What Are The Different Types of Life Insurance Policies?

There are several types of different life insurance policies. Life insurance policies can be really simple or extremely complex. Much of this is a function of the type of policy and how it performs.

A life insurance policy can be broken down into two broad types of life insurance categories – term life insurance and permanent life insurance.

Within each of these categories are a number of subcategories. Each subcategory has its own unique features.

Term life insurance provides life insurance protection over a specified period of time (or term). The intent of permanent life insurance is to provide life insurance protection for the entire life of the insured.

In this article, we will discuss different types of life insurance and provide a summary of how each policy works.

TERM LIFE INSURANCE

Term life insurance is one of the simplest types of life insurance products available. It is widely used by families who have a desire to provide family protection over a specific period of time.

As with all fully underwritten life insurance coverage, premiums are based on the age and health of the individual at the time they apply for insurance coverage.

When coverage is applied for, the policy owner decides the length of the coverage. The most common term life insurance policies are:

- 10-Year Term

- 15-Year Term

- 20-Year Term

- 30-Year Term

Premiums are guaranteed based on the chosen term. The longer the term, the more expensive the premium. As long as premiums are paid on time the carrier will pay the death benefit.

Unlike permanent life insurance, term life insurance does not accumulate cash value. The best analogy of term life insurance is that it is like renting a home. You pay rent over a period of time, but you do not have any equity.

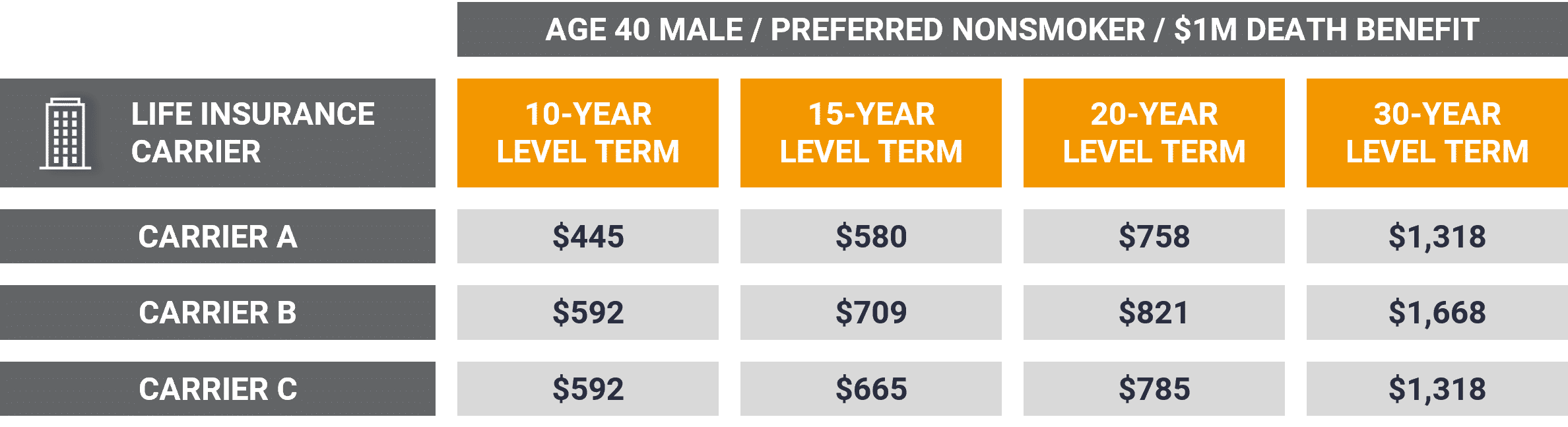

Term Life Insurance Example

Assumptions:

- 40-Year-Old Male / Preferred Nonsmoker Health Class

- 40-Year-Old Female / Preferred Nonsmoker Health Class

- $1,000,000 Death Benefit on Each Individual

- Premiums are Paid Annually

The premiums are guaranteed not to change for the length of the term. For instance, the $445 annual premium offered by Carrier A is guaranteed for 10-years. Each year the premium will be $445. However, if the insured needs coverage in Year 11 the premium can increase significantly.

If you need coverage beyond the chosen term, the carrier will allow you to continue the coverage. However, premiums will increase drastically and will increase annually.

Term Life Insurance Conversion

Most term life insurance policies allow the policy owner to convert their coverage to permanent life insurance. The conversion has to be to a permanent policy issued by the same company the term life insurance is with.

The benefit of a conversion is it does not require you to go through the underwriting process again. They will issue the permanent policy using the health class rating you received when the term life insurance policy was originally issued. This can be beneficial for an insured who has had changes to their health.

