2018 Whole Life Insurance Dividend Rate Annoucements

It is that time of year when insurance companies announce their 2018 whole life insurance dividend rate and payout for the upcoming year.

This year’s announcement is trending with continued declines in declared dividend rates for most companies. Some companies have made it easy to learn what the dividend rate will be for the upcoming year. Others, prefer to hide the information or just not publish it at all.

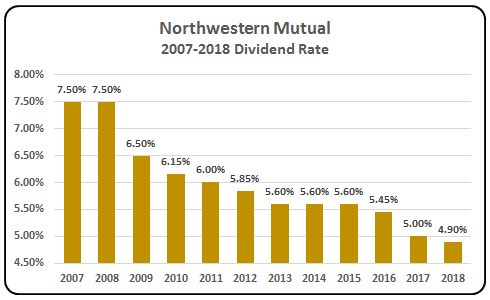

Northwestern Mutual

On October 25th Northwestern Mutual made its 2018 dividend announcement. The announcement estimates $5.3 billion of dividends will be paid throughout 2018. Dividends are paid to policy owners who own whole life insurance, disability insurance and some annuity products.

The total dividend payout is projected to be the most paid out by any insurance company. What the press release fails to point out is Northwestern Mutual has reduced its dividend payout rate once again. After the large reduction last year from 5.45% to 5.00% it would appear the dividend interest rate continues to decline.

It is projected in 2018, the Northwestern Mutual dividend payout rate will drop from 5.00% to 4.90%. While the reduction seems relatively small, it is a reduction of 55 basis points over the last two years.

Northwestern Mutual failed to include any information about the rate reduction in the press release. Choosing to focus on the large payout instead. In fact, it was only when we looked at their website focused on “How We Determine Dividends” did we discover any mention of the reduction. This makes Northwestern Mutual the largest dividend-paying insurance company with the lowest dividend rate.

Source(s)

Northwestern Mutual 2018 Policyowner Dividend Press Release

Northwestern Mutual How We Determine Dividends

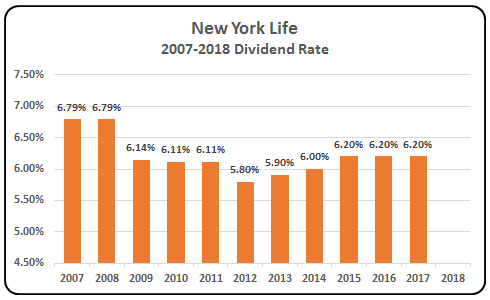

New York Life

On November 16, 2017, New York Life announced they will payout eligible policy owners an estimated dividend of $1.78 billion in 2018. The company also announced the dividend payout will be the largest in company history.

Like their fellow competitor Northwestern Mutual, New York Life did not provide information on what the actual dividend rate will be in 2018. Since 2015 the declared dividend rate has remained at 6.20%. We will update the 2018 dividend rate once it becomes public.

Unlike many other insurance company’s offering whole life insurance, New York Life’s dividend rate has been consistent without any major deviations. If you have purchased a New York Life policy since 2009 your policy is likely in good shape. For those who purchased a policy in 2008 or prior, it would be prudent to review your coverage.

With that said, there shouldn’t be a lot of surprises with a New York Life policy.

Source

2018 New York Life Dividend Announcement

[DOWNLOAD] The 2018 Whole Life Insurance Dividend Summary to learn more about how each carrier’s dividend has performed over the past decade.

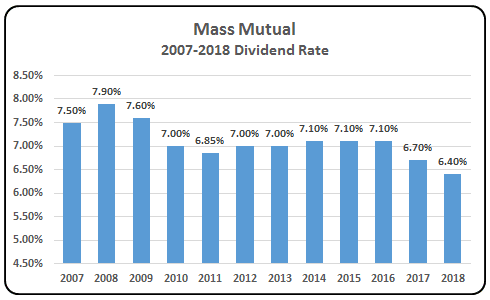

Mass Mutual

MassMutual announced its 2018 dividend interest rate and payout on November 6th. The announcement estimates a dividend payout of $1.6 billion in 2018 to eligible policy owners.

In the press release, MassMutual also announced it will be reducing its dividend interest rate from 6.70% in 2017 to 6.40% in 2018.

From 2014 thru 2016, MassMutual’s dividend interest rate was 7.10% each year. Since 2016, MassMutual’s dividend interest rate has declined 70-basis points. This large decline will have an impact on policy performance moving forward.

