High Net Worth Life Insurance Estate Planning

When it comes to estate planning, life insurance can be an important tool for high-net-worth individuals and families. Often, life insurance is used to help provide liquidity for estate taxes, provide estate equalization, pay for ongoing expenses, and help maintain the continuity of a privately held business.

High net worth life insurance estate planning is a process of creating an estate plan to include life insurance as a tool to help you transfer your wealth to your heirs in an efficient and tax-advantaged manner.

Life insurance can help families avoid having to liquidate or access assets of the estate to pay for estate taxes, expenses, and other obligations. It can play a key role especially when the estate owns real estate or other illiquid assets that cannot be easily converted to cash.

Without proper planning, your life insurance policy could be includable in your estate and subject to estate taxes.

What Is An Estate Tax?

One of the more common reasons high net worth families choose to purchase life insurance is to provide liquidity to help pay some or all of the estate tax.

An estate tax is a type of tax that is imposed on the transfer of property at death. The estate tax is calculated based on the value of assets at death.

In 2022, each individual has a $12,060,000 estate tax exemption. That’s $24,120,000 per couple. Any amount over the exemption will be subject to a 40-percent estate tax.

Under current legislation, on January 1, 2026, the estate tax exemption will revert back to $5.49 million adjusted for inflation.

In addition to the federal estate tax, there are 17 states that have an estate or inheritance tax. Taxable estate values also vary from state to state. Click here to if your state requires an estate or inheritance tax.

One of the main benefits of using life insurance for estate planning is the death benefit is generally income tax-free.

However, individual ownership of a life insurance policy will result in the death benefit being includable or added to the value of the insured’s estate. Thereby subjecting the death benefit to the 40-percent estate tax rate.

Oftentimes you can avoid this by using an Irrevocable Life Insurance Trust or ILIT.

How Does an Irrevocable Life Insurance Trust Work for Estate Planning?

An irrevocable life insurance trust (ILIT) is a type of trust established to own and be the beneficiary of one or more life insurance policies.

There are several benefits associated with using an irrevocable life insurance trust for estate planning purposes, including the ability to minimize estate taxes, avoid probate, protection from creditors, and provide financial security for loved ones.

Establishing an irrevocable life insurance trust starts with it being drafted and executed. A qualified attorney should do this. During this process, the insured(s) will typically serve as grantors of the trust. The grantor will name the beneficiaries of the trust, along with a trustee and successor trustees.

You will also be able to place any provisions in the trust you deem necessary. For example, a minimum age a beneficiary must be in order to receive trust assets.

The trustee is responsible for signing on behalf of the trust. The trustee is also responsible for overseeing the trust and making decisions based on the trust language.

What Are the Benefits of Using an Irrevocable Life Insurance Trust for Estate Planning?

One of the benefits of using an irrevocable life insurance trust (ILIT) is that it can help minimize estate taxes. When a high-net-worth individual dies, their estate is typically subject to estate taxes.

However, assets held in an irrevocable trust are typically exempt from these taxes. This can potentially save the heirs to the estate a significant amount of money.

Another benefit of using an irrevocable life insurance trust is that it can help to avoid probate. Probate is the legal process through which a will is validated, and it can typically be lengthy and costly. If an individual has their assets held in an irrevocable trust, however, these assets are not subject to probate. This can expedite the process of distributing assets after the death of the individual who created the trust.

Finally, an irrevocable life insurance trust can provide financial security for loved ones in the event of death. An ILIT can provide a number of benefits to individuals and families who are looking to plan their estate effectively.

If you are considering using ILIT in your own estate planning, it is important to work with an experienced attorney who can assist you in drafting and executing the proper documents.

How Do You Fund an Irrevocable Life Insurance Trust?

Most commonly high net worth individuals and families fund their irrevocable life insurance trust by using a portion or all of their annual gift tax exemption amount. The annual gift tax exemption is the amount of money you can give to another person each year without owing taxes on that money.

In 2022, the annual gift tax exemption amount is $16,000 per donor per person. If you and your spouse are both grantors to an ILIT with four beneficiaries, you are able to gift up to a total of $128,000 tax-free to the trust annually.

This is done by writing a check from your estate to your ILIT. The ILIT should establish a checking account prior to making the gift by the trustee. The trustee will deposit the gift into the trust checking account. The trustee will then write a check from the ILIT to the insurance company.