Term life insurance conversions can only be done during the term period or prior to a certain age. Each term life insurance policy will include the maximum conversion age in the policy contract. It will typically be age 65, 70, or 75.

If you purchase a 30-year term policy at age 50 and you can convert up to age 75, you will only be able to convert the coverage during the first 25-policy years.

Most carriers offer a term insurance conversion, but not all. Some carriers will limit what permanent product you can convert to. The pricing will likely be much higher than their other permanent life insurance products.

PERMANENT LIFE INSURANCE

Permanent life insurance is meant to provide coverage for the life of the insured. A permanent life insurance policy is a type of life insurance that is more expensive than term life insurance. Unlike term insurance, permanent life insurance allows the policy to build cash value (or equity) within the policy.

Permanent life insurance policies come in the form of two types of life insurance: Whole Life Insurance and Universal Life Insurance.

Under these subcategories is also a number of additional subcategories.

Permanent life insurance differs from term life insurance in that permanent insurance has cash value. The cash value is equity inside of your life insurance policy. You can use policy cash values to take tax-free policy distributions or offset future insurance expenses.

The difference between whole life insurance and universal life insurance policies can be different and complex.

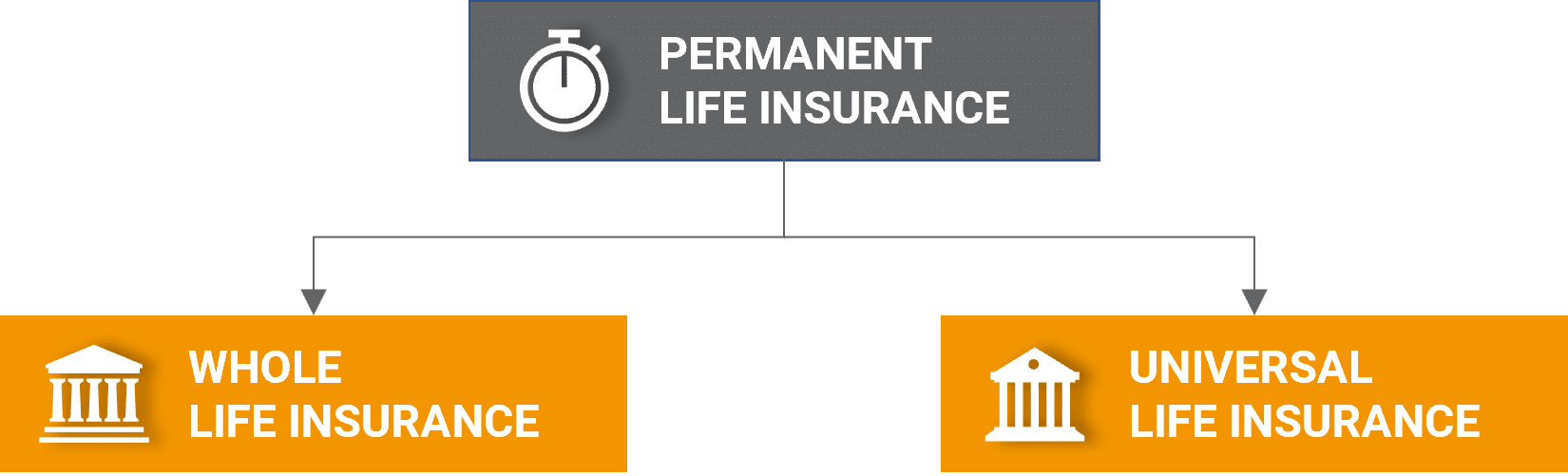

WHOLE LIFE INSURANCE

Whole life insurance is a type of life insurance that provides guaranteed protection and premiums over the insured’s lifetime, as long as premiums are paid. A whole life policy also builds cash value.

The guarantees of a whole life insurance policy are based on guaranteed dividend rates and guaranteed mortality charges. Whole life insurance dividends are a portion of the carrier’s profits that are paid to policy owners. Current dividend rates may be higher than the guaranteed dividend rate, providing additional benefits to policy owners.

A whole life insurance policy with guaranteed dividends will tend to have higher premiums. While a whole life insurance policy assuming a current dividend rate may have lower premiums.

Additional benefits may include Paid-Up Additions (PUAs). Paid-Up Additions are added to the base death benefit. Dividends may also be used to offset future premium payments or distributed directly to the policy owner.

Premium payments for a whole life insurance policy offer little flexibility. Missed premiums can result in policy loans that can have an adverse outcome on policy performance.

