What John Hancock’s Crediting Rate Increase Means for Policy Owners

On September 1, 2022, John Hancock increased their crediting rate 20 basis points on their Protection Universal Life and Protection Survivorship Universal Life product suite. This results in a current crediting rate of 4.85-percent for John Hancock USA policies and 4.60-percent crediting rate for John Hancock NY policies.

This announcement comes following a crediting rate increase on March 1, 2022. At that time, John Hancock announced it would increase the crediting rate on the same suite of products by 30 basis points.

Over the course of the past 6-months policy owners have seen a total crediting rate increase of 50-basis points since March 1, 2022. This is great news for policy owners as current crediting rates on John Hancock USA Protection policies had dropped as low as 4.35-percent.

This is a stark contrast to what we’ve seen other carriers do. Over the past decade, we have seen crediting rates on current assumption universal life policies plummet. In many cases, we have seen current crediting rates equal to guaranteed crediting rates.

We have written about current assumption universal life insurance policies and how crediting rates impact policy performance in other posts. To better understand how it works you can review the following blog posts:

- Low Interest Rates Causing Permanent Life Insurance Massively Underperform

- The Problem with Some Life Insurance Carriers

- The Importance of Life Insurance Policy Review

We are including the following case study to help illustrate what the rate increase means and how it impacts policy performance we are including the following case study.

Background Information

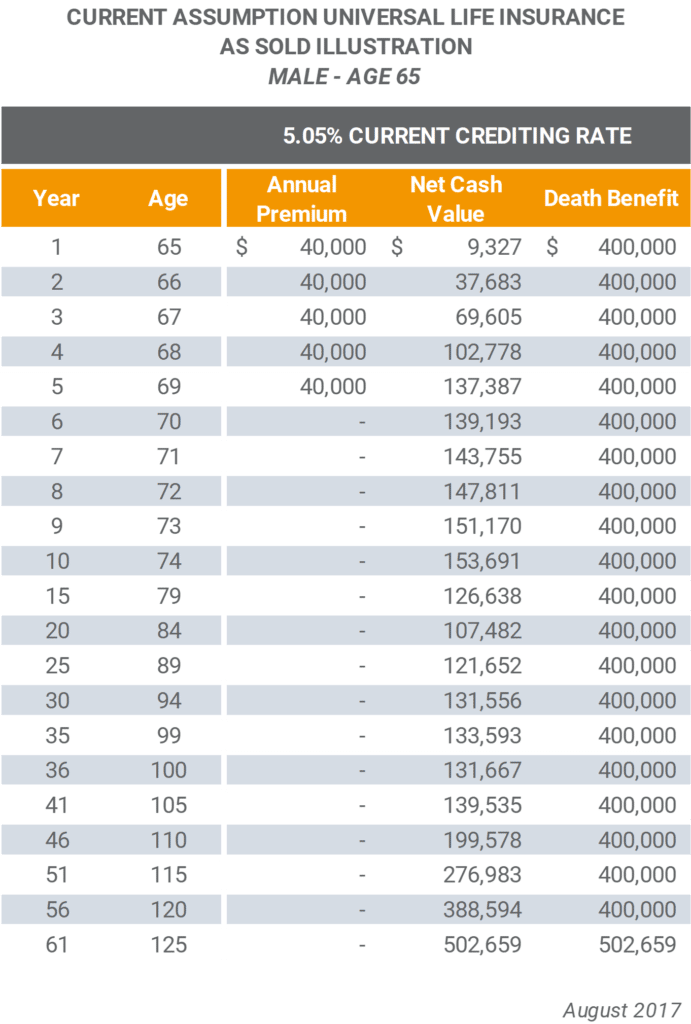

The policy is a single-life John Hancock Protection Universal Life policy issued in August of 2017. At issue, the policy assumes a current crediting rate of 5.05-percent.

The goal was to make five premium payments of $40,000 to secure $400,000 of death benefit over the insured’s lifetime. Under current assumptions, the policy was projected to last to maturity or the insured’s Age 125.

At Age 100 the policy has over $130,000 of cash and continues to perform to maturity.

In March of 2018, John Hancock began reducing the crediting rate on this policy from the initial 5.05-percent. The crediting rate reduction went into effect nearly six months after the policy was originally obtained.