What if the Life Insurance Premium is Greater than My Annual Gift Tax Exemption Amount?

If your life insurance premium is greater than your annual gift tax exemption, you may be subject to gift taxes.

However, there are ways to minimize or avoid gift taxes, such as using life insurance private financing or premium financing.

What is Life Insurance Private Financing?

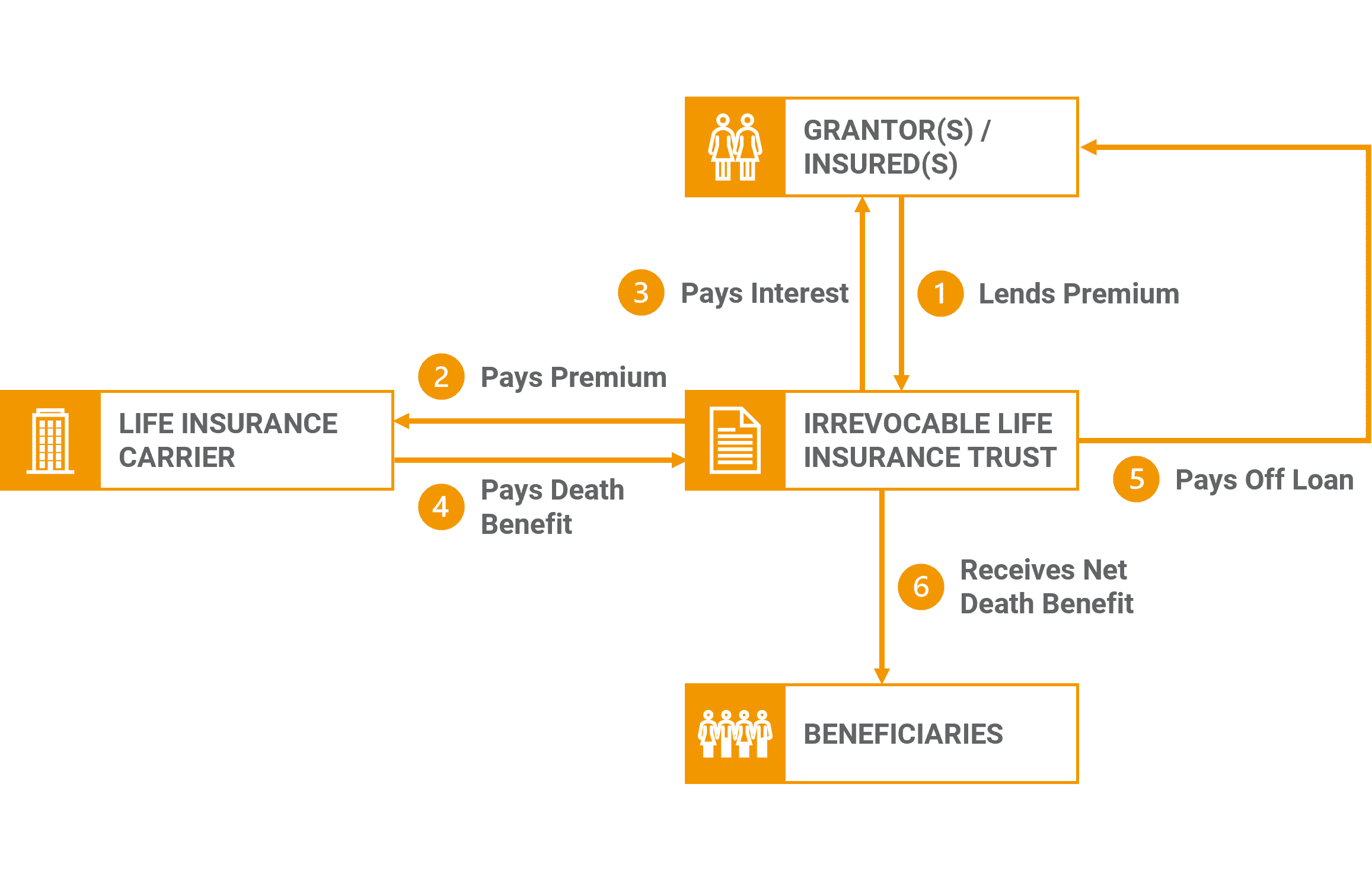

Life insurance private financing is an arrangement where the high net worth individual or family make a personal loan to their irrevocable life insurance trust.