LEVEL PREMIUM WHOLE LIFE INSURANCE

Level Premium (or Level Pay) Whole Life Insurance is the most common form of whole life insurance. A Level Pay Whole Life Insurance policy requires the policy owner to pay premiums for the insured’s lifetime. This type of policy will typically have guaranteed and non-guaranteed features.

Guaranteed performance is based on the guaranteed dividend rate and guaranteed mortality. The guaranteed dividend rate is the minimum dividend rate a carrier is obligated to pay. The guaranteed mortality is the maximum amount a carrier can charge for expenses.

Non-guaranteed rates are based on a carrier’s current or actual dividend rate. The non-guaranteed rate can never be less than the guaranteed rate.

Level Premium Whole Life Insurance Example

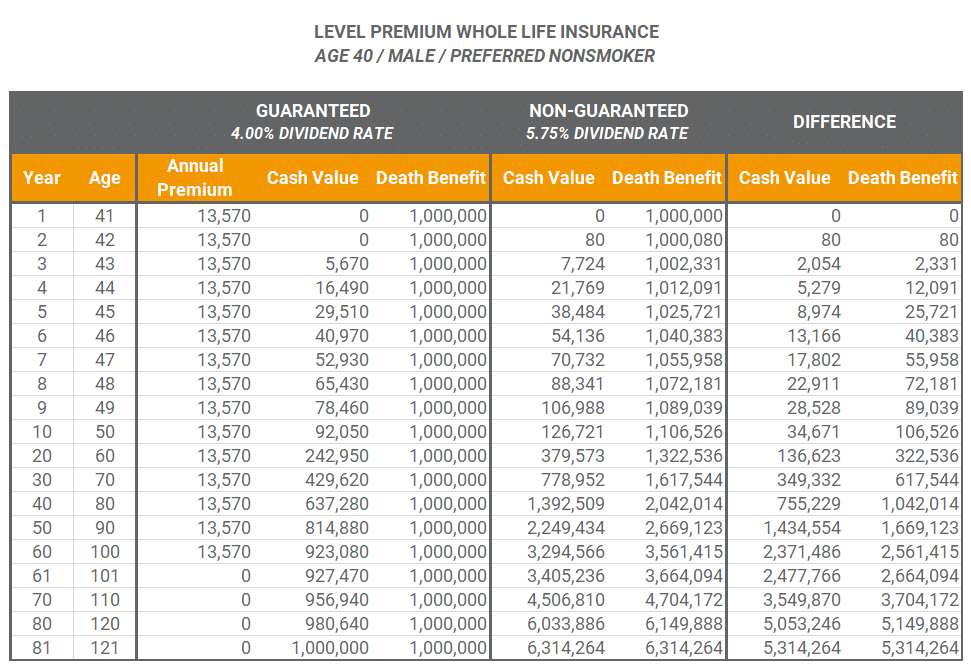

The following example assumes the insured is a 40-year-old male in a preferred nonsmoker health class.

Here we have two sets of columns. The first set is the Guaranteed columns. These columns are guaranteed by the life insurance carrier. As long as the $13,570 annual premium is paid, the beneficiaries will receive at least $1M of death benefit. This is the worst-case scenario.

The second set of columns is the Non-Guaranteed assumptions. The Non-Guaranteed projections are based on the carrier’s current Non-Guaranteed Dividend Rate and current Mortality Charges.

If the Non-Guaranteed Divided Rate drops below 5.75-percent, the non-guaranteed projections will be lower. Policy performance will be better if it is higher.

If the policy continues to perform based on the Non-Guaranteed assumptions, the policy owner may be able to use cash values to Offset or pay future premiums. Doing this would result in the policy death benefit and cash value being less. But, the policy owner would not be required to make future premium payments.

You will notice at Age 80 the Non-Guaranteed Cash Value is $755,229 more than the Guaranteed Cash Value. In the same year, the Non-Guaranteed Death Benefit is over $2M.

What If The Non-Guaranteed Dividend Rate Goes Down?

If the Non-Guaranteed Dividend Rate drops it will only affect the Non-Guaranteed Cash Value and Death Benefit. The Guaranteed values will never change provided premium payments continue to be made on time.

