Low Interest Rates Causing Permanent Life Insurance (Universal and Whole Life) to Massively Under Perform

Crediting rates and dividend rates on permanent life insurance policies are at all-time lows and will likely continue to decrease. An underperforming life insurance policy can be financially devastating for policy owners of permanent life insurance.

To understand how crediting and dividend rate reductions impact policy cash values, premiums, and death benefits it is important to understand some basic fundamentals of permanent life insurance.

Generally speaking, most permanent policies consist of four underlying factors (1) guaranteed crediting or dividend rate, (2) current crediting or dividend rate, (3) guaranteed cost of insurance, and (4) current cost of insurance. Any downward adjustment to current rates and increases to the current cost of insurance can result in an underperforming life insurance policy.

Guaranteed Crediting Rate or Dividend Rate

The Guaranteed Crediting Rate or Dividend Rate of a universal life insurance policy or whole life insurance policy is the contractual minimum the carrier is legally required to credit the policy cash value.

Most policies will have a guaranteed crediting or dividend rate between 2-percent and 4-percent. The guaranteed rate will vary from policy to policy. In fact, most carriers have different policies with different guaranteed rates.

Whole life policies will generally offer higher guaranteed rates than most universal life policies. Also, the longer your policy has been in force, the more likely it is to have a higher guaranteed rate.

Current Crediting Rate or Dividend Rate

The Current Crediting Rate or Dividend Rate of a universal life insurance policy or whole life insurance policy is the rate the policy cash value is currently receiving.

Why Is the Crediting Rate or Dividend Rate So Important?

Under a current assumption universal or whole life insurance policy the current crediting rate projects how a policy MAY perform in the future, NOT how it will perform.

When individuals are shown a current assumption permanent life insurance product there are usually two sets of projections on the illustration.

The first set of projections are the Guaranteed Assumption. The Guaranteed Assumptions assume the Guaranteed Crediting Rate and the Maximum Cost of Insurance Charges. This is a worst-case scenario.

The second set of projections illustrate the Current Assumptions. The Current Assumptions assume the Current Crediting Rate and Current Cost of Insurance Charges. This is a picture of where the carrier and policy are at today. It is not necessarily a best-case scenario since Current Crediting Rates can end up being higher than projected.

A carrier may also reduce the policy’s Current Cost of Insurance, which would improve the policy’s performance. As a reminder, the Current Assumptions are not GUARANTEED.

Let’s take a look at an example…

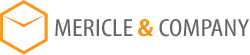

In 2018, the insured purchased the following policy. It has a $500,000 death benefit and was initially illustrated assuming a 4.95% Current Crediting Rate.

Under the Guaranteed Assumptions column, you will notice that if premiums continue to be paid there is a Guaranteed Death Benefit that lasts thru Age 90. This policy has better guarantees than most Current Assumption Universal Life Insurance policies. Many carrier guarantees will typically last somewhere between Age 70 and 85.

The Current Assumptions show the policy with enough cash value and premium to last well beyond the insured’s Age 105. In fact, based on the non-guaranteed assumptions, the policy owner can discontinue premium payment after Age 105 and the coverage will last to Age 125.

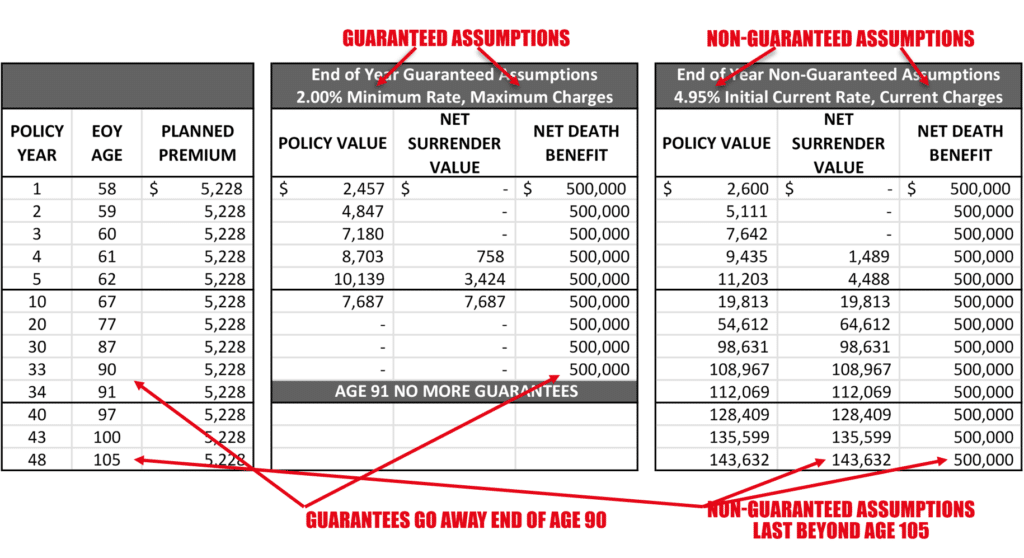

Unfortunately, two years later, this carrier’s Current Crediting Rate dropped from 4.95% to 4.55% (or 40 basis points). When we updated the illustrations and assumptions the policy looked like the following:

On the left, you will see the current projections using the policy’s initial assumptions. On the right, you will see how the policy will perform under the current $5,228 yearly premium and current assumptions.

