy was issued, they have no idea what your health is like when the conversion occurs.

These carriers disincentivize term life insurance policy owners from converting their coverage by making it cost-prohibitive to do so.

Lastly, there are a number of carriers that do not offer competitively priced term life insurance coverage. They also make available their entire permanent product portfolios for term life insurance conversion. This creates a great opportunity for an individual considering term life insurance but may have a need or desire for permanent coverage in the future.

Now for the disclosure. A carrier may allow for a term life insurance conversion to their entire product portfolio today. They may have the ability to change this in the future. What this means is a carrier may make the decision in the future to limit the permanent policy you can convert to.

In addition, we do not know what a carrier’s pricing on their permanent policies may be in the future. They may be very competitive today from a pricing perspective, but may not be competitive at the time you want to convert your coverage.

Final Thoughts

Term life insurance offers great life insurance protection at a low cost over a specific period of time. Good term life insurance policies will give you the option to convert your term policy to permanent life insurance coverage.

We recommend you work with a life insurance advisor to help you with the term life conversion process. In order to complete a term conversion, the policy owner will need to provide the carrier with the term conversion paperwork. A life insurance advisor can help facilitate this process.

If the insured is in good health, you should also consider reviewing other permanent life insurance options prior to the conversion. There may be better products available that the one you may be considering converting to.

If you are considering a term life insurance conversion and have an interest in learning more about your options we are happy to assist you with this process. Simply click this link to schedule a call.

DISCLOSURE

TAX ADVICE

Any tax advice contained in this communication is not intended or written to be used, for the purpose of (i) avoiding penalties under the Internal Revenue Code or (ii) promoting, marketing, or recommending to another party any transaction or matter addressed herein.

These materials are not intended to be opinions or advice on legal, tax, accounting, or investment matters. Private counsel should be consulted prior to application of this general information to specific situations.

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable. We cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

The information in this post is hypothetical. Values shown are not guaranteed and will vary from product to product. Assumptions are subject to change by the carrier. Actual results may be more or less favorable.

Jason Mericle

Founder

Jason Mericle created Mericle & Company to provide families, business owners, and high net worth families access to unbiased life insurance information.

With more than two decades of experience, he has been involved with helping clients with everything from the placement of term life insurance to highly sophisticated and complex income and estate planning strategies utilizing life insurance.

Stay In The Know

Get exclusive tips and practical information to help you create, grow, sustain, and protect your wealth.

Ask Us Anything

We Are Here To Answer Your Questions