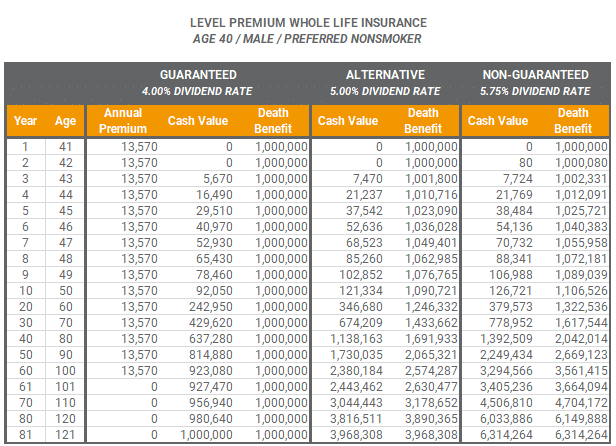

The following example assumes an Alternative Non-Guaranteed Dividend Rate of 5-percent.

Nothing has changed in the Guaranteed Columns. However, the projections in the Alternative Columns have gone down when compared to the current Non-Guaranteed Dividend Rate.

At Age 80 projected policy cash values are approximately $250,000 less in the Alternative Columns versus the current Non-Guaranteed columns. The Death Benefit is about $350,000 less.

LIMITED PAY WHOLE LIFE INSURANCE

Limited pay whole life insurance functions the same way as Level Pay Whole Life Insurance. The biggest difference is premiums are paid over a shorter period of time.

Most policies offering a limited pay require you to do this at policy inception. Products offering a limited pay usually require you to do it as a:

- One-time lump sum payment

- Over a 10-Year Period (or 10-Pay)

- To a Certain Age such as Age 65

Limited Pay Whole Life insurance premiums will be higher than Level Pay Whole Life Insurance. But premiums will be paid over a shorter period of time. Over the policy’s life, the total outlay will likely be less with a Limited Pay Whole Life policy.

Limited Pay Whole Life Insurance Example

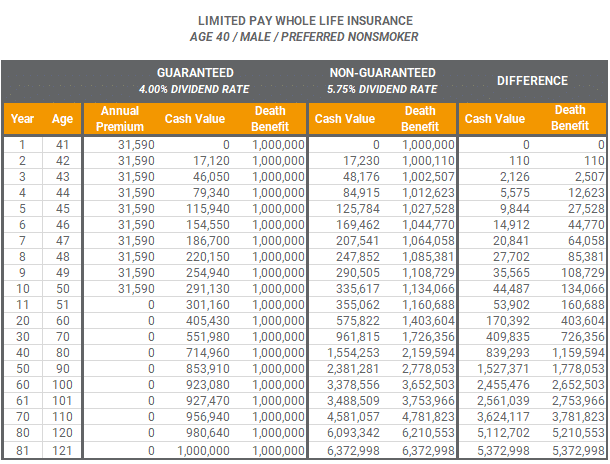

Here is an example of the same 40-year-old male from our prior example. The only difference is we are going to pay premiums for 10-years and not for the insured’s entire life.

Using the same policy from the Lifetime Whole Life Insurance example you will see the premium increases from $13,570 per year for life to $31,590 per year for 10-years. When the 10th premium payment is made the policy is guaranteed for the life of the insured.

Because more money is being contributed to the policy in the early years, both the guaranteed and non-guaranteed policy performance is higher than it is when paying over the lifetime of the policy.

The Guaranteed and Non-Guaranteed assumptions work the same way as it does with a Level Pay Whole Life insurance policy. The biggest difference is the number of years premiums are paid.

UNIVERSAL LIFE INSURANCE

Universal life insurance allows you to build cash value (just like a whole life insurance policy) and includes flexible premium payments and death benefits.

One of the biggest differences between whole life and universal life is flexible premium payments. You are able to control the frequency and amount of premium payments.

The other difference is policy cash values are based on a crediting rate and not a dividend rate. How the crediting rate is determined will vary based on the type of universal life insurance policy you are using.

The amount and timing of premium payments will directly affect a policy’s cash value and the ability to maintain coverage in the future. A policy with low cash values will not last long without additional premiums.

There are four primary types of universal life insurance policies:

- Current Assumption Universal Life Insurance

- No Lapse Guarantee Universal Life Insurance

- Indexed Universal Life Insurance

- Variable Universal Life Insurance

The main difference between these four types of life insurance is how the policy cash value is credited.

CURRENT ASSUMPTION UNIVERSAL LIFE INSURANCE

Current Assumption Universal Life Insurance offers death benefit and cash value accumulation based on both guaranteed and current assumptions. It offers flexible premiums and cash value growth.