In most cases, the family will make a loan to the trust annually or as a lump sum in return for a promissory note from the trust. The promissory note must charge interest at or above the Applicable Federal Rate (AFR).

The trust will then use the borrowed money to make premium payments from the trust to the insurance carrier. If the grantor lends a lump sum the trust can invest the excess funds and/or use them to pay interest back to the family.

At the end of the loan period, the trust will repay the loan using the assets of the trust. This can be done using cash value from the life insurance policy or using proceeds from the policy death benefit when a death claim is paid.

In certain cases, it may make sense to use a portion of the annual gift tax exemption amount and then lend the remaining portion necessary to pay the balance of the life insurance premium.

Loan repayments will be includable and subject to estate taxes. The remaining net death benefit will stay in the trust income and estate tax-free.

What is Life Insurance Premium Financing?

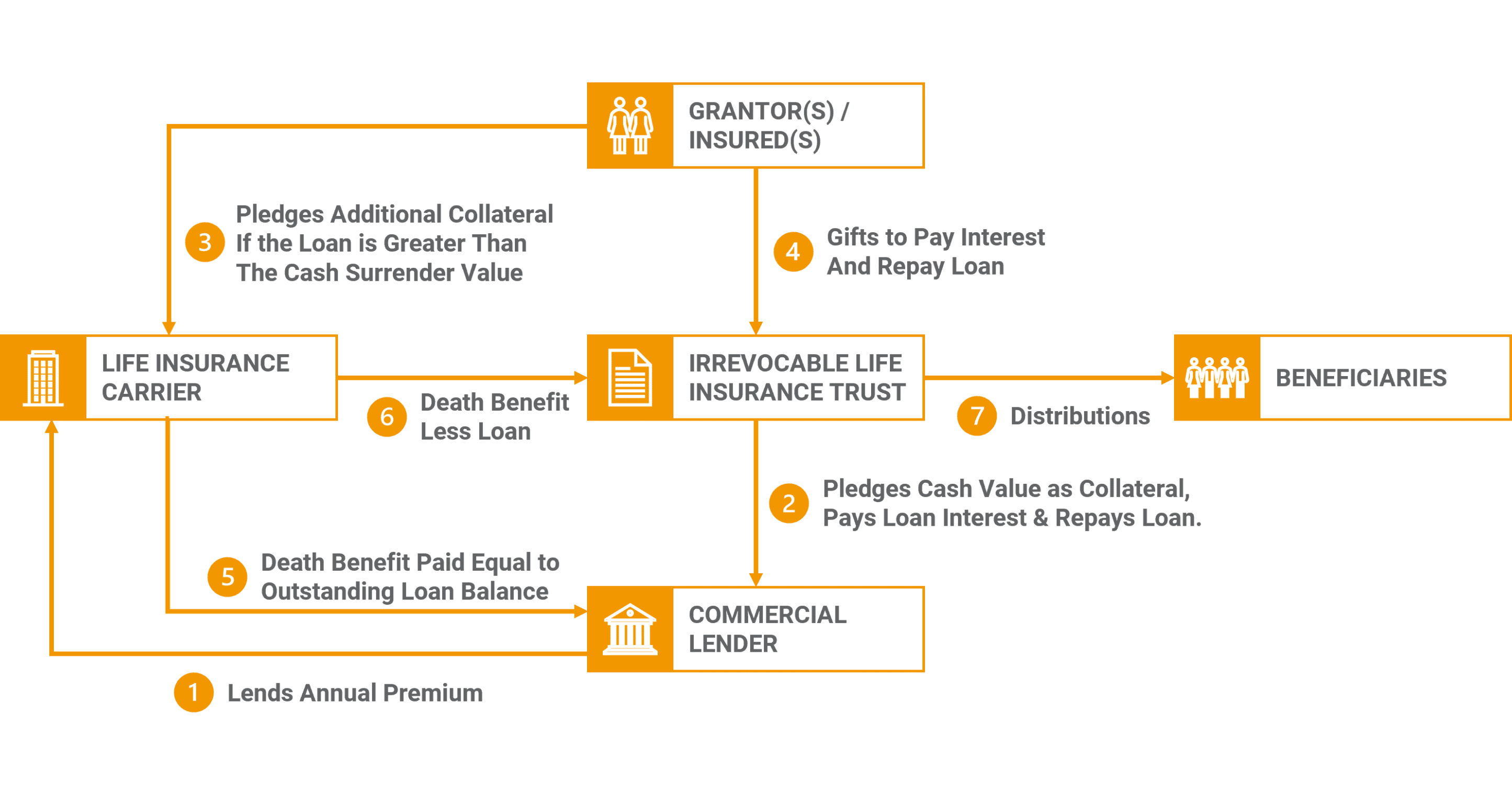

Premium financing life insurance is the process of borrowing the premium from a third-party lender – typically a bank. When using life insurance premium financing with an ILIT the trust is the borrower and the grantor guarantees the loan.

The lender will make the premium payment to the insurance carrier. The grantor of the ILIT will gift the loan interest due to the trust. The trustee will make the loan interest payment from the trust checking account to the premium finance lender.

Premium financing lenders will require collateral for the outstanding loan balance. In most cases, the trustee can pledge policy cash values for purposes of securing the lender’s collateral requirement.

However, if the cash value is less than the outstanding loan balance the grantor will have to pledge additional collateral to the lender.

In these situations, the grantor will often pledge cash in the form of a savings or checking account. It may also be possible to use an investment portfolio.

The trust can repay the loan while the insured(s) is still alive via the cash value or other liquid assets from the grantor. If death occurs the premium financing lender will be repaid from the death benefit proceeds. The ILIT will then receive the death benefit less the outstanding loan balance.

Who are Candidates for Life Insurance Premium Financing?

Life insurance premium finance generally makes the most sense for high-net-worth life insurance estate planning when the individual or family:

- Own illiquid assets and are unable to generate enough cash flow to pay ongoing premiums,

- Assets in the estate are able to earn more than what it costs to borrow the premium,

- Want to reduce their gift tax exposure, and/or

- Have a short-term liquidity need to fund policy premiums.

What Type of Life Insurance Policy Makes the Most Sense for High-Net-Worth Estate Planning?