While this reduction is cause for concern, the dividend rate remains 150-basis points or 1.5-percent higher than Northwestern Mutual.

Source

MassMutual 2018 Policyowner Dividend Press Release

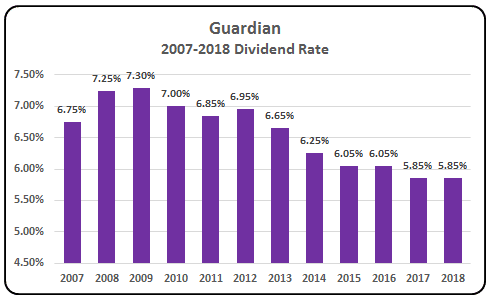

Guardian

On November 16th, 2017, Guardian announced their 2018 dividend for eligible policies. The Guardian Board of Directors approved an estimated $911 million dividend payout. This payout is the largest dividend to policyholders in the company’s history.

In the press release, Guardian also announced their dividend will remain at 5.85% for 2018. This marks the second consecutive year of Guardian paying a 5.85% dividend.

Maintaining the dividend for the second straight year provides some stability for policyholders. However, from 2016 to 2017, they reduced the dividend from 6.00% to its current level of 5.85%.

Over the past decade, Guardian’s dividend rate was highest in 2009 at 7.30%. If you purchased a Guardian policy in 2013 or prior, we would recommend completing a policy review. You can do this by contacting your agent or Guardian directly, and request a current in-force illustration. If you prefer, we can assist you with this process.

Source

Guardian Announces Largest Policyholder Dividend in Company’s History

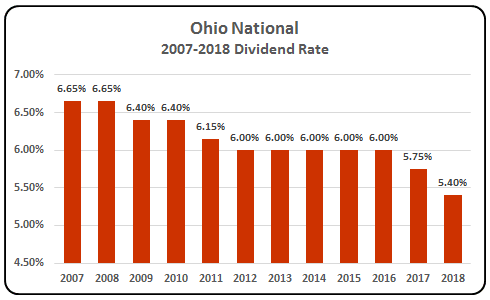

Ohio National

Ohio National announced it will be reducing its dividend rate to 5.40% for policies issued after August 1, 1998. For policies issued prior to this date, the dividend rate is 4.75%. The total dividend payout for Ohio National is expected to exceed $75 million in 2018.

This dividend rate reduction marks Ohio National’s second year of decline. In 2016, their dividend rate was 6.00%. It was reduced to 5.75% in 2017, and now 5.40% in 2018. This represents a 60-basis point decline over the past two years.

It starting to sound redundant, but if you purchased an Ohio National policy in 2016 or prior you could consider a policy review. This will give you an idea of how your policy is performing, and how best to proceed.

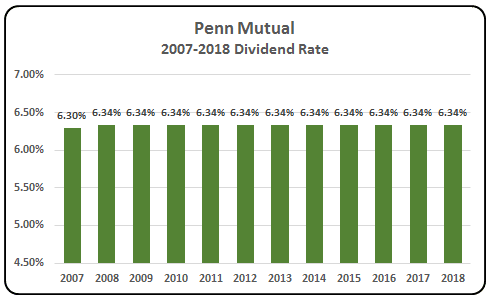

Penn Mutual

On November 22, 2017, Penn Mutual announced it will maintain its current dividend rate at 6.34% for 2018. They also announced it pay estimated dividends of $70 million to eligible policies and policyholders.

Penn Mutual’s announcement to maintain its 6.34% dividend rate is the most consistent and stable in the industry. Penn Mutual has sustained a 6.34% dividend rate since 2008. No other insurance company in the marketplace has been able to do this.

Source

Penn Mutual 2018 Dividend Announcement

Ranking The Dividends By Category

Total Dividend Payout

With an estimated total dividend payout of an estimated $5.3 billion, Northwestern Mutual is clearly the winner in this category. However, this dividend is more of a reflection of the size and number of policyholders than actual performance.

As suggested last year, if you own a Northwestern Mutual policy you need to be extremely cautious.

Dividend Rate

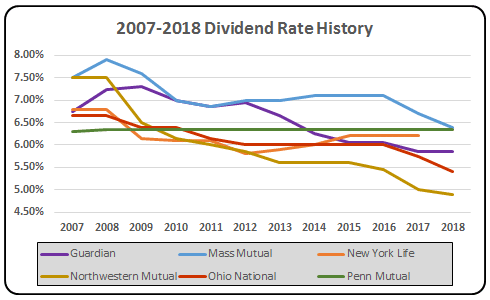

Even with a 30-basis point dividend rate reduction from 2017 to 2018, Mass Mutual has the highest 2018 dividend rate at 6.40%. Besides Mass Mutual, Penn Mutual came in at second place with a dividend rate of 6.34%.