Now, let’s fast forward to February of 2021…

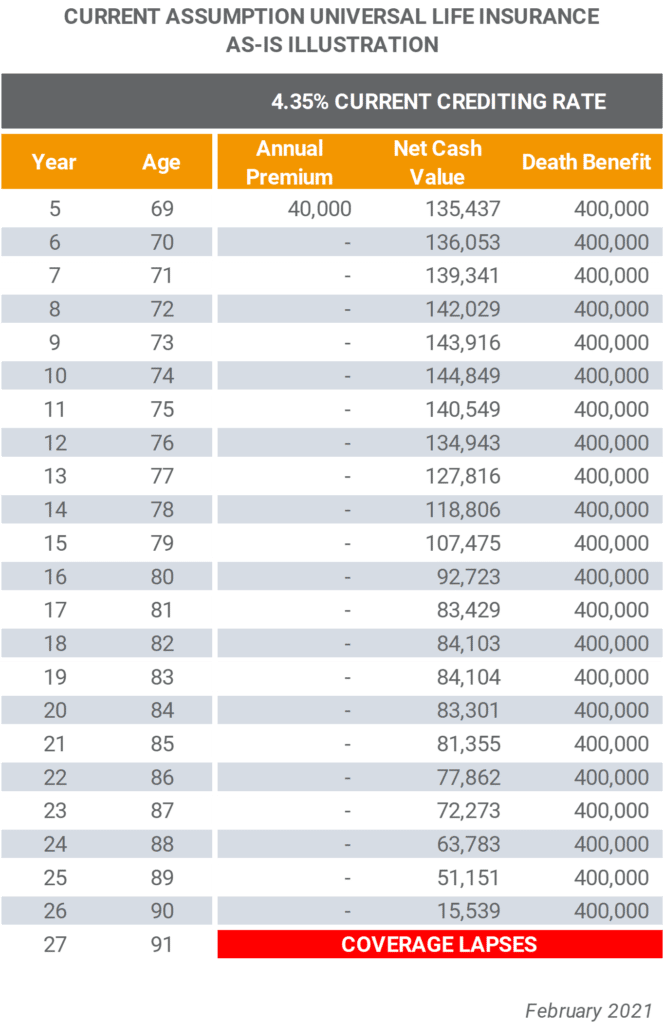

Sometime between August of 2017 and February of 2021 John Hancock reduced the policy crediting rate from 5.05-percent to 4.35-percent.

In August of 2021, the final premium payment of $40,000 is due.

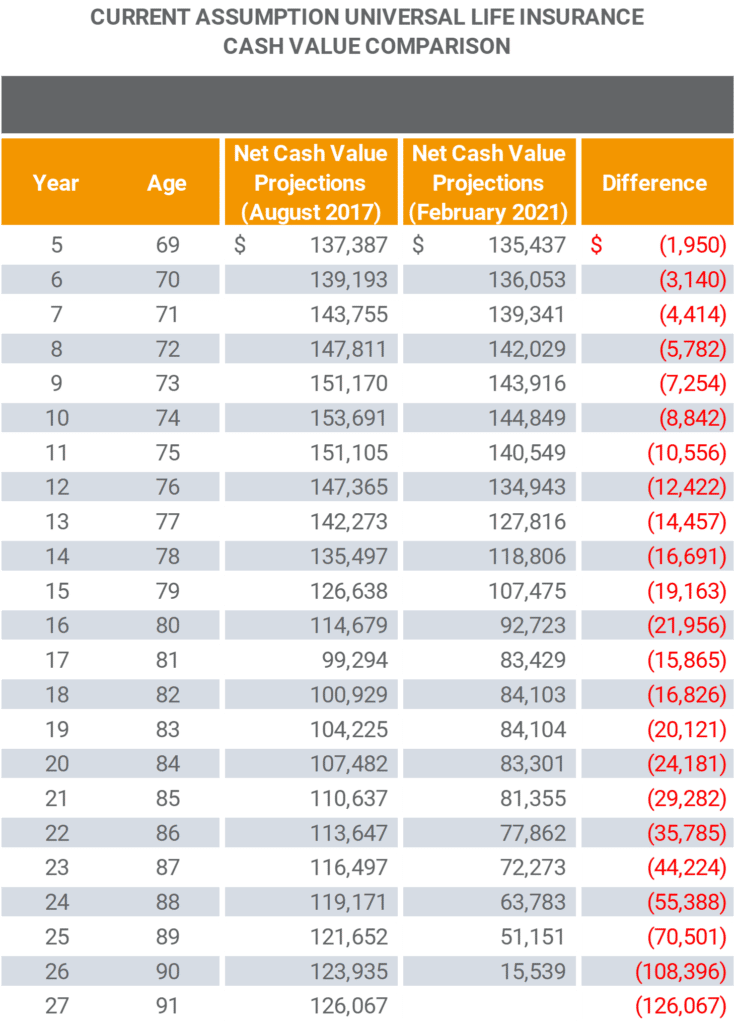

Once the final premium payment is made the policy is projected to have a net cash value of $135,437. This is only $1,950 less than what was originally projected at $137,387, which does not seem like a big deal.

But over time it does become a big deal…

The above compares the initial projected cash values when the policy was issued to the current cash value based on a 4.35-percent crediting rate. The current projected crediting rate erodes the policy cash values to the point at which the policy is projected to lapse at the insured’s Age 90.

There is a difference of more than $100,000 of cash value at Age 90, although the projected crediting rate went down by only 70 basis points.

But Wait. There’s More.

In March of 2022, John Hancock announced they would be increasing the crediting rate from 4.35-percent to 4.65-percent. This is good news for the policy owner.

In August of 2022, we requested an updated illustration as a part of our annual policy review process. The final premium payment of $40,000 was made in the prior year in accordance with the original projections.

Assuming no additional premium payments and the now current crediting rate of 4.65-percent, the policy is projected to last to the insured’s Age 91. This is obviously not significant, but it is a move in the right direction.

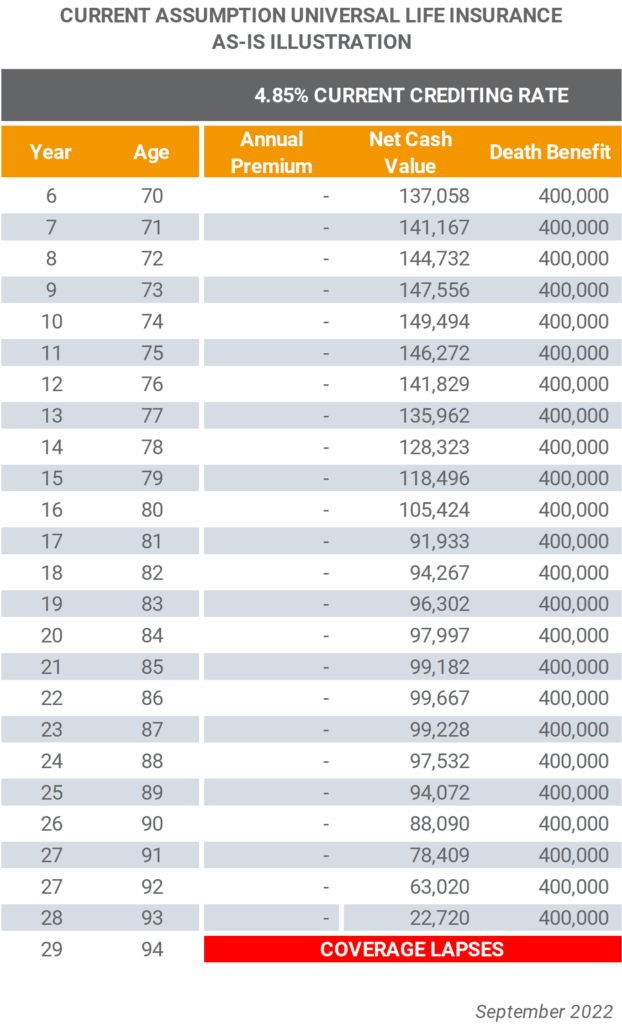

As we were requesting these new in-force illustrations, John Hancock announced for the second time in a six-month period that they would be increasing the current crediting rate again from 4.65-percent to 4.85-percent.

The results of this crediting rate increase now project the policy to last to the insured’s Age 93 / 94.

This is a move in the right direction. But, it still doesn’t get us back to the original projections. Moving forward, it is highly unlikely the policy will average the initial illustrated crediting rate of 5.05-percent over the insured’s lifetime. The result being the coverage will lapse prior to maturity.

Even if the current crediting rate were to increase to 5.05-percent the policy would continue to underperform. This is caused by the policy crediting rate being less than 5.05-percent over the past few years.

In order for the policy to get back on track as initially illustrated the current crediting rate would likely need to exceed 5.25-percent or more over the lifetime of the policy.

What Options Does the Insured / Policy Owner Have?

Option 1 – Do Nothing

The insured can do nothing. By doing nothing the insured will still have the coverage. Assuming he passes away prior to Age 94 his beneficiaries will still receive the death benefit. If he lives beyond Age 93 / 94, he will need to make additional premium payments prior to the policy lapsing. The longer he waits to do this the more expensive it will be.

In fact, if he waits until the policy is about to lapse the premium to maintain the coverage will be $81,456 per year from Age 94 to Age 116. This option would only make sense if the insured’s mortality was imminent.

Option 2 – Make Additional Premium Payments

By making additional premium payments early the cost to get the coverage back to how it was initially illustrated is negligible.

Is it frustrating? Yes.

But dealing with the problem now will have a much smaller financial impact than waiting to deal with it in the future.

For purposes of this, we looked at two options:

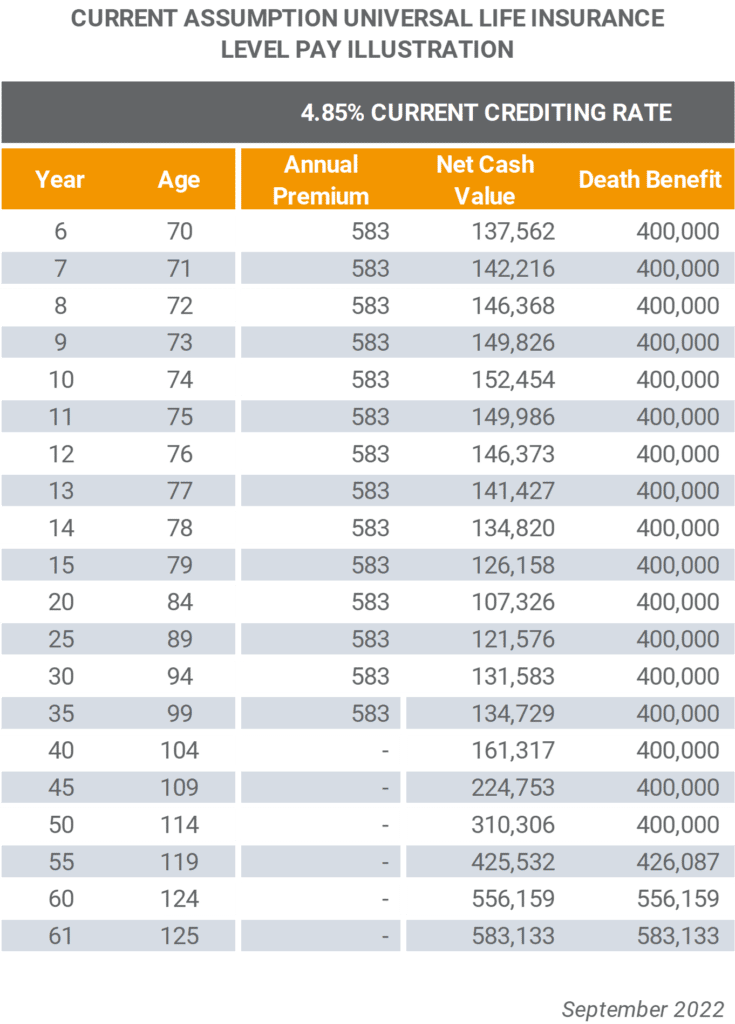

A. Making Level Payments to Age 100 for Coverage to Last to Maturity, and

B. Making a Single, Lump Sum Payment Today for Coverage to Last to Maturity

Option A – Level Payment to Age 100

Assuming the policy owner begins making level premium payments to Age 100 the policy will last to maturity at Age 125.

The total annual premium requires from now until the insured’s Age 100 is $583 per year. If current crediting rates continue to increase the policy owner can reduce this payment or reduce the number of years the payment is made.

Conversely, if crediting rates go down we will be in a similar situation where additional premiums will be required or the coverage will not last as long.

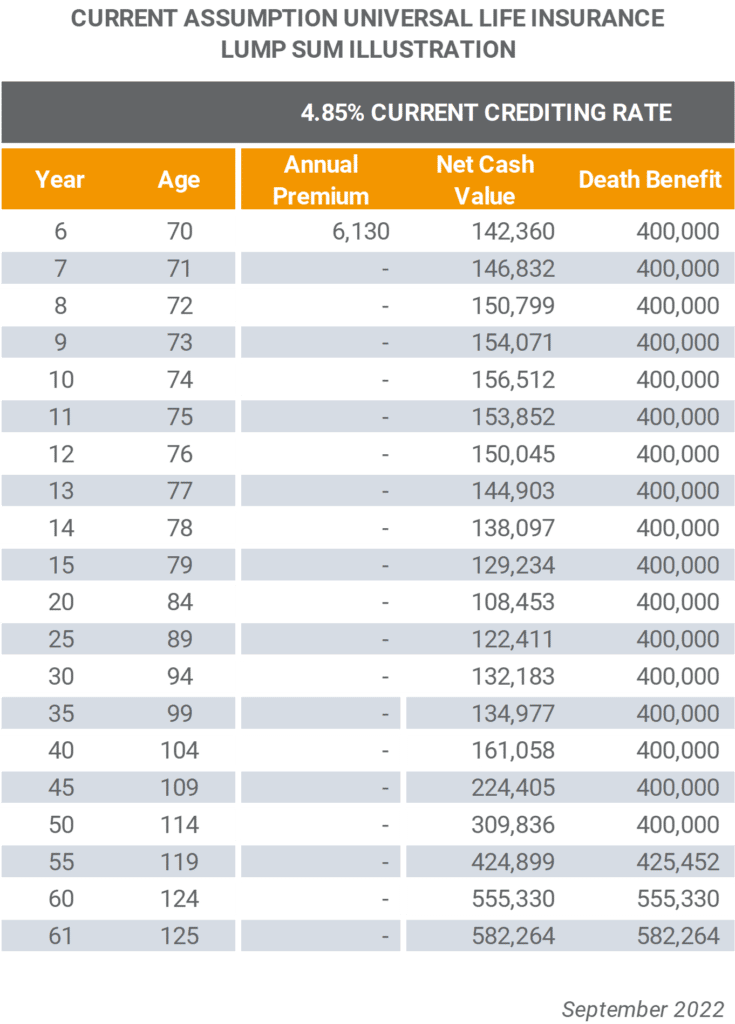

Option B – Lump Sum Payment Today

Making a lump sum payment today will reduce the total cost over time. By making a $6,130 lump sum payment today the coverage will last to maturity (or Age 125).

Again, if crediting rates go down additional premiums may be required. If crediting rates go up the policy cash values will increase having little impact on the policy over time.

Option 3 – Reduce the Death Benefit

The third option the policy owner has is to reduce the death benefit from $400,000 to $392,000. This will result in the policy lasting to maturity. Essentially you are giving up $8,000 of death benefit for the policy to last to Age 125.

The result is a lower death benefit for his beneficiaries, but no additional premiums are required to maintain the coverage over his lifetime.

Final Thoughts on John Hancock’s Crediting Rate Increase

Over the past decades, we have seen significant reductions in current crediting rates and dividend rates. The net result is negative for many owners of current assumption permanent life insurance policies.

Some carriers have even reduced their current crediting rates to the guaranteed crediting rates. This is causing many policies to massively underperform.

John Hancock is the only carrier we are aware of that is increasing its current crediting rates. This is a positive for policy owners and individuals who are interested in securing permanent life insurance.

John Hancock has always been a carrier with very competitive life insurance products. The actions they have taken to increase crediting rates show their commitment to policy owners.

The information contained in this article is hypothetical. Results and performance will vary based on a number of factors. Consult with a licensed professional to learn more.

Jason Mericle

Founder

Jason Mericle created Mericle & Company to provide families, business owners, and high net worth families access to unbiased life insurance information.

With more than two decades of experience, he has been involved with helping clients with everything from the placement of term life insurance to highly sophisticated and complex income and estate planning strategies utilizing life insurance.

Stay In The Know

Get exclusive tips and practical information to help you create, grow, sustain, and protect your wealth.

Ask Us Anything

We Are Here To Answer Your Questions