Premium Financing Life Insurance

Premium financing life insurance is the process of borrowing money to pay large life insurance premiums. Annual premiums will typically range from $100,000 on the low-end to multiple millions of dollars on the high-end.

Life insurance premium finance for estate planning is most commonly used when a life insurance policy is owned by an Irrevocable Life Insurance Trust (ILIT).

The policy owner secures a loan from a third-party lender. The third-party lender is usually a bank with a division specializing in life insurance premium financing loans. Not all banks are able to make premium finance life insurance loans.

DISCLOSURE

The information included in this article is for the sole purpose of providing an overview of how premium financing works. There are a number of different programs, designs, policy options, and considerations when evaluating life insurance premium financing.

Some premium finance structures can be beneficial. Other structures can be overly aggressive resulting in a negative outcome for the client. We encourage everyone to complete their own due diligence with their tax, legal, and investment team prior to entering into any premium finance arrangement.

Who Is An Ideal Candidate for Premium Financing Life Insurance?

Ideal candidates for life insurance premium financing are wealthy individuals and families who have an interest in borrowing life insurance premiums due to one (or more) of the following:

- Assets of the estate are illiquid and unable to generate enough cash flow to pay ongoing premiums.

- Assets of the estate generate a greater return than what it costs to borrow premiums (e.g. interest rates).

- Interested in reducing gift tax exposure to fund life insurance.

- A short-term liquidity need exists to fund life insurance premiums while anticipating a future liquidity event to fund the life insurance policy.

Life Insurance Premium Financing Key Benefits

Premium financed life insurance offers a number of benefits to high-net-worth individuals and families. Life insurance premium finance provides the ability to:

- Obtain large amounts of life insurance with low initial out-of-pocket costs.

- Protect, sustain, and grow assets by using bank financing to fund large life insurance premiums.

- Leverage annual gift-tax exclusions and/or lifetime exemption to transfer other assets estate tax-free.

- Minimize or eliminate gift taxes on policy premiums when using an irrevocable life insurance trust.

- Use policy cash value as part or all of the collateral for the premium finance loan.

How Premium Financed Life Insurance Works

Once a need for life insurance protection is identified the question becomes what is the best way to fund the policy. There are a number of ways to fund the need. Life insurance premium financing is one of several options.