Reducing the current crediting rate from 4.95% to 4.55% causes the policy to lapse at the insured’s Age 99. The difference in projected cash value at Age 98 is approximately $130,000. All of this is because of a current crediting rate reduction of .40 percent.

What Are Our Options for Fixing an Underperforming Life Insurance Policy?

The first option is to do nothing. You can wait-and-see to determine if the current crediting rate goes back up to 4.95%, but even then the crediting rate would have to be more than 4.95% to perform as originally issued.

The second option is to reduce the death benefit. The client has the option to reduce the death benefit slightly with the goal of having the coverage last longer.

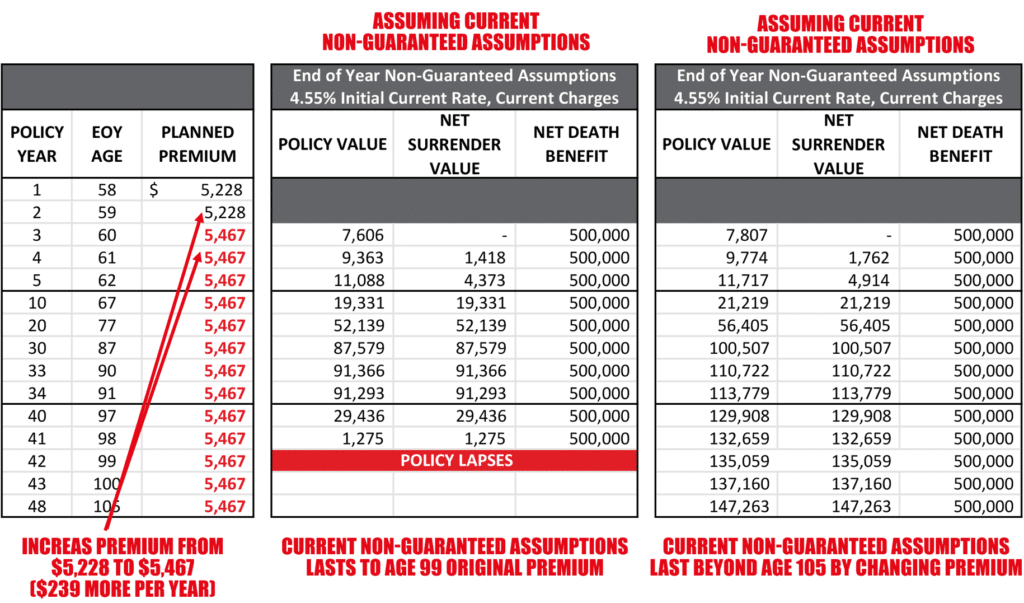

The third option is to increase the yearly premium payment based on the current assumptions. This would allow the policy to get back on track. At a time when the current crediting rate goes up you could reduce the premium payments at that time to keep the policy on track. Let’s take a look…

This image shows by increasing the yearly premium from $5,228 to $5,467 the policy will perform in a similar fashion as to when it was originally set up assuming current policy assumptions. By paying $239 more dollars per year the policy returns to its original goal of lasting to Age 125.

Obviously, if current crediting rates continue to decline the underperforming life insurance policy will require additional premiums. The benefit of making this adjustment now instead of waiting for 15-years is the increase in premiums can be rather insignificant. If we were to wait to make the adjustment the additional premium could be quite substantial.