When high net worth individuals and families use life insurance for estate planning it is important to choose the right type of life insurance policy. In most cases, some form of permanent life insurance makes the most sense.

Choosing the right type of permanent life insurance policy can often vary depending on your needs and what you and your family are trying to accomplish. Permanent life insurance comes in the form of whole life insurance or universal life insurance.

Within each of these two permanent life insurance policy types are additional subcategories or versions.

For instance, universal life insurance policies offer the following subtypes:

- Current Assumption Universal Life

- No Lapse Guarantee Universal Life

- Indexed Universal Life

- Variable Universal Life

When using life insurance for estate planning purposes we generally recommend using some form of universal life insurance.

Universal life insurance tends to make the most sense because the cost of coverage is usually less than whole life. Universal life insurance also offers much more flexibility than whole life insurance.

When doing high net worth life insurance estate planning the primary goal when designing the policy is generally to secure the most amount of coverage for the least amount of cost.

Should I Use an Individual or Survivorship Life Insurance Policy for My Estate Planning?

The answer to this question is it depends on the situation and what you are trying to accomplish.

Individual life insurance protection insures the life of one individual. Survivorship (or second-to-die or joint-survivor) life insurance insures the lives of two individuals, most commonly insuring spouses.

Since we are insuring two lives with a survivorship life insurance policy the cost tends to be less expensive in comparison with an individual policy. The reason for this is survivorship life insurance policies pay a death benefit when the second insured passes away.

What will ultimately determine whether individual or survivorship coverage is used is based on the planning goals, ages, insurability, etc.

In situations where the spouses are in a second, third, or fourth marriage it may not make sense to use survivorship life insurance. Again, this is entirely dependent on how you and when you want to transfer assets to heirs.

How Much Life Insurance Do I Need for My Estate?

There is no one-size-fits-all answer to this question. The amount of life insurance you will need for your estate plan will depend on a number of factors, including the size and complexity of your estate, your personal financial situation, and your family’s needs.

In many cases, when using life insurance for estate planning families will choose to insure a portion of or all of their estate tax liability. Essentially 40-percent of the projected tax liability above your $12.06 million lifetime exemption amount adjusted for projected growth.

You may even desire to factor the anticipated lifetime exemption reduction in 2026 to $5.49 million adjusted for inflation. Oftentimes the main driving factor of how much coverage to purchase is based on a set maximum premium amount.

How can Life Insurance Help with Estate Equalization?

When you have multiple heirs dividing assets equally can sometimes be difficult. This can be especially true when there is a family business or properties – like a primary residence or vacation home.

As an example, what if dad passes away and leaves a $3 million home to his three children. Two of the children have no desire to keep the home. They have more interest in selling it. The remaining child has fond memories of the home and wants to keep it.

However, the child who wants to keep the home doesn’t have $2 million to purchase the home from their siblings. Dad’s home, although unintentionally, has the potential to create a major financial and emotional conflict for his three children.

In this scenario, life insurance for estate planning can help to equalize the children’s inheritance. With proper planning, dad could leave the home to the one child who wants to keep it. The two remaining siblings would receive life insurance proceeds (or other liquid assets) to offset the value of the home.

Estate equalization can apply to any type of illiquid asset where one of your heirs may not have an affinity or desire to inherit it. Illiquid assets may include a privately owned business, art, coins, commercial real estate, cars, and other collectibles.

By using life insurance for estate equalization, you can create harmony amongst your heirs. Life insurance can help balance the value of assets that may be difficult to divide.

What Role Does Life Insurance Play if I Own a Business?

Life insurance can be especially useful for an owner or owners of a privately owned business. The financial impact due to the death of an owner can be catastrophic for both the business and their family. It can also create complications between family members and any co-owners (or partners) in the business.

If you own a business with other individuals the first step is to establish a buy/sell agreement with life insurance. A buy/sell agreement serves as a rule book for shareholders specifying what happens when a triggering event occurs. Triggering events may include disability, death, or retirement.

A buy/sell agreement can establish an agreed-upon value of the business. It can also specify who has the right to purchase company stock if a triggering event occurs.

There are a number of buy/sell agreement structures. Determining which buy/sell structure to use will largely depend on your company type, the number of owners, and tax implications.

If an owner experiences a triggering event the buy/sell agreement will provide guidance on what steps are to be taken.

What if I Don’t Have Any Partners?

If you are the sole owner of your business, you still have a few options. One is to establish a one-way buy-sell agreement with an employee. This employee is someone you know is capable of taking over the business if something were to happen to you.

If a triggering event were to occur, they would own a life insurance policy insuring your life allowing them to purchase company stock from your family. The key employee may be a child or someone who knows and understands how to continue to operate the company.

Alternatively, similar to our use of life insurance for estate planning, you may decide to purchase a policy individually or in an ILIT insuring your life. The policy should be large enough to ensure the company can continue to operate for a period of time you deem to be suitable.

High Net Worth Life Insurance Estate Planning Final Thoughts

It is important for high-net-worth individuals and families to consider life insurance as a part of their estate planning. Life insurance provides liquidity for heirs to help pay estate taxes and/or ongoing expenses associated with a high-net-worth estate.

When you are planning your estate and considering life insurance as part of that process, it is important to work with an advisor who can help you understand your options and find the best policy for your needs. With the right planning, you can be certain your assets will pass on to your heirs according to your wishes.

Whether you are looking to protect your estate or establish a legacy for future generations, life insurance is a useful tool to consider as a part of your estate planning process.

With the right planning, you can help ensure your family is taken care of financially even after you are gone.

Click here to schedule a call to learn more about how life insurance can help with your estate planning.

The values shown are hypothetical. Actual financial outcomes may be more or less favorable. Each situation will vary from client to client. The purpose of the above information is for educational purposes only. You should consult with your attorney, accountant, or other advisors familiar with your situation.

IRC CIRCULAR 230 NOTICE: To the extent this message or any information concerns tax matters, it is not intended to be used by a taxpayer to avoid penalties that may be imposed by law.

Jason Mericle

Founder

Jason Mericle created Mericle & Company to provide families, business owners, and high net worth families access to unbiased life insurance information.

With more than two decades of experience, he has been involved with helping clients with everything from the placement of term life insurance to highly sophisticated and complex income and estate planning strategies utilizing life insurance.

Stay In The Know

Get exclusive tips and practical information to help you create, grow, sustain, and protect your wealth.

Ask Us Anything

We Are Here To Answer Your Questions

Start A Conversation

Schedule a complimentary 30 minute Zoom meeting to learn more about your options.