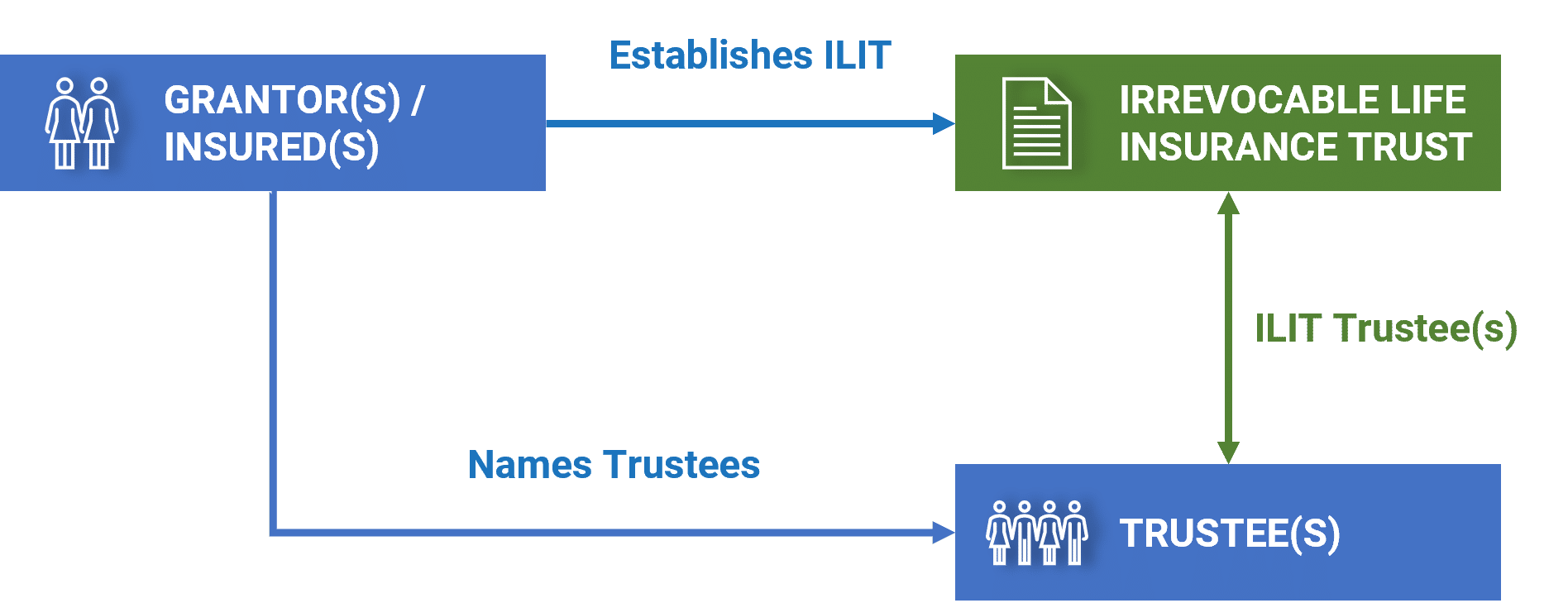

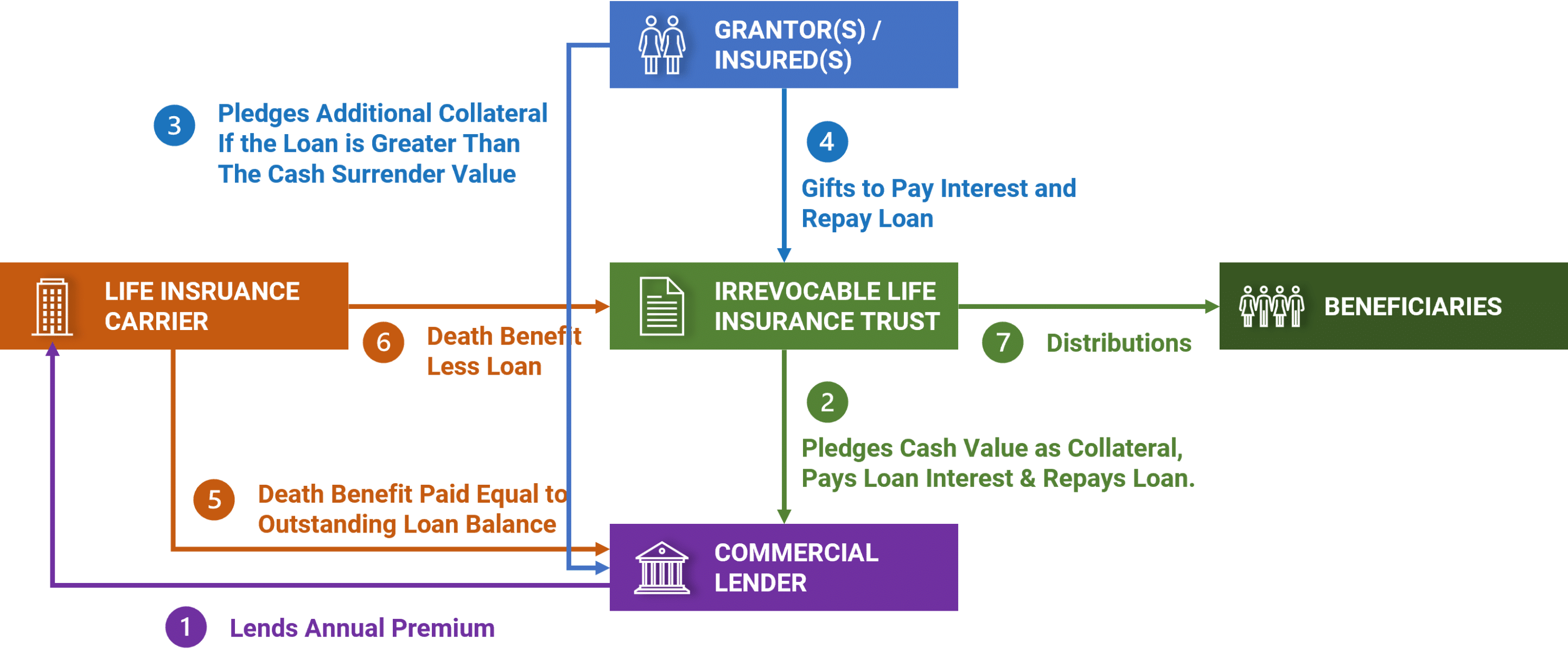

When utilizing life insurance premium financing for estate planning purposes it is common to establish an irrevocable trust to own and be the beneficiary of the life insurance policy. The irrevocable life insurance trust (ILIT) will be the borrower and make premium payments to the life insurance carrier.