Assuming New York Life maintains their 2017 crediting rate of 6.20%, Mass Mutual, Penn Mutual, and New York Life would be the only insurance companies with a dividend crediting rate of 6.00% or more.

Biggest Losers

Identifying the biggest losers is not a difficult task.

Biggest Loser #1 – Northwestern Mutual

While Northwestern Mutual will have the highest dividend payout this year, they will also have the lowest dividend rate of 4.90%. Northwestern Mutual is the only company on our list with a dividend rate below 5.00%. What makes it even worse is their dividend rate has declined by 55-basis points or .55-percent since 2016.

One can only imagine how much their dividend rate would have dropped had their dividend rate been in line with their competitor’s dividend rates. Read more about the Northwestern Mutual struggles.

Biggest Loser #2 – Ohio National

Ohio National’s dividend rate has dropped by 60-basis points or .60-percent since 2016. From 2016 to 2017, they reduced the dividend from 6.00% to 5.75%. From 2017 to 2018, the dividend rate is reduced to 5.40%.

A 60-basis point reduction over two years is significant. At a 5.40% dividend rate, Ohio National has the second worse dividend rate. It will be interesting to see if Ohio National’s dividend rate continues to decline in 2019.

[DOWNLOAD] The 2018 Whole Life Insurance Dividend Summary to learn more about how each carrier’s dividend has performed over the past decade.

Biggest Loser #3 – Mass Mutual

Mass Mutual is interesting. They have the highest declared dividend rate of the all the carriers we reviewed at 6.40%. However, the dividend was at 7.10% in 2016 and 6.70% in 2017. The drop to 6.40% in 2018 represents a 70-basis point or .70-percent decline since 2016.

This decline is the largest 2-year decline of the carriers we reviewed. In fairness, their 2016 dividend rate was the highest of the carriers by 70-basis points. The reduction brings their dividend more in line with their industry peers.

The major cause of concern for Mass Mutual policyholders is the size of the reduction over the past two years. With a dividend rate at or over 7.00% since 2003 (except for 2011), policyholders need to be aware of how the dividend reduction impacts their policies. If not, it could have a catastrophic effect on policies, like what Northwestern Mutual policyholders are experiencing.

Biggest Winner

The fact that Penn Mutual has been able to sustain a 6.34% dividend rate for more than a decade makes them the clear winner. While their total dividend payout may be the lowest amongst the carriers, this is more a reflection of their size and number of policyholders.

The fact they’ve been able to keep this rate level for so long is a testament to the company’s leadership.

The BIG Picture

Unquestionably, the low-interest rate environment has an impact on an insurance carrier’s dividend. Over the past decade (with the exception of Penn Mutual), each carrier has reduced its dividend. The impact on policyholders can be rather significant.

When an individual purchases a life insurance policy they are required to sign an illustration. The illustration is a projection of how the policy will perform. This includes premium amount, length of time to pay premium, cash value, death benefit, paid-up additions, etc.

Many people don’t realize the illustration is only a projection, and assume the policy will continue to perform the same way it was initially illustrated. The reality is the initial illustration used a projection based on the insurance carrier’s dividend rate at the time the policy was purchased. If the whole life insurance dividend rate goes down after you’ve purchased the policy the projections WILL change.

The result can be catastrophic to a policy. A policy will not perform as originally intended. A policy owner may have to pay additional premiums, pay premiums longer, have less cash value and/or death benefit, less cash flow from the policy, etc.

The reality is if you’ve purchased a whole life insurance policy at a time when the dividend rate was higher than it is now, you should consider reviewing your policy. You can contact the insurance company directly for this information, the advisor who sold you the policy or reach out to an outside advisor to assist you with understanding what is going on with your policy.

If you prefer, you can request a complimentary consultation with Mericle & Company to assist you with your needs.

Jason Mericle

Founder

Jason Mericle created Mericle & Company to provide families, business owners, and high net worth families access to unbiased life insurance information.

With more than two decades of experience, he has been involved with helping clients with everything from the placement of term life insurance to highly sophisticated and complex income and estate planning strategies utilizing life insurance.

Stay In The Know

Get exclusive tips and practical information to help you create, grow, sustain, and protect your wealth.

Ask Us Anything

We Are Here To Answer Your Questions