Current assumption universal life insurance policies (similar to whole life) have four factors that affect policy performance. The four factors are as follows:

- Guaranteed Crediting Rate

- Current Crediting Rate

- Guaranteed Mortality Costs

- Current Mortality Costs

The Guaranteed Crediting Rate is the minimum rate a policy cash value can be credited. Most Current Assumption Universal Life Insurance policies will have a Guaranteed Crediting Rate ranging from 2 to 4-percent. The older the policy, the higher the Guaranteed Crediting Rate will typically be.

The Current Crediting Rate is the rate at which the policy cash value is currently being credited. This rate will be equal to the Guaranteed Crediting Rate or higher. The Current Crediting Rate is based on the return of the insurance carrier’s General Account. General Accounts are often invested in corporate bonds, treasury bonds, and other conservative investment vehicles.

In today’s environment, Current Crediting Rates will range from 3% – 4.5%.

Guaranteed Mortality Costs are the maximum amount a carrier can charge for the coverage. The Current Mortality Costs are what the carrier is actually charging for the coverage.

The best way to think of it is, if the Current Mortality Cost is $1 per $1,000 of life insurance coverage the charges for a $1M policy would be $1,000. But the policy may have a Guaranteed Mortality Cost of $2 per $1,000 of coverage resulting in policy charges of $2,000.

While the carrier may be charging Current Mortality Costs (which most do), they can contractually increase the charges to the Guaranteed Mortality Costs.

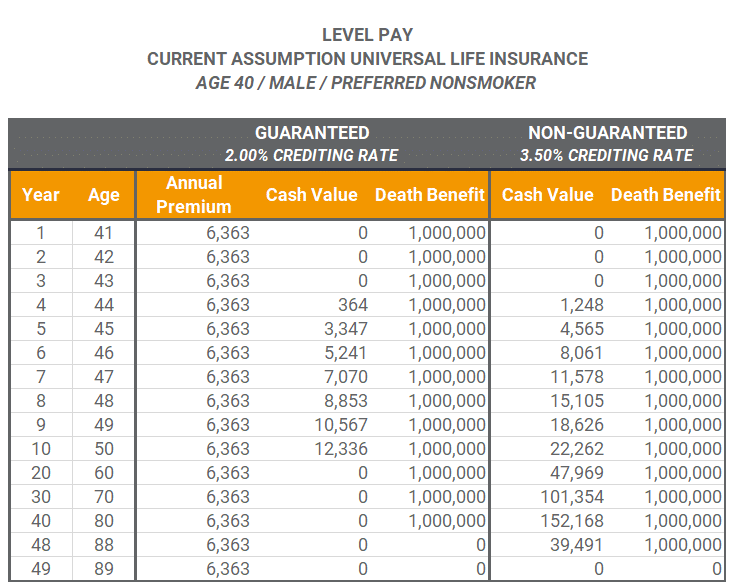

Current Assumption Universal Life Insurance Example

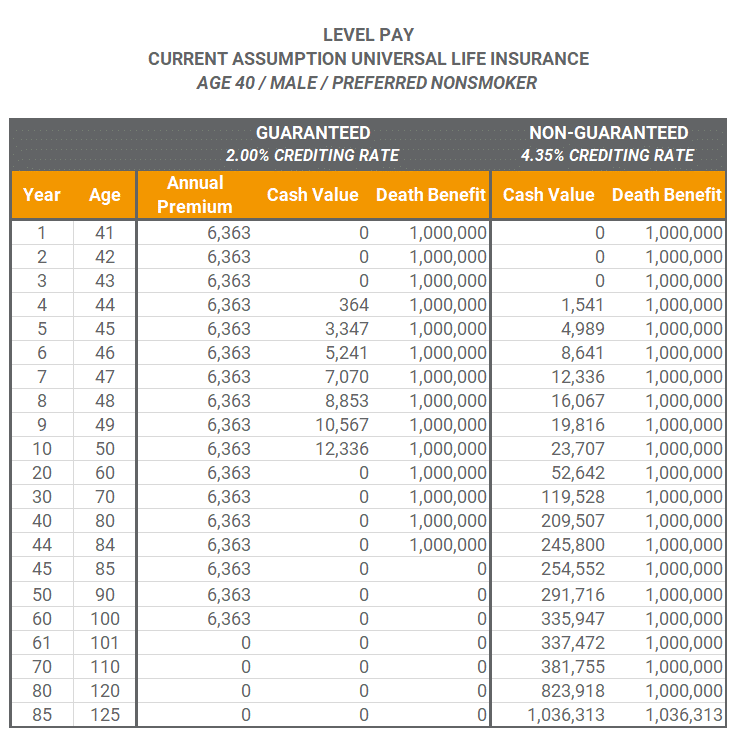

The following example assumes the same 40-year-old male from our prior examples. In this scenario, we are solving for the premium to secure $1M of coverage using Current Assumptions.