In this scenario, the Insured(s) will be the Grantor(s) of the ILIT. The Grantor will name the ILIT Trustee(s). The trustee(s) should not be the grantor(s).

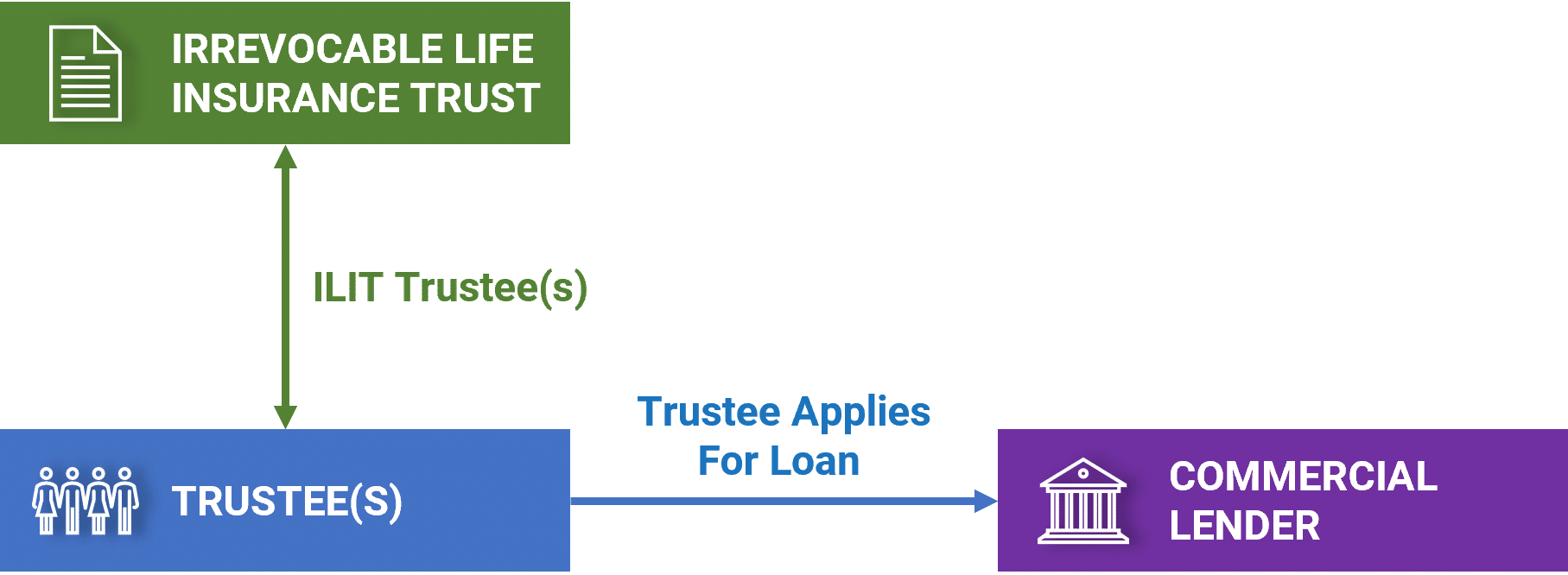

The trustee(s) will apply for the loan on behalf of the ILIT for the policy premiums. The grantor(s)/insured(s) will typically provide a personal guarantee for the loan to the ILIT. They will also provide personal financial information to the premium financing lender in order to receive loan approval.