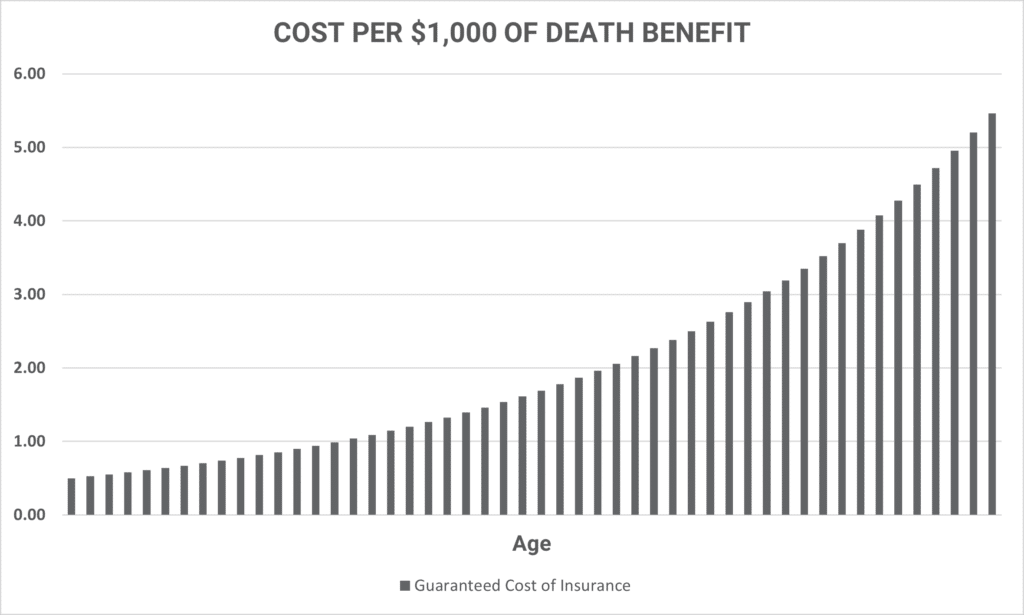

Guaranteed Cost of Insurance

The Guaranteed Cost of Insurance is the maximum amount a carrier can charge in a policy. The cost of insurance is generally based on your age and death benefit. As you get older the cost of insurance is higher because you are closer to mortality.

Remember, the Guaranteed Cost of Insurance is the maximum amount the carrier can charge in any given year. Like the Guaranteed Crediting Rate and Current Assumption Crediting Rate, it is likely the carrier is using Current Cost of Insurance charges.

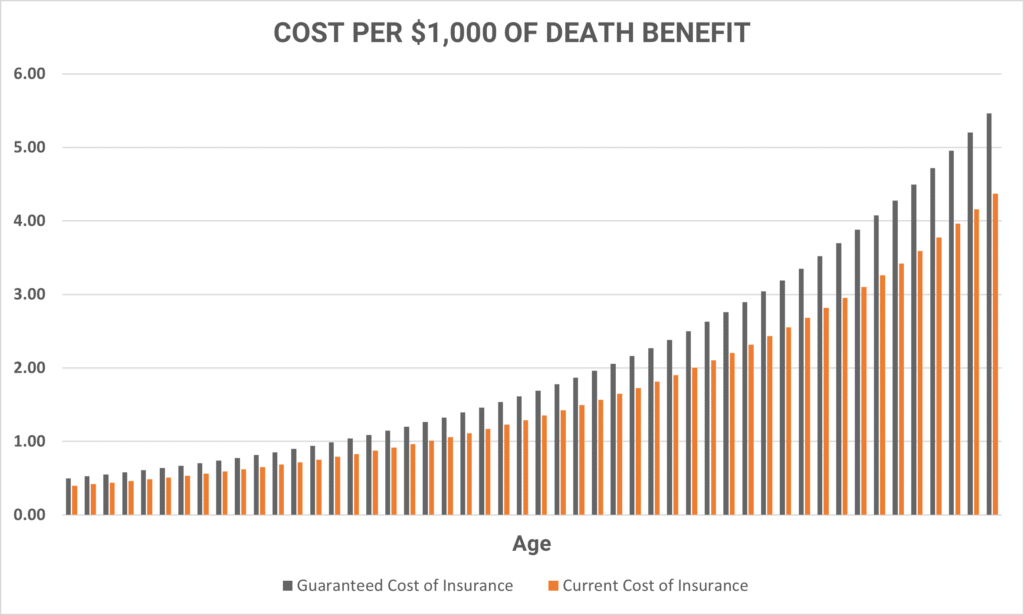

Current Cost of Insurance Charges

Like the Current Crediting Rate, the Current Assumption column we reviewed earlier, illustrates and assumes the Current Crediting Rate and Current Cost of Insurance. While the insurance carrier can charge up to the Guaranteed Cost of Insurance, it is likely they are not.

In a time where life expectancies are increasing it would not make much sense for an insurance carrier to increase their current cost of insurance.

The Reality of Low-Interest Rates and Underperforming Life Insurance

Right now, more so than ever, people need to have their permanent life insurance reviewed either by their existing advisor or an individual with expertise in this area.

Being in a low-interest rate environment has a significant impact on carriers, policies, and in turn policy owners. We are currently seeing current crediting rate and dividend rate reductions across the board with all carriers.

The example we illustrated above demonstrates how the slightest of declines can impact a life insurance policy’s longevity and performance. Over the past year, we have reviewed numerous policies on individuals in their 80s and even 90s. Many underperforming life insurance policies are in dire need of additional premiums to keep the policy in force.

The sooner we can identify potential issues the smaller the economic impact will be to the policy owner. If you or someone you know owns a permanent life insurance policy that you would like to have reviewed please click this link to schedule a call to discuss further.

The above information above is for informational purposes and should not be relied upon for individual planning purposes. The information is solely for marketing and educational purposes and not for individual situations.

Jason Mericle

Founder

Jason Mericle created Mericle & Company to provide families, business owners, and high net worth families access to unbiased life insurance information.

With more than two decades of experience, he has been involved with helping clients with everything from the placement of term life insurance to highly sophisticated and complex income and estate planning strategies utilizing life insurance.

Stay In The Know

Get exclusive tips and practical information to help you create, grow, sustain, and protect your wealth.

Ask Us Anything

We Are Here To Answer Your Questions