Based on a $6,363 annual premium, this policy will guarantee $1M of life insurance protection through the insured’s Age 84. After Age 84 the policy contract guarantees go away.

Using Current Assumptions, the policy will continue to last until the insured’s Age 125. This assumes a policy cash value Non-Guaranteed Crediting Rate of 4.35-percent.

If the Non-Guaranteed Crediting Rate performs higher than 4.35-percent, the policy owner may be able:

- Reduce Annual Premium Payments, or

- Stop Making Premium Payments at some Point in the Future

Current Assumptions Universal Life Insurance premiums are usually determined based on current assumptions, death benefit, and how long the coverage will last. A reduction in Current Crediting Rates or increase in Current Mortality Costs may require the policy owner to:

- Increase premiums,

- Reduce the length of time the coverage lasts

- Lower the death benefit, or

- A combination of the three.

What If The Non-Guaranteed Crediting Rate Goes Down?

In this example, we are assuming the Non-Guaranteed Crediting Rate drops from 4.35-percent to 3.5-percent. We are also assuming the policy owner does not make any changes to the annual premium.

The policy still offers the same guarantees. However, the reduction in the Non-Guaranteed Dividend Rate causes the policy to lapse in Policy Year 49 or Age 89.

You can avoid this by increasing premiums payments or reducing the amount of coverage. We recommend doing a policy review on annual basis for these types of policies. A small increase in premiums early on can help this policy to continue to perform similar to the original projections.

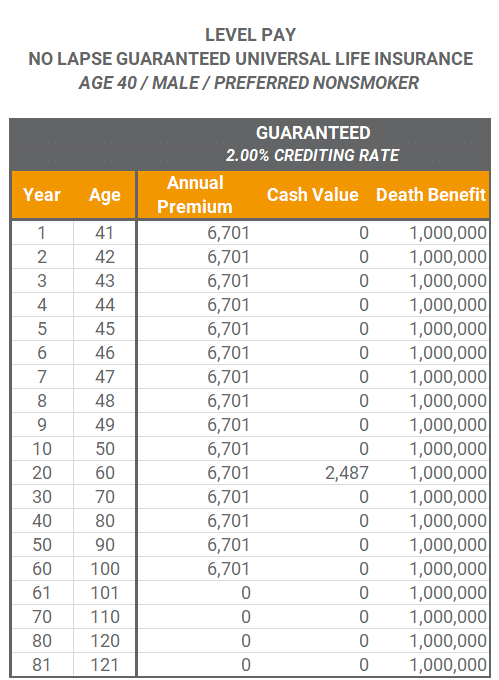

NO LAPSE GUARANTEE UNIVERSAL LIFE INSURANCE

No Lapse Guarantee (NLG) Universal Life Insurance provides guaranteed universal life insurance coverage for the life of the insured. Regardless of if a carrier adjusts crediting rates or mortality costs, the premium and death benefit are guaranteed.

The policy owner can choose to make premium payments over the life of the policy or over a shorter period of time. As long as the carrier receives premium payments on time, premiums will never change.

No Lapse Guarantee Universal Life insurance policy generally offers lower cash value in comparison to other permanent life insurance. In exchange, the policy has very few moving parts. No Lapse Guarantee Universal Life insurance works more like a permanent term life insurance policy.

No Lapse Guarantee Universal Life Insurance policies do offer premium flexibility. However, if the policy is being minimally funded, it is likely failure to make a premium payment will result in coverage lapsing or the guarantees going away.

Like other universal life insurance policies, the policy owner can elect to pay over a shorter period of time or for the life of the insured. If paying over a shorter period of time, the policy owner can elect to lengthen the number of years to pay premiums at any time. This will reduce the premium, but lengthen the number of years premiums are necessary.

INDEXED UNIVERSAL LIFE INSURANCE

Indexed Universal Life Insurance is similar to a Current Assumption Universal Life policy. It provides a death benefit and cash accumulation.

With an Indexed Universal Life Insurance policy, the policy owner has the option of placing the cash value in the Fixed Account or an Indexed Account. The Fixed Account will credit a fixed crediting rate that includes a minimum Guaranteed Crediting Rate.

The Indexed Account allows policy cash values to be credited based on how the chosen index performs. Index Accounts are placed in an Index Segment. The carrier will record the beginning and ending value of an Index Segment in order to determine the Segment Growth Rate. Index Segment are usually calculated over the course of 1-year, but can also occur over a 5-year period.

Indexed Universal Life Insurance is unique because when index returns are negative, the policy is credited the Floor. The Floor is a Guaranteed Minimum Crediting Rate. Most Index Universal Life policies offer a Floor of 0-percent or 1-percent.

The Index Growth will be subject to a Cap Rate, Participation Rate, and/or Spread. These rates are what ultimately determine the cash value crediting rate.

Cap Rates

Cap Rates are the maximum crediting rate an Indexed Account can be credited. For instance, assuming an Index Segment has a Cap Rate of 12-percent and the Index Account returns 15-percent. The portion of the policy allocated to this Index Account will be credited the Cap Rate of 12-percent.

If the Index Account returns 6-percent, the policy cash value will receive a credit of 6-percent. If the Index Account returns -28 percent, the policy will receive the minimum Floor crediting rate of 0-percent.

Participation Rates

Participation Rates are a percentage that is applied to the Segment Growth Rate. In the example above, we assumed a 100-percent Participation Rate. However, some Index Segments may have a 150-percent Participation Rate. The Segment Growth Rate is then multiplied by the Participation Rate to determine the amount the Index Account is credited.

For instance, assuming a Segment Growth Rate of 6-percent and a Participation Rate of 150-percent would result in the Index Account being credited 9-percent (6% Segment Growth Rate TIMES 150% Participation Rate).

Now, let us assume Segment Growth Rate of 10-percent, Participation Rate of 150-percent, and Cap Rate of 12-percent. The Segment Growth Rate is multiplied by the Participation Rate resulting in a Crediting Rate of 15-percent. However, there is a Cap Rate of 12-percent. Because of this, the Index Account will be credited 12-percent, not 15-percent.

Spread

The spread is usually reserved for Index Accounts that do not have a Cap Rate. The Spread is a percentage return (or minimum threshold) the Index Segment must return before it is credited.

For instance, assuming a 5-percent Spread and 22-percent Segment Growth Rate would result in an Index Crediting Rate of 17-percent (22-percent Segment Growth Rate LESS 5-percent Spread). If the Segment Growth Rate is 3-percent, the Index Account will be credited the Floor of 0-percent.

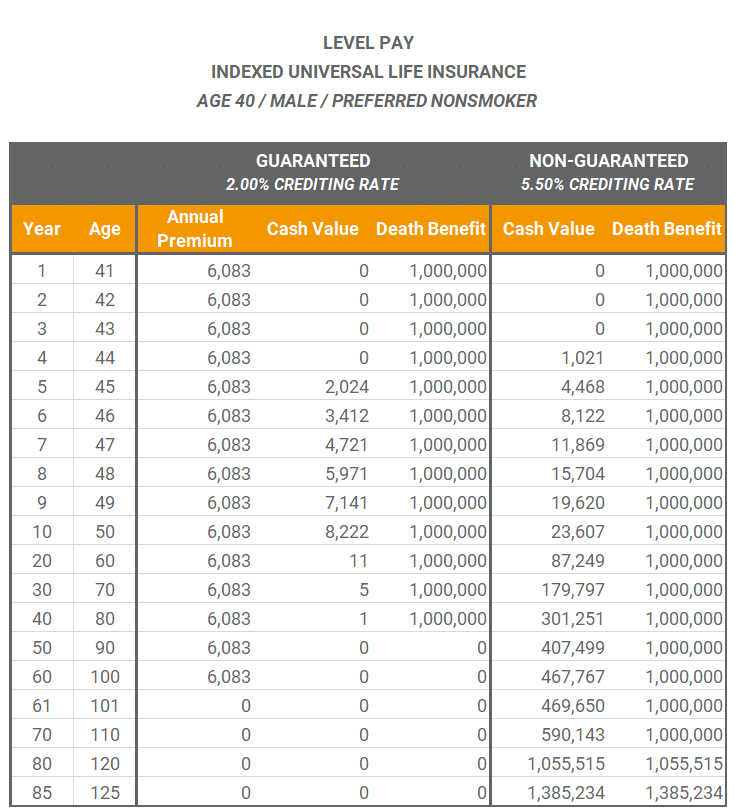

Indexed Universal Life Insurance Example

In this example, we are assuming policy cash values are in the Index Account. The Index Account is based on the S&P 500 1-Year Point-to-Point Index Segment. The Index Segment has a 100-percent Participation Rate and 9.00-percent Cap Rate. We have assumed an average annual indexed crediting rate of 5.50-percent.

This policy is similar to a Current Assumption Universal Life Insurance policy. The main difference is how the policy cash value Crediting Rate is determined.

Instead of the carrier applying a fixed Crediting Rate to policy cash values, the crediting rate is determined based on the performance of the underlying Index Account.

VARIABLE UNIVERSAL LIFE INSURANCE

Again, Variable Universal Life Insurance is similar to Current Assumption Universal Life Insurance. Both types of policies are based on current and guaranteed assumptions and offer premium flexibility.

The cash value can be placed in a fixed account or invested across a number of sub-accounts. Sub-accounts are similar to mutual funds. Most Variable Universal Life Insurance policies offer a range of sub-accounts to policy owners.

Sub-accounts will be comprised of stocks, bonds, or money market accounts. Each sub-account will have its own area of focus such as growth, value, emerging markets, etc. The policy owner can allocate the cash value across multiple sub-accounts in order to diversify policy performance. Sub-accounts will also include management fees in addition to policy expenses and charges.

Sub-accounts are subject to market risk and market returns. Unlike Indexed Universal Life Insurance, you can experience negative returns in a Variable Universal Life Insurance policy.

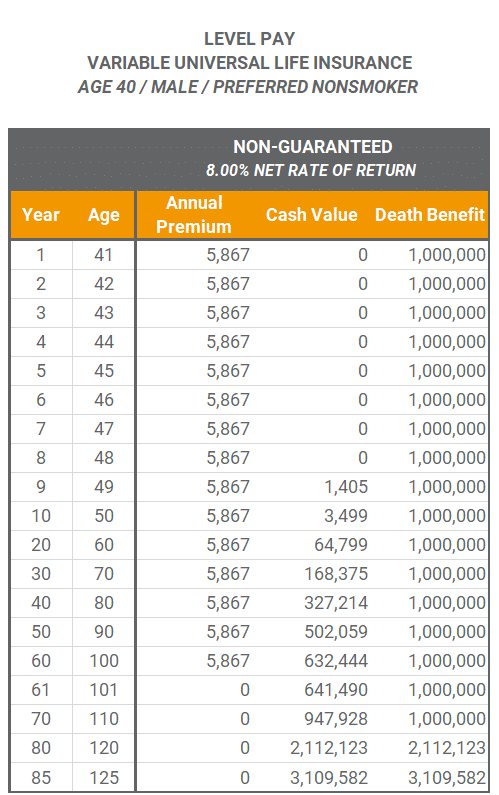

Variable Universal Life Insurance Example

This example assumes the cash value is fully invested in the market. We are using an assumed 8-percent return to project policy performance.

Few Variable Universal Life Insurance policies offer guarantees. Although there are some carriers and products that do.

In this example, based on an 8-percent return, the annual premium to maintain $1M of life insurance coverage is $5,867. Like other types of life insurance policies, if actual returns are less than current projections, adjustments to the policy will be necessary.

FINAL THOUGHTS ON TYPES OF LIFE INSURANCE

As we have reviewed, an insured has a number of types of life insurance policies to consider. In addition, product suites will vary from carrier to carrier. Each carrier offers different policy types. There are certain carriers that do not offer whole life, while other carriers may not have an indexed universal life insurance policy.

What is important for anyone considering life insurance is to work with somebody who understands the different types of life insurance, and what you are trying to accomplish. From there, they will be able to present you with different policy options that make the most sense for you.

In some cases, a combination of different types of life insurance policies may make the most sense. In other cases, term life insurance may be exactly what you need.

The intent of the above information is not to be opinions or advice for tax, legal, accounting, or investment advice. Consulting with your attorney and/or tax advisor prior to the application of this general information for specific situations is advisable.

The values shown are hypothetical. Actual financial outcomes may be more or less favorable. Each situation will vary from client to client. The purpose of the above information is for educational purposes only.

IRC CIRCULAR 230 NOTICE: To the extent this message or any information concerns tax matters, it is not intended to be used by a taxpayer to avoid penalties that may be imposed by law.

Jason Mericle

Founder

Jason Mericle created Mericle & Company to provide families, business owners, and high net worth families access to unbiased life insurance information.

With more than two decades of experience, he has been involved with helping clients with everything from the placement of term life insurance to highly sophisticated and complex income and estate planning strategies utilizing life insurance.

Stay In The Know

Get exclusive tips and practical information to help you create, grow, sustain, and protect your wealth.

Ask Us Anything

We Are Here To Answer Your Questions

Start A Conversation

Schedule a complimentary 30 minute Zoom meeting to learn more about your options.