The life insurance premium finance lender will establish the terms of the premium finance loan to include (but not limited to):

- Interest rate

- Length of the loan

- Payment schedules

- Collateral requirements

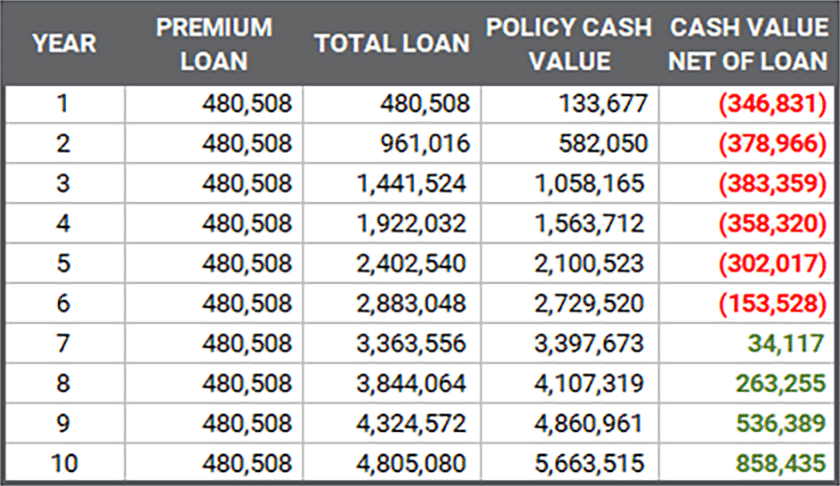

In most scenarios, all or a portion of the cash value is available to provide collateral to the premium finance lender. In early policy years, the cash value can be much lower than the premiums paid. Typically, the grantor(s) will be responsible for securing the shortfall between the outstanding loan balance and cash value. This can be done using a line of credit or securing the loan with other liquid assets.

Moving forward, the ILIT and the trustee(s) will be responsible for paying loan interest directly to the lender. In most cases, the grantor(s) will make a gift to the ILIT for loan interest.

Understanding the Life Insurance Premium Finance Loan

Life insurance premium finance loans are made annually on the policy anniversary when premiums are due. The number of years premium is owed will vary based on the needs of the client and plan design.

In most plans, premiums are made over a 7 to 10-year period. In certain cases, it may make sense for premiums to be paid over a longer period of time. Scenarios also exist where it may make sense to fund the policy for 5 or fewer years.

The lender will review the loan documents each year. The lender may reserve the right to not renew the loan on the anniversary. Grantor(s) may also need to provide updated financial information in order to continue the loan.

The lender may also require additional collateral for any shortfall between the outstanding loan balance and cash surrender value.

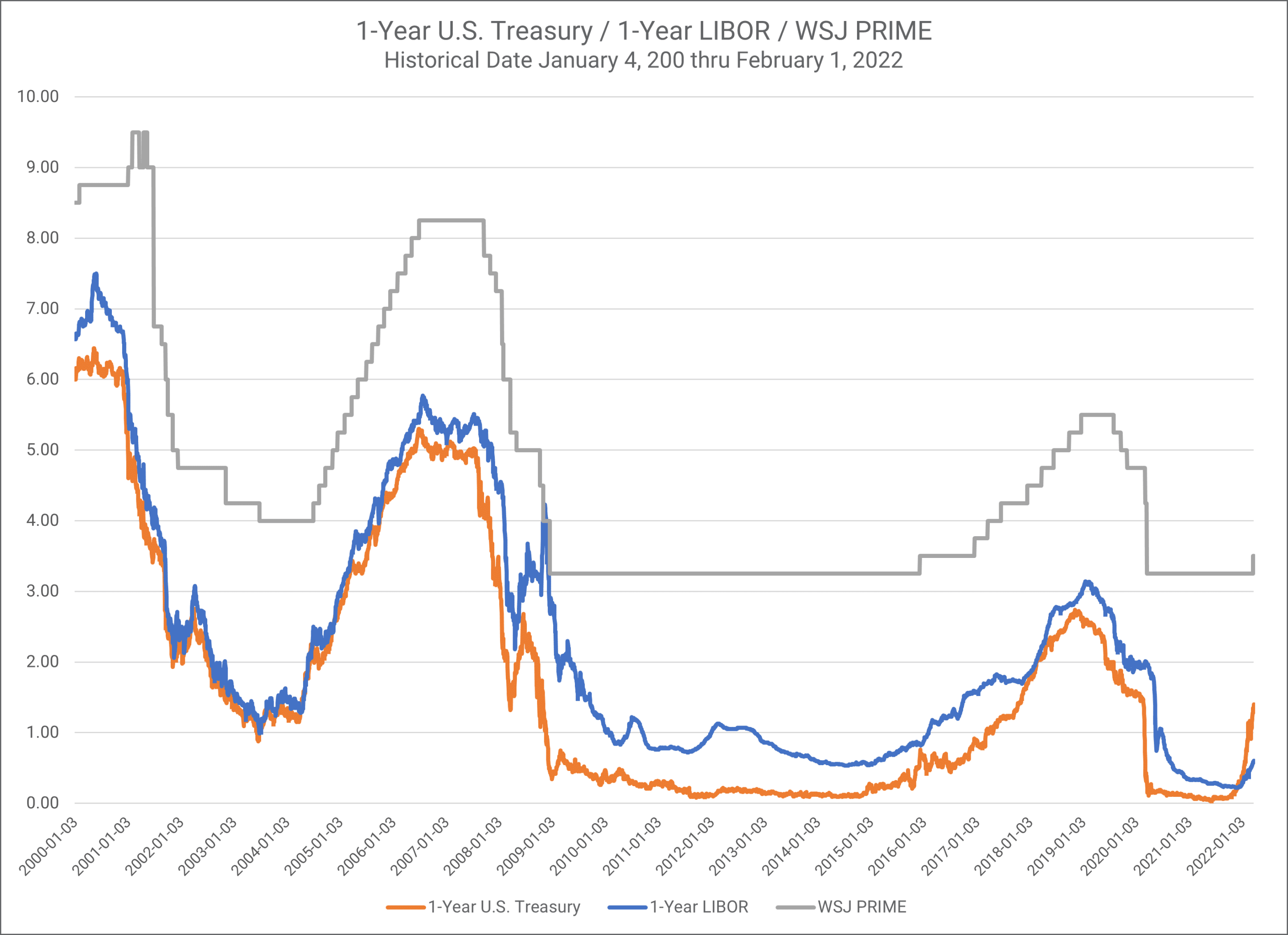

The loan interest rate is based on a commercially available loan benchmark rate such as LIBOR, WSJ Prime, or certain Treasury Rates. The loan interest rate will also include a spread with a minimum interest rate floor. The spread can range from 100 to 400 basis points above the underlying loan benchmark rate depending on the lender, benchmark rate, and the size of the loan.

The loan interest rate will change or reset. If the loan interest is based on a 1-year rate it will reset every year based on what the loan benchmark rate is at that time and subject to any minimums or spreads.

London Interbank Offered Rate (LIBOR)

Historically, the London Interbank Offered Rate or LIBOR has been one of the more common benchmark rates for premium financing. Beginning in 2022 LIBOR will no longer be available for new loans.

In the United States, the Secured Overnight Financing Rate (SOFR) will replace LIBOR. SOFR is based on the overnight loan rate U.S. Financial Institutions pay to each other.

Example

If the WSJ Prime Rate at loan inception is 3-percent and the note terms include an additional 150 basis points, your borrowing rate is 4.50-percent for that year. If the WSJ Prime rate drops to 2-percent on the loan anniversary, the borrowing rate will be 3.50-percent.

Some lenders will make available a fixed rate over a specified period of time. These loans will typically have additional charges in order to lock in a fixed rate over a number of years. Depending on the circumstance, it may make sense to lock the rate over a period of time.

When the loan documents specify a minimum loan interest rate and the loan benchmark rate plus spread drops below the minimum, the ILIT will owe interest based on the minimum loan interest rate.

Understanding Premium Financed Life Insurance Collateral

When the Irrevocable Life Insurance Trust is the borrower the structure of the loan is a traditional recourse loan. As a result, the grantor/insured will need to personally guarantee the loan and will need to secure the loan with additional collateral when a collateral shortfall exists.

The lender will accept a portion or all of the life insurance policy’s cash value as collateral for the outstanding loan balance. In situations where the outstanding loan balance is greater than the cash surrender value, additional assets must be pledged to secure the loan. This typically occurs during the first five to ten policy years.

During this period, policy cash values are not enough to collateralize the entire loan. Thereby requiring additional collateral to secure the entire loan balance. The most common form of additional collateral is a letter of credit or pledging cash or cash equivalents from the grantor’s estate.

Different lenders will accept other forms of collateral such as real estate or art. But most prefer bank accounts (checking and savings) or stock portfolios as the preferred form of collateral.

The lender will review policy cash values and collateral requirements on an annual (or more frequent) basis. Based on policy cash value performance and interest rates, more or less collateral may be necessary than initially projected.

Funding and Maintaining a Premium Financed Life Insurance Policy

Now that we have a better understanding of how loan interest and collateral work let’s take a look at the overall life insurance premium financing structure. When the loan and policy have been approved, the lender will make the initial premium payment to the life insurance carrier via the ILIT.

The ILIT will be responsible for making loan interest payments to the lender each year. The trustee will pledge the policy cash values as collateral, while the grantor provides additional collateral for the shortfall.

The trustee will also pledge a portion of the policy’s death benefit to the lender to repay the loan when death occurs. Ongoing loan interest payments will also be the responsibility of the trustee via a gift of loan interest from the grantor to the ILIT. Life insurance premium financing loan interest is not deductible.

According to the provisions of the premium finance loan documents, the lender will continue to lend the annual premium on the policy anniversary.

Life Insurance Premium Finance Exit Strategies

Life insurance premium finance loans will typically need to be renewed every three to five years, sometimes longer. Because of this, it makes sense for the grantor to maintain good credit, sufficient collateral, and timely loan interest payments. This will help to ensure favorable loan terms and rates when refinancing the life insurance premium finance loan.

The policy owner (in this case ILIT) should have a secondary strategy to exit the premium finance loan.

The most easily understood exit strategy is repaying the loan via the death benefit when the insured(s) pass away. At death, the life insurance death benefit pays off the outstanding loan balance. The ILIT would then receive the net death benefit proceeds.

For instance, the ILIT owns a policy with a $25 million gross death benefit. When the insured(s) pass away the outstanding life insurance premium financing loan balance is $5 million. The insurance carrier pays the $5 million loan balance to the lender. The ILIT would then receive a lump sum payment of the net death benefit equal to $20 million.

Using death as a way to exit a premium financing arrangement may seem practical. However, it is prudent to incorporate an exit strategy while the insured(s) are still living.

In today’s environment, there are a number of plan designs that show loan repayment using policy cash values. Based on the policy performance, there may be enough cash value to repay the loan and maintain the life insurance coverage. This will usually occur somewhere around Policy Year 16 to 25.

Alternatively, the grantor could exit the loan using other arrangements. This may include incorporating a Grantor Retained Annuity Trust (GRAT) or other advanced methods.

Perhaps a liquidity event occurs, such as the sale of a business or real estate, allowing the loan to be repaid.

Reducing Premium Financing Life Insurance Risk

When designed properly, premium financed life insurance will:

- Minimize gift taxes,

- Allow the family to retain control of invested assets,

- Transfer wealth to heirs with little impact on cash flow, and

- Reduce the need of liquidating taxable assets.

When considering premium financing life insurance it is important to understand the risks:

Loan Interest Rates

As discussed previously, loan interest rates can impact life insurance premium financing structures. The loan interest rate is going to determine the loan interest owed. This rate can fluctuate both up and down. Loan interest can be paid in advance or in arrears.

A low-interest-rate environment makes life insurance premium financing more attractive. As interest rates rise, larger interest payments are necessary to maintain the loan.

Life Insurance Product Options

The most common types of life insurance products for life insurance premium financing are whole life or universal life products. More specifically, we are seeing index universal life insurance as the product of choice for premium financing.

Index universal life insurance allows a policy’s cash value to be credited based on the performance of a chosen index. The available index options will vary, but the most common is the S&P 500.

One of the benefits of index universal life insurance is in years where index returns are negative the cash value is credited a guaranteed floor of zero percent.

When using premium financing life insurance, policy illustrations will assume a projected crediting or dividend rate over the life of the policy. This rate projects how the policy will perform to include premiums, cash values, and length of coverage.

If the actual performance of the policy is less than the initially projected rate the policy will underperform. Underperforming policies can result in the following:

- The need for additional collateral.

- Failure to use the cash value to pay off the loan in the year it is projected.

- Need for additional premium.

- Reduction of the death benefit.

Before entering into a premium financing arrangement make sure you understand how the policy works.

Zero Outlay Life Insurance Premium Financing

There are a number of premium finance promoters offering structures that show a zero outlay to acquire life insurance. They do this by accruing or borrowing the loan interest, in addition to the premium from the lender.

This method increases the risk of negative outcomes for the participants. Given fluctuations in interest rates and policy performance, it makes the most sense to pay interest instead of accruing it.

Gifting Loan Interest

Loan interest will grow each year as additional premium loans are made and/or interest rates rise. The initial loan interest due will be relatively small but will grow over time as additional premium loans are made.

The use of annual exclusion gifts to pay the initial interest due will likely be feasible. As interest owed increases, the grantor(s) may need to use a portion of their lifetime exemption to make interest payments.

Steps to Establish Premium Financed Life Insurance

Step 1 – Life Insurance Premium Financing Informal Modeling

The process of informally modeling a life insurance premium financing arrangement will provide you with an idea of how the strategy may be of benefit to you and your family. This will allow you to understand the options available from a funding and policy perspective.

During this process, you will be able to visualize different assumptions and how they may impact the overall arrangement. From there, it is up to you to determine if it makes sense to move forward.

Step 2 – Informal Application for Preliminary Underwriting Offers

Informally applying for life insurance coverage is always the best way to apply for large amounts of life insurance coverage.

Informal life insurance applications allow the advisor and their underwriting team to request medical records from the insured(s) physicians. After receiving the records, the advisor will submit them to multiple life insurance carriers to obtain informal offers.

The life insurance carrier will review the medical information and make an informal offer. Informal offers will include the insured’s health class rating and the amount of coverage the carrier is able to insure. Health class ratings determine how each carrier prices its policy.

Informal health class offers allow the advisor to design a life insurance premium financing proposal based on actual information. In most cases, informal health class offers are the health class rating the insurance will receive when they apply formally with the chosen life insurance carrier(s).

Informal underwriting gives the insured a more likely than not understanding of how policy pricing will impact the life insurance premium financing arrangement. With this information, the insured is able to make an informed decision on whether or not to proceed based on the most favorable financial outcomes.

At no point in this process has the insured agreed to commit to obtaining life insurance coverage.

NOTE: Offers are informal or preliminary and are subject to each carrier’s formal requirements. Formal requirements will include the submittal of the carrier’s application and any additional requirements they may need to make a formal offer. Additional requirements can include updated medical records, paramedical exam, financial information, etc.

Step 3 – The Grantor Creates an Irrevocable Life Insurance Trust

Provided the insured(s) are comfortable with the proposed coverage, the next step is to establish a trust that will own the life insurance coverage and borrow premiums.

The most commonly used trust is an Irrevocable Life Insurance Trust (ILIT). An ILIT should be established by an attorney who specializes in trust and estate planning. The insured(s) will typically be the grantor(s) of the trust.

The grantor(s) will choose a trustee or co-trustees (other than themselves), trust beneficiaries, and provide instructions as to how trust assets are distributed at death. The attorney will then draft the trust, and the grantor(s) will then execute it.

Step 4 – Formally Apply for Life Insurance nad Premium Financing Loan

Under a typical life insurance premium financing arrangement, the trust and insured will submit a formal application to the chosen life insurance carrier(s). The recently executed irrevocable life insurance trust (ILIT) will be the owner and beneficiary of the life insurance policy.

The main benefit of using an ILIT is it keeps the life insurance death benefit out of the insured’s estate. The result is the death being income and estate tax-free. If the insured owns the policy individually, the death benefit is includable in their estate and likely subject to estate taxes.

Simultaneously, the trustee submits an application to the life insurance premium financing lender on behalf of the ILIT. In some cases, this may be the grantor’s own bank. With the application, the grantor will provide their financial information. This information typically includes two years of personal tax returns and a personal financial statement.

Upon policy and loan approval, both the insurance carrier and bank will make formal offers. The life insurance policy will come in the form of the carrier issuing the policy. The bank loan offer will come in the form of a term sheet. In the term sheet, the lender will establish the terms of the loan.

At this time, the grantor(s) must make the final decision to move forward with the life insurance premium financing arrangement.

Step 5 – Funding the Life Insurance Policy

When the loan and policy have been approved, the lender will make the initial premium payment to the carrier. The ILIT will be responsible for making loan interest payments in accordance with the loan documents. According to the provisions of the loan documents, the lender may continue to provide additional future annual premiums.

Step 6 – Ongoing Life Insurance Premium Financing Policy and Loan Maintenance

Hopefully, by now, you realize there are a number of variables that can impact how premium financed life insurance performs over time. This is not a transaction you enter into and leave on autopilot. It requires ongoing review and maintenance to avoid any adverse results.

Initial projections used to model the future will change over time. Policy values and interest rates will fluctuate causing changes to the arrangement evolves in the future. If there is one certainty with premium financing life insurance is the numbers will change.

This is why it is so important to review the structure on a regular basis with a professional who understands how it works. From there, you can continue to proactively manage the process in accordance with your needs, wants, and wishes.

Premium Financing Life Insurance Key Considerations

It is important to review and monitor premium financing life insurance arrangements to include loan interest and policy crediting rates. It is important to remember:

- Life insurance premium financing is a way to pay for life insurance that you need. It should not be the reason you buy life insurance.

- Premium finance loan interest rates can go up and down. Higher rates mean loan interest payments will be more than initially projected.

- Policy cash value crediting rates can change, which may result in additional collateral to maintain the loan.

- Borrowing additional policy premiums may be necessary if the policy cash value performs lower than initially projected.

Life insurance premium financing can be an excellent option for the right individual and set of circumstances. It is certainly not a transaction that is for everybody. If you or somebody you know is interested in learning more about premium financing life insurance we are happy to assist. Simply click here to schedule a preliminary life insurance premium financing call.

The above information is not intended to be opinions or advice for tax, legal, accounting, or investment advice. Consult with your attorney and/or tax advisor prior to the application of this general information for specific situations.

IRC CIRCULAR 230 NOTICE: To the extent this message or any information concerns tax matters, it is not intended to be used by a taxpayer to avoid penalties that may be imposed by law.

Jason Mericle

Founder

Jason Mericle created Mericle & Company to provide families, business owners, and high net worth families access to unbiased life insurance information.

With more than two decades of experience, he has been involved with helping clients with everything from the placement of term life insurance to highly sophisticated and complex income and estate planning strategies utilizing life insurance.

Stay In The Know

Get exclusive tips and practical information to help you create, grow, sustain, and protect your wealth.

Ask Us Anything

We Are Here To Answer Your Questions

Start A Conversation

Schedule a complimentary 30 minute Zoom meeting to learn